Used electric vehicle (EV) prices have fallen by almost as much as a third (31%) over the past year, new data suggests.

The latest AA Used Car Index shows almost all of the top electric and hybrid models listed on the platform recorded double-digit price drops in quarter two (Q2) 2025.

The steepest annual fall of 31% was reported by the Lexus RX (hybrid), while the used value of a Renault Zoe dropped by 21% and the Nissan Leaf by 20%.

Overall, the average price of the most searched-for EVs and hybrids on the AA Cars platform fell by 12.8% year-on-year.

It suggests a further acceleration in price falls compared with Q1 and reflects a second-hand EV market that is rapidly expanding as more ex-lease and ex-fleet EVs reach the used market.

AA Cars says that the downward pressure on prices is giving used car buyers access to models that were previously out of reach, including the Tesla Model 3, which has lost over £4,400 in value over the past 12 months.

Most searched-for EVs and hybrids in Q2 2025, with annual and quarterly price changes

|

Most popular Hybrid/EV ranking |

Make and model |

Average price this year (Q2 2025) |

Average price last year (Q2 2024) |

Average price the previous quarter (Q1 2025) |

Annual price change (Q2 2024 to Q2 2025) |

Quarterly price change (Q1 2025 to Q2 2025 |

|

1 |

Toyota Yaris (hybrid) |

£14,826 |

£16,482 |

£15,386 |

-10.04% |

-3.64% |

|

2 |

Toyota Prius (hybrid) |

£9,794 |

£12,062 |

£10,067 |

-18.80% |

-2.71% |

|

3 |

Honda Jazz (hybrid) |

£16,784 |

£17,942 |

£17,083 |

-6.46% |

-1.75% |

|

4 |

Nissan Leaf |

£9,955 |

£12,434 |

£11,171 |

-19.94% |

-10.89% |

|

5 |

Nissan Qashqai (hybrid) |

£21,288 |

£24,200 |

£21,705 |

-12.03% |

-1.92% |

|

6 |

Kia Niro (hybrid) |

£17,365 |

£20,240 |

£19,001 |

-14.20% |

-8.61% |

|

7 |

Toyota RAV4 (hybrid) |

£23,610 |

£24,092 |

£24,692 |

-2.00% |

-4.38% |

|

8 |

Toyota Corolla (hybrid) |

£17,909 |

£19,418 |

£18,695 |

-7.77% |

-4.20% |

|

9 |

Toyota C-HR (hybrid) |

£18,718 |

£20,197 |

£19,309 |

-7.32% |

-3.06% |

|

10 |

Toyota Auris (hybrid) |

£9,866 |

£11,102 |

£9,974 |

-11.13% |

-1.08% |

|

11 |

Mitsubishi Outlander (hybrid) |

£11,392 |

£13,713 |

£12,007 |

-16.92% |

-5.12% |

|

12 |

Kia Sportage (hybrid) |

£24,185 |

£25,852 |

£25,526 |

-6.45% |

-5.25% |

|

13 |

BMW 3 Series (hybrid) |

£21,034 |

£23,225 |

£20,923 |

-9.43% |

0.53% |

|

14 |

Lexus RX (hybrid) |

£20,099 |

£29,214 |

£26,810 |

-31.20% |

-25.03% |

|

15 |

Tesla Model 3 |

£19,087 |

£23,582 |

£20,313 |

-19.06% |

-6.03% |

|

16 |

Renault Zoe |

£9,087 |

£11,459 |

£9,476 |

-20.70% |

-4.10% |

|

17 |

Lexus CT (hybrid) |

£10,880 |

£12,453 |

£11,258 |

-12.64% |

-3.36% |

|

18 |

Volkswagen Golf (hybrid) |

£20,392 |

£20,717 |

£20,515 |

-1.57% |

-0.60% |

|

19 |

Ford Kuga (hybrid) |

£23,451 |

£26,564 |

£24,235 |

-11.72% |

-3.24% |

|

20 |

BMW i3 |

£12,057 |

£13,687 |

£12,736 |

-11.91% |

-5.33% |

Source: AA Cars Index

AA Cars data suggests that the growing affordability and choice are already shifting consumer behaviour, with record levels of EV searches and more drivers weighing up electric and hybrid options as prices continue to fall.

While EVs have seen consistent year-on-year declines, some petrol and diesel models have bounced back in price.

The Volkswagen Polo (hybrid) rose 9.4% annually and 3.8% over the quarter, making it one of the best-performing conventional cars on the platform.

The Vauxhall Corsa, now the UK’s most searched-for used petrol or diesel car on the platform, recorded prices rise 7% year-on-year.

Meanwhile, among petrol and diesel models, the Ford Fiesta dropped 11.7% in value over the past year, the Ford Focus fell by 6.6%, and the Ford Kuga (hybrid) lost almost 6% in the past three months alone.

Overall, the average price of the most popular petrol and diesel cars on the AA Cars platform increased slightly by 1.1% year-on-year, masking some of the more dramatic movements seen in individual models.

Most searched-for vehicles in Q2 2025, with annual and quarterly price changes

|

Most popular car ranking |

Make and model |

Average price this year (Q2 2025) |

Average price last year (Q2 2024) |

Average price previous quarter (Q1 2025) |

Annual price change (Q2 2024 to Q2 2025) |

Quarterly price change (Q1 2025 to Q2 2025 |

|

1 |

Vauxhall Corsa |

£9,891 |

£9,247 |

£9,870 |

6.96% |

0.21% |

|

2 |

Nissan Qashqai (hybrid) |

£14,853 |

£15,525 |

£15,631 |

-4.53% |

-4.98% |

|

3 |

Ford Fiesta |

£8,252 |

£9,217 |

£8,649 |

-11.69% |

-4.59% |

|

4 |

Ford Focus |

£10,218 |

£10,895 |

£10,952 |

-6.63% |

-6.70% |

|

5 |

Volkswagen Polo (hybrid) |

£12,799 |

£11,597 |

£12,334 |

9.39% |

3.77% |

|

6 |

Audi A3 |

£18,521 |

£19,974 |

£18,895 |

-7.85% |

-1.98% |

|

7 |

Mercedes A Class |

£16,650 |

£17,958 |

£17,073 |

-7.86% |

-2.47% |

|

8 |

Ford Transit |

£17,364 |

£20,781 |

£17,141 |

-19.68% |

1.30% |

|

9 |

Volkswagen Golf (hybrid) |

£16,942 |

£16,585 |

£16,507 |

2.11% |

2.63% |

|

10 |

Kia Sportage (hybrid) |

£19,121 |

£18,181 |

£19,084 |

4.91% |

0.19% |

|

11 |

Nissan Juke |

£13,049 |

£13,439 |

£13,507 |

-2.99% |

-3.39% |

|

12 |

Volkswagen Tiguan |

£22,705 |

£21,107 |

£21,961 |

7.04% |

3.39% |

|

13 |

Vauxhall Mokka |

£12,268 |

£11,993 |

£12,767 |

2.24% |

-3.92% |

|

14 |

Ford Kuga (hybrid) |

£15,844 |

£16,349 |

£16,817 |

-3.19% |

-5.79% |

|

15 |

Audi A1 |

£16,341 |

£16,454 |

£15,613 |

-0.69% |

4.66% |

|

16 |

Toyota Yaris (hybrid) |

£14,483 |

£14,412 |

£14,456 |

0.48% |

0.18% |

|

17 |

Land Rover Range Rover Evoque |

£20,346 |

£21,569 |

£21,132 |

-6.01% |

-3.72% |

|

18 |

MINI Hatch |

£12,593 |

£13,352 |

£13,845 |

-6.03% |

-9.05% |

|

19 |

Fiat 500 |

£7,412 |

£7,871 |

£7,569 |

-6.19% |

-2.07% |

|

20 |

Hyundai Tucson |

£19,557 |

£19,444 |

£19,395 |

0.58% |

0.84% |

Source: AA Cars Index

James Hosking, director at AA Cars, said: “Used EV prices have fallen off a cliff in the past year, and for drivers who’ve been priced out of electric motoring until now, this is a genuine turning point.

“We’re seeing a growing wave of supply coming onto the used market, particularly as fleets and leasing firms de-fleet early-generation EVs and hybrids, and that’s giving buyers more choice at more accessible prices.

“Our data shows that the price of almost every top EV or hybrid has dropped by double digits over the past 12 months, with some premium models down by more than 30%. It’s possible that some of this fall could be due to the age of EV models on sale getting higher.

“That kind of price movement is bringing greener vehicles within reach of thousands more households and could help to convert curiosity into action.

“The challenge is making sure buyers have the confidence to go electric. Concerns around charging access, battery range and long-term running costs haven’t gone away, and while falling prices are helping to shift EVs from a niche to a more mainstream choice, greater support is still needed to turn interest into long-term adoption.”

He added: “Petrol and diesel values, meanwhile, remain mixed. We’ve seen strong demand for newer stock like the VW Polo, but prices continue to fall on older models such as the Ford Fiesta. This volatility shows that while headline prices may be stabilising, buyers are still being highly selective and savvy.

“Ultimately, the used market is a mirror to consumer confidence. The drop in EV prices will help accelerate the shift to zero-emission motoring, but continued investment in infrastructure, clear policy direction and compelling finance options will all be critical to turning this short-term price trend into a long-term behaviour change.”

BCA reports used car demand remains positive at half-year point

BCA reports another strong used car performance in June as average values improved by 3.1% month-on-month and buyer participation and sold volumes remained positive, and ahead of prior year.

Buyer engagement on premium 3–4-year-old stock saw the biggest lift, and the EV sector had a particularly robust month with a new record weekly sold volume figure established.

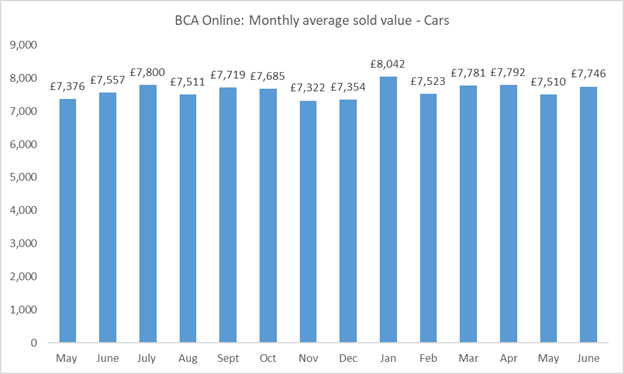

Used car values averaged £7,746 in June, up by £236 (3.1%) month-on-month, while performance against price guide expectations improved by two percentage points and year-on-year values rose by £189 (2.5%).

Over the first six months of 2025, the average sold value of a used car across the board at BCA was £7,717.

During June, BCA achieved a new benchmark with nearly 1,300 EVs sold in one week.

At the half-year point, BCA has sold more than 26,000 EVs, more than a 1,000 every week on average as demand for plug-in models has increased through 2025.

BCA’s chief operating officer, Stuart Pearson, said: “June started well and maintained the momentum throughout the month, with a noticeable uptick in demand and volumes continuing to be ahead of last year.

“In traditionally what has been one of the toughest quarters for used cars, the market was significantly more robust than we have typically seen in previous years.”

He added: “In fact, the wider used car sector in 2025 remains well ahead of the same period last year with both volume and value performance reflecting an extremely competitive marketplace.

“We are now well into that period of the year when the wholesale environment has traditionally experienced some pressure on demand, but buyer engagement remains excellent, and stock churn reflects a healthy marketplace.”

He concluded: “If anything, the market has strengthened further into the early weeks of July and despite some glorious weather that can often disrupt trading, demand has remained buoyant, and our inbound levels of fresh stock are extremely healthy.

“With only a very marginal movement in published guide prices to date this month, the confidence seen in the used car market over recent months looks set to continue.”

Login to comment

Comments

No comments have been made yet.