In a clear nod to the rapidly-evolving business environment, Arval has renamed its Corporate Vehicle Observatory report, which assesses company views on fleet issues across Europe, as the Arval Mobility Observatory (AMO).

In a clear nod to the rapidly-evolving business environment, Arval has renamed its Corporate Vehicle Observatory report, which assesses company views on fleet issues across Europe, as the Arval Mobility Observatory (AMO).

Mobility is the hot topic with many countries seeing the traditional fleet manager becoming a mobility manager. This is particularly so in Netherlands and Belgium where the flat topography lends itself more readily to alternative and integrated forms of travel solution.

The UK is lagging behind, although, even here, there are signs that travel is being integrated into the fleet role.

Consequently, the AMO survey puts greater emphasis on mobility this year, questioning fleet decision-makers on the propensity to give up cars for alternative solutions as well as the use of alternative fuels.

However, as head of AMO in the UK Shaun Sadlier pointed out: “The company car is still going to play a major role. Often it is the practical choice, particularly where the driver does big mileage and multi-point stops. It also still has a role as a benefit. But there’s no doubt, mobility will be a bigger part of future travel solutions.”

Mobility services complement, not replace, car offering

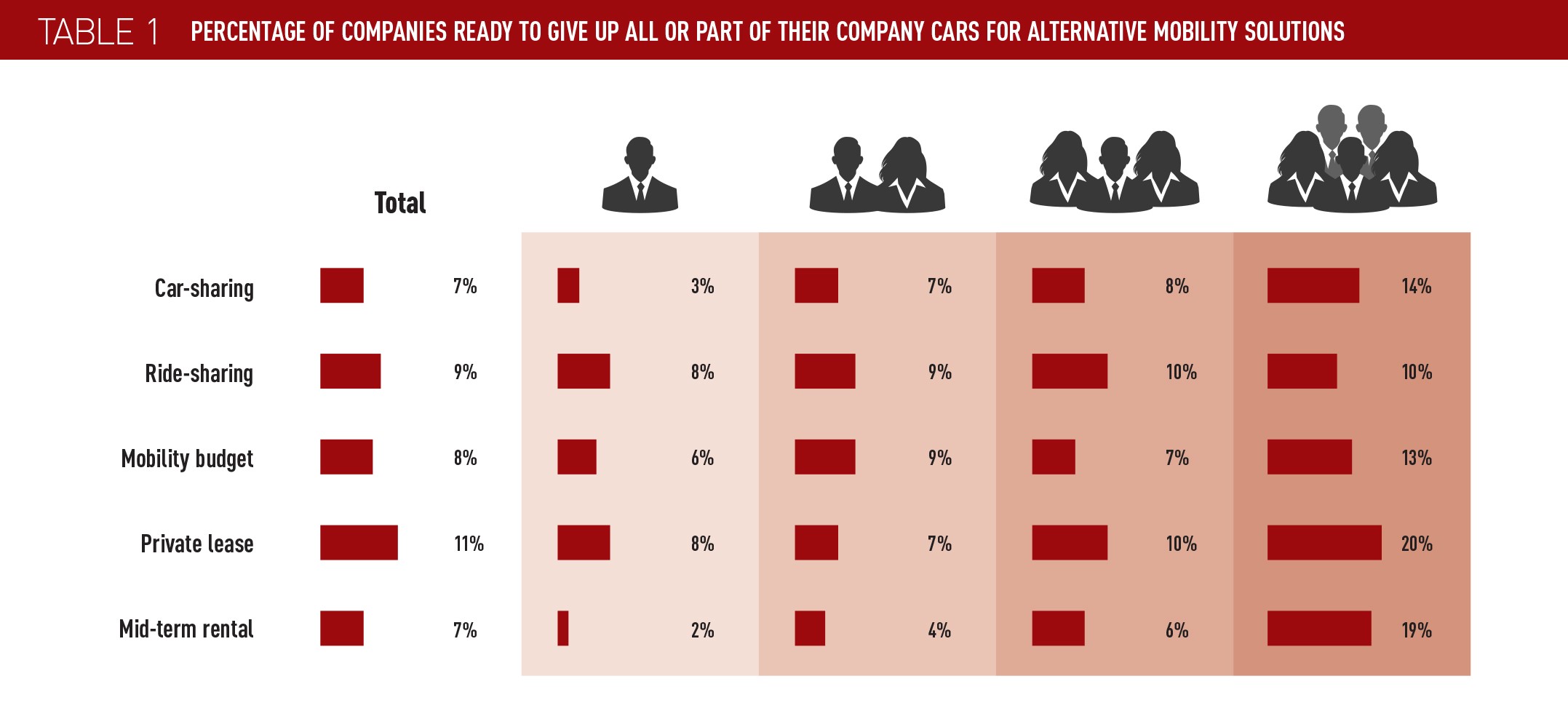

Despite those bullish predictions, the vast majority of companies are not yet ready to give up their company cars for alternative mobility solutions (see table 1).

Greatest interest is predictably among the largest companies, while the most popular alternatives are private lease (11%) – likely to be for those taking cash allowances – and ride-sharing (9%).

Interestingly, when questioned in last year’s report about whether they used mobility alternatives, 26% of UK companies said they were using car-sharing and 38% were using ride-sharing. Adding in those who were also considering using these services within the next three years, the percentages rose to 34% and 48% respectively.

It appears these services are being offered primarily to employees who do not have access to a company car; few businesses are willing to stop providing the car as the solitary option, according to this year’s research.

Indeed, the proportion using or considering using within the next three years has actually dipped slightly year-on-year. Now, 31% highlighted car-sharing and 45% ride-sharing, although the biggest companies were by far the most proactive in this area., at 57% and 65% respectively.

The survey asked, for the first time, about mobility budgets. In total, 8% of companies said they were ready to offer mobility budgets instead of company cars, rising to 13% for the largest companies, while 21% would consider it as a solution within the next three years (32% for the biggest corporates).

More companies would also consider introducing private leases, most likely to meet the needs of cash takers who want solutions such as affinity schemes via their employer from providers they trust.

Sadlier said: “We are increasingly talking to customers about mobility solutions.”

However, he added: “It appears that the vast majority see them as supplementing or being a partial alternative to the traditional fleet.”

Employees still value having a company car as a benefit – the AMO research showed ease of motoring was the most popular reason for choosing a company car, followed by not having to finance their own vehicle and no risk of ownership, such as maintenance costs.

“A mixed provision model is the one most likely to develop in the majority of businesses, where a range of mobility solutions are used alongside company cars with employees using the most appropriate form of transport for each journey,” Sadlier said.

“Our belief is that, over the next few years, as more and more fleet managers become mobility managers, one of the most interesting developments will be the process that businesses undergo in learning how to use mobility options in the most effective manner.”

Congestion concerns trouble fleets

Uncertainty caused by future company car taxation is dominating many fleet discussions, but was relegated to the second biggest challenge companies are facing in the next five years.

Top concern is increasing congestion due to a lack of road infrastructure said 49% (see table 2). With many respondents running van fleets, this is a business critical issue.

It is the area fleets want the Government to focus on most urgently, with 54% highlighting improving roads and 47% stressing the importance of tackling congestion (table 3).

“When we talk to fleet and mobility managers, there is a general level of concern, not really over the building of new roads, although these are needed in some places, but at the condition of existing ones and the impression that they are not being used to their maximum efficiency,” Sadlier said.

Nevertheless, he was surprised that increased vehicle taxation wasn’t more prominent, with 30% of respondents ticking the box.

Many of the challenges are external regulatory and policy factors rather than practical issues, such as unclear Government policy on transport and clean air zones.

Implementation of alternative fuel policies was cited by 19% and this, according to Sadlier, is the biggest topic Arval is working on, with some 30 client projects starting in the past three months.

Concerns included introducing the correct reimbursement grading for plug-in hybrids and using accurate fuel consumption figures for total cost of ownership calculations (Arval recommends using the advisory fuel rate). Pure electric vehicle (EV) anxieties centre on range and charging infrastructure.

“We are working on breaking the myth that EVs are for low mileage drivers,” Sadlier said. “It’s about the driving profile: for example 25,000 miles a year, but 100 miles per day is ideal. When you get to 250-300 miles per day, it is less appropriate.”

Uptake is continuing to grow with 34% of companies implementing or planning to implement at least one alternative fuel solution, up from 32% in 2018. It is accelerating fastest among larger companies, up from 69% to 78%, with full electric vehicles accounting for most of the year-on-year increase.

“The fact that larger organisations are leading the way in the adoption of newer fuel options is unsurprising for a number of reasons,” Sadlier said.

“Many have corporate social responsibility targets to meet and a more structured approach to their fleet, so tend to incorporate new developments into their fleet policies as a matter of course in a methodical fashion.

“Bearing in mind that a substantial part of the company car parc is operated by fleets at the smaller end of the spectrum, special efforts need to be made to educate them about the benefits of these vehicles.”

With the cost of EVs still substantially higher than diesel/petrol equivalents, fleets also believe that Government needs to introduce better incentives to encourage uptake. This includes the BIK tax tables with the 2% level not being introduced until 2020/21.

“If the Government wants to achieve its clean air strategy, they can help business by reducing the cost,” Sadlier said.

“Linked to the adoption of zero-emissions fuels is the belief that more should be done to tackle road transport-based pollution. Our experience is that businesses are almost always supportive of Government moves to make improvements in this area.

“Finally, some people may think it surprising that fleet and mobility managers want to see better public transport but the strategic developments we are seeing in this area show that businesses see the future of travel as being one where cars and vans are used alongside a range of other options. Better trains, trams and buses should form a key part of this mix if possible.”

Diesel’s inexorable decline

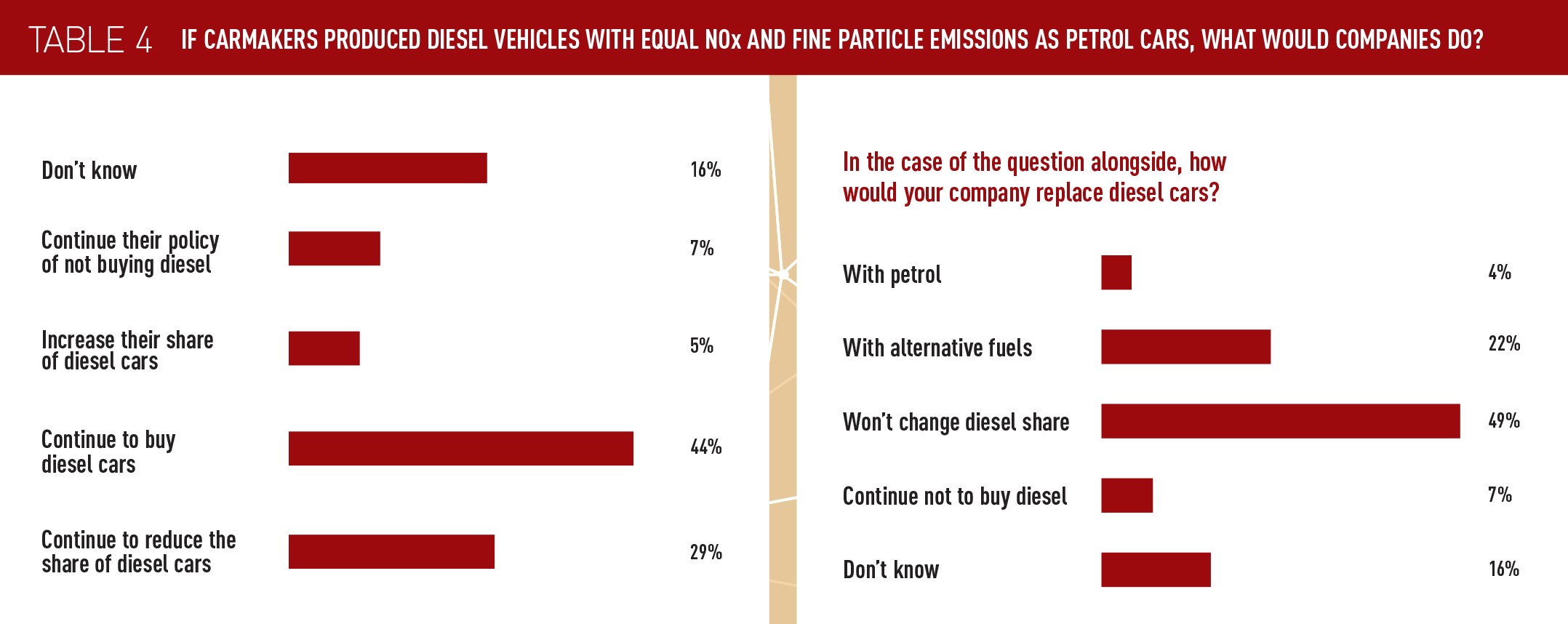

Companies will continue to reduce the number of diesel cars on their fleets and there appears to be little manufacturers can do about it.

When questioned about their response should carmakers introduce diesel with equal NOx and fine particle emissions as petrol cars, 29% said they would continue to replace diesel cars and 7% would continue with their policy of not buying diesel (table 4). Just 5% would increase their share of diesel, while 44% would continue to buy diesel.

“RDE2 diesels are starting to become available and some of them are comparable with petrol on NOx emissions while also offering better CO2 output and fuel economy,” said Sadlier. “However, it appears diesel has become so inherently unpopular that there will be no large scale resurgence in its popularity, despite this development.

“We have some major clients that have targets to be completely out of diesel by 2024/25 across Europe. That means their final diesel orders would be this year. It’s a fixed pattern and changes in diesel efficiency and emissions will not change that.”

Most fleets intend to replace diesels with electric vehicles – 22% versus 4% for petrol – which will give a strong push to alternative fuel adoption.

Clean air zone strategies

One-third of fleets expect to be impacted by the introduction of low emission and clean air zones, with most simply replacing vehicles with those that meet the new standards of Euro 4 petrol and Euro 6 diesel.

Awareness among fleets is high, although 13% said they intended to make no changes and would accept the impact on their business operations. A further 12% are searching for other transportation options, such as last mile EVs, bike couriers and scooters, perhaps anticipating further tightening of the rules.

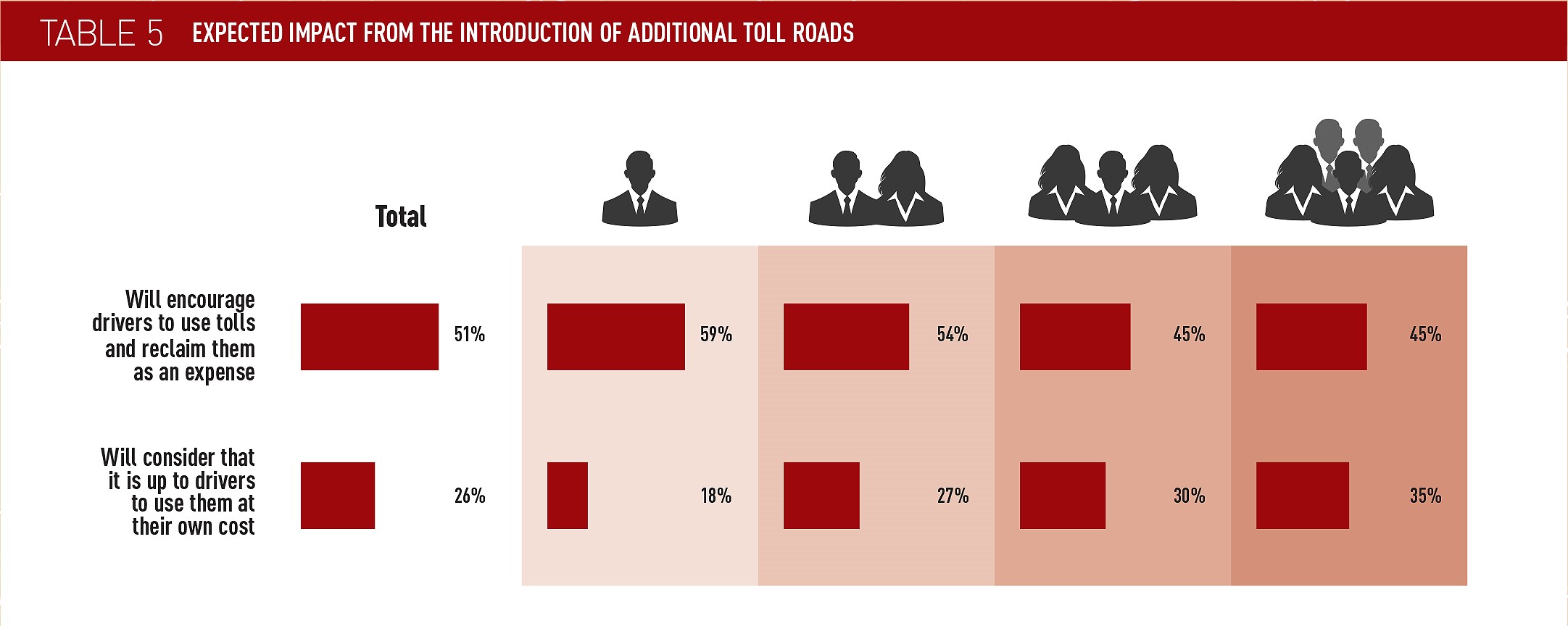

Fleet attitudes towards the introduction of more toll roads were revealing (table 5). Just more than half (51%) would tell drivers to use them and reclaim the cost as an expense, with smaller companies more likely (59%) than large corporates (45%).

Their reasoning, surmised Sadlier, was “presumably in the expectation that they are reasonably priced and will help to make their transport faster and more efficient”.

Personal finance solutions

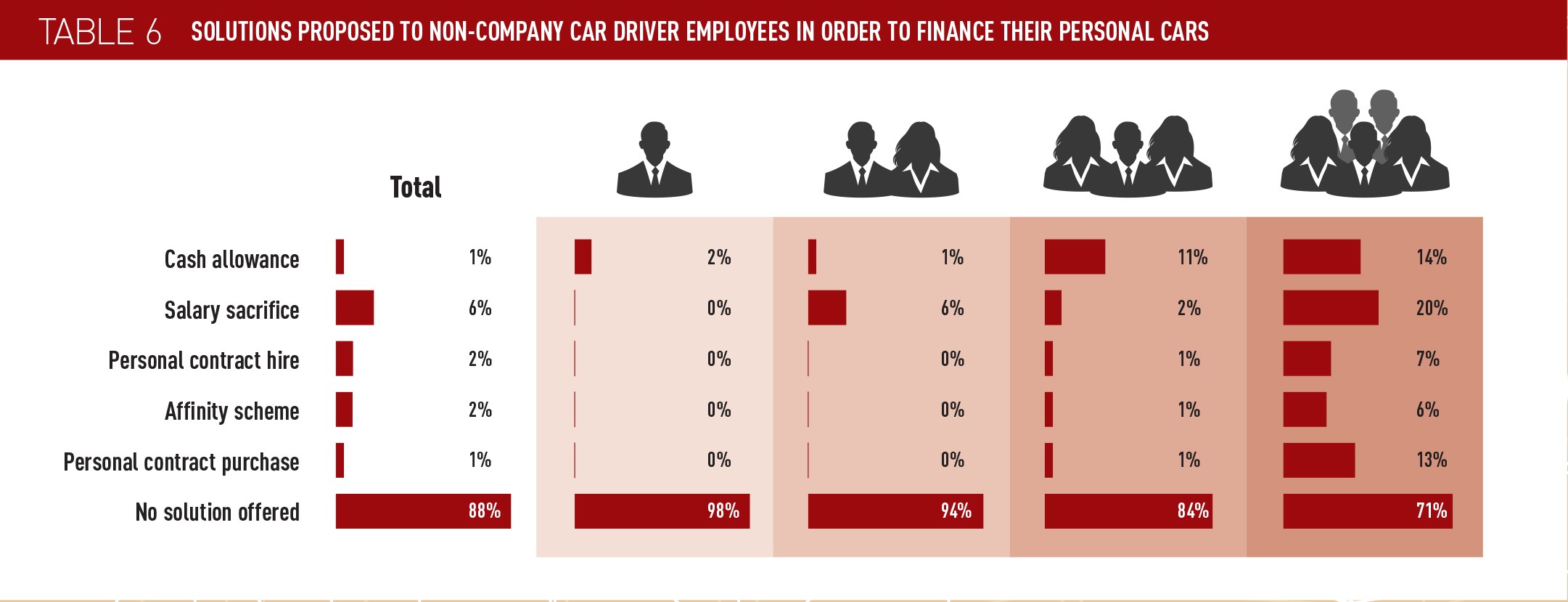

Just 12% of companies offer solutions to non-company car employees, although that proportion rises to 29% for the largest businesses (table 6).

Cash allowances are the most popular option, offered by 7% of companies (14% of large corporates), followed by salary sacrifice at 6% (20%). Few of the smallest companies offer any alternative.

“It’s a pain for smaller companies,” said Sadlier. “Large companies have the internal functions to manage multiple schemes and to understand the flexible benefits package.”

He added: “We are still talking to companies about salary sacrifice, but, increasingly, it’s part of a wider offering for employees with company cars, PCH and affinity schemes.

“Businesses are seeing it as an attractive employee benefit to offer car leasing schemes that offer many of the advantages of company car schemes to a wider range of employees.”

This trend is more than offsetting the slight reduction in the number of company cars.

“We have been saying for some time that, while there has been a marginal fall in the number of company cars generally, the overall fleet leased to employees in the UK has increased,” Sadlier said.

“Even among large employers, penetration for this type of initiative is still only around the 30% mark, so we expect this to be a major area of growth for leasing companies in the next few years.”

Safety first

Fleets are increasingly stipulating the latest safety technology on their vehicles as risk management continues to remain a priority.

However, while advanced driving assistance systems (ADAS) are becoming more common as optional choices, there is a lack of reliable information available about which work best in terms of actually helping drivers avoid accidents.

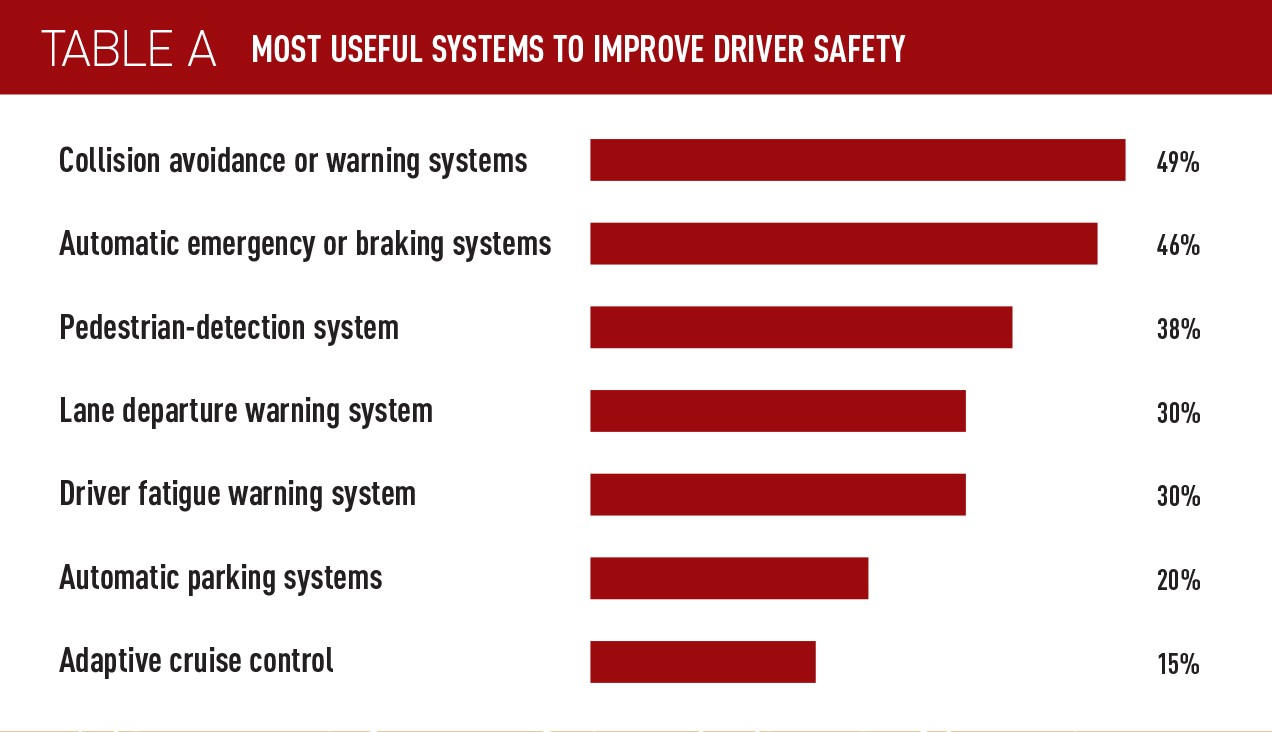

Shaun Sadlier said: “This research represents a list of devices fleet and mobility managers believe will be most useful in real world conditions – and what it indicates they want more than anything is to avoid collisions with other vehicles and pedestrians.”

Collision avoidance/warning systems are seen as most useful, followed by automatic emergency braking systems (see table A).

“Our view is that ADAS technology works best in promoting safety when used alongside telematics devices that allow driver behaviour to be highlighted, helping employees to make improvements both by themselves and through options such as training,” Sadlier said.

“Some fleets mandate this equipment and we are seeing others with their manufacturer tenders ask whether the vehicle has it.”

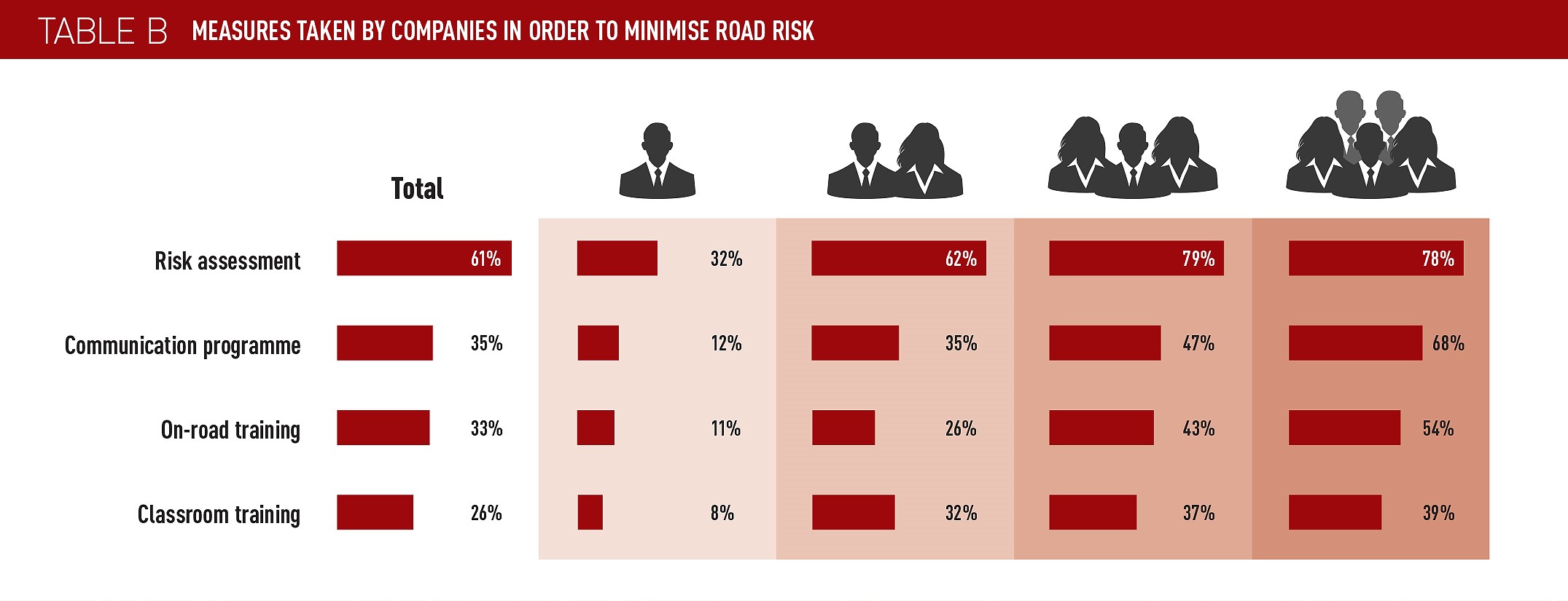

However, there is a big gap between large and small companies when it comes to road risk measures. Just 32% of small businesses carry out risk assessments compared with 78% of large companies (see table B).

“This is almost certainly an issue of resources,” Sadlier said. “A large organisation will tend to have company-wide risk assessment arrangements in place that cover all their activities in depth and the fleet will benefit from this professionalism.

“What is needed are more services and practical help to enable smaller employers to raise their safety to standards comparable with their larger counterparts and this is a task in which the entire fleet industry needs to play a part.”

He added: “We are now seeing in policies what drivers should do in averse weather conditions, for example, don’t drive in snow. We’ve not seen this before, but in the past year it’s starting to be introduced.”

Login to comment

Comments

No comments have been made yet.