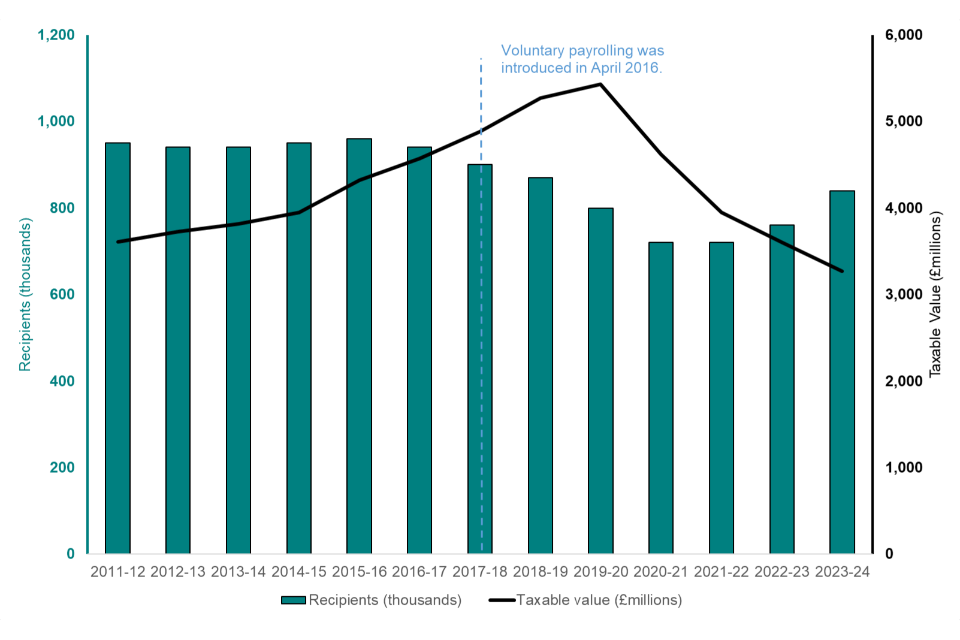

The number of employees paying company car tax has risen by 80,000 year-on-year – a 10.5% uplift – building on the previous year’s increase of 5.5%, new figures from HMRC show.

The latest benefit-in-kind (BIK) statistics show that there were 840,000 employees paying company car tax in 2023/24, compared to 760,000 the previous tax year (2022/23).

Number of recipients and total taxable value of company cars

Source:HMRC

Despite the increase in the company car parc, the total taxable value of company car benefit was £3.27 billion, down from £3.6bn the previous year.

Over the period from tax year 2011/12 to 2019/20 the total taxable value of reported company cars increased significantly from £3.61bn to £5.43bn, before falling to £3.27bn in 2023/24.

The increase to 2019/20, says HMRC, was primarily due to increases in the ‘appropriate percentages’ used to calculate the taxable value of a company car, and to a lesser extent increases in the average car list price.

These offset the falling number of company car drivers. By contrast, in 2020/21 the total taxable value decreased.

This was driven by a reduction in the number of company cars and a shift towards electric powered cars, which are subject to lower ‘appropriate percentages’.

The shift to electric powered company cars has continued in 2023/24. The ‘appropriate percentages’ have increased slightly for non-electric vehicles and there was only a modest increase in the average list price for non-electric vehicles (EVs), it added.

Growth in overall company car numbers can be attributed, in part, to the growing popularity of salary sacrifice schemes for cars.

Last year’s FN50 survey revealed that salary sacrifice had reached its highest market share ever totalling almost 83,000 units, accounting for 6.2% of cars on the FN50 risk fleet.

HMRC also acknowledges that the overall number of company car drivers could be even higher, with “considerable underreporting” after voluntary payrolling was introduced in April 2016.

The new HMRC data also shows that there has been a long-term downward trend in both the number of recipients and the total taxable value of car fuel from 240,000 recipients (taxable value £770m) in 2011/12 to 40,000 recipients (taxable value £170m) in 2023/24.

This trend, says HMRC, is likely to reflect rising fuel prices during most of this period, causing employers and employees to look more carefully at whether the value of the benefit received is worth incurring the fuel benefit tax charge.

Although average fuel costs were around 10% lower in 2020/21, there were significant travel restrictions at various times due to the pandemic which may have driven some taxpayers to relinquish car fuel from their employer.

The rise in EVs also means fewer company cars used car fuel in 2023/24 compared to earlier years.

As a result, the total taxable value of car fuel benefit has fallen from £240m in 2019/20, to £200m in 2022/23 and to £170m in 2023/24.

Total income tax and NIC liabilities for car fuel benefit were around £60m and £20m respectively.

The average taxable values for car benefit and car fuel benefit in 2023/24 were £3,910 and £3,990 respectively, down from £4,750 and £4,260 the year prior.

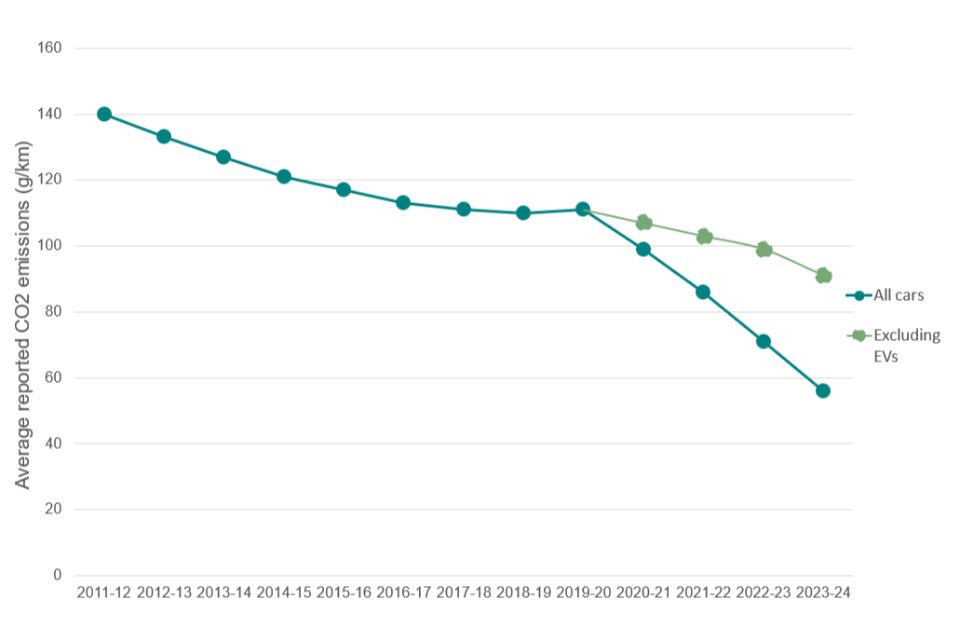

Company cars by CO2 emissions and fuel type

In 2002/03, 58% of company cars had reported emissions in excess of 165g/km, just over 20 years later (2023/24), the new figures from HMRC shows that less than 1 % of company cars had reported CO2 emissions in excess of 165g/km.

HMRC says this is due to fossil fuel cars becoming more efficient and an increasing share of company cars powered exclusively by electricity.

The number of reported recipients of company cars with CO2 emissions of 75g/km or less was 534,000 (up from around 369,000 in the previous tax year). This includes fully electric cars (340,000 in 2023/24 - up from 220,000 in 2022/23).

The number of recipients of cars with emissions of 115g/km and above has also decreased substantially.

In 2011/12, only 13% of company cars had emissions of less than 115g/km. In 2023/24, this was 75%.

Average (reported) CO2 emissions of company cars since April 2011

Historically, most company cars used diesel fuel but this has changed over time.

Diesel cars accounted for around 80% of company cars up to 2017, with a steady decline to 23% by 2022/23.

The proportion of company cars using diesel fuel reduced to 13% (105,000) in 2023/24, with 41% (340,000) of company cars being fully electric in this year, the new data shows.

Between April 2010 and April 2015 electric cars (with CO2 emissions of 0 g/km) were not liable to company car tax. Accordingly, these statistics only include electric cars from 2015/16. However, the numbers of electric company cars were very small until 2020/21.

One effect of the increase in electric company cars is that they have helped reduce the average CO2 emission rate of company cars to 56g/km in 2023/24.

Even after excluding electric cars from the average, the average CO2 emission rate has reduced to 91g/km confirming a trend towards lower emission fossil fuel cars.

The number of ultra-low emission vehicles (ULEVS), with CO2 emissions no greater than 75g/km (but not zero emission), have also increased steadily in recent years from 5,000 in 2014/15 to 192,000 in 2023/24, according to HMRC data.

Login to comment

Comments

No comments have been made yet.