A new emissions testing regime, economic uncertainty and a demand for greater flexibility have all impacted fleet funding and replacement cycles over the past year.

Leasing firms have faced major tax changes and doubt over how those new rules should be applied, while company car contracts have been signed without future knowledge of benefit-in-kind (BIK) rates.

New salary sacrifice rules introduced before last year’s FN50, were welcomed for their clarity and the funding method was declared ‘alive and kicking’.

Twelve months later, and reassurances received from HMRC that the finance rental of cars should be separated from other costs have gone.

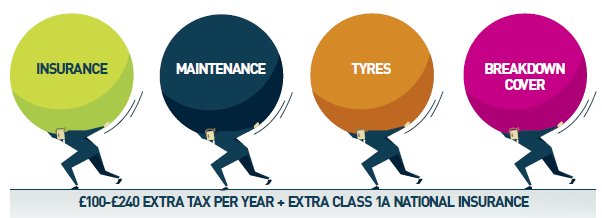

Insurance, maintenance, tyres and breakdown cover, the fleet industry was told, would not be taxed when a new tax regime for so-called Optional Remuneration Arrangements (OpRA) was introduced.

However, HMRC now says their omission was an “oversight” and they should have been included in the original legislation.

Correcting a ‘mistake’

Tax officials recently told Fleet News that the error had not been identified during the initial consultation on the OpRA policy proposals (despite leasing companies lobbying on this exact point).

It is now looking to correct what it described as a “mistake”, from April 2019.

Industry estimates suggest that, for those drivers affected, it could cost them an additional £100-£240 in tax per year. Employers will also end up paying more Class 1A National Insurance (NI).

Talking to Fleet News when the changes were announced in August, SG Fleet estimated that the new rules would impact 43% of salary sacrifice vehicles. More than a third of those (36%) will see their monthly company car tax bill go up by less than £120 a year, it says.

Looking at the cars it has ordered in the previous six months, Zenith says fewer than half will be impacted by the latest legislation change. “The average impact, where there is one, will be around a £10 per month increase,” says Claire Evans, head of fleet consultancy at Zenith.

It remains to be seen how these latest changes may impact future take-up of cars funded via salary sacrifice, but numbers have fallen in the past year.

There were approximately 52,000 cars funded via salary sacrifice, according to this year’s FN50 survey. That’s almost 14% fewer than the 60,200 salary sacrifice cars being funded in 2017. In terms of market share, salary sacrifice’s influence has also waned, holding 4% this year, compared with the 4.7% it held in 2017 and its 4.2% share in 2016. It stood at 5% in 2015 and 2014.

“We’ve also seen the tax environment become more complex for company car drivers and salary sacrifice takers, with rising BIK and the new OpRA provisions,” says Ashley Barnett, head of consultancy at Lex Autolease.

“As a result of this ever-changing environment, combined with more flexible working arrangements and people undertaking fewer miles, we’ve seen a number of people review the value a company car provides. This, coupled with the number of offers available in the personal contract hire (PCH) market, has seen a rapid increase in this area.”

Looking at all of the funding methods offered by the top 50 leasing companies, contract hire/operating lease retains its dominant position. Out of the 1.3 million cars funded by the FN50, 91% are funded by this method. That’s a four percentage point increase on last year’s 87% market share, and a return to a level last seen in 2015.

Meanwhile, the split between business/fleet funding and private/retail stands at 87.2% versus 12.8% – reflecting the increasing focus of a number of providers in PCH products.

“Fleets and drivers value manageable and flexible funding options in times of economic uncertainty, regulatory change and fast-paced technological development,” says Barnett.

Lex Autolease reports that 94% of its risk fleet of almost 280,000 cars is funded via contract hire/operating lease, up from 90% in 2017. Salary sacrifice holds just a 1% market share for the leasing giant, while 27% of Lex Autolease’s car fleet is conducted via private/retail lines compared to 73% business/fleet.

Barnett explains: “Alongside standard PCH, we also have a personal car leasing (PCL) product, currently being piloted with a number of our corporate customers who already have a company car scheme in place.

“PCL is available to all employees but may be of particular interest to those considering opting out of their company car scheme and taking the cash alternative, with a view to leasing their own vehicle.

“It is structured to maximise discounts via affinity terms with selected manufacturers and special offers, opening up access to our buying power, but without the bespoke customer discounts which could give rise to BIK taxes.”

Alphabet (GB), with an even larger share of cars funded via private/retail lines than Lex Autolease, some 39%, says that over the past few years it has seen growth in contract hire, while finance lease has slipped a little in popularity.

“One of the key drivers behind this increase has been the growth in PCH and, although the pace of growth for PCH has slowed this year, it is still on an upward trajectory,” says Clive Buhagiar, head of commercial performance at Alphabet (GB).

“Traditionally, as a product, PCH has seen a very low rate of maintenance penetration, but within our fleet a large proportion of PCH contracts are now maintained. So clearly there is a customer appetite for an ‘all inclusive’ vehicle mobility package – perhaps as a result of this product appealing to employees who are seeking to opt out of conventional company car programmes.”

New fuel test regime

Complexity and uncertainty have become bywords for the Worldwide harmonised Light vehicle Test Procedure (WLTP). It has replaced the New European Driving Cycle (NEDC) in a bid to show a real-world impact of emissions.

The new WLTP CO2 value is being converted to correlated NEDC figures using the EU-wide CO2MPAS equation. However, on average, leasing firms and end-user fleets are facing CO2 increases of between 10% and 20%, moving many cars up a couple of tax bands.

Barnett says: “With the uncertainty around how WLTP will affect company car tax and the lack of clarity around longer-term tax implications of company car choices, we are seeing buying decisions delayed and contract periods extended.”

He believes clarity in the Budget (article written before the October 29 announcements) for decision-makers around these two concerns could see a sudden hike in replacements.

The full impact of fleets extending contracts, while awaiting clarity over the future of company car tax, will be felt in next year’s survey.

This year’s average replacement cycle, however, stands at 35.8 months and 51,727 miles. The lowest reported risk fleet average was 12 months/8,000 miles, while the highest out of the FN50 was 48 months/98,000 miles.

It is not all about contract extensions, however. “With newer technology coming onto the market, we are seeing customers enquiring about the opportunity for drivers to elect for shorter contract durations so they are able to access cleaner, lower emission technology sooner,” says Barnett.

WLTP may have also had an impact on returns. Just more than a half of cars (51.6%) were returned on time, while 38.9% were returned late and 9.6% early.

Buhagiar says: “This year we’re seeing more cars returned ‘late’ and contracts extended, as some fleet decision-makers play for time to analyse the changing market conditions and formulate their own fleet policy responses to changes resulting from WLTP and taxation.”

Meanwhile, Arval says that over the past year, it has seen a lengthening in replacement cycles by about three months to an average of almost 43 months and of mileage by roughly 2,500 to around 63,500 miles.

Shaun Sadlier, head of consultancy at Arval, says: “There are numerous factors behind this. Fleets hanging onto cars for longer while the WLTP situation plays out is certainly one of them, as is a general tendency towards contract extensions in times of economic uncertainty.

“However, it has to be said that we do also see some fleets opting for longer contracts simply in recognition of the ability of modern cars to take higher miles without the kind of apparent wear and tear we would have seen in the past.”

Login to comment

Comments

No comments have been made yet.