The number of employees paying company car tax has stayed the same year-on-year, ending several years of decline, according to new figures published by HMRC.

The latest benefit-in-kind (BIK) statistics show that there were 720,000 employees paying company car tax in 2021/22, exactly the same as reported for the previous tax year (2020/21).

The number of company car drivers had been steadily declining since 2015/16, when there were 960,000 employees paying BIK on a company vehicle.

HMRC data published last year, for example, revealed 80,000 fewer employees paying company car tax year-on-year.

The growing popularity of salary sacrifice schemes for cars, which attract BIK, will have helped halt that decline as well as low company car tax rates for electric vehicles (EVs).

HMRC says that the drop in the number of company car drivers in 2020/21 is expected to have been exacerbated somewhat by the impacts of the Covid-19 pandemic and the associated reduction in economic activity.

Changes in work practices during that period may have also continued into 2021/22, it said.

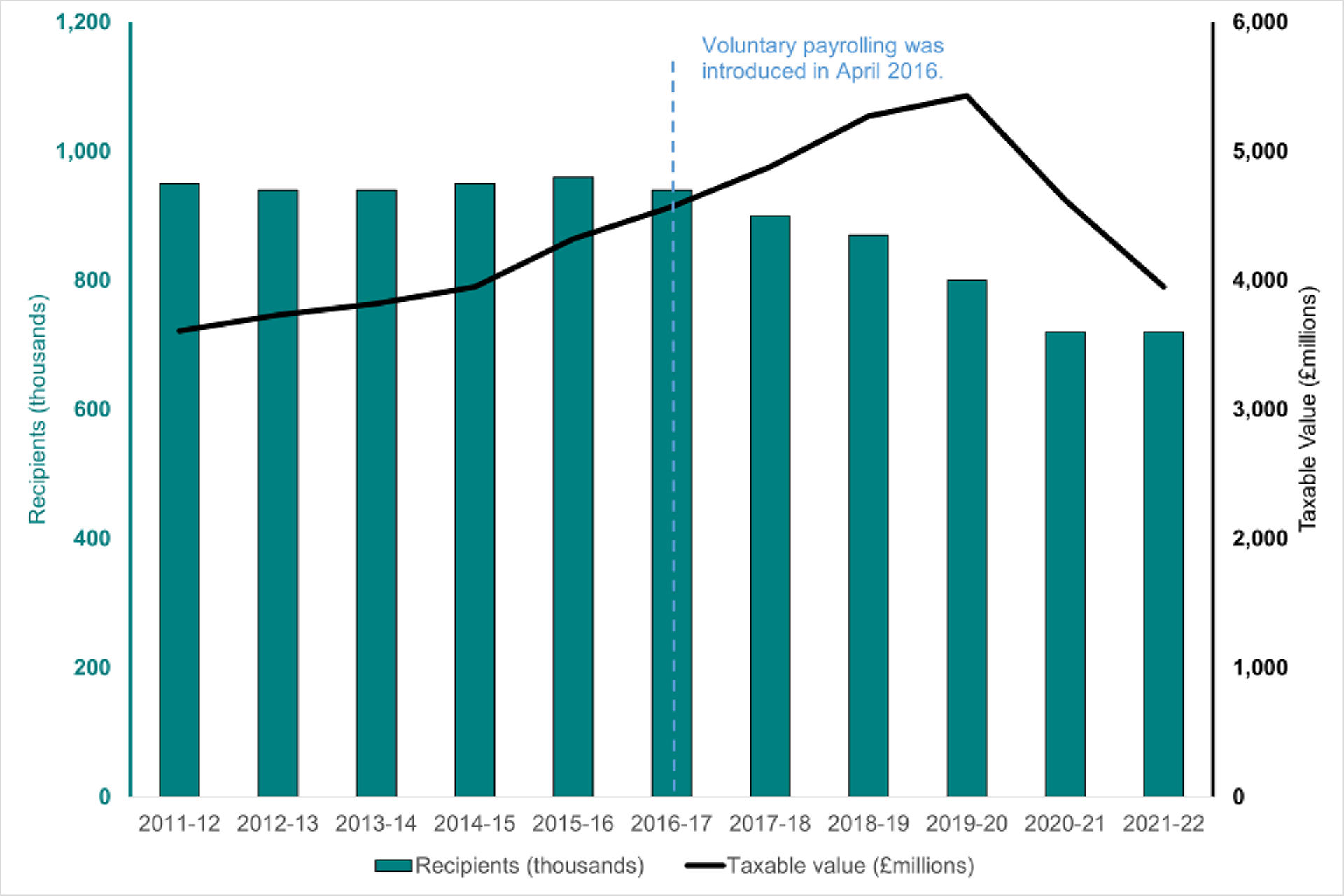

Number of recipients and total taxable value of company cars (from April 2011)

Source: HMRC

Source: HMRC

From 2011/12 to 2015/16, the number of employees in receipt of a company car had remained relatively stable at just under one million.

In more recent years, however, it has steadily declined to the current level.

HMRC says that reporting issues brought about by voluntary payrolling, introduced in 2016, may mean there is a "substantial number of individuals" in these years who received a company car that, while taxed at payroll, was not properly reported to HMRC. The appropriate tax was collected but the car benefit not recorded.

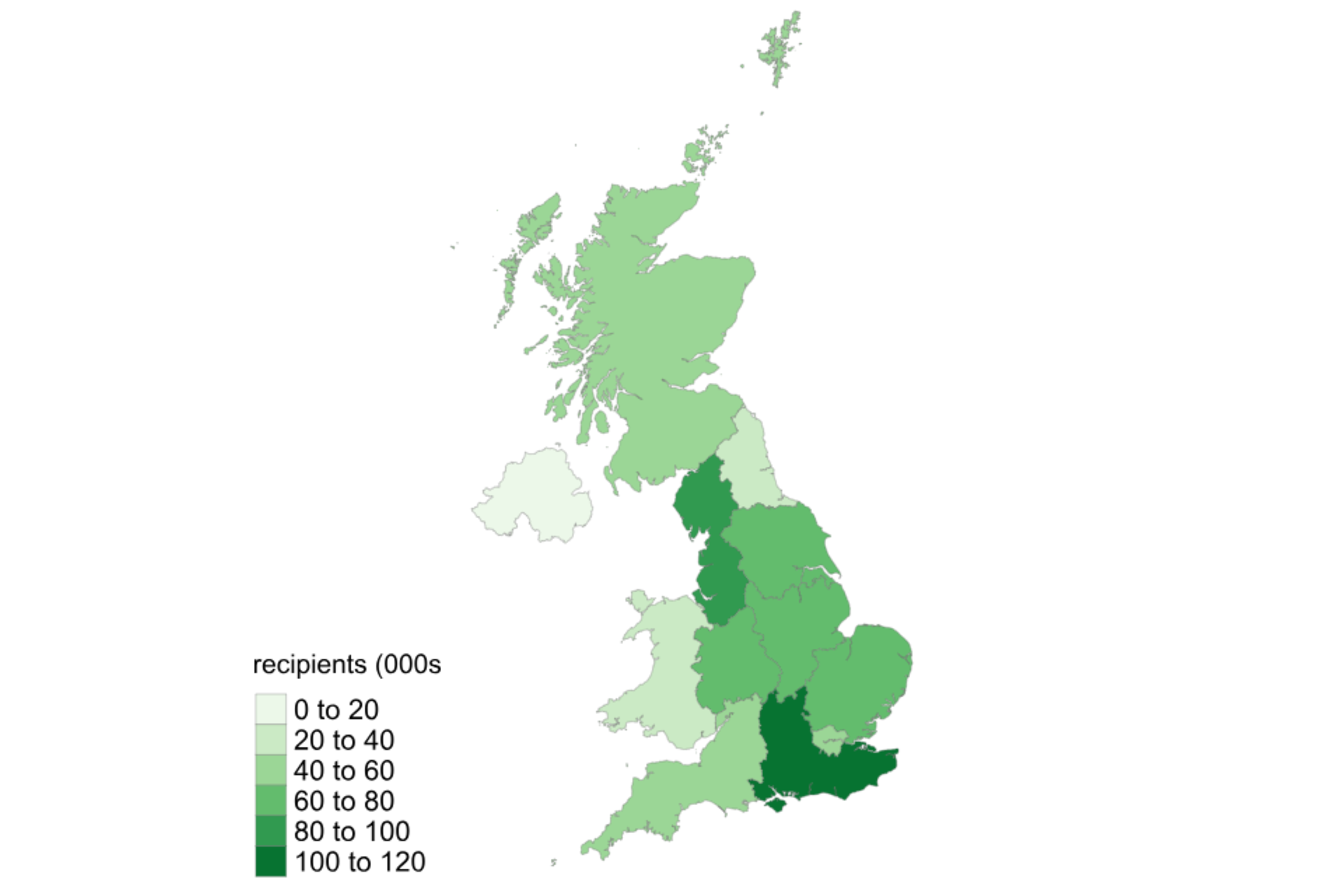

HMRC has also published a map showing the number of car benefit recipients in each region or country of the UK for tax year 2021 to 2022.

The South East of England has the highest number of car benefit recipients at 105,000 with a taxable value of £570 million.

Tax take from company cars

The total taxable value of company car benefit was £3.95 billion in 2021/22, down from £4.62bn in 2020/21.

In 2019/20, the taxable value of the UK’s company car fleet stood at £5.43bn.

Over the period from 2011/12 to 2019/20 the total taxable value of reported company cars had increased significantly from £3.61bn to £5.43bn, which HMRC says was primarily due to increases in the ‘appropriate percentages’ used to calculate the taxable value of a company car, and to a lesser extent increases in the average car list price. These offset the falling number of company car drivers.

The decrease in the total taxable value in the past two tax years was driven by a reduction in the number of company cars and a shift towards electric powered cars, which are subject to lower appropriate percentages, suggests HMRC.

The shift to electric powered cars has continued in 2021/22. The appropriate percentages only increased slightly for non-electric vehicles and there was only a modest increase in the average list price for non-electric vehicles, it says.

Total income tax and NIC liabilities arising from company car benefit were around £1.27bn and £0.55bn respectively, in 2021/22.

In the previous tax year (2020/21), they stood at around £1.42bn and £0.64bn respectively, which equates to an overall decline of £240m for the Treasury year-on-year.

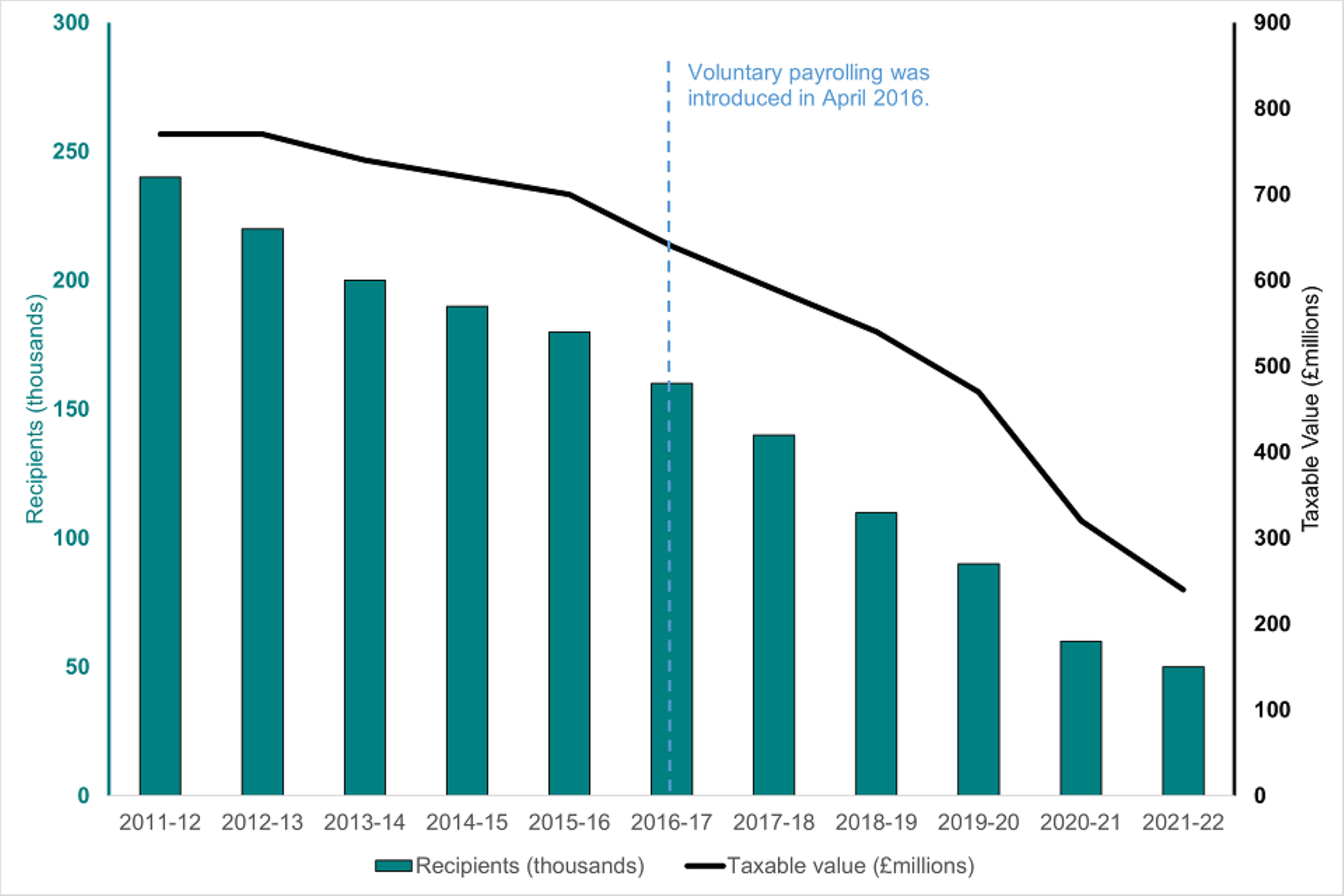

Car fuel benefit

The long-term downward trend in both the number of recipients and the total taxable value of car fuel from 240,000 recipients (taxable value £770m) in 2011/12, to 50,000 recipients (taxable value £240m) in 2021/22, continues.

Year-on-year that equated to 10,000 fewer recipients of the benefit, with total income tax and NIC liabilities for car fuel benefit at around £80m and £30m respectively, an overall decline of £30m for the Treasury year-on-year.

This downward trend, says HMRC, will have been affected by the Covid pandemic travel restrictions in 2020, as well as the continuing increased share of company cars powered exclusively by electricity in 2021/22.

The average taxable values for car benefit and car fuel benefit in 2021/22 were £5,520 and £4,660 respectively, down from £6,400 and £4,950 the previous year (2020/21).

Number of recipients and taxable value of fuel benefit (since April 2011)

Source:HMRC

Source:HMRC

rosco7 - 04/07/2023 10:09

The UK Treasury is responsible for setting Company Car Tax rates and discounts, and they are sleep walking into a crisis. All fleet managers know that as we approach 2030, the Treasury will significantly increase the benefit in kind percentage. My estimate is that they will need to have 25% of P11D price for any zero emission vehicle from 2030, in order to maintain parity with the equivalent salary. Therefore as we approach 2030, they need to accelerate the BiK% much quicker as we approach a time when ICE vehicles will not be available. I know this will not be popular, but the alternative is we continue with large discounts until 2030, then the rate will immediately step up to 25% thereafter. This will be a massive problem and repeat the breach of trust that occurred when they changed diesel BiK rates massively catching out drivers who are unable to adapt until lease contracts renew. There needs to be much more discussion with the Treasury on this matter. The HMRC are not in control of this, they simply implement the rates as set out by UK Treasury.