Author: Rupert Pontin (pictured), director of valuations, Cazana

The new car registration data for the month of April 2019 did not bring a great deal of joy for the industry once again as figures dropped by 4.1% against the same period last year.

This takes the total volume of new car registrations for the year to 2.7% lower than by the end of April 2018.

If the industry can take any positives from this then it must be the fact that the new fleet sector registration figure was up by 2.9% in comparison with April last year and overall year to date sits at just 0.2% below the same period last year.

Unfortunately, there is no escaping the fact that Brexit is now having a serious impact on the economy overall.

It seems that at the moment not a day goes by without news of further job losses and withdrawal of investment in the country with many businesses seemingly moving away from the UK.

This should not come as a surprise given the disarray in direction, strategy and support of the current government and whilst it is easy to point fingers it is wise to remember that consensus has it that no other UK party has given any firm indication of a credible or acceptable alternative either.

The damage has already been done as the country was not strong enough in the early stages of Brexit negotiations.

All said the resolution of the Brexit position is absolutely imperative.

Whether we leave or stay is less important to many than the security of knowing what individual businesses large or small need to face and prepare for.

Commercial strategy is almost impossible without a framework on which to work.

Indeed, had the politicians worked harder on this in the earlier days then there may have been better market confidence and perhaps less scepticism in the UK as a credible place to be based and do business.

Looking now at the used fleet car market and it is clear that despite poor new car sales the used car market is still performing fairly well overall.

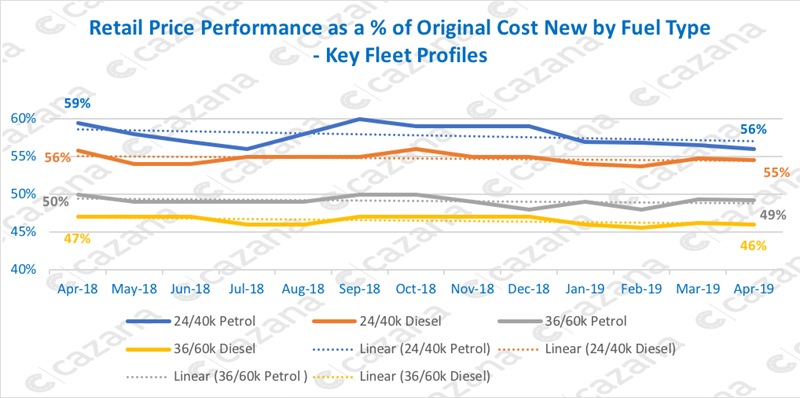

Looking at a high level the chart below shows fleet vehicle performance at key age and mileage profiles and split by fuel type:-

Data powered by cazana.com

It is clear from this chart overall that the used fleet market has taken a little dip over the course of the last year, yet also encouraging to note that there is consistency in general market performance of the previous 12 months across the profiles.

All the trend lines show a downward trajectory and it will be interesting to see how this continues over the coming months.

The interesting point about this data is that it clearly shows that the two-year-old forty thousand mile car has shown a marked decline in the retail pricing.

A three-percentage point drop compared to the same period last year is significant.

This is important as it also reflects the sentiment and activity of similar aged ex-PCP profile cars that in recent months have been dropping in price.

As such it is likely that the proliferation of early churn on PCP cars is causing a bit of volume pressure in the retail market and thus also damaging ex fleet cars.

Moving to market sector analysis it seems appropriate that as the economy struggles and some businesses seek to reduce or curtail operations in the UK, we focus on the executive sector.

This is the domain of the individuals who have perhaps reached the very top in their business life and seek to drive some of the nicest cars in today’s market.

Also, home of the chauffer driven business, pricing performance of cars in this sector is often an indicator of sentiment round the board tables and money markets.

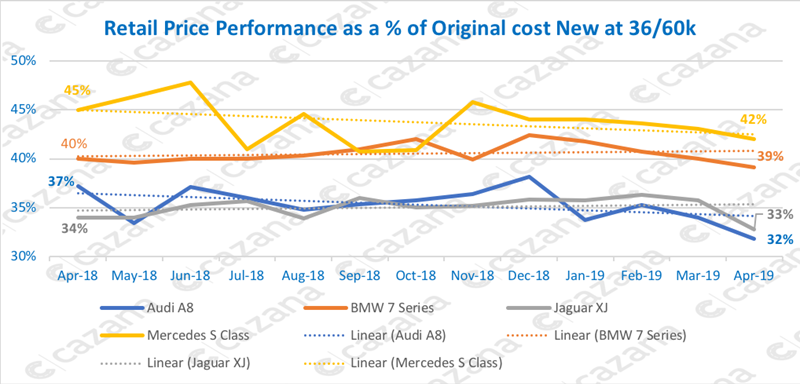

The chart below shows retail price performance as a percentage of original cost new for key models:-

Data powered by cazana.com

This chart is revealing as it is clear from all the trendlines that every car in this selection of key models is showing a downward trajectory.

What is of specific note is the five-percentage point decrease in Audi A8 retail pricing.

Data sources indicate that this may be due to a very aggressive new car pricing strategy over the last 12 months.

It may also come as a surprise to see the Mercedes S Class prices dropping by three percentage points although indications are that this is due to higher volumes of the car coming back to the used car market.

There is far greater stability around the BMW 7 Series and Jaguar XJ models and this in itself is important given that in both cases there has been notable manufacturer support on new cars although it seems that retail demand has remained firm.

It is an interesting sector and due to the value of the investment in each asset can be a scary place to transact.

In conclusion, the April market has been a difficult period for both the new and used car markets.

With new sales cause for concern, more so in the private market, there should be some pent-up fleet demand to keep registrations on an even keel in coming months but it is by no means certain.

The used market is now beginning to see retail pricing come under pressure for certain cars and specifically the two-year-old used profile needs to be carefully monitored.

Login to comment

Comments

No comments have been made yet.