Paying the cost of vehicle repair or insurance excess is just the tip of the iceberg, with the true cost of a collision being much greater. Andrew Ryan reports

When a company vehicle is involved in a crash, the obvious costs are just the tip of the iceberg.

For, unlike the bills for the repair or insurance excess which are easily visible, the real cost implications lay hidden beneath the surface.

These include losing key personnel to injury or ill-health, loss of business, potential loss of reputation and the expense of hiring replacement vehicles while company cars or vans are off the road.

“One of the challenges is that many of these figures never appear on a balance sheet,” says Andy Price, director of consultancy Fleet Safety Management.

“All the CFO sees is the insurance cost and maybe the cost of the excess. But they don’t see that the employee was absent for seven hours trying to sort the issue out with the leasing company, or worse that they are off injured as a result of the collision.

“Many organisations look at collisions as an inevitable part of doing business, so they accept these costs and they bury their heads in the sand somewhat and don’t think about what the knock-on effects are.”

The International Loss Control Institute says that for every £1 an insurer pays out, the uninsured losses can be as much as between £8 and £53.

Price feels that these figures are a “little bit on the high side because, while there is clearly hidden costs every time a collision occurs, if you start putting those sort of figures out into a boardroom then you would get laughed out because you can’t really justify them”.

As a rule of thumb, he doubles the claims cost because, although some of the numbers which come out are still horrendous, they are more believable.

The aim of highlighting the total cost of crashes to a board is to win investment and backing to either introduce a road risk programme or improve a current one to help reduce the number of collisions.

To further highlight the importance of addressing road risk, Price also uses another technique: he calculates how much revenue a company with an average claim cost of £1,000 would have to make to pay for its collisions.

If that company has a claim frequency of 25% and profitability of 10%, every vehicle on the fleet – not just those involved in a collision – has to generate £5,000 of revenue to fund the uninsured losses associated with the collisions it is having.

If the incident rate is higher or the profitability lower, then this figure will be even more.

Presenting the total cost of crashes to a company in this way is a real eye opener, says Price, and can help win buy-in to a risk management prog-ramme which will help to cut the number of collisions.

Reducing the number of collisions is the best way to bring down cost. However, as long as businesses rely on vehicles for their oper-ation, incidents will happen, says incident management company FMG.

Yet there are numerous opportunities to mitigate and reduce costs within the incident repair process.

This will help minimise the impact on a fleet’s insurance premiums when they come up for renewal.

Doug Jenkins, specialist business resilience manager – motor at AXA Insurance, adds: “The individual we insure might turn round and say ‘that’s what we’re insured for’ and, of course, it is, but at the end of the day it is cost which they can reduce and it’s making the premiums go up.

"If somebody is paying a £100,000 premium and we are paying out £120,000 in claims, then something has to give.”

READ MORE: Fleet200: prompt action by drivers after a collision can reduce insurance costs

Vehicle selection

Minimising the cost of crashes can start with vehicle selection. Cars or vans fitted with advanced driver assistance systems (ADAS) such as blindspot warning and parking assistance will reduce the likelihood of being involved in a collision.

For example, Thatcham Research says autonomous emergency braking (AEB) can reduce the frequency of front and rear crashes by 40%.

But the technology also increases the cost of repair. As well as the expense of the equipment, the work becomes more involved than before, with the rising mix of new materials in modern vehicles also leading to more intrusive repairs.

“This means that where we were once able to partially replace a panel, we now need to replace it in its entirety,” says Thomas Hudd, operations manager at the Thatcham Research Technology Centre.

“This is especially true of aluminium panels, which are challenging the repair industry as they are stiffer and harder to reshape than steel.”

Jenkins adds: “We are finding with the technology that is in many cars now, the only space they’ve got to fit it is often in the wings, back panels and so on.

“You can get damage to a front wing or a door panel which would ordinarily be £300, £400 or £500 is now £2,000 because of the electronics in them.

READ MORE: Do In-cab cameras instantly reduce insurance premiums?

“What would be a good exercise is if fleets feel that they are paying a lot for damage-only accidents, then they could have a look at the breakdown of what the damage was and what they are paying for, because they might get a panel repair at £300 and then the technology may be costing £1,000.

“If they can do without a certain feature without compromising safety, then that is something.”

The Association of British Insurers says the average cost of a car repair bill has risen 32% over the past three years to £1,678, and, while ADAS may not account for the entire increase, it is definitely a major contributor.

As ADAS technology becomes more common-place, fleet management company CLM has seen a 6.6% increase in the cost of repairs for cars in their first year since registration, compared to the overall average increase of 2.8%.

Thatcham estimates ADAS technology is currently fitted to around 6% of vehicles on UK roads and expects this to increase to around 40% by 2020, meaning that while, in theory, fewer cars will be in accidents, the costs when they do will rise.

The brand and model of vehicle can also make a difference to repair costs, says Jenkins. “If you look at a premium marque like a Mercedes-Benz or BMW, the total cost of ownership can be far better than a mainstream brand because of the higher depreciation of makes such as Ford and Vauxhall, but the repair costs are a lot higher,” he adds.

“It is a double-edged sword really. You can go for the better marque which can help you attract better people to work for the company, but, when you do have a bump in one of them, it can be very expensive.

“Certainly take a look at what your fleet make-up is and at what the repair cost is.”

Speed of first notification of loss

“Once you’ve been involved in a collision, there is a whole industry out there trying to make money from that incident,” says Price.

Speed of response after a crash is critical to minimising this cost. Delays in reporting the incident to an insurer or incident management company drastically reduces the opportunity to capture and control the third party costs.

Failing to capture the third party can result in an increase in the entire cost of the incident by more than 900%, says FMG.

“The speed of that first call is crucial to mitigating costs for the at-fault party,” says an FMG spokesman.

“Contacting the third party as early as possible greatly reduces the risk of them pursuing or being approached by other organisations where repair and replacement vehicle costs might not be as tightly controlled.

READ MORE: Fleets warned to improve risk management or face significant insurance premium rises

“This could, for example, be due to repairs which could be completed within 10 days lingering on for up to 90 days if unmanaged, coupled with excessive replacement vehicle charges, and other associated claims also increasing.”

Jenkins adds: “We keep banging on about the golden hour to report an incident, and it literally is that now. People think 24 or 48 hours is good, but it is far too late.”

If the third party is captured, then the insurance company would be able to put them into a rental car costing £25 to £35 per day. However, if they go into a credit hire vehicle, then charges could be up to £200 or £300 a day, says Jenkins.

“It is all legal and then what happens is the credit repair side kicks in and you go to a garage and they will say ‘we haven’t got the parts, the parts will not be in for a couple of weeks’ and then they are the wrong parts,” he adds.

“Again, it is all legal, but then they put in a huge claim at the end for credit hire and credit repair.

“The quicker we can capture the third party, the quicker we can put them in a vehicle of ours. It’s cheaper to start with and then the quicker we can do the repairs in our own repair network, the cheaper it is as well.”

Many incident management companies provide 24-hour hotlines so drivers can report collisions immediately, while an increasing number provide apps so drivers can collect and submit all relevant information through their smartphones.

Vehicles can be issued with driver and bump cards which details what the employee should do in the event of a collision, while part-filled accident forms can also be carried in vehicles to speed up the reporting time as well.

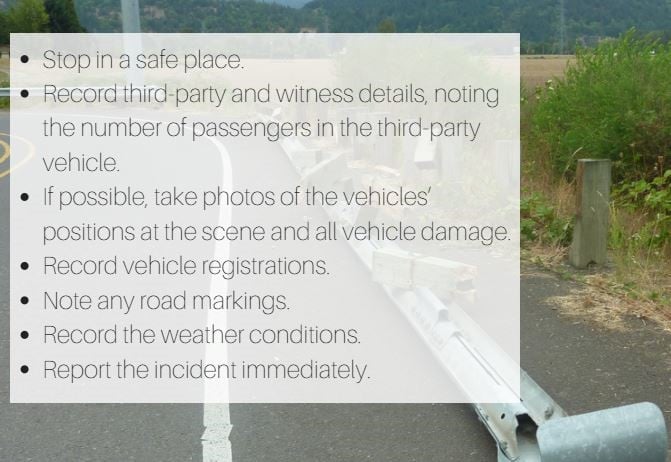

After a collision, FMG recommends drivers should:

The human effect

Any collision also has an effect on a company’s employees: injuries can lead to staff absence, while dealing with the incident also takes up time which keeps them from their main job.

This has cost implications as any absenteeism may need to be covered through overtime or recruitment.

A driver’s well-being should also be considered. Clare Cain, group insurance/risk manager at Kelly Communications, says: “You have to offer support following a collision, not just to improve the driver’s skills, but also to ensure they aren’t suffering from stress or depression.

“Even if the incident isn’t their fault, it can still have profound consequences.”

Colin Hartley, managing director of risk consultancy Driive, adds that the “ripple effect” means the impact of an incident goes far beyond the driver.

“ is a traumatic event and it has a traumatic effect on everybody in the company, certainly everybody who is involved directly with that driver, and when you consider how many people that may be, it can literally run into thousands (of pounds),” he says.

READ MORE: Fleets can play a greater part in preventing collisions - Fleet200 industry speaker

Using incident management companies

Many fleets use incident management companies to deal with collisions as they feel it reduces admin, speeds up first notification of loss time, and minimises downtime as the repair process is being continually managed.

“We’ve outsourced incident management for a long time, purely because it needs specialist knowledge,” says Keith Cook, deputy financial controller of Computacenter.

He adds: “I’d far rather pay somebody that’s got the skills to handle that.”

Chris Mitchinson, director in-life services at CLM, adds: “It can also be difficult for those in-house to obtain quick responses from repairers and insurers to the extent and cost of the damage and a reliable estimate of when the vehicle will be back on the road.

“An outsourced incident management service is a smarter, quicker and more effective way of handling the incident, and can be much more efficient, timely and cost-effective than trying to manage it yourself.

“By facilitating faster repair times through specialist repairers, vehicle off-road time, along with overall cost, is considerably reduced, factors which most insurance companies take into account when negotiating renewal premiums with fleet customers.”

Incident management companies can also handle claims for uninsured losses which are not covered under the vehicle insurance.

These may include vehicle recovery costs, damaged clothing worn by the driver or passengers, damaged items such as glasses, and any hire cost incurred.

Case study: Kelly Communications

Kelly Group has saved “tens of thousands” of pounds through its incident reporting procedure.

The company manages incidents in-house and operates a 24-hour telephone line which drivers are asked to call as soon as they have a collision.

“They have to do that from the scene of the accident. This is the key part,” says Clare Cain (above), group insurance/risk manager at Kelly Communications.

“When I started here I was getting report forms one week later, two weeks later, and they were not really telling me anything about the incident.”

This led to the introduction of the telephone line which, as well as speaking to their own driver at the scene, also allows the company to talk to the third party.

“I can grab everything at the scene when I speak to that third party and understand from my driver what has happened,” says Cain.

“I can determine liability very quickly. If my driver is totally in the wrong I would say to the third party ‘that person has caused damage to your vehicle which I am extremely sorry for’.

“I then go on to explain that we can offer all the services that their own insurance company can offer, which we can, so I lock them down.

“I give them a like-for-like replacement vehicle on the rate I have, not what a credit hire company is going to give them, which is three times the amount.

“I cut out all credit hire, I cut out all other repairers. I will offer to remove their vehicle from the scene for them, I’ll also offer them repairs with insurance-approved repairers who will collect their car from them to give them a door-to-door service.”

Around 90% of those third parties accept Kelly Communications’ offer.

Login to comment

Comments

No comments have been made yet.