Author: Rupert Pontin (pictured), director of valuations, Cazana

The final month of 2018 was always going to be an interesting one as the new car market sought to find its final position with OEM’s contemplating how they were going to end the year from a commercial strategy and product supply perspective.

With lower registration volumes a given, the question was how much the battle for market share and positioning would be affected by WLTP driven supply restrictions.

A reduction of 5.5% in total registrations over December 2017 was a reasonable outcome taking the full year market decline to 6.8%, just 0.3% higher than Cazana predicted a year ago.

But the fleet market was extremely competitive during the last few months of the year and this position has been driven by both consumer and business confidence.

The chart below tracks business confidence levels throughout 2018:-

The festive season usually tends to mask some of the general press apathy towards the economic position, although this year the underlying message of impending economic disharmony remained reasonably high profile.

Avoiding a hard Brexit

As the country struggles to avoid a hard Brexit, many still believe that the UK might remain in Europe after all, although it is the miscommunication and delaying tactics that are having a negative effect on confidence right now.

The chart above shows that apart from the lowest ebb of confidence in August 2016, December 2018 year showed the lowest confidence factor in the last two years which is in part why new car sales were so challenging.

However, the complexities and poor performance of the new car market boosted the popularity of used cars and subsequently, the retail asking price of vehicles improved almost market wide.

The anecdotal discussion might suggest otherwise and there is a specific interest around what is happening in the ex-fleet sector at the moment.

Fuel concerns slow down car choice decision making

This is in part because the company car driver is in a tricky position right now given the concern over the impact of WLTP on personal taxation.

Compounded by the discussion around fuel type and concerns over diesel, many drivers are yet to properly understand whether they should genuinely consider changing their car to alternative propulsion types.

This is made even more difficult because many businesses are urging staff to embrace modern technology for meetings and discussions rather than travelling and this is having an impact on the mileage driven by the company car driver hence perhaps allowing them to be more flexible on the type of car that they can choose and run.

The result has been a slow-down in the new fleet market with many user choosers delaying changing their cars and the majority of recent fleet registrations seem to have been for the business-critical cars for those that do not have the luxury of a choice.

The perception has been that there has not only been a drop in the volume of cars coming to the market, but this has been combined with a reduction in consumer demand and wholesale buyers have subsequently been seeking to bid low for cars.

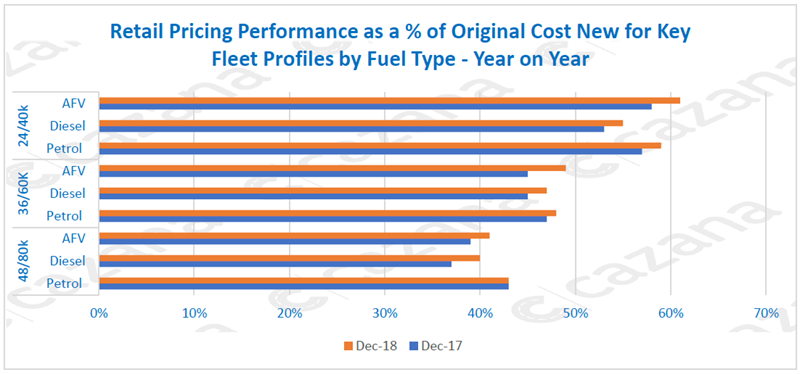

The chart below compares the retail pricing performance as a percentage of cost new year on year for typical fleet profile vehicles:-

Data powered by cazana.com

Data powered by cazana.com

This chart above is based on live retail data across the whole UK market and shows the reality of the situation.

It demonstrates that for all fuel types across every key age and mileage profile, except older petrol models at 48 months old which has remained similar, there has been an increase in retail pricing in comparison with the same period last year.

This confirms the fact that consumer demand has remained firm and it also suggests that pricing has increased as a result of greater demand for late plate cars as consumers have given a greater focus on the used car market rather then the new market.

With fewer pre-registered cars available pricing across the board has been lifted to reflect demand.

This means that vendors using live retail driven market data would have had the opportunity to improve financial returns on vehicles heading to the wholesale market and suggests that anecdotal market comment of the need to sell cheaply to clear stock was at best misguided.

This position is likely to remain consistent for the coming weeks, although defleet volume will probably improve as January draws to a close and the question will be whether the consumer demand also remains strong.

To summarise, the used fleet market in December was surprisingly buoyant and perhaps out- performed the expectations of many of the fleet vendors.

In situations like this, the need for quality retail driven pricing data cannot be underestimated and it is interesting to note that there are still many vendors relying on historical based valuation data that reflects often subjective and anecdotal based pricing trends that can only really be understood by looking at the market on a daily basis.

Login to comment

Comments

No comments have been made yet.