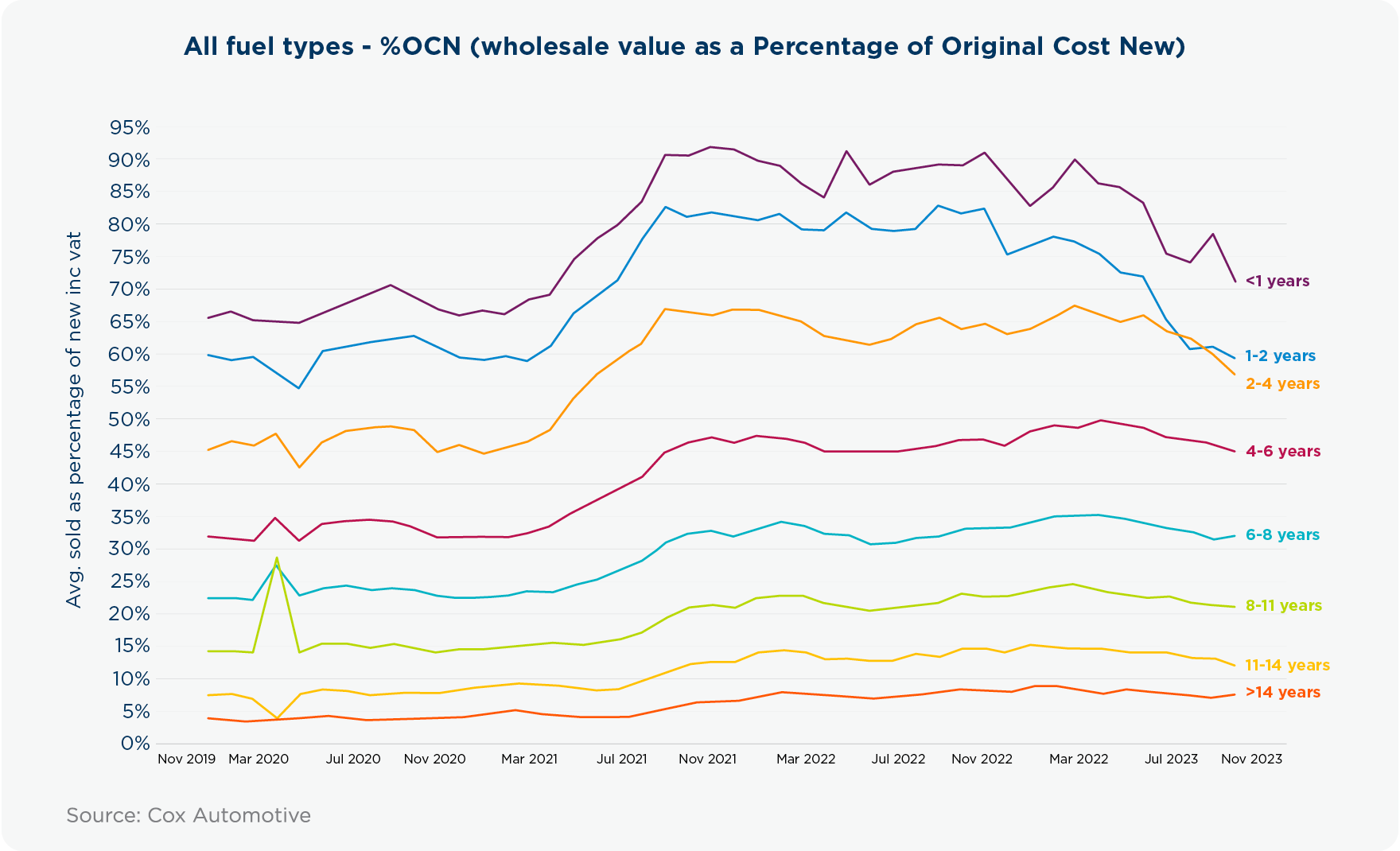

Cox Automotive has published predictions for the new and used car market in 2024, with fears that current residual values (RVs) may not be sustainable in the long term.

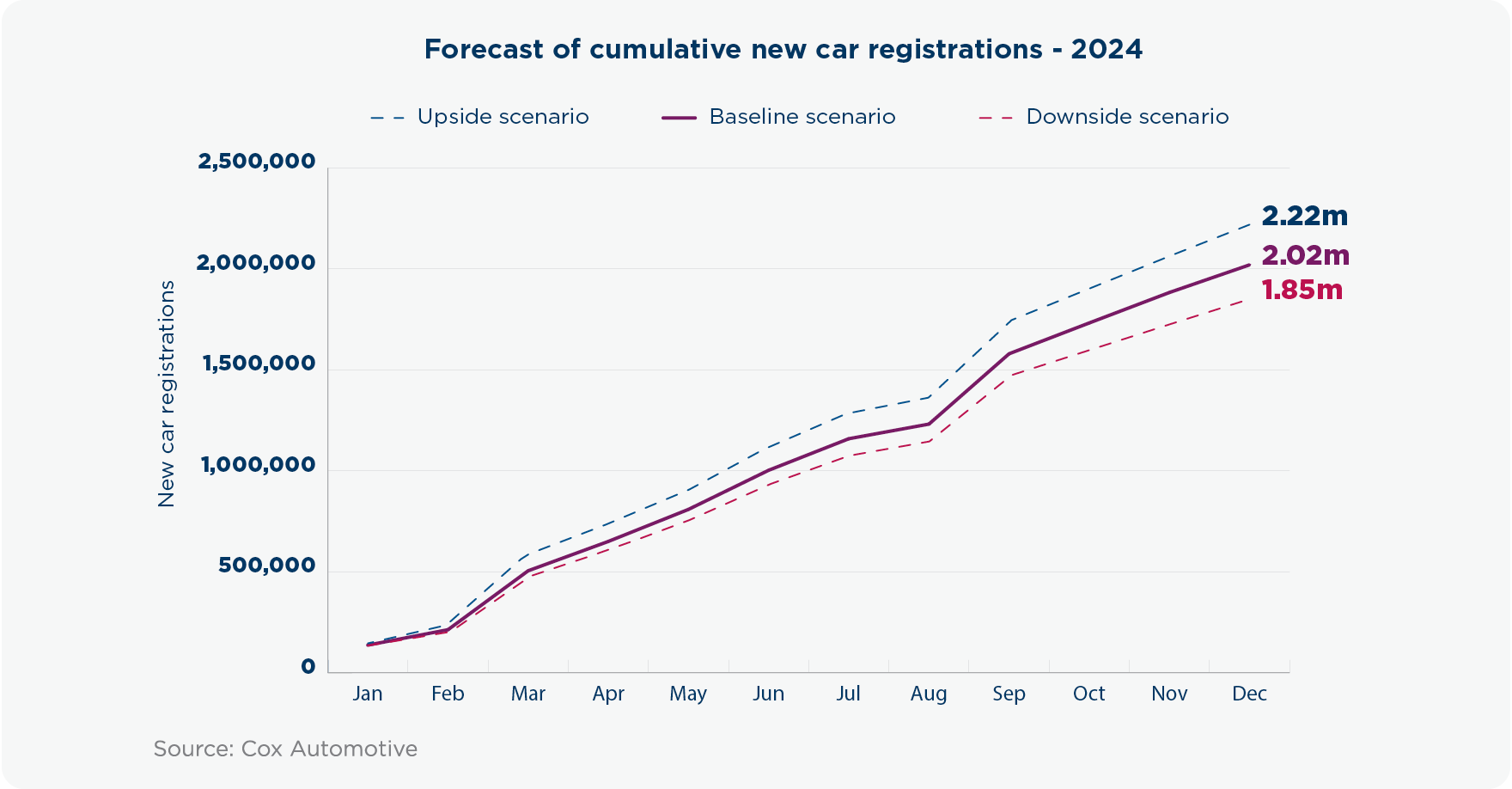

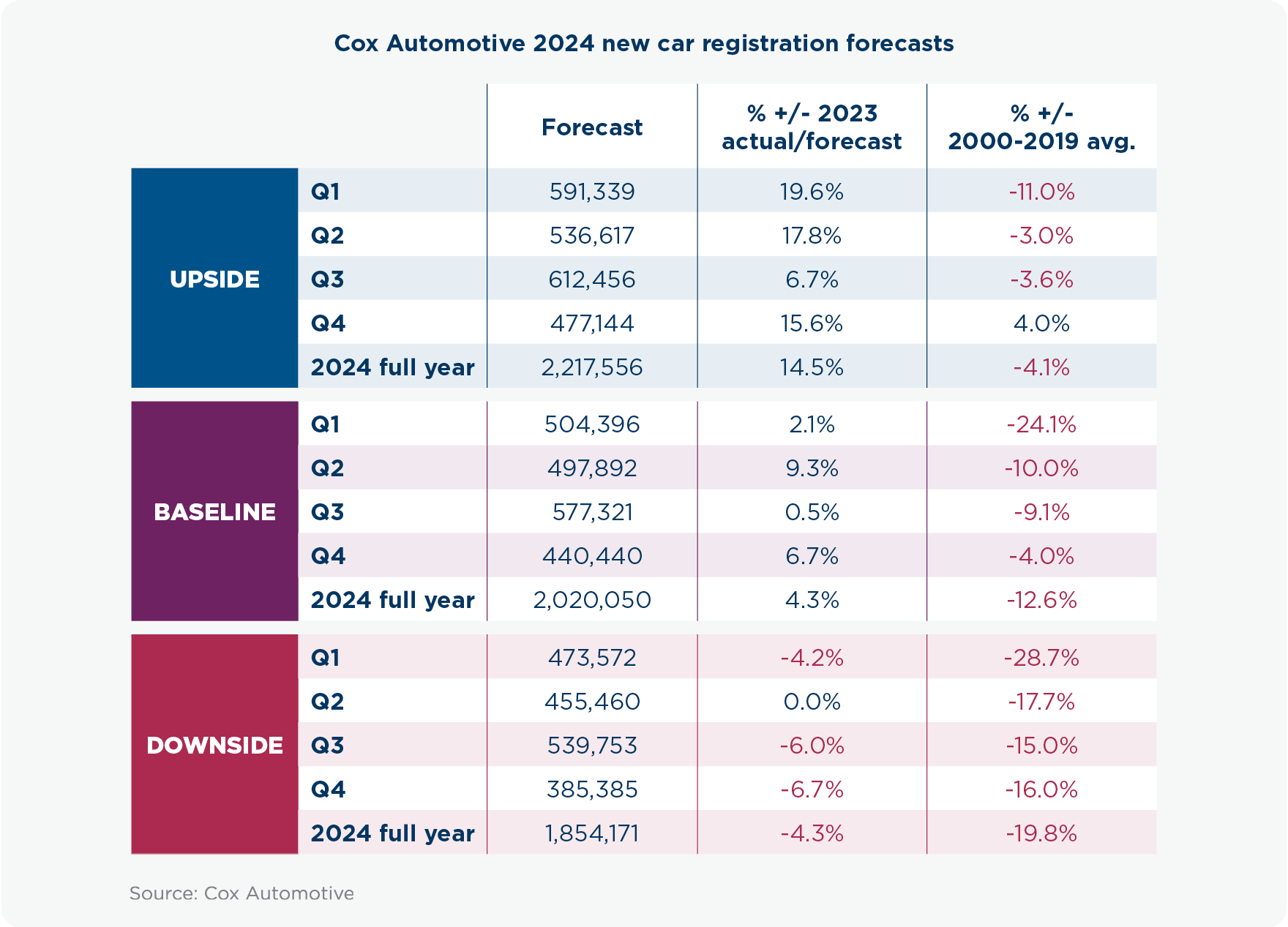

It expects a baseline scenario of 2,020,050 new vehicle registrations in 2024 for the UK’s new vehicle market, which would be a 4.3% year-on-year increase, albeit a continued steep decline compared to the 2000-2019 average.

For the used car sector, the baseline scenario figure is 7,350,205 transactions, which would be a 2.8% year-on-year increase, but a 0.3% decrease compared to the 2001-2019 average.

The calculations suggest that 2024 will be a period of stabilisation in the automotive sector generally, followed by a notable rise in registrations in successive years.

The baseline scenario is one of three scenarios published by Cox Automotive and is the scenario it expects to play out.

The report also includes upside and downside scenarios.

Hypotheses guiding the baseline prediction include figures for new car registrations will be dictated by continuing economic pressures, the agency sales model transition and the stabilising of global production volumes.

Used market numbers for 2024 will be shaped by issues including a gradual adoption of used battery electric vehicles (BEVs), a moderately recovering economy and a “carefully managed” growth in the supply of used vehicles – the report concludes.

Insight Report author and Cox Automotive’s insight director, Philip Nothard, said: “Recent years in the automotive sector have seen a period of unprecedented change and tumult that are being driven by economic forces, geopolitics and technological innovation.

“In our latest Insight Report, we closely examine these factors and outline how we think the future will pan out for dealers, the EV market and much more.

“We anticipate that the market will eventually be split between manufacturers who want profitability at the cost of volume and market share; and those who will return to a 'push' market at the cost of profit for volume and market dominance.”

‘Significant reductions in values’

The Cox Automotive Insight Report 2023/24 says that the current monetary value of used cars continues to cause alarm, indicating a situation that might not be sustainable in the long term.

This is especially concerning, according to Cox Automotive, when considering the economic backdrop, the overall cost of motoring and the increasing availability of new vehicles.

The unprecedented rise in vehicle values over the past three years has halted, it says. With supply and demand now more aligned, Cox Automotive believes that failure to improve the economic outlook will put additional pressure on used values.

The threat of significant reductions in values should not be exaggerated but it should also not be ignored; the situation is delicate, it adds.

Nothard told Fleet News: “We’ve come out of this strong supply and demand imbalance through the pandemic, that drove the values up. That is now starting to shift, with over supply. In addition to that, you've got a lot of cars coming into the used vehicle market through defleets.”

However, with new Cap HPI figures showing marked decline in used values in October, he added: “It's dropping, but it's dropping from a high point when you put it in context of the increases we’ve seen over recent years.”

The report also notes that the combined effect of reduced production and possible consumer response to delaying the ban on the sale of new ICE cars from 2030 to 2035 could drive increased demand and boost the value of non-electric vehicles.

Used electric vehicle values

Cox Automotive expects a gradual stabilisation of battery electric vehicle (BEV) used residual values as they move closer to parity with internal combustion engine (ICE) vehicles.

The report suggests that this shift is an encouraging sign for the future of the EV market.

However, it acknowledges that the outlook for EV values is unclear. The wholesale market is seeing a growing number of EVs, and as battery technology improves, offering greater range and affordability in new vehicles, fluctuations in BEV values should be expected.

“The leasing companies kind of know what's coming and (in some cases) they are going for that secondary lease,” said Nothard. “It's all about depreciation protection and the leasing companies will manage that.”

The report says that, while some seasonal improvement is expected in January 2024, it may not be a substantial bounce.

New car market

In 2023, new car registrations reached 1.9 million, a 20% year-on-year increase. Nonetheless, that total remained well below (16.2%) the 2000-2019 UK average.

While many anticipate continued recovery into 2024, the report says that the market must be prepared for the obstacles that manufacturers will face in the UK. These include the transition to agency model, a growing electrified market and seemingly unshakeable economic headwinds.

In its baseline scenario, Cox Automotive is predicting a new car market of some 2,020,050 units in 2024, a 4.3% year-on-year increase, while still some 12.6% below the 2000-2019 average.

Login to comment

Comments

No comments have been made yet.