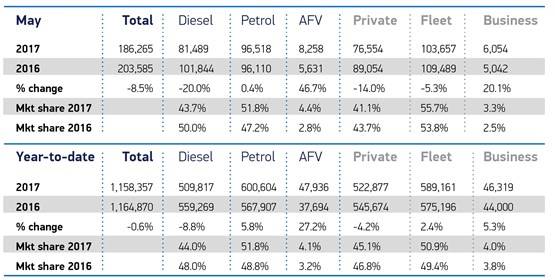

The UK new car market declined in May ahead of the general election, with demand falling by 8.5 percentage points, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT).

Fleet and business registrations however, only registered a fall of about 4 percentage points, with the sector accounting for 59% (109,711 units) of the 186,265 new cars registered in May.

Year-to-date, 635,480 new cars have been registered to fleet and business so far this year, about 3% ahead of the same period last year.

Mike Hawes, SMMT chief executive, said, “We expected demand in the new car market to remain negative in May due to the pull-forward to March – which was an all-time record month – resulting from VED reform. Added to this, the general election was always likely to give many pause for thought and affect purchasing patterns in the short term.

“Although demand has fallen, it’s important to remember that the market remains at a very high level and, with a raft of new models packed with the latest low emission and connected technology coming to market this summer, we expect the market to remain strong over the year.”

Although it dipped slightly in the previous month, the market for alternative fuel vehicles (AFVs) bounced back in May to continue the upward trend seen in the first quarter and take a new record market share of 4.4%. More than 8,000 AFVs were registered in the month, representing an increase of 46.7%. Almost 50,000 new AFVs have joined Britain’s roads so far this year.

Despite a dip of 0.6 percentage points in overall registrations since January, more than 1.1 million new cars have been registered on UK roads so far in 2017.

Business and fleet sectors have driven demand, up 5.3% and 2.4% respectively to offset the decline from private buyers. However, more than half a million new cars have been registered by private buyers since the start of the year.

John Leech, head of automotive at KPMG UK, said: “The sharp fall in new car sales in May indicates that the peak in the UK new car market was in the first quarter of 2017.

“We should now expect to see a steady cooling of sales over the rest of the year and in 2018. UK consumer confidence for major purchases has been declining throughout 2017, as measured by GfK Nielsen, and the adverse changes to Vehicle Excise Duty applied in April 2017 are expected to dampen demand throughout the second quarter of 2017.

“Car manufacturers have switched their attention from the UK market to Europe in response to the sterling’s weakness and stronger consumer demand in the EU. German car sales were up 13% and French car sales were up 8%. We maintain our forecast for 2017 new car sales at 2.5 million, falling from the all-time record of 2.7 million in 2016.”

Chris Bosworth, director of strategy at Close Brothers Motor Finance, said: “The new car market is experiencing a turbulent time.

“The unsettled political landscape and rising inflation has impacted consumer spending, and the recent new vehicle tax rate is certainly impacting new car growth.

“Following the general election and as we enter the Brexit discussions it’s likely we’ll continue to see this pattern continue. 13% of British motorists questioned in our latest Britain Under the Bonnet survey say Brexit has already had a direct impact on their car purchasing plans and has made them more likely to purchase a used car or to hold off their purchase altogether – all of which will have a knock-on effect on the industry and the wider economy. As such, we expect consumers will continue to move to the 1-3 year ‘nearly new stock’ market, given the quality and value of cars available in this market.”

Login to comment

Comments

No comments have been made yet.