While collecting more emissions data than ever before, Alphabet says that fleets are failing to fully leverage it.

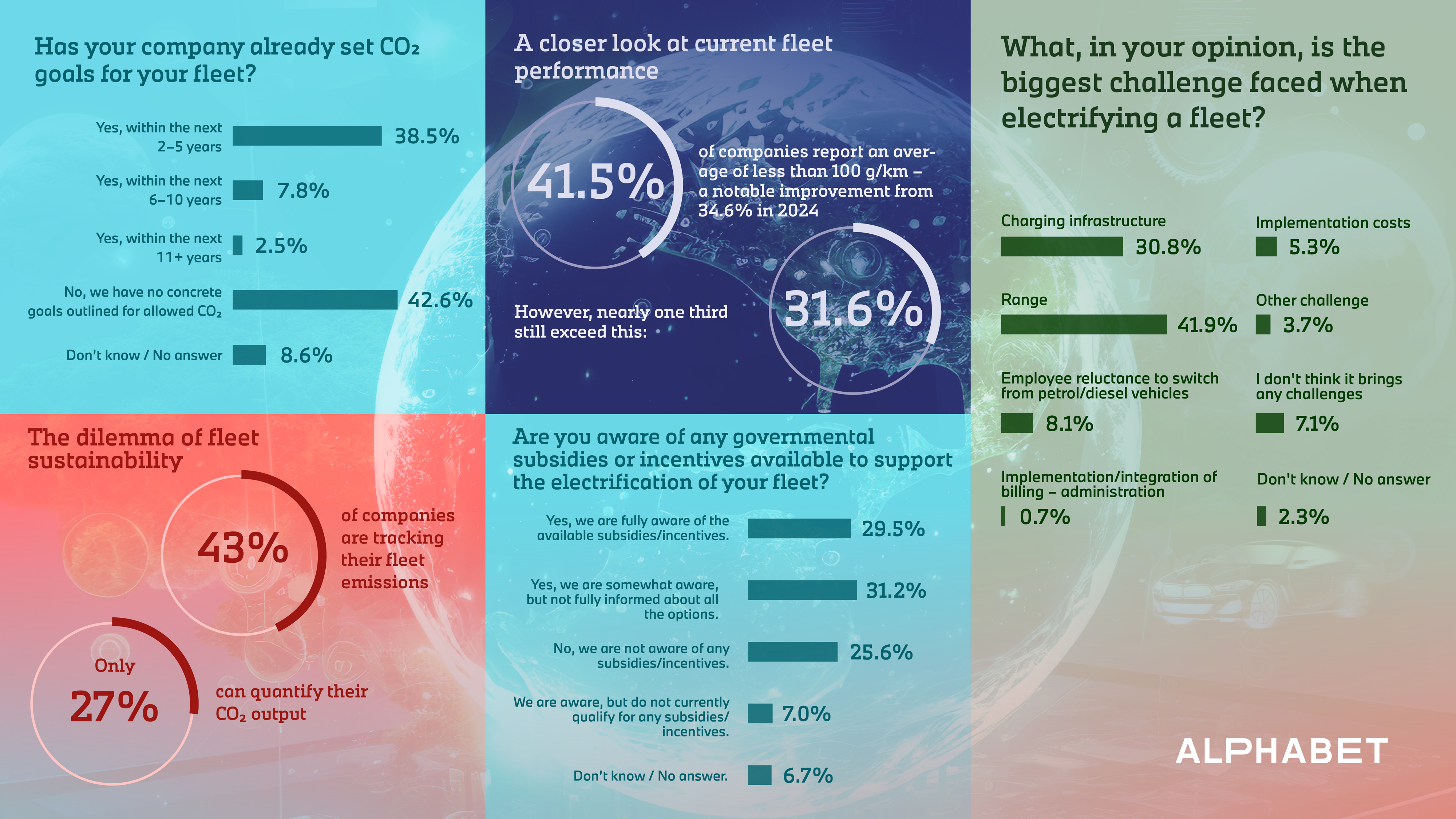

Just over a quarter (27%) of companies can accurately quantify their fleet’s CO₂ output, despite a steady rise in tracking efforts, according to Alphabet’s latest European Fleet Emission Monitor (EFEM).

Based on responses from over 740 fleet managers across 12 countries (including the UK), the report reveals a growing disconnect: digitalisation is advancing, sustainability is high on the agenda.

However, it found that fleets remain stuck in outdated systems, overwhelmed by information, and unprepared for tightening regulations.

In an increasingly high-stakes landscape, Alphabet says that this inaction is no longer a passive choice – it’s a business risk.

The 2025 survey highlights a steady increase in European companies tracking fleet emissions, which is now at 43%, almost 1% higher than last year.

Despite this, fewer than one in four (21.4%) UK companies surveyed are using fleet management tools to measure their CO₂ consumption, revealing a growing polarity between data collection and actionable insight.

This doesn't indicate a lack of interest, says Alphabet, rather it shows many companies are still establishing their digital infrastructure and internal capabilities necessary to manage the expanding data effectively.

It also found that many European businesses remain overwhelmed by unstructured data and outdated tools.

Almost 42% (one-in-five in the UK - 21%), still rely on fuel-based estimates, while others are still reliant on manual processes and legacy systems, which Alphabet says makes it difficult for fleet managers to glean meaningful insights or respond effectively to regulatory and cost pressures.

Despite the obvious need, the uptake of advanced digital tools has not kept pace with changing legislation, and the sector remains slow to embrace artificial intelligence (AI).

This is evidenced by only 4.5% of UK companies using AI to monitor driver behaviour and the same number using advanced automation tools for billing and cost management.

This compares to a European average of 0.7% and 1.8% respectively of European countries, with only 3% of all those surveyed using AI for fleet reporting.

Ian Turner (pictured above), chief sales officer for Alphabet (GB), said: “This year’s European survey shows that, while the industry is making progress, there’s still plenty of work to be done to help companies make better informed decisions, and to support them with their sustainability goals and emissions reporting.

“Data analysis is the cornerstone to realising this potential. Advanced vehicle connectivity, AI and carbon reporting tools will play a crucial role in fleet reporting over the next 12 to 24 months by enabling real-time data collection, review, and action.”

“This will lead to improved efficiency, reduced costs, and better driver safety, which will ultimately bring operational and strategic resilience,” he added.

Many European companies surveyed are still navigating fleet sustainability without a clear direction.

In fact, only 8% reported that the EU’s adoption of the Corporate Sustainability Reporting Directive in 2023 had influenced their fleet planning, compared to 9.5% in the UK, where sustainability reporting it is not yet mandatory for most companies under the UK’s Sustainability Disclosure Requirements.

By comparison, more than three-quarters (76%) of UK companies surveyed said that sustainability is one of the most important aspects in their decision-making, with two thirds of all companies confirming that they have set concrete CO₂ goals for the future.

For those that have a dedicated sustainability department or function, a quarter said their time will be spent tracking the company’s CO₂ emissions, including fleet emissions, with almost one-fifth (17%) of tasks relating to carbon deduction.

Knowledge gaps undermine electrification incentives

Despite the increased focus on electric vehicle adoption, a third (33%) of fleet managers in the UK still feel in the dark or misguided about e-mobility developments and opportunities.

This, says Alphabet, highlights the growing problem of misinformation and disinformation surrounding vehicle electrification.

And, while this figure is even higher in many other European countries, it still shows the disparity and knowledge gap, which is hindering the UK’s drive to greater electrification and also diminishes the impact of available Government subsidies and incentives.

Furthermore, a third (33%) of all UK companies surveyed are unaware of financial support schemes available, and fewer than one in four (23%) fully grasp the benefits they could access.

The result is a noticeable disconnect between well-intentioned policy and practical implementation, highlighting the need for stronger guidance, better communication, and more integrated support across the industry.

The countries surveyed, included the UK, Austria, Belgium, Denmark, France, Germany, Italy, Netherlands, Poland, Spain, Sweden and Switzerland.

Login to comment

Comments

No comments have been made yet.