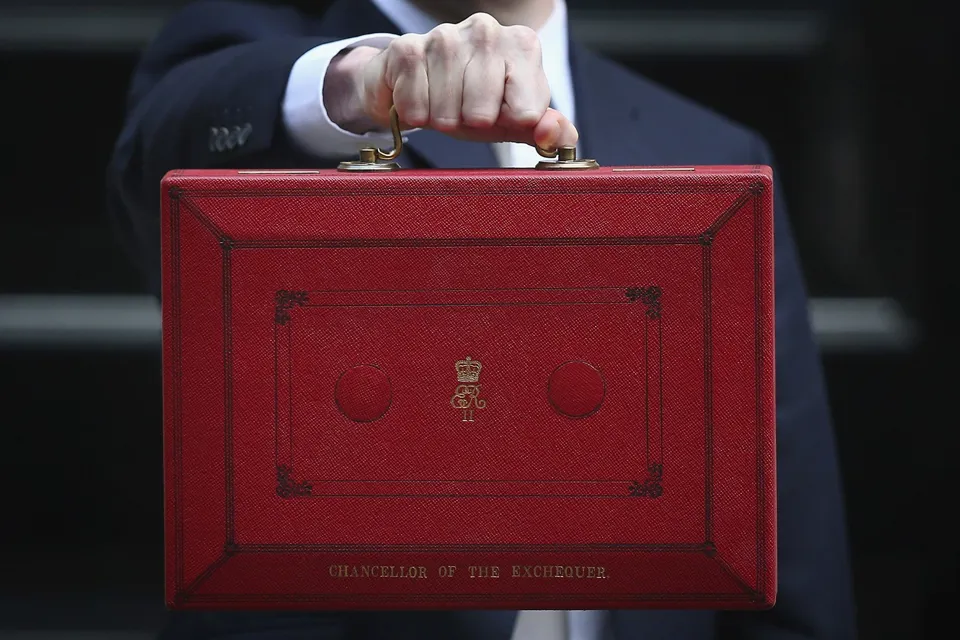

The Chancellor’s decision to freeze the rate of duty on fuel is welcomed by the logistics sector, which is already battling inflation at a five year high.

However, a cut would have done far more to boost the economy, says the Freight Transport Association (FTA) and the Road Haulage Association (RHA).

The FTA had called for a 3p per litre (ppl) cut in fuel duty to provide a significant and immediate positive impact on the nation’s economy.

Christopher Snelling, FTA's head of national policy, said the freight industry is disappointed by the budget announcement. He believes the Chancellor could have gone far further to assist the sector which supports all other businesses across the UK.

“A freeze in fuel duty is a welcome decision, but it demonstrates a real lack of ambition by the Chancellor,” he said. “The cost of moving goods around the country and overseas determines the cost of doing business in Britain and the price of goods in our shops.

“At a time when British business is under extreme pressure to prove its credentials and reinforce existing trading relationships, Hammond has missed an opportunity to cut these costs, and make the UK a more competitive place to do business.

"Fuel duty increases would have been the wrong tool to use to address air quality. As logistics operators currently have no practical alternative to diesel it would have produced no change in behaviour, just adding cost to those businesses who are facing the burden of the planned Clean Air Zones.”

FTA research shows the price of diesel accounts for nearly a third of the operating costs for an average 44 tonne truck. Just one penny increase in the cost of a litre can add £470 a year to the cost of running one of vehicle.

Many FTA members run fleets of hundreds or even thousands of vehicles and the resultant cost of a duty rise can have a significant effect on operating margins and future solvency.

Recent data from the Insolvency Service shows the number of freight firms filing for insolvency between April and June was almost double the same period last year and has reached its highest level in five years. In the three months up to 30 June 2016, 32 UK road freight companies declared insolvency. A year later, the figure had reached 59.

RHA chief executive Richard Burnett said: “At a time of Brexit uncertainty, the Chancellor had the golden opportunity to make the production and distribution of UK goods more competitive.

“Fuel duty makes the UK less competitive - we have the highest fuel duty in Europe -nearly 50% higher than the European average. And despite the 7-year freeze, at 57.95 pence per litre, fuel duty remains grossly excessive. It has a negative effect on everything we buy and makes all UK made goods more expensive to transport.

“We implore the Chancellor to amend his budget and introduce a fuel duty rebate scheme for essential users of fuel – a system already adopted by 8 EU member states, including our nearest neighbours – The Republic of Ireland, Belgium and France.

“An Essential User Rebate of 10 pence per litre would enable our hauliers to gain advantage over their European counterparts and would considerably lessen the fiscal drain on our emergency services which are also in a financial stranglehold as a result of the high price of diesel.

“Let the sectors that work tirelessly to keep the economy moving and the population safe, well and fed be rewarded, not punished.”

Elsewhere in the budget, the Chancellor, Philip Hammond, announced that the first-year Vehicle Excise Duty (VED) rate for diesel cars that don’t meet the latest emission standards will also go up by one band.

However, he explained that the VED measure would only apply to cars. “So before the headline writers start limbering up let me be quite clear,” he said. “No white van man or woman will be hit by these measures. This levy will fund a new £220 million Clean Air Fund to provide support the implementation of local air quality plans.”

The Chancellor said he will also end the fuel duty escalator for Liquefed Petroleum Gas (LPG). The LPG rate will be frozen in 2018-19, alongside the main rate of fuel duty.

The Fuel Beneft Charge and the Van Beneft Charge will both increase by RPI from 6 April 2018.

Furthermore, there will be a freeze for Heavy Goods Vehicle (HGV) VED and Road User Levy rates from April 1 2018.

A call for evidence on updating the existing HGV Road User Levy will be launched this autumn. The Government says it will work with industry to update the levy so that it rewards hauliers that plan their routes efficiently, to encourage the efficient use of roads and improve air quality.

Login to comment

Comments

No comments have been made yet.