Vehicle leasing companies are forecasting further rapid growth in salary sacrifice for cars after reporting a record rise in the benefit during the past year.

The latest Leasing Outlook Report from the British Vehicle Rental and Leasing Association (BVRLA) shows salary sacrifice grew by 68% year-on-year in the third quarter of 2023, with a 12% uptick on the previous quarter (Q2 2023).

Leasing companies expect this growth to continue as cash allowance drivers join the wider employee base in switching to this surrogate fleet scheme when their current car finance contracts end.

Some car manufacturers are even reported to be working with leasing companies on how to position their cars attractively within salary sacrifice schemes.

EVs dominate BCH orders

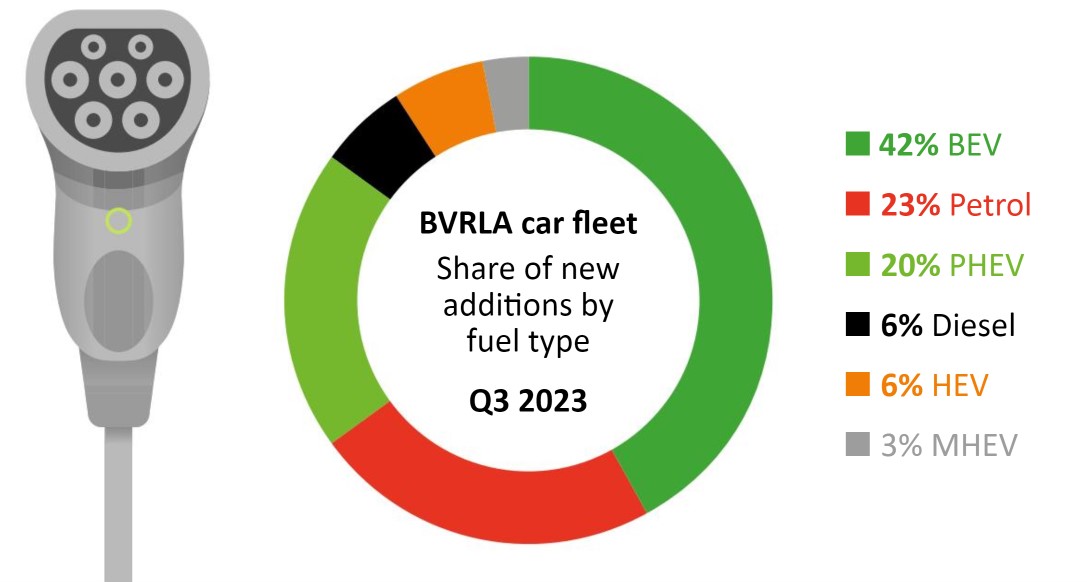

The BVRLA report also reveals how electric vehicles (EVs) are dominating business contract hire (BCH) orders.

More than three-quarters (79%) of new business contract hire cars that joined the BVRLA fleet in Q3 2023 are capable of driving in zero emission mode.

“The leasing sector is reaping these benefits when it comes to vehicle supply and benefit-in-kind tax,” Toby Poston, BVRLA

Battery electric vehicles (BEVs) dominated the BCH market in the three months from July to September, accounting for 47% of deliveries, followed by plug-in hybrids with 25% and hybrid cars with 7%.

Petrol and diesel power represented just 15% and 4% of new BCH additions respectively.

It means that more than half (51%) of the BVRLA lease fleet cars are now zero emission capable.

However, the BVRLA figures also highlight the disparity between the popularity of EVs with company car drivers and the slow uptake among private motorists.

Battery electric penetration of new personal contract hire agreements was only 15% in Q3, three times lower than BCH, in a sector where petrol remains the driving force (62%). Stimulating demand for BEVs in the retail sector, especially secondhand cars, is a major priority for leasing companies amid widespread residual value concerns, says the BVRLA.

Overall, the BVRLA leasing fleet has reached a six-year high, recording 2.2% year-on-year growth to approach levels last seen in Q4 2017.

The total lease fleet is just above 1.9 million vehicles thanks to increased demand for leased vans and BCH cars.

Vans grew 3.3% year-on-year, hitting 516,253 units. They are now responsible for more than a quarter of the total lease fleet.

Car fleet growth was lower at 1.8%, with the healthy performance of BCH offset by a small decline in personal contract hire.

The BVRLA says that the overall fleet growth and continued transition to BEVs have been facilitated by the return of vehicle supply and easing of delivery lead times.

Maintenance included

It has instead been replaced by a perfect storm of parts delays and a technician shortage, combining to increase downtime for service, maintenance, and repair (SMR) work.

Nearly 900,000 vehicles (64%) on the leasing fleet are now provided with service packages from the leasing provider.

That proportion is growing as leasing companies seek to manage longer lead times for parts and an increase in workshop visits due to fewer ‘right-first-time' repairs.

More than three-quarters (77%) of BCH agreements for cars in Q3 2023 included maintenance, while LCV agreements including fleet management are up 25% year on year.

Toby Poston, BVRLA director of corporate affairs, said: “Stability and certainty breed growth, and the leasing sector is reaping these benefits when it comes to vehicle supply and benefit-in-kind tax.

“As ever, a more detailed analysis shows that some motor finance products are doing better than others, while new supply chain challenges continue to appear.

“The BVRLA will continue to work with policymakers and colleagues from across the automotive industry to try and deliver positive market momentum across all segments.”

The full report includes analysis from Auto Trader, Cap HPI, and Fleet Assist, and can be read on the BVRLA website.

Login to comment

Comments

No comments have been made yet.