UK used car transactions fell for the second consecutive quarter this year, declining 12.2% over the three months of July to September, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT).

Some 1,785,447 vehicles changed hands, the first time that quarter three transactions have dipped below two million since 2015, as semiconductor shortages continued to impact the supply of new car stock.

In the year to date, used car sales are now down 9.7% to 5,319,482.

Used battery electric vehicle (BEV) sales bucked the trend, however, with Q3 reflecting growth in the electrified new car market as activity rose 44.1% to 16,775 transactions, adding up to 48,032 in the year to date.

The market for used hybrid electric vehicles (HEVs) also grew, up 2.5% in the quarter with 41,479 cars finding new owners, taking the yearly total so far to 119,722.

Plug-in hybrid (PHEV) transactions, meanwhile, fell 5.8% to 13,899 in Q3, though they remain up 7.1% since January at 44,724.

It means that combined transactions for electrified vehicles reached 4% market share in the third quarter, up from 3.3% a year before.

Used petrol and diesel vehicle continued to dominate, however, totalling 1,708,299 transactions in Q3 with petrol taking the lion’s share of the total market at 57.1%.

Mike Hawes, SMMT Chief Executive, said, “Given the short supply of new cars due largely to sustained chip shortages, a declining used car market comes as little surprise, although it’s great to see a growing number of used buyers able to get into an electric car.

“The demand is clearly there and to feed it we need a buoyant new car market, which means giving buyers confidence to invest.

“Next week’s Autumn Statement is an opportunity for the Government to make a long-term fiscal commitment to zero emission motoring, including adequate public charging infrastructure, which, especially given the economic headwinds, would go a long way to stimulating the market and delivering both economic and net zero progress.”

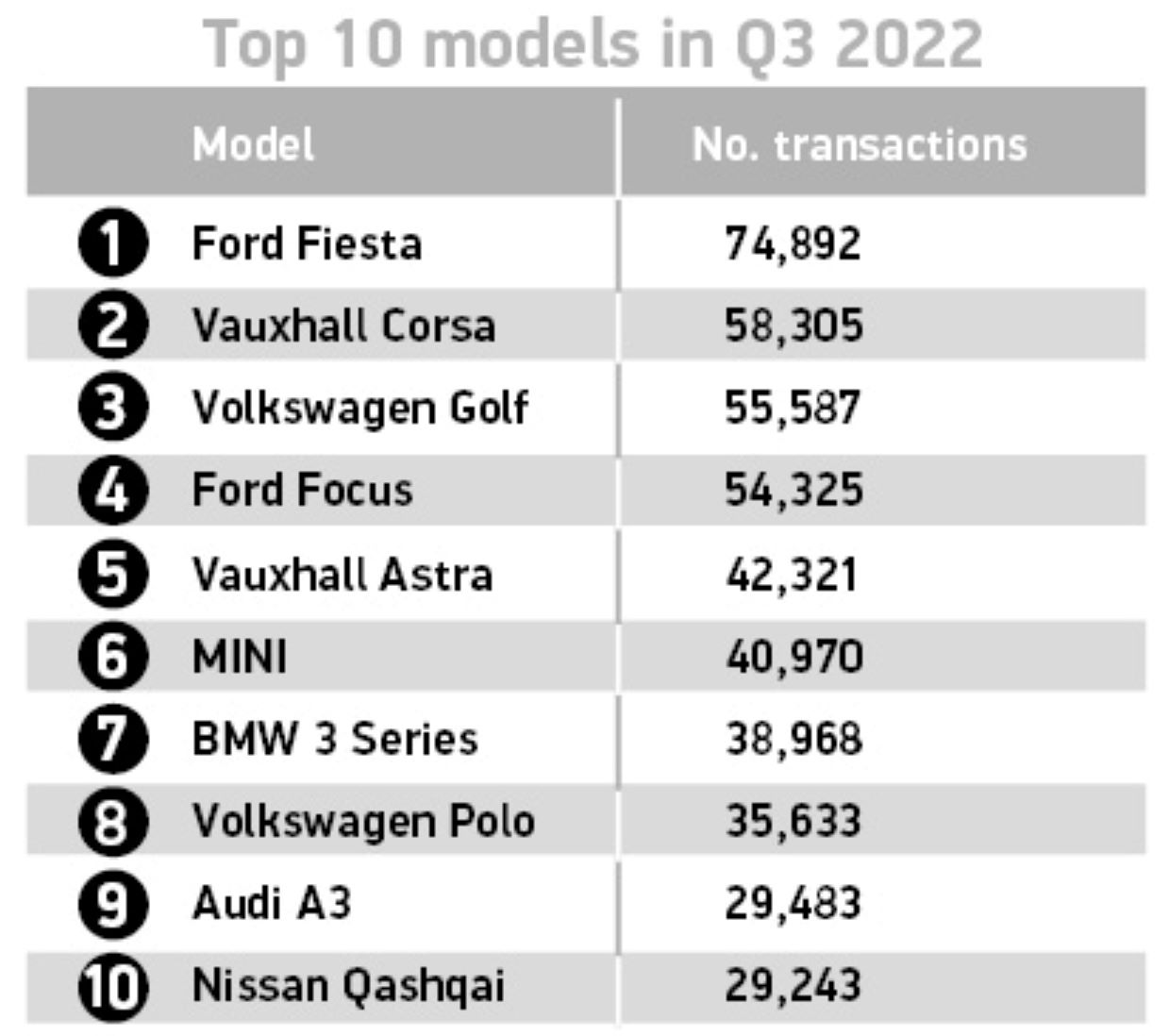

Sales declined across all segments, but superminis maintained their popularity, with a 32.2% market share, followed by lower medium (26.4%), while carrying the smallest decrease (0.8%) was dual purpose in third (14.7%).

Collectively, these three segments account for more than seven in 10 (73.3%) of all used car purchases in the quarter.

MPV transactions fell the most, down 18.5%, followed by minis (18.2%) and upper mediums (-17.1%).

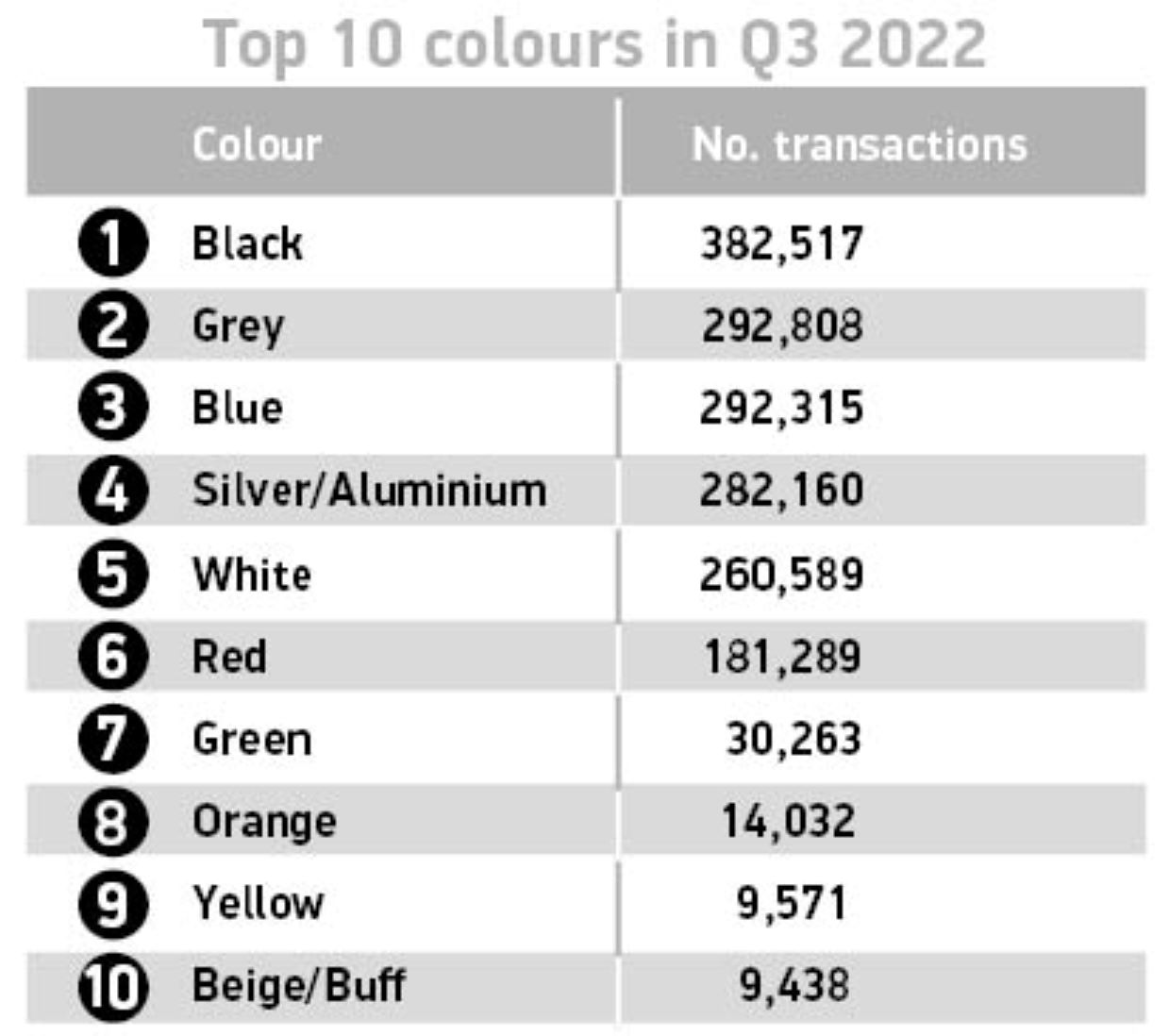

Black continued to prove the most popular used car colour, accounting for a fifth (21.4%) of the market, ahead of grey which moved into second place – up from fourth this time last year – while blue remained in third.

Demand for silver vehicles fell by 18%, the most for any colour, as it slipped from second to the fourth best seller this quarter.

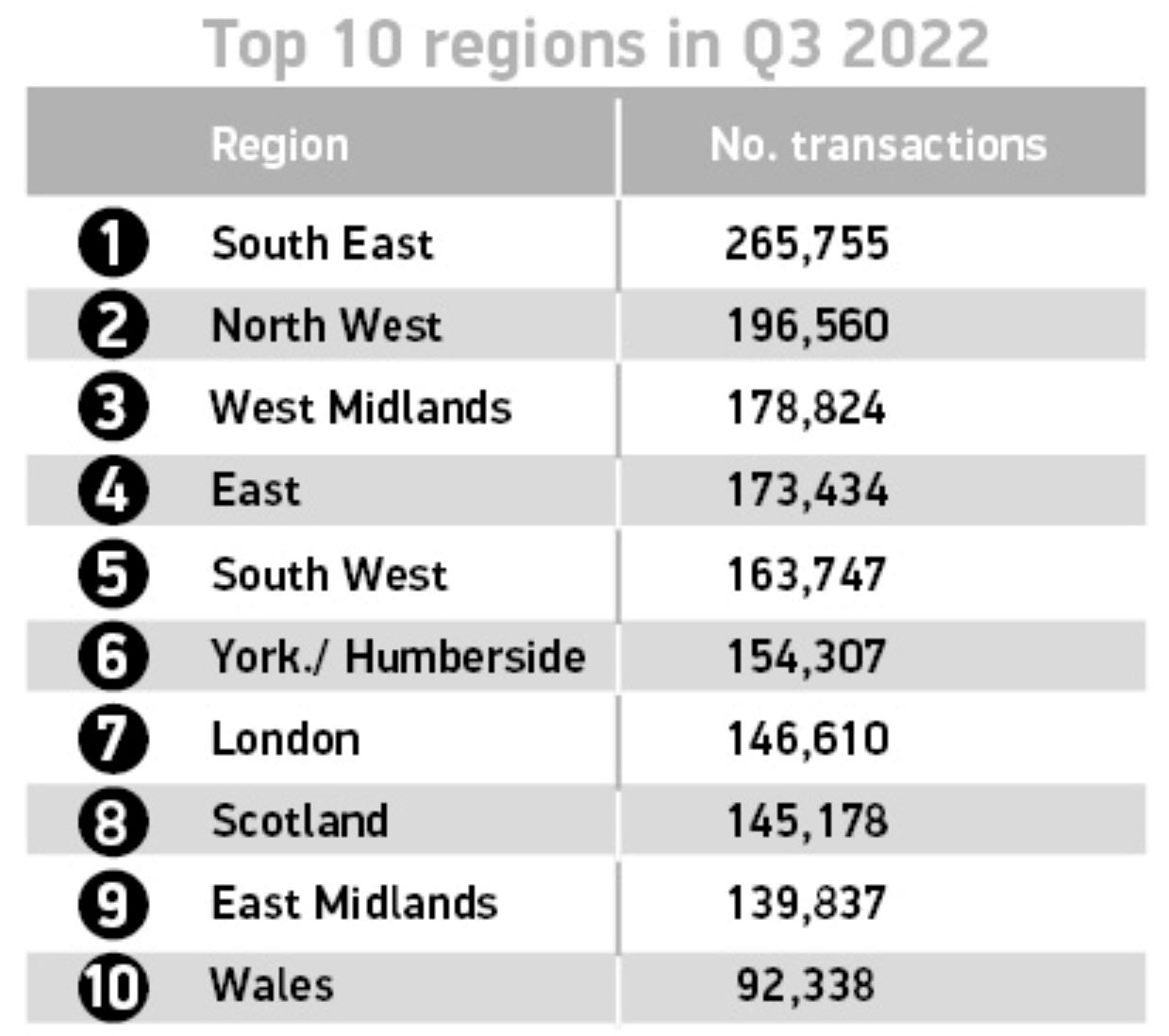

The South-East region, excluding London, saw the most activity in Q3 with 265,755 used cars changing hands. In second was the North-West, with 196,560 transactions, followed by the West Midlands in third at 178,824.

Northern Ireland saw the least activity in the quarter, with 56,563 used cars sold, followed by the North-East at 72,181.

Richard Peberdy, UK head of automotive at KPMG, said: “Used car demand and pricing has been very hot for more than a year and inevitably over time this begins to cool, aided no doubt by harder economic conditions.

“New - and therefore used - car supply still remains very tight, although a silver lining is that electric vehicles are beginning to come through in more numbers to the used car market, which is being welcomed by consumers.”

Login to comment

Comments

No comments have been made yet.