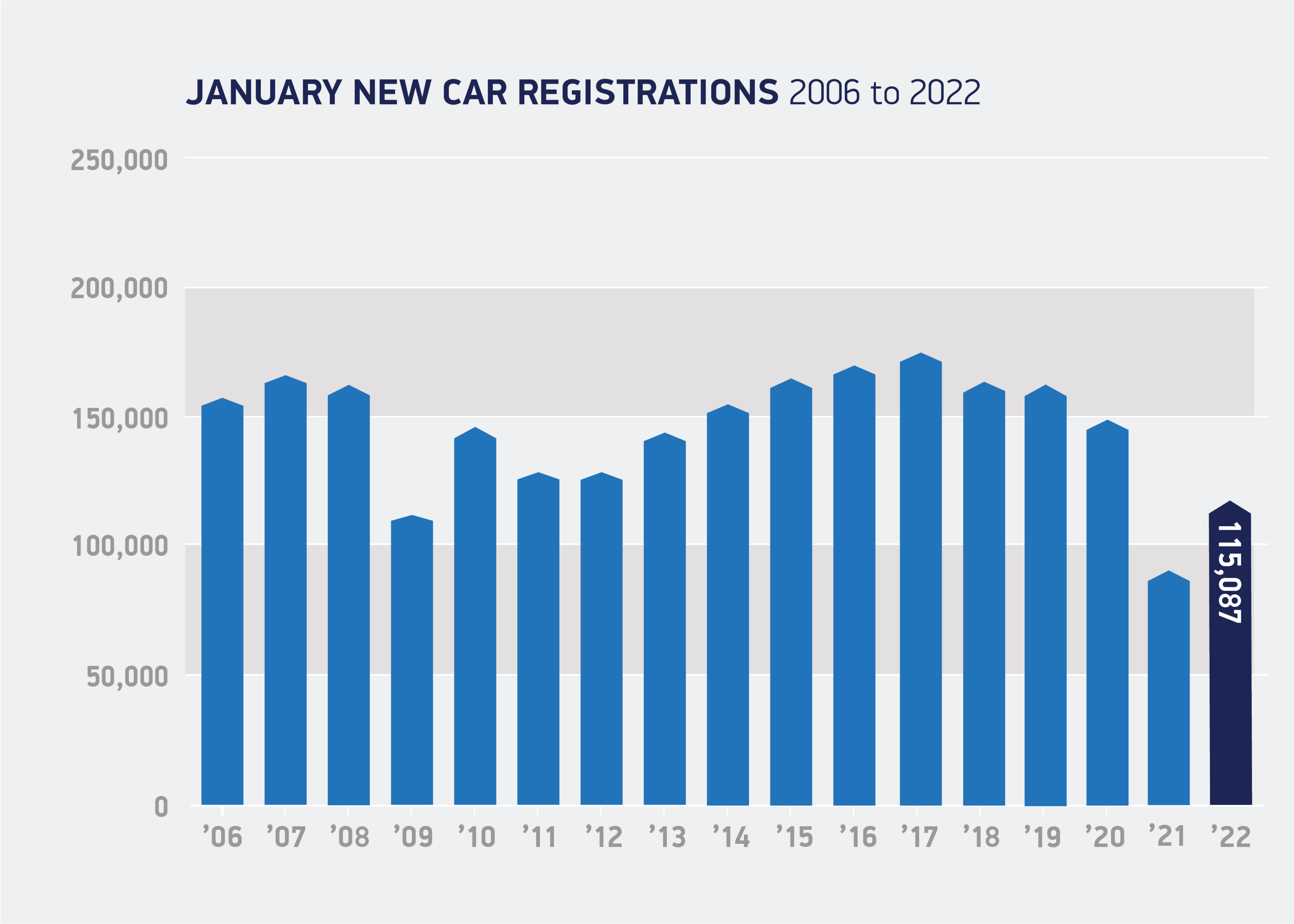

New car registrations are more than a fifth down on pre-pandemic levels, with the global semiconductor shortage continuing to impact supply, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

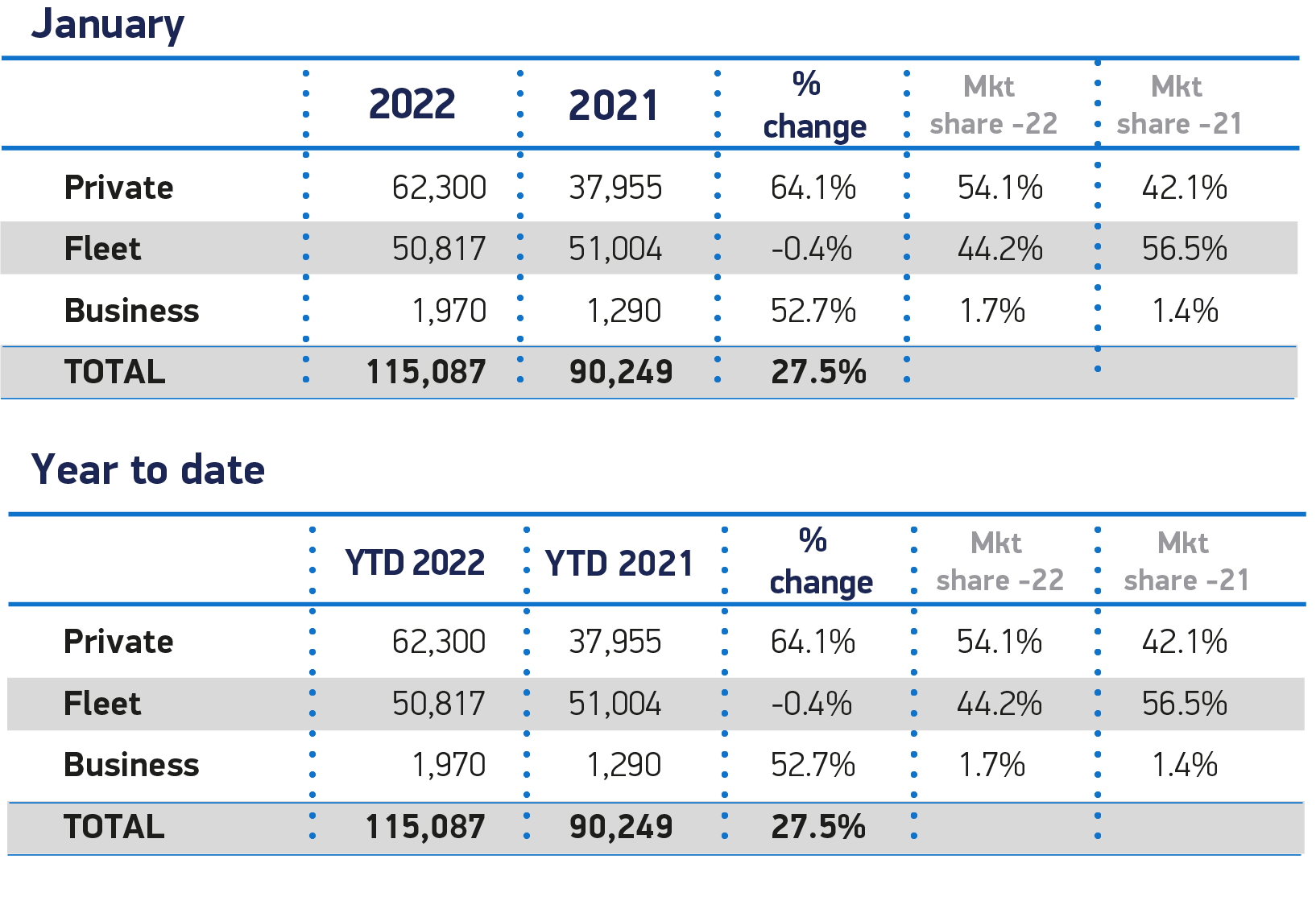

Fleet and business registrations were up by just 0.1% in January compared to the start of last year, with 52,787 new company cars registered.

Private registrations were almost double those seen in January 2021, with 62,300 new cars sold last month compared to the 37,955 units that were registered last year when showrooms were closed.

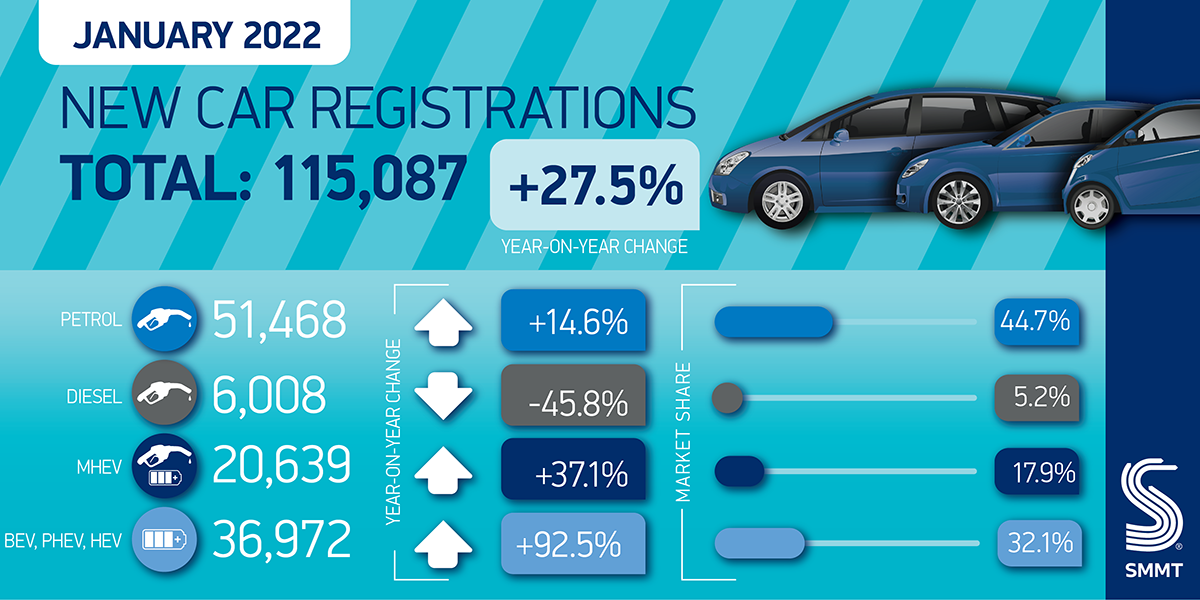

Year-on-year it means the new car market is 27.5% up on January 2021, but the market remains well below pre-pandemic levels, 22.9% lower than in January 2020.

Mike Hawes, chief executive of the SMMT, said, “Given the lockdown-impacted January 2021, this month’s figures were always going to be an improvement, but it is still reassuring to see a strengthening market.”

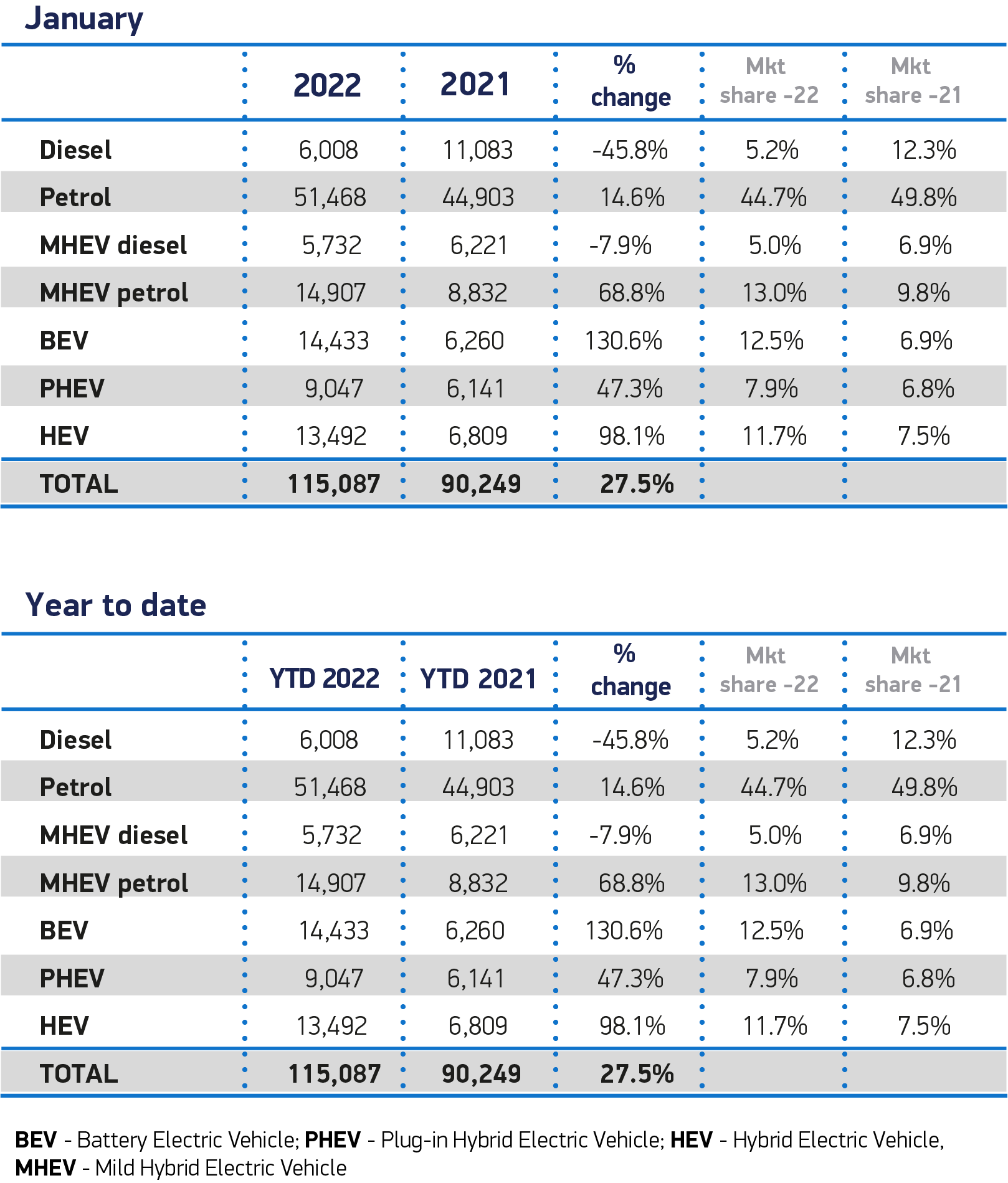

Electric vehicles (EVs) continue to bolster growth, with battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) cars accounting for 71.5% of the uplift in registrations.

Plug-in vehicles enjoyed another bumper month, with 14,433 BEVs and 9,047 PHEVs registered, equal to some 20.4% of the market. With 13,492 HEVs also registered, almost one in three new cars joining British roads in January was electrified.

Despite the challenges of 2021, with manufacturers battling against global semiconductor shortages, new trading arrangements and Covid impacts, including shuttered showrooms and staff shortages, it was a record year for zero and ultra-low emission vehicles.

As a result, new data shows that average new car CO2 emissions fell by 11.2%, to its lowest ever recorded level of 119.7g/km.

There are now more than 140 plug-in car models available to UK buyers, with almost 50 more scheduled for release in 2022.

Hawes said: “Once again it is electrified vehicles that are driving the growth, despite the ongoing headwinds of chip shortages, rising inflation and the cost-of-living squeeze. 2022 is off to a reasonable start, however, and with around 50 new electrified models due for release this year, customers will have an ever-greater choice, which can only be good for our shared environmental ambitions.”

Cutting CO2 even further, however, will require more drivers to switch to electric and other zero emission technologies, says the SMMT.

One of the obstacles remains perceptions of a lack of charging infrastructure, which must be built ahead of demand – and that demand is increasing exponentially.

The rapid pace of change is underlined by the latest market outlook, which forecasts registrations of BEVs and PHEVs to grow by 61% and 42% respectively in 2022, meaning that, by the end of the year, almost one in four new cars would come with a plug.

Overall, total new car registrations are expected to rise 15.2% on 2021, to 1.897 million units. This is a downward revision from October’s outlook of 1.96 million, as the ongoing semiconductor shortage, increasing costs of living and rising interest rates are expected to dampen some demand in 2022.

A 2022 market of 1.897 million would still be down 17.9% on the pre-pandemic 2019, but the recovery is expected to continue into 2023, with the market projected to climb above two million units for the first time since 2019.

Meryem Brassington, electrification propositions lead at Lex Autolease said: “The electric vehicle industry has had every challenge thrown at it over the last 12 months, with labour and material shortages threatening to stall the good progress that has been made. However, today’s figures reaffirm its robustness to keep up with the demands of motorists across the country.

“As we accelerate towards the 2030 ICE ban deadline, Government departments and industry bodies must continue to work together to ensure the UK remains the most attractive place for electric vehicle production.

“Recent manufacturer commitments from Jaguar Land Rover and Bentley, and the announcements of a battery recycling plant and Gigafactory by Britishvolt, have brought renewed impetus for the Road to Zero policy, helping to make certain that more vehicles on the roads are truly sustainable.

“Today’s publication of the Transport Committee road pricing report will also spark a wider conversation around the future for EV users, so we look forward to better understanding the implications and next steps.”

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, says that the latest SMMT figures illustrate the demand for EVs is only going one way, following a record-breaking year for EV registrations in 2021.

“With motorists increasingly realising the cost and environmental benefits of EVs, and a growing variety of EV models on the market, we will continue to see healthy EV registration figures and in the coming months we can expect to reach the watershed moment where one in two new cars registered will be an EV.

“However, the well-documented semiconductor shortage is hampering OEMs ability to efficiently allocate EVs across all areas of the market where strong demand is present.

“To negate these issues, fleets should look to leasing providers offering innovative, flexible solutions with the reassurance of price protection to facilitate the continued surge in EV uptake once the backlog has subsided.

“In the meantime, clarity from the Government on how it plans to counteract the potential tipping point of EV tax breaks and Salary Sacrifice schemes coming to an end would be welcomed across the board.”

Login to comment

Comments

No comments have been made yet.