Fleet sales were down more than 7% last year, as the new car market suffered its worst performance in five years.

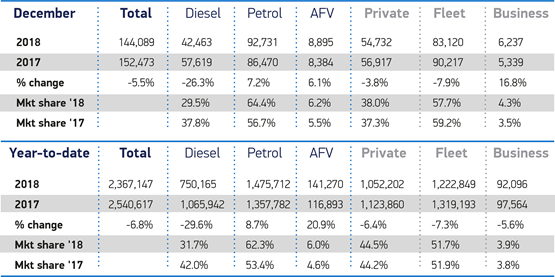

Figures from the Society of Motor Manufacturers and Traders show that a total of 2.36 million cars were registered last year – 12% below the peak in 2016 and 6.8% less than in 2017.

Mike Hawes, chief executive of the SMMT, said the decline was the result of a number of factors including Brexit, WLTP and the continued uncertainty over diesel.

“A second year of substantial decline is a major concern, as falling consumer confidence, confusing fiscal and policy messages and shortages due to regulatory changes have combined to create a highly turbulent market.

“The industry is facing ever-tougher environmental targets against a backdrop of political and economic uncertainty that is weakening demand so these figures should act as a wake-up call for policy makers,” added Hawes.

While last year was described as “highly turbulent”, Hawes said the performance was broadly in line with forecasts and “probably in line with the average for the past 10 years”.

This year, the SMMT predicts a further decline of 2% in overall registrations – but the outcome of the Brexit deal is likely to big the biggest driver to market performance in 2019.

“The chancellor has spoken of a boost to the economy if a deal goes through. Without a deal it could be a different situation,” said Hawes.

The SMMT has a clear position that a “no deal” Brexit is not an option and it wants to ensure that there is a degree of continuity.

“Frictionless trade is what this industry depends on,” said Hawes. “Tariffs will push up the price of vehicles.”

Electric vehicle registrations could also be affected by the Brexit deal, as it is yet to be established how UK sales will contribute to manufacturer’s individual CO2 targets.

Hawes warned that manufacturers are unlikely to allocate large quantities of EV stock to the UK if those sales don’t count towards their targets.

The biggest volume decline was seen in the diesel sector, down 29.6% in 2018, with the volume loss equivalent to some 180% of the overall market’s decline.

The figures also show the UK new car fleet average CO2 rose for a second successive year, by 2.9% to 124.5g/km. This is despite huge investment by manufacturers to deliver ever more efficient cars, with the average new or updated model emitting -8.3% less CO2 than that it replaced.

Diesels are, on average, 15-20% more efficient than petrol equivalents and so have a substantial role to play in addressing climate change, says the SMMT.

Hawes said: “Supportive, not punitive measures are needed to grow sales, because replacing older cars with new technologies, whether diesel, petrol, hybrid or plug-in, is good for the environment, the consumer, the industry and the exchequer.”

He believes that diesel sales could see a resurgence as consumers look to switch back from less efficient petrol models and the introduction of RDE2 standards provides a fiscal incentive.

Ashley Barnett, head of consultancy at Lex Autolease, said it was "widely acknowledged" that 2018 would be a "challenging" year for the new car market, with fleets in particular impacted by changes to emissions testing and an "increasingly complex" tax regime.

He continued: "It’s therefore no surprise to see that total registrations are down on 2017 – and interesting also to highlight a 4.4% decrease in total registrations compared to 2014. This supports the fact that fleets have been hardest hit, based on the average 48-month replacement cycle. Drivers that were due to renew last year evidently decided against it and we’ve seen an increase in contract extensions as a result."

Barnett told Fleet News that it was "positive" that alternative fuel vehicles (AFVs) had a strong year with registration growth of over 20%. However, he said: "It’s not just plug-in vehicles that can contribute towards sustainability targets. Fewer vehicles overall being registered means that the UK fleet is ageing, and that, by nature, means that it isn’t as efficient as it could be – take-up of the latest clean technology across all fuel types is being delayed as people continue to drive older, less efficient vehicles.

"For the country’s fleet to be as sustainable as possible, it’s also important that every driver chooses the right vehicle to suit their specific requirements, which, for high mileage motorway users, could be an RDE2-compliant diesel or the newest Euro 6 diesels.

“We will be taking part in the consultation on WLTP and are urging customers to do the same. To support fleets and encourage new orders, it’s important to minimise any increases in company car tax and VED as a result of WLTP.

"Clarity on company car tax is also needed post 2020/21 so that fleets can fulfil their potential to make a significant contribution towards a cleaner, greener future for the UK.”

Justin Benson, head of automotive at KPMG UK, acknowledged the resurgence in petrol powered vehicles and a rise in AFVs. He said: “Although CO2 emissions increased for a second year, more people are buying battery electric vehicles, and whilst these vehicles continue to be a small percentage of overall sales, this is increasing as the technology becomes better known and range anxiety decreases.

"Rising residual values for electric vehicles will significantly help future new AFV sales in 2019 and beyond. In the meantime, those keeping an eye out for new car bargains should definitely have a battery vehicle on their shortlist in 2019.”

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, believes that overcoming obstacles to the commercial adoption of AFVs is now critical to maintain and accelerate momentum in 2019.

He said: "Our own research found that 73% of fleet owners, who experienced the largest decline in new registrations last year, believe the Government should do more to support the move to AFVs.

“Initiatives such as Optimise Prime, the world's biggest trial of commercial electric vehicles, are an important part of addressing shortcomings in charging infrastructure and encouraging corporate and Government investment.”

Looking at the overall new car market, Ian Gilmartin, head of retail and wholesale at Barclays Corporate Banking, concluded: "It’s not time to panic and worth remembering that in absolute terms sales are still way ahead of the nadir we hit at the start of the decade.

"Manufacturers and retailers are making positive steps to try to innovate and adapt to the changing landscape, in particular through the development of new alternatively fuelled models. But they can’t do it all on their own – they need support from the Government to encourage more new vehicle purchases and allow the industry to thrive this year.”

The Engineer - 08/01/2019 08:22

Would be nice if lease companies put some resources into actually putting a choice of cars on their quote systems, I know WLTP causes a lot of new data but its chaos.. for a while now I could walk into a dealer and order a CR-V hybrid, or a Citroen Aircross for example but can't order as a company car. The Skoda Karok reappeared on our system, now its gone again! why? in fact only a tiny amount are listed. Many models in reality have stayed the same spec. but with just revised fuel and emission data so shouldn't take long to update. Even our (massive) lease supplier, you get the feeling there is just one bloke in a back office doing the numbers, part time! - every few days for months I have checked the system nothing I want is there still. Can't order what isn't there. Needs some serious resources putting into the task.