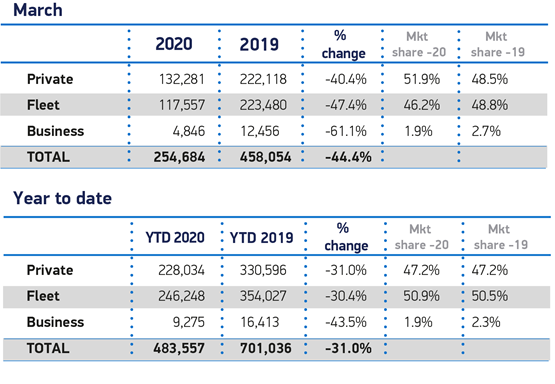

New fleet and business car registrations almost halved in March, while private registrations were similarly hit by the coronavirus crisis, falling by more than 40%.

Just 122,403 company cars were registered in the important plate change month, 48% fewer than the 235,936 units registered in May 2019, figures from the Society of Motor Manufacturers and Traders (SMMT) show.

Year-to-date, fleet and business registrations now stand at 255,523 units, 31% down on the 370,440 new cars registered in the first quarter of 2019.

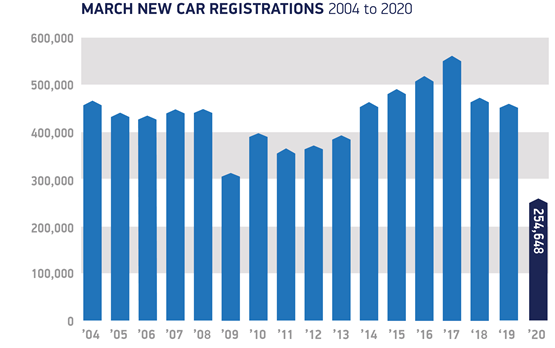

Overall, the new car market declined by 44% in March, with 203,370 fewer cars registered than in March 2019, as showrooms closed in line with Government advice to contain the spread of COVID-19.

The performance represented a steeper fall than during the 2009 financial crisis and the worst March since the late nineties when the market changed to the bi-annual plate change system.

With lockdowns taking place in many European countries earlier than the UK, even more dramatic falls have been reported elsewhere, with Italy down 85%, France 72% and Spain down 69% in March.

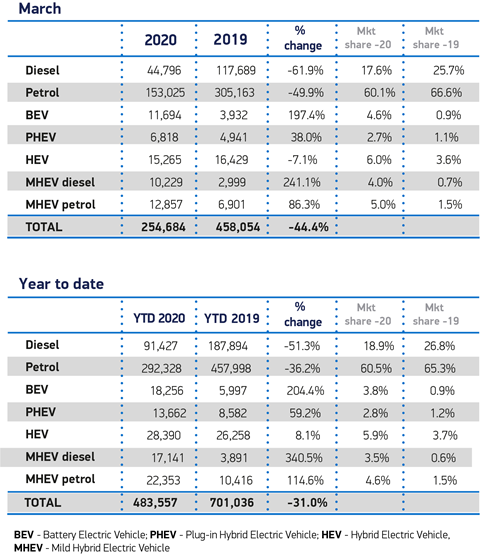

In total, 254,684 new cars were registered in the month, with the numbers of petrol and diesel cars joining the road were down 49.9% and 61.9%, respectively.

There was some good news for early adopters, who were able to take delivery of the latest alternative fuel cars before the crisis took hold in the UK.

Registrations of battery electric vehicles (BEVs) rose almost three-fold in the month to 11,694 units, accounting for 4.6% of the market, while plug-in hybrids (PHEVs) grew 38.0%. Uptake of hybrid electric vehicles (HEVs), however, fell 7.1%.

Mike Hawes, SMMT chief executive, said: “With the country locked down in crisis mode for a large part of March, this decline will come as no surprise.

“Despite this being the lowest March since we moved to the bi-annual plate change system, it could have been worse had the significant advanced orders placed for the new 20 plate not been delivered in the early part of the month.

“We should not, however, draw long term conclusions from these figures other than this being a stark realisation of what happens when economies grind to a halt.

“How long the market remains stalled is uncertain, but it will re-open and the products will be there. In the meantime, we will continue to work with government to do all we can to ensure the thousands of people employed in this sector are ready for work and Britain gets back on the move.”

The SMMT has downgraded its interim market outlook for the year to 1.73 million registrations – a 23% decline on the previous outlook made in January and some 25% lower than the 2.31 million units registered in 2019. A further outlook will be published in April to reflect the latest conditions.

Despite the challenges, car manufacturers and their retail networks are providing volunteers and diverting resources and funding to help the national effort during the pandemic.

Hundreds of vehicles have been deployed in local communities across the UK, helping front-line workers and volunteers in the emergency services, welfare and charity sectors to look after society’s most vulnerable.

Other supportive efforts include providing breakdown assistance for NHS workers, converting premises into storage and food bank facilities, supplying personal protective equipment such as safety goggles and face shields and working alongside other sectors to scale up ventilator production.

Michael Woodward, UK automotive lead at Deloitte, said: “Like almost every other industry, COVID-19 has had a significant impact on UK automotive.

"Since the outbreak began, supply chains globally have been under increasing pressure and, following the UK’s current lockdown restrictions, dealerships have now closed their doors and manufacturers halted production.

“The safety of workers, dealers and consumers remains paramount, and a return to ‘business as usual’ unclear. As a result, everyone from manufacturers to dealers will be asking themselves how they can respond to demand when we emerge from the current situation."

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, told Fleet News that "today’s figures" serve as a stark reminder of the economic challenges that the COVID-19 pandemic presents to the industry and consumers alike.

He concluded: “While there will be an unavoidable delay to new registrations, a number of orders will have been placed before lockdown measures were introduced, meaning that many are still being processed.

"This is something we’re seeing as a business, and although there’s an unavoidable delay in delivering vehicles, our focus is to ensure our existing customers feel supported in these uncertain times.

"We will continue to monitor the impact of COVID-19 closely, whilst working with partners and customers to offer flexible payment options to support those affected.”

Login to comment

Comments

No comments have been made yet.