The demand for used battery electric vehicles (BEVs) doubled in quarter three (Q3), reaching a record market share as volumes rose by 99.9% to 34,021 units.

The increase means used BEVs now account for 1.8% of the market, up from 1% last year, according to new figures published by the Society of Motor Manufacturers and Traders (SMMT).

Sales of plug-in hybrids (PHEVs), and hybrids (HEVs) also grew in Q3, up 34.6%, and 46.4% respectively.

Volumes for petrol and diesel cars, meanwhile, grew by 4% to 1,065,448 and 2.3% to 704,204 units respectively.

Richard Peberdy, UK head of automotive for KPMG, said: “Used electric vehicle prices have seen volatility for some months now, due to a normalisation of pricing as supply grows within a market that’s still in its infancy.

“This lowering of used EV prices is leading to increased choice and cost viability for consumers looking to make the transition to an EV.

“Quarter on quarter this is helping to drive up EV market share as a percentage of the overall used car market.”

Ian Plummer, commercial director at Auto Trader, says that demand for electric vehicles (EVs) is close to record levels, fuelled by an enticing combination of improved availability and affordability.

“On average, used EV prices fell around 22% during Q3 compared with last year, with many models now costing the same as their traditionally fuelled counterparts removing the previous price barriers that held up EV adoption,” he said.

“Thankfully for retailers and funders selling EVs, prices have now stabilised, but with used EVs now accounting for about 8% of all used car enquiries sent to retailers through our platform, all metrics point to this positive trend continuing.”

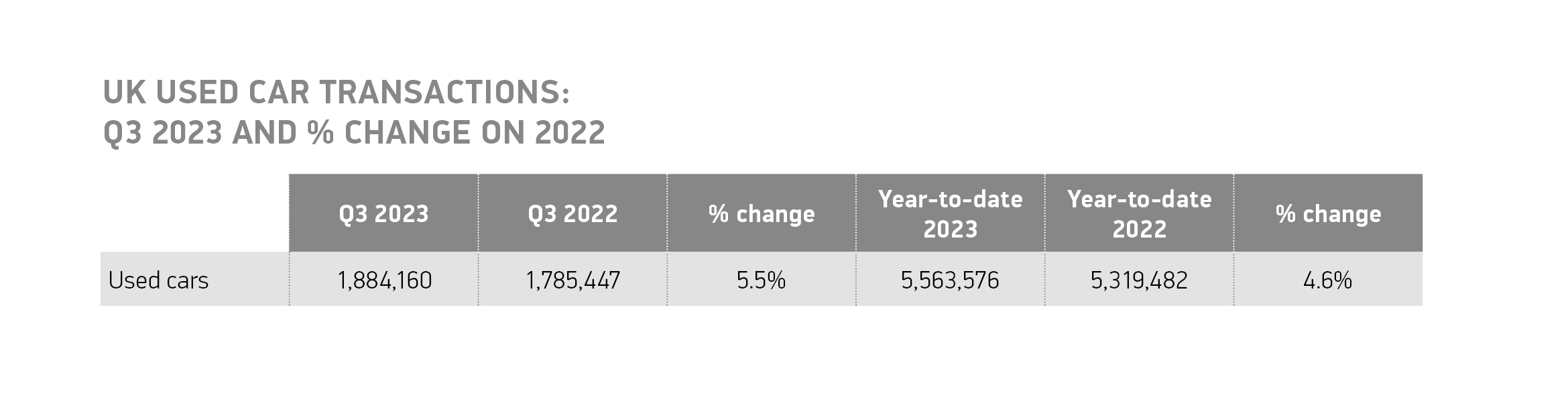

Looking at the used market as a whole, it grew by 5.5% during Q3, with 1,884,160 units changing hands.

The increase marks the third successive quarter of growth, with 98,713 additional transactions compared with the same period in 2022, following an increase in supply as the new car market recovers.

Volumes in each month of the quarter rose, with the strongest gain in September, up 6.3%, which helped the market deliver the best Q3 performance since 2021.

As a result, the overall market is up 4.6% to 5,563,576 units year to date, an increase of 244,094 units on 2022, although uptake remains 9.3% below pre-pandemic levels.

Mike Hawes, SMMT chief executive, said: "The used car market continues to grow strongly, with re-energised supply unlocking demand for pre-owned electric vehicles – the result being twice as many motorists switching to zero emission motoring in the quarter.

“Maintaining this momentum requires growth in the new car market, to boost supply to the used sector and cement this success.

“Equally important is the urgent need for charging infrastructure rollout so that all drivers can have confidence in being able to charge whenever and wherever they need."

The SMMT figures come in the wake of a worrying fall in used car values. They have slipped a further 1.5% on average since Cap HPI reported a 4.2% fall in October, the largest drop in a single month for more than a decade.

Superminis remained the most popular vehicle type, rising by 5.8% to 607,484 units and accounting for 32.3% of transactions.

Rounding off the top three vehicle types were lower medium and dual-purpose cars, both rising by 7.1% to make up 26.8% and 14.9% of the market.

Combined, the three segments account for almost three quarters (73.9%) of all cars sold in Q3.

At the other end of the scale, sports and luxury saloons were the only segments to see declines, falling by 1.8% and 2.5%, respectively.

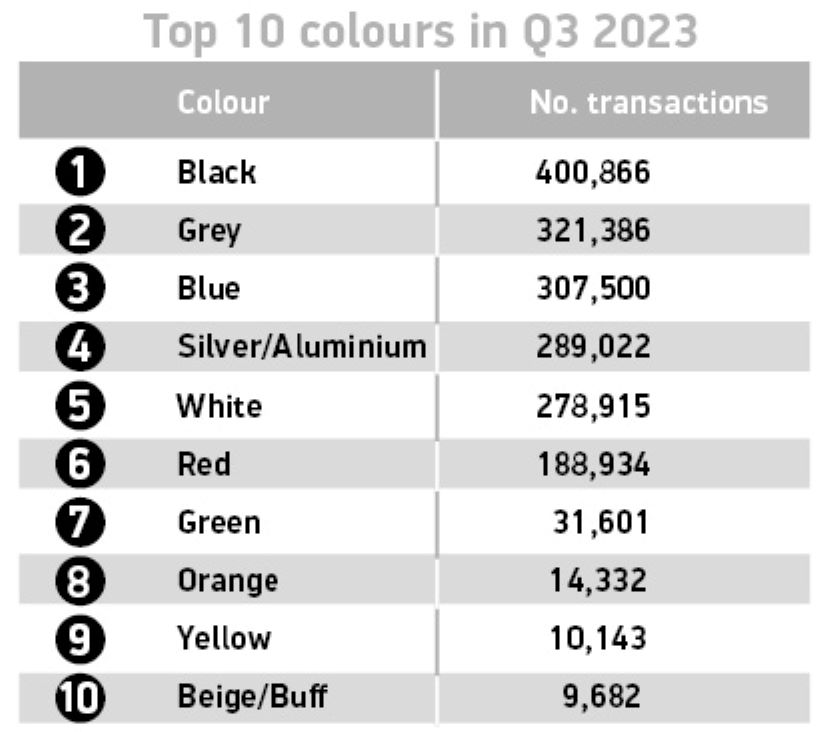

Black remained the most popular used car colour for the 11th consecutive quarter, equating to more than a fifth (21.3%) of sales.

The top five remain the same as Q3 2022, with grey taking second place and seeing above average gains – growing 9.8% to increase market share to 17.1%.

Blue held strong in third place, silver – which once firmly held pole position – was fourth and white placed in fifth.

Login to comment

Comments

No comments have been made yet.