Advertisement feature from Lytx

Insuring a fleet can be expensive. Average repair costs have increased by up to 40% in the past eight years and liability disputes can drive up expenditure for both fleets and insurers. Connected technology is already helping insurers by providing information about First Notice of Loss (FNOL) – automatically sending notifications when a black box captures unusual G-force readings as a result of sudden braking or impact – but now it’s possible to go further.

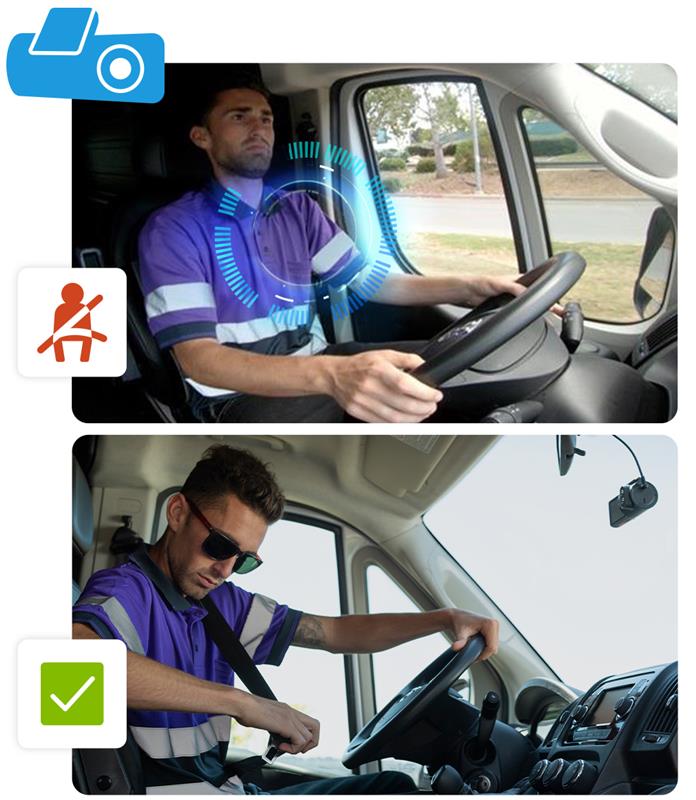

Machine Vision and Artificial Intelligence (MV+AI) technology has become a key enabler in providing today’s fleet managers with an understanding of what’s really happening both inside and outside the cab and to see when something is about to happen, not just when something has happened. First Notification of Risk (FNOR) uses MV+AI to identify incidents or distracted driving in real-time. Drivers can be alerted, and accidents prevented from occurring. At the same time, managers and insurers are kept informed about trends of risky behaviour. After an incident, we have information not just about what has happened, but why.

This is also delivering benefits when it comes to lowering insurance costs. FNOR data can provide insurers with complete visibility over the fleet’s safety profile, as well as access to live, real-time footage.

Finally, managers are kept informed about trends of risky behaviour which can be monitored over time – whether that’s a peak in risky driving behaviours on a particular day of the week, or a pattern of behaviour that indicates a lower level of driver risk.

For more information, contact us +44 (0) 1908 880733

intlchannelsales@lytx.com

intlchannelsales@lytx.com

Login to comment

Comments

No comments have been made yet.