The automotive market may never return to pre-pandemic levels, as new and used vehicle sales continue to be hit by several headwinds, warns Cox Automotive.

As a result, the company has downgraded its new car forecasts to reflect the current state of the industry and ongoing challenges.

Philip Nothard, insight and strategy director at Cox Automotive, claims that even without the Ukraine crisis, Cox Automotive would have been looking to revise its forecasts.

At the same time, despite there being anecdotal reports that manufacturers have begun to fulfil orders from a supply-starved leasing sector and even reports of tactical registrations (albeit nowhere near pre-pandemic levels), supply has not picked up in the volumes anticipated.

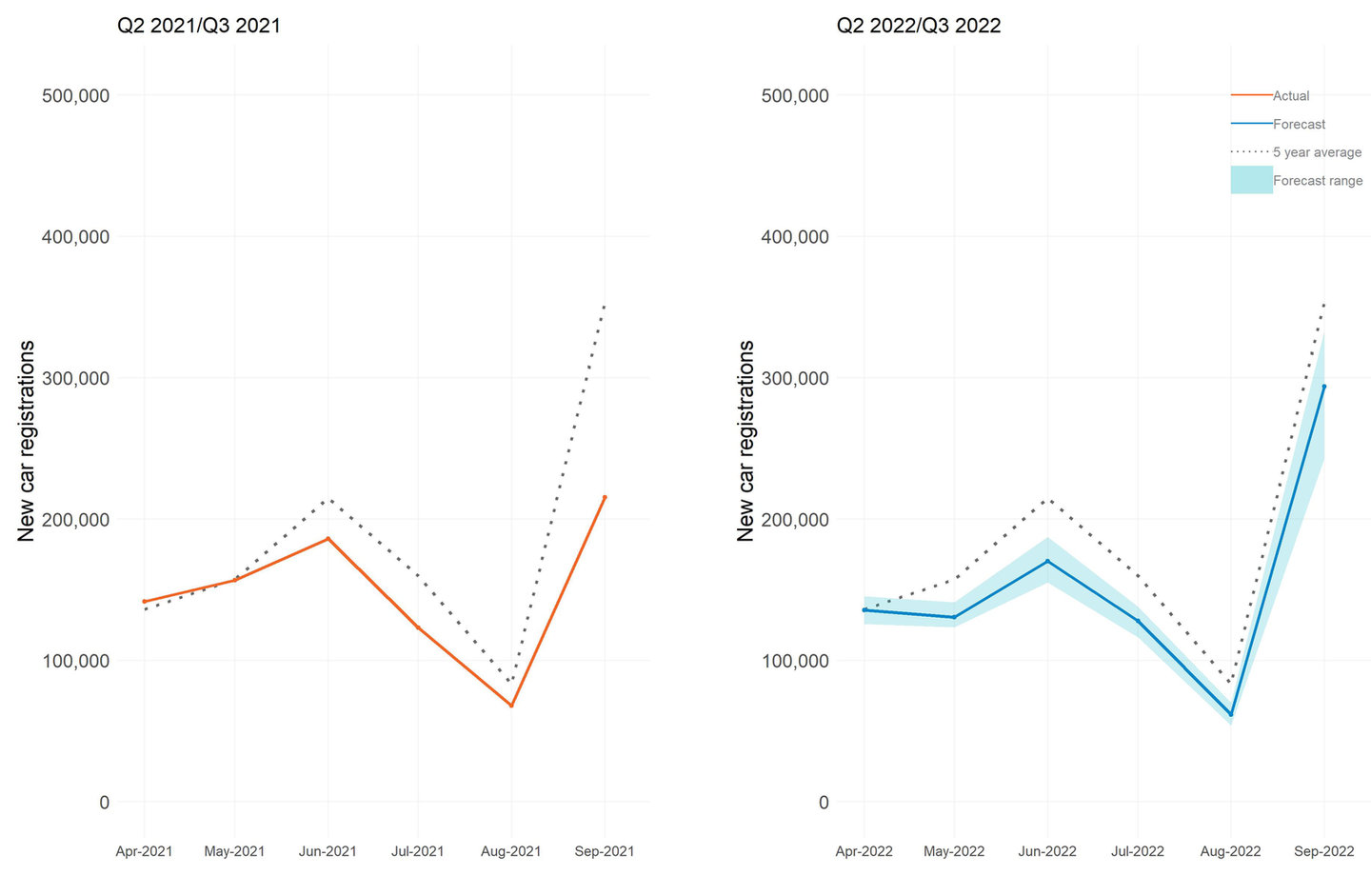

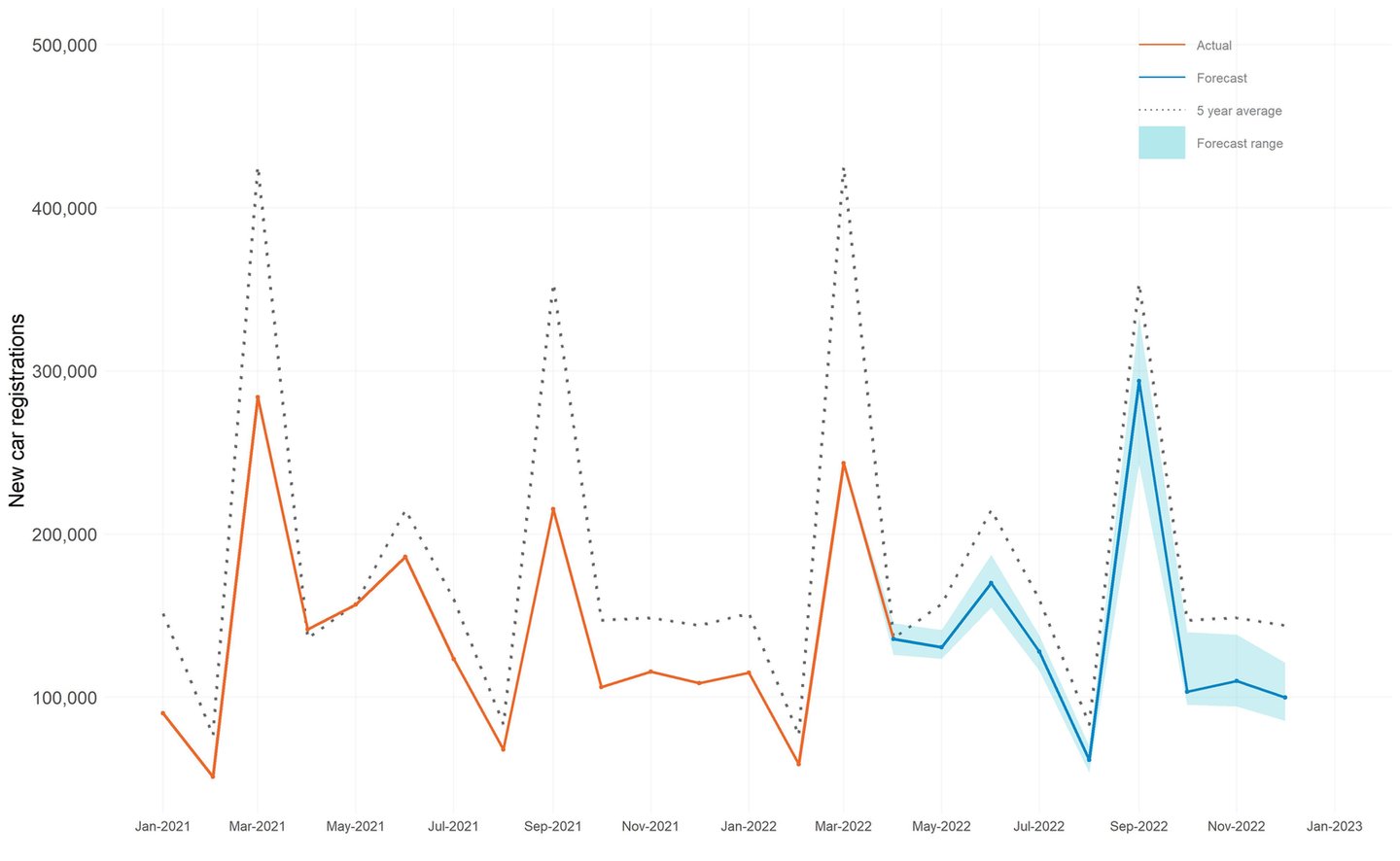

Cox Automotive has therefore adjusted its new car forecasts for 2022. Its baseline scenario sees Q2 2022 end on 436,286 registrations, a reduction of 9.9% down year-on-year, while Q3 2022 is now predicted to end on 483,433 registrations, a 22% increase year-on-year.

In addition, Cox Automotive expects the baseline scenario for the full year to end on 1.65 million registrations, a 0.2% increase year-on-year, but a 13.8% downgrade, with an upside scenario of 1.83 million, a 11.2% year-on-year increase, resulting in a 14.1% downgrade and a downside scenario of 1.51 million, an 8.3% year-on-year decline, but a 11.3% downgrade on its previous forecast.

“It is looking increasingly likely that the pre-pandemic automotive market we all knew may never return as the sector continues to be hit by headwinds,” said Nothard.

“Whether it is a growing number of manufacturers switching to the agency model or ongoing supply chain disruption, the UK’s automotive sector looks set for short to medium-term volatility and may well emerge from this looking completely different to pre-pandemic levels.

The year began with the hope that the UK’s new car supply constraints would endure a smooth and progressive recovery throughout the year as semiconductor and raw material supplies steadily returned, says Cox Automotive.

However, these hopes were dashed, with the conflict in Ukraine impacting the automotive supply chain and the entire logistics and distribution network.

Nothard explained: “Supply headaches also persist from the long-awaited fulfilment of orders made 12 or even 18 months ago. However, there are also reports of this year’s order books already being full, so it’s clear the backlog of orders will only grow, and new orders won’t turn into actual registrations until at least H2 2022 or even into 2023.”

Nothard reports that many of the cars eventually rolling off the production line are missing specifications such as touch screens, heated seats, and sat nav devices.

These are short-term solutions many manufacturers are implementing to overcome the ongoing semiconductor shortage. However, it means consumers are often compromising on what options they initially wanted to order on a vehicle.

Nothard also highlights the effects of fewer new car registrations and what this means for the used vehicle parc.

When comparing the pre-pandemic years of 2018/19, with the pandemic years of 2020/21, the UK saw 1.4 million fewer registrations.

Combining the five European countries; Germany, Italy, Spain, France, and the UK, 5.8 million fewer registrations were recorded.

Nothard claims global vehicle production is also down 31 million, which will lead to a continued supply and demand imbalance.

Login to comment

Comments

No comments have been made yet.