This feature was taken from our comprehensive guide to fleet electrification. Click here to read the full special report.

Taking on electric vehicles is no longer an option chosen only by the more environmentally-conscious organisations or those looking for good publicity: it is now non-negotiable.

Under a Government mandate, all new cars and vans sold in the UK from 2030 must have significant zero emission capability, which means no new purely petrol or diesel models will be registered.

From 2035, all new cars and vans registered must be zero emission.

Although these dates are several years away, for many organisations they may be just one, two or three replacement cycles away, meaning fleets which have not yet started the transition should start planning now.

There are also business and productivity reasons to make the switch sooner.

Many organisations have made corporate pledges to reduce their carbon emissions, and as their vehicles are a major source of the pollutant, they are pushing ahead with programmes to electrify their fleets.

Cost is often cited as a reason to delay electrification but in many instances – and despite a higher purchase price or leasing rental – running a battery electric vehicle can be cheaper to run over its time on a fleet than an ICE alternative (see below).

Regulation is also playing its part in making BEVs attractive from a financial point of view.

Concern around air quality, for example, has seen a rapid expansion in Clean Air Zones. As initiatives similar to London’s Ultra Low Emission Zone spread to other cities in the UK, it is likely that financial penalties or outright bans – as seen in Oxford – for more polluting vehicles will increase significantly.

Regulations can offer rewards as well as penalties. National and local government schemes offer incentives such as grants towards the purchase of EVs and charging infrastructure, as well as tax relief mechanisms such as the current Vehicle Excise Duty exemption.

BEVs can also contribute to a better working environment for drivers.

They are quieter than ICE vehicles and, as they have only one gear, are smoother and easier to drive, particularly in stop-start traffic. This can lead to reduced fatigue and happier drivers.

With fewer moving parts than ICE vehicles BEVs also require less maintenance and potentially have longer lifespans, allowing them to spend more time on the road and less in the workshop.

However, despite these benefits, it is important to understand that petrol and diesel vehicles are still likely to have their place on a modern fleet for some time yet, as current BEV technology and the charging infrastructure means they are less well suited to some tasks, such as long-distance deliveries.

This highlights an important point for organisations which have not yet stated their electrification journeys: stay calm, do not be improperly influenced by organisations which have already acquired hundreds of BEVS, but plan thoroughly and take on the vehicles at a pace and in a way which suits their operations.

While bulk ordering BEVs may sound like an excellent idea, if they are not supported by the right charging infrastructure or not suited to their intended job purpose, then the organisation will encounter a multitude of issues.

The companies that flourish by going electric are those that understands their needs, make the necessary preparations well ahead of time, and who make the transition gradually, as this allows them to address any teething problems along the way.

The process also differs for perk cars and job-need cars/commercial vehicles.

Perk Cars

Perk cars are the most straightforward part of a fleet to electrify.

Company car drivers benefit from favourable benefit-in-kind tax rates for ultra-low emission vehicles, which mean they can save hundreds of pounds each month if they choose an EV over a petrol or diesel model.

In recent years the limited choice and high/purchase cost of a BEV meant they were available through company car choice lists only to the more senior employees in an organisation, the launch of lower cost models such as the MG ZS and Vauxhall Corsa Electric, means they can now be offered in all bands.

Organisations can also use the company car choice list to further drive the uptake of electric vehicles.

This could be met with resistance from some employees, but this can be overcome through education to encourage them to make the switch.

Another way to get company car drivers behind the wheel of an EV is for the organisation to capitalise on the tax benefits offered.

For example, the low BIK also mean employers make significant National Insurance Contribution savings if an employee takes an EV over an ICE model.

These savings could be used to increase the rental limit on BEVs eligible for different company car bands to give drivers access to a vehicle which would otherwise be unavailable to them.

An increasing amount of organisations are also launching salary sacrifice schemes as a cost-effective way of getting drivers – both employees who are eligible for company cars as well as those who are not – to select EVs.

These work by taking a payment from an employee’s salary before tax to cover the cost of the car, maintenance, and insurance.

Employees have to pay BIK on the vehicle, but the total sum works out much cheaper than if the employee purchases the same car through a personal lease or deal.

Job-need cars and vans

Job-need cars and light commercial vehicles present a different challenge as the key requirement for them is to be able to meet operational requirements so their drivers can perform their jobs effectively.

For these vehicles, the first step is for an organisation to understand the make up of its fleet and how the vehicles are used, including factors such as payload and carrying capacity, as well as maximum distance travelled on a daily basis.

Many fleet decision-makers find telematics is a very useful tool when analysing vehicle usage data.

All of this information should be compared to the capabilities of current BEVs on the market to identify which vehicles are the easiest to replace zero-emission ones.

This data should also be compared with the replacement schedules of existing vehicles, as it may be that a vehicle which is due to be replaced soon but its role is currently not suited for electrification could be switched with another where a BEV would be suitable.

In taking these steps, fleet decision-makers can develop an accurate electrification roadmap that encompasses business need, vehicle availability and renewal timings.

Operational differences

Once an electric vehicle is on the fleet, there are a number of differences in the way they need to be managed to a petrol or diesel one.

The most important one is arguably ensuring the vehicles have sufficient charge when they are needed.

This could be the charge points installed at the workplace, at an employee’s home, on the public charging network of a mixture of these.

The overall aim is to ensure that charging, which takes longer than refuelling a petrol or diesel vehicle, has a minimal impact on a working day, as the time an EV is plugged in is time the vehicle could be earning its owner money.

Telematics also has a key role to play in the smooth operation of an electric fleet, says the Association of Fleet Professionals.

Many electric van operators are timing charging sessions to coincide with drivers’ breaks, and then using telematics to confirm that employees are only charging their batteries to 80%, as this is seen as the most productive balance of work availability against charging time.

This is because a vehicle’s battery management software typically slows down the rate of charge at 80% to reduce the build-up of heat and to protect battery health.

Telematics and routing software can also help employers manage where the vehicle is charged.

Many organisations try to minimise the use of rapid charging, especially on motorways, as there is generally a wide gap between the cheapest available power, which is usually at home, and the most expensive, which is normally the fastest commercial charging.

Additionally, in cases where there is limited charging provision, such as in remote areas, telematics means work can be planned around the few facilities that are available, making EVs usable in places where there might otherwise be difficulties.

In all of these instances, the use of telematics makes planning and monitoring much easier, showing the location and type of chargers in relation to the vehicle route and allowing charging strategies to be implemented effectively.

Total cost of ownership

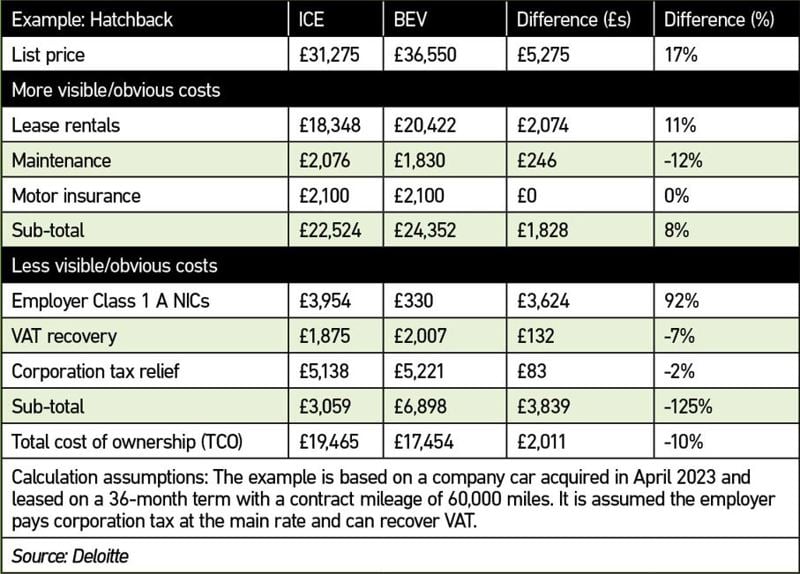

Taking a total cost of ownership (TCO) approach to vehicle procurement not only shows that EVs are often cheaper over their lifetime, but it also facilitates better financial management of a car scheme.

TCO captures all direct and indirect costs associated with buying and using a car over its expected lifetime.

It includes the more visible and obvious costs, such as vehicle funding (including lease rentals, finance payments, depreciation etc.), maintenance costs (including tyres, servicing, MOTs etc.) and insurance.

TCO also takes into consideration the less visible costs, such as refuelling – be that electricity or petrol – mileage reimbursement, and direct and indirect taxes including VAT, corporation tax and National Insurance Contributions.

Integrating these elements enables employers to make better informed judgements on the financial implications associated with switching to EVs.

As this example provided by Deloitte shows, the EV is more expensive if you only consider the list price or the obvious costs.

However, the ICE vehicle is much more expensive when incorporating the less visible costs; the greatest difference being the employer NICs.

Explore more EV fleet resources

From infrastructure grants to fleet charging solutions, Fleet News can help you. Dive deeper into the insights that matter for your electric transition. View EV fleet articles.

Plus...

A Guide to Fleet Electrification: a special digital report.

Fleet News has published a digital report offering advice to any business taking those first steps into the world of electric vehicles, while laying out the challenges to those yet to start their transition.

Fleet News has published a digital report offering advice to any business taking those first steps into the world of electric vehicles, while laying out the challenges to those yet to start their transition.

Companies operating fleets of cars and vans have less than seven years until they will no longer be able to buy full petrol and diesel vehicles.

For many, that means a maximum of two replacement cycles.

Yet a large proportion have not started to consider the implications for their businesses; some have no plans to look at electric vehicle scenarios until close to the 2030 deadline, according to Fleet News surveys.

A few still believe the Government will soften its stance and push back the deadline due to the current supply delays.

These businesses are playing a high-risk strategy: transitioning to electric is rarely straightforward.

Among the many considerations are the installation of workplace charging infrastructure, reimbursement policies and the possible reworking of daily workflows and journey plans to accommodate vehicles, particularly light commercial vehicles, with less range.

The Fleet News Guide to Running an Electric Fleet will help companies to take those first steps, offering advice to speed up and simplify the process.

It also details the electric vehicles coming soon from Audi, BMW, Cupra, Ford, Kia, Hyundai, Peugeot, Polestar, Tesla, Vauxhall, Volvo and Volkswagen.

Report sponsors Allstar, ATS Euromaster, Europcar, Northgate Vehicle Hire, Zenith and Webfleet also offer their advice for a smooth and speedy transition.

Login to comment

Comments

No comments have been made yet.