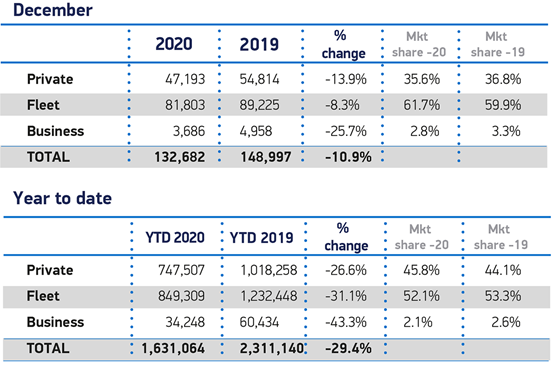

Fleet and business registrations fell by 32% in 2020, with 400,000 fewer company cars registered compared to 2019, but fleets were behind a massive increase in the uptake of electric vehicles (EVs).

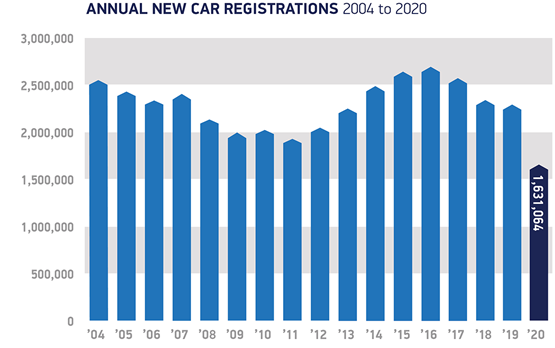

The new figures, published today by the Society of Motor Manufacturers and Traders (SMMT), show overall demand in the new car market fell to the lowest level since 1992.

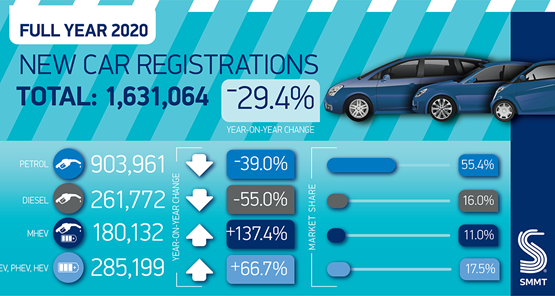

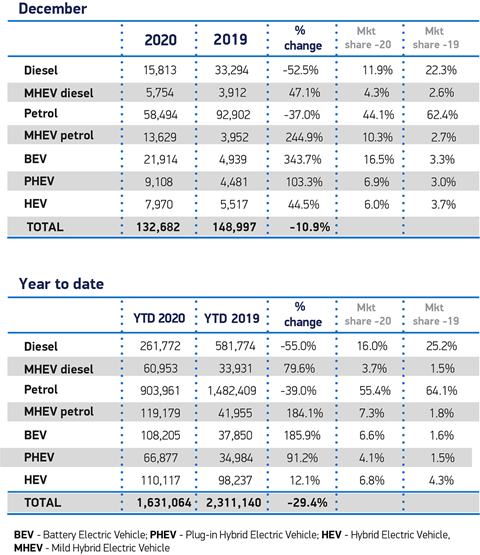

They also reveal the continuing decline of diesel, with 55% fewer diesel cars registered in 2020 compared to 2019.

The SMMT sales figures show there were 883,557 cars registered to fleet and business during 2020, compared to almost 1.3 million vehicles the previous year.

However, the latest sales data also reveals that in December, fleet and business registrations were only 9% down compared to December 2019.

It suggests a recovering company car market, with 85,489 fleet and business registrations, equating to 64% market share.

Overall, the UK new car market fell by almost a third (29%) in 2020, with annual registrations dropping to 1,631,064 units.

Against a backdrop of Covid-19, the industry suffered a total turnover loss of some £20.4 billion, with private vehicle demand falling by 27% overall, amounting to a £1.9bn loss of VAT to the Exchequer, says the SMMT.

Mike Hawes, chief executive of the SMMT, says that 2020 will be seen as a “lost year” for automotive, with the sector under “pandemic-enforced shutdown” for much of the year and uncertainty over future trading conditions taking their toll.

However, he said: “With the rollout of vaccines and clarity over our new relationship with the EU, we must make 2021 a year of recovery.

“With manufacturers bringing record numbers of electrified vehicles to market over the coming months, we will work with Government to encourage drivers to make the switch, while promoting investment in our globally-renowned manufacturing base – recharging the market, industry and economy.”

Demand fell across all segments bar specialist sports, which grew by 7%, although Britain’s most popular class of car remained the supermini, retaining a 31% market share despite a 26% decline in registrations.

Meanwhile, although falling by a combined 33%, petrol and mild hybrid (MHEV) petrol cars made up 63% of registrations, while diesel and MHEV diesels, down 48%, comprised almost a fifth of the market.

Fleets adopt more electric vehicles

Battery and plug-in hybrid electric cars accounted for more than one in 10 registrations – up from around one in 30 in 2019.

Demand for battery electric vehicles (BEVs) grew by 186% to 108,205 units, while registrations of plug-in hybrids (PHEVs) rose 91% to 66,877.

Most of these registrations (68%) were for company cars. Gerry Keaney, chief executive of the British Vehicle Rental and Leasing Association (BVRLA), says that 2020 has been a “tipping point” for EV uptake and demonstrates what can be achieved when Government works closely with fleets to develop a set of powerful grants and tax incentives and invest in a robust public charging network.

"While only a handful of EVs were on sale in 2011, there are now more than 100 models available.” Poppy Welch, head of Go Ultra Low

“The latest BVRLA data shows that the fleet sector continues to lead the charge towards zero emission motoring, with battery electric vehicles responsible for 21% of company car registrations in the three months to October 2020.”

With so much uncertainty surrounding the impact of EU Exit, coronavirus and the economic downturn, Keaney says that the Government must do everything it can to support the vehicle buyers that underpin the UK’s new car market.

“With the next Budget just weeks away, the Chancellor must continue to ring-fence the long-term grants and tax incentives that make electric vehicles affordable,” he said.

“He must also resist the urge to pile more motoring tax increases on fleets and drivers that have yet to make the transition to zero emission motoring.

“Many of these businesses and individuals are struggling financially and can’t yet find an electric vehicle that meets their needs or budget.”

More than 100 plug-in car models are now available to UK buyers, and manufacturers are scheduled to bring more than 35 to market in 2021 – more than the number of either petrol or diesel new models planned for the year.

Poppy Welch, head of Go Ultra Low, believes that in the context of the new car market, 2020 will be remembered as the breakthrough year for EVs.

"After a ninth successive year of growth in EV registrations, we’ve now seen market share rise to 10.7%," she said.

"This has been made possible, in large part, by the Government’s ongoing support and long-term vision, combined with the automotive industry’s commitment to developing a wide range of zero-emissions vehicles that are clearly convincing the public with their performance, financial and environmental credentials.

"While only a handful of EVs were on sale in 2011, there are now more than 100 models available.”

When will the market get 'back on its feet?

Ashley Barnett, head of consultancy at Lex Autolease, said that the 29% year-on-year drop really “hammers home” just how challenging the coronavirus pandemic has been for the motor industry.

“The market will take some time to get back on its feet,” he said. “How long that is remains to be seen.”

He added: “The growth in EVs is comforting but ultimately is from an extremely low base – only 6.6% of vehicles on the roads are EVs (including PHEVs).

“All eyes will be firmly on the spring Budget and the rumoured plans for a road pricing scheme which may go some way to recoup lost tax revenue when EVs begin to overtake conventional ICE models.

“The Chancellor has an opportunity to reassure would-be EV drivers that fiscal incentives will remain on the table and incentivise them to take the first step into alternatively-fuelled vehicles.”

Jon Lawes, managing director of Hitachi Capital Vehicle Solutions, expects economic uncertainties to continue into the first quarter of 2021, while the pandemic dampens consumer confidence.

However, he said: “The UK’s long negotiated tariff-free trade agreement with the EU should provide a welcome boost for the motor industry to lay the foundations to support a recovery in the sector.

“Similarly, the positive trend in EV uptake demonstrates that the transition to electric will gather momentum in the months ahead heightened by the wide range of new EV models coming to market in 2021 and growing consumer demand.”

Stuart Thomas - 07/01/2021 09:07

This is only part of the picture , commercial vehicles are also a vital element for fleet so should be reflected in the article and conversation for an overall view.