Risk management and electrification are at the top of the agenda for almost all fleet managers, and this was the case at the Fleet News Awards roundtable last month.

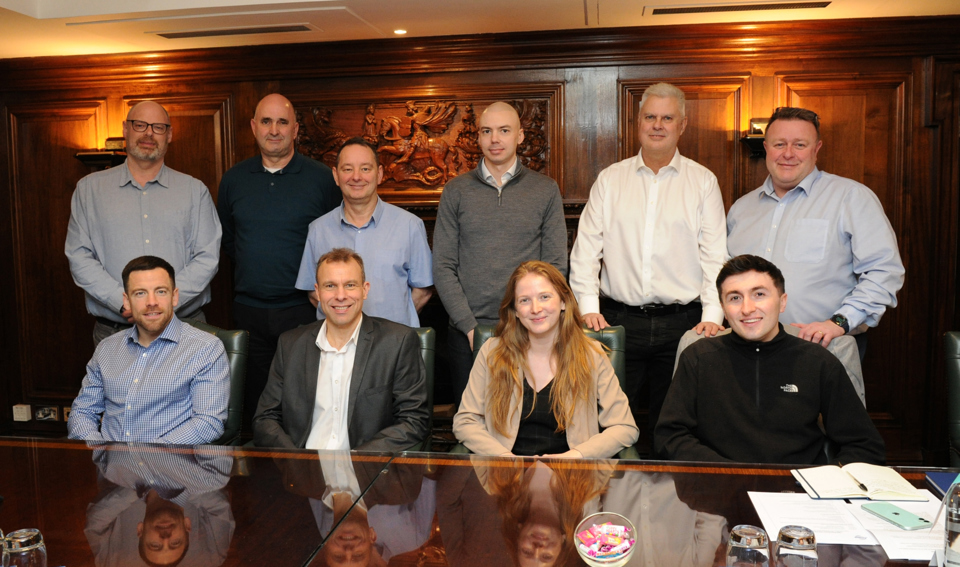

The event, sponsored by sopp+sopp, featured fleet decision-makers who were short-listed for this year’s Fleet News Awards.

During the meeting, they shared experiences and best practice advice to help their peers meet many of the challenges they had already faced.

Fleet News: What initiatives have you introduced to improve risk management?

Andy Wills, fleet manager, Mitsubishi B V: I knew introducing dashcams was one of the things we should consider - having done it at my last employer, I knew they work. I know it’s contentious and can be difficult to ‘force’ them on drivers, so at Mitsubishi, I made it optional for our drivers rather than mandatory. Despite this, we’ve had a 95% uptake – everyone except just a few people have agreed to have one.

Aaron Powell, fleet director, Speedy Asset Services: As well as dashcams, we have driver facing cameras in our vans and trucks, and that created some debate among the drivers. But when you prove to your drivers the cameras are there to protect them and not catch them out, it becomes easier.

We’re not sitting there watching 1,800 cameras all day long. We’re not going to hear them talking or singing; we don’t hear anything. We’re only going to look at the footage if there is a g-force event, and we can prove you weren’t on the phone, you were doing everything right and it was somebody else’s fault. Or, if it was their fault, we can get on and deal with it straight away.

We’re rolling out cameras now for our 650 cars. Every time an employee gets a new car it will come with a dashcam already fitted. We are hardwiring it in so people can’t say they forgot to plug it in.

Andy Wills: The key point is the camera never lies. Over the years I’ve read many claim forms and then watched camera footage, and you think to yourself ‘Are you on a different planet? I’m watching what happened and you’re telling me something different’.

Chris Beeby, business development director, Sopp+Sopp: From our perspective of managing the incident and then the ramifications based on liability and the incident’s severity and circumstances, if you could get observed evidence from the scene – and that’s essentially what the footage is - then you are going to be in a much better position in determining liability. That will then help you to protect your claims cost or support the driver, support the incident and make the right decision about what’s next. There’s nothing that does that like the camera.

Fleet News: Have you seen your insurance premiums rise, and have you taken any measures to mitigate that?

Aaran Powell: I think the increase in insurance has come with the increasing numbers of electric vans: it’s about writing off a £50,000 van rather than having a £2,000 accident claim.

Andy Wills: The thing with insurers, you’ve got to show your commitment to improve, but it doesn’t necessarily reduce premiums, not initially anyway.

Chris Beeby: It depends as well on who your insurer is, what policy cover you have and your insurer’s appetite to look at things like your claims experience and the risk management initiatives that you have.

We’ve seen some of our fleet customers have positive dialogue with insurers over what they have done and initiatives that they’ve put forward to support cost reduction.

But we’ve seen it where a few customers of ours have actively shown a strong appetite for risk management and have reduced incidents, but their premiums are still going up today.

Aaron Powell: Get your insurance company on board to contribute as well. If you’ve got some initiatives, like you want to fit cameras, they may contribute financially because it helps them in the long run.

Andy Wills: They normally do a pound for pound, so they will match your spending up to a certain limit.

Fleet News: What progress are you making when it comes to electrifying your fleets?

Catherine South, payroll and fleet manager, Flagship Group: From January this year, we are ordering EVs only, so we have made that jump.

It does create some challenges, but before that we were allowing drivers to have plug-in hybrids and that has definitely been integral over the past couple of years in getting drivers to the point where they would say ‘Okay, I’m ready for a full EV’.

We’ve actually got a few drivers in the PHEVs who have come to us and said ‘I know I’ve got a couple of years left on my lease, but I’d love to go full EV’.

Since we’ve gone EV only, we’ve had a couple of people push back, but we’re managing to reallocate within our fleet.

It’s definitely a hearts and minds thing. Being a payroll manager as well, it’s about the people, so we work really closely with HR which really works for us.

James Ferrol, fleet manager, Dunelm: At the company I worked at before I joined Dunelm in July, we faced the same issues: we actually introduced a fully-electric fleet policy in January last year.

As a lot of our company car drivers were in sales, we had a population where they were typically in houses with garages or off-road parking. This meant they were able to get chargers installed.

Catherine South: We have a partnership with Pod Point to install home chargers if people don’t have them, and we have office chargers with Mer.

If people say they can’t have home chargers, we open up the conversation with Pod Point and they are very clever about what they can do and where they can put them.

We’re also looking at the future, having conversations with our local city council and other companies to engage with them on their charging networks as well as share our chargers.

With our van drivers, we're currently going through a bit of a trial where they're having the home chargers installed.

And obviously, because their mileage is mostly all business, we're kind of going through the process where they're charging, and it's up to them to, I guess, navigate their own energy tariff, which is a bit of a challenge, because they don't see it as a priority.

James Ferrol: We're currently at about 40% electric and 40% hybrid, and then the remainder of our cars are petrol and diesel.

When I joined the first bit of feedback I got was that company car list was not good, so my kind of first big challenge was I put together a proposal to change the wholelife cost bands.

The company car drivers in our lowest bond are more engineers and they are really high-mileage users so they have to have to car capable of doing their job, but the bands didn’t allow them to go into BEVs.

One of the big complaints was that to get a fit-for-purpose vehicle they have to pay a trade-up, but that’s not what a trade-up should be about: it should be to allow drivers to upgrade their cars if they want to.

The core vehicle offering basically means that if they choose that the spec is fixed, they can't change any of that, and they get a choice of two colours.

So far, it's been really successful. One of the spillover benefits I didn't realise I’d get we've actually negotiated some enhanced terms with manufacturers.

Delegates:

Matt Thomas, fleet optimisation manager, Bill Plant Driving School

Sheriff Bajo, fleet compliance officer, Dundee City Council

James Ferrol, fleet manager, Dunelm

Catherine South, payroll and fleet manager, Flagship Group

Andy Wills. Fleet manager, Mitsubishi Electric B V

Aaron Powell, fleet director, Speedy Asset Services

Gareth Jones, fleet compliance manager, Speedy Asset Services

Simon Ungless, fleet manager, The AA

Jenny Dolan, group fleet manager, Wheatley Group

Chris Beeby, business development director, sopp+sopp

Callum Langan, managing director, sopp+sopp

Login to comment

Comments

No comments have been made yet.