Cash for car schemes will be considered as part of the consultation on the future of salary sacrifice arrangements, HM Revenue and Customs (HMRC) has confirmed to Fleet News.

The UK tax authority had already come under fire for including cars obtained through salary sacrifice schemes in the consultation on potential tax changes.

However, it now appears that thousands more company car drivers could see their tax arrangements overhauled as HMRC casts its net much wider than first thought.

An HMRC spokesman told Fleet News: “We are not looking just at traditional salary sacrifice, we are looking at when an employee can get a cash sum.

“The most common is a car allowance where they can either get a car or a cash sum, which they can use on their own personal car or anything else. In this case, there will still be a direct convertibility to cash, and so the amount we will tax on the person who takes the car is the higher of the taxable values. This is based on CO2 emissions or the car allowance that the employer considers to be the same value – the car allowance amount.”

Fleet representative body ACFO believes the impact on the company car market would be significant. “This has the potential to fundamentally change the landscape of fleet provision,” said Caroline Sandall, deputy chairman of ACFO. “It is vital fleets assess the impact for their organisation.”

Both ACFO and the British Vehicle Rental and Leasing Association (BVRLA) have met with HMRC to discuss the fleet industry’s concerns.

Gerry Keaney, chief executive of the BVRLA, said: “We are talking to HMRC to ensure they are aware of the potentially harmful consequences. These flexible benefit schemes provide a valuable way of extending the advantages of a traditional company car scheme to reward and retain staff.”

Deloitte claims as many as 500,000 company car drivers could be hit with the changes – around 50% of the 970,000 employees identified by HMRC as paying benefit-in-kind (BIK) tax on a car. But exact numbers are hard to establish – the BVRLA estimates between 80,000 to 100,000 company cars are sourced through traditional salary sacrifice schemes, while FN50 figures from the UK’s top 50 leasing companies suggest a salary sacrifice fleet closer to 60,000 units.

Deloitte in turn estimates that up to half of the remaining company car drivers – some 360,000-450,000 employees – have a cash allowance option.

Alastair Kendrick, tax director at MacIntyre Hudson, said: “It’s hard to put a size on the driver population, but there will be a significant number of employees who are not essential car users who are offered a cash or car alternative.”

The impact will be felt most by those cash allowance drivers who opted for an ultra-low emission vehicle (ULEV) to keep their BIK tax bill down. HMRC says it will tax whichever is the greater amount; the benefit-in-kind value of the car or the cash allowance sum offered.

It means if the cash sum offered is greater than the taxable value of the benefit, the employee would have their company car taxed as earnings rather than a benefit in kind.

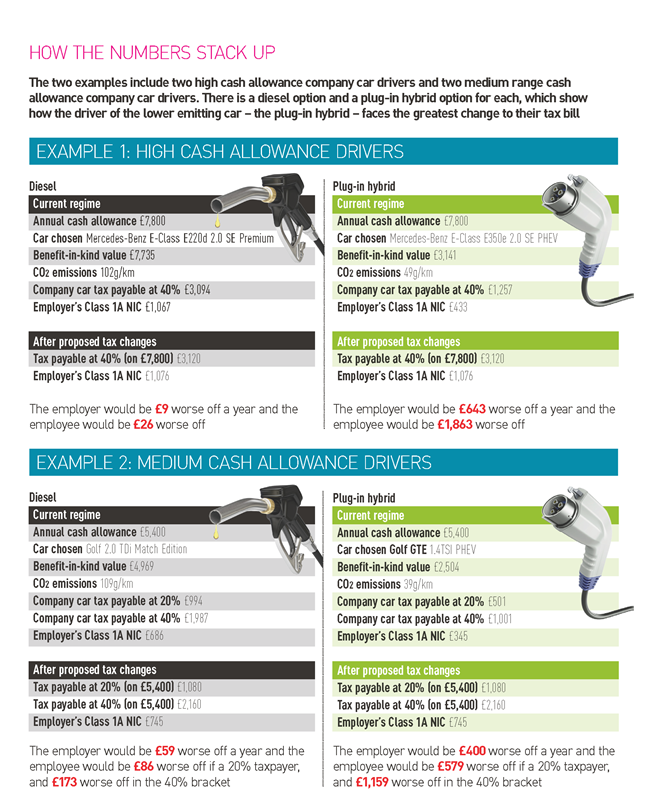

For example, a driver who was offered a cash sum of £5,400 (£450 per month), but decided to opt instead for a Volkswagen Golf, with emissions of 109g/km, would have to stump up an addition £86 if a 20% taxpayer, or £173 if in the 40% bracket (see panel). The employer would also pay Class 1A National Insurance (NI) on the higher amount, equating to an additional £59 in tax.

But if they had opted for a plug-in hybrid Golf, with emissions of 39g/km, the employee’s tax bill would rise by £579 for a 20% taxpayer or £1,159 if they are in the 40% bracket. The employer would also have to pay an additional £400.

The changes would add a high degree of complexity to a company car tax system which is fairly well understood. Coupled with the proposed removal of tax breaks for traditional car salary sacrifice schemes, it would also contradict the Government’s desire to drive the uptake of ULEVs. It wants 5% of all new car sales to be ULEVs by 2020, rising to 100% by 2040.

Last year, salary sacrifice for cars had more than doubled the growth in the uptake of ULEVs, according to the BVRLA, with 5.6% share of new business for salary sacrifice cars versus 2.78% for the overall market.

John Pryor, ACFO chairman, said: “We know that salary sacrifice schemes have been very successful in introducing low CO2 cars to employees – whether they previously had entitlement to a car or cash allowance – and that when no scheme is available, the private car typically has higher emissions of CO2.”

Salary sacrifice provider Tusker, which is due to meet HMRC in the next few days, is in no doubt that HMRC’s plans would harm the uptake of ULEVs. It also argues that unlike other salary sacrifice schemes which offer goods and services, such as mobile phones cars generate further revenues for HMRC throughout their lifecycle.

David Hosking, Tusker’s chief executive, said: “We welcome the Government’s consultation to dispel the myth that our car benefit schemes are the same as these other salary sacrifice options.”

Tusker is making its customers and prospective customers aware of the consultation, while fleet managers are being urged to approach driver communications with caution.

Sandall said: “While it is always important to keep drivers updated, this is a consultation document only and it remains possible for a number of changes to be made to the proposal.

“Added to that, we will not know the detail of the changes to fully scope the impact until this is formally announced, so fleets should carefully consider any impact and corresponding actions that are taken now to manage their driver population.”

The fleet industry has until October 19 to respond to consultation, with new rules expected to be announced in the Autumn Statement in November and adopted from April 2017.

Mark Humphreys - 26/09/2016 11:00

If HMRC want 100% ULEV sales by 2040, then why make the preliminary changes along that direction financially punitive to anyone deciding to become more environmentally friendly? Talk about shooting yourself in the foot...Let's keep the sludge-burning 'tractors' running, I say...Mother Nature is big enough to look after herself! On a slightly different point, surely the elected politicians and decision-makers work for the populace (it used to be called democracy)? We are paying them to work for the good of the people and the country - whilst I agree that certain policies have their merits and may even benefit the majority of people, the people should always have the final say, or at least have the option to publicly debate these changes before they are unilaterally enforced...who's policing the policemen?