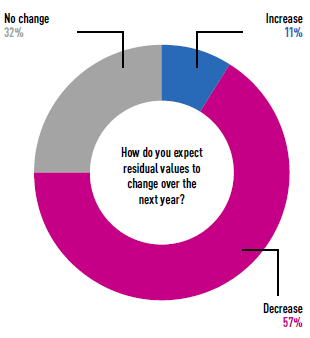

While leasing companies are the most positive they have been for years over residual values (RVs) for cars, they are more cautious when it comes to vans.

However, optimism is still a little higher that it was 12 months ago, when 9% thought values would increase and 66% decrease.

This year’s research for the Fleet News' FN50 found that 11% of respondents feel they will rise, while 57% expect them to fall. This means that more than four in 10 (43%) expect no change or better.

The negative outlook has been influenced by the uncertainty caused by Brexit as well as global concerns over a forthcoming economic downturn, according to Simon Hill, managing director of Total Motion.

He also expects an increased number of vans to hit the used market, which will affect RVs. The new LCV market hit record levels in 2015 and 2016, and he says part of this was down to manufacturers oversupplying vehicles which means that an above average number of vans – particularly from rental companies – will hit the used market soon.

“Where the manufacturers haven’t been oversupplying, the underlying message is still very positive,” he adds.

Of the leasing companies which expect RVs to fall, the average drop predicted is 4%, with individual expectations ranging from 1% to 15%.

JCT600 Vehicle Leasing Solutions is one of those which expects stability. Managing director Paul Walters says: “With Brexit, and the introduction of WLTP for light commercials looming, it is difficult to tell what impact either a deal or no deal would have.”

Overall, the average increase anticipated by those leasing companies who expect RVs to rise is 6%.

The more optimistic outlook comes on the back of a strong year for used values, with ex-fleet and lease LCVs sold through BCA in August reaching £8,135, 15% (£1,083) more than in the same month last year.

Cox Automotive saw average selling prices rise 12% (up £739) to a record high, despite age and mileage remaining steady.

James Davis, director of commercial vehicles at Manheim Remarketing, part of Cox Automotive, says: “Demand for used vans looks set to remain strong, pushing average prices to new heights, as a number of factors combine to affect the levels of supply in the market.

“As uncertainty around Brexit continues, it’s likely that current lease-holders will opt to extend rather than replace vehicles at the end of their term, leading to a fall in supply within the wholesale market.

“In the new van market, manufacturers will be looking ahead to the WLTP/RDE regulations that come into force in September 2019.

“Testing the huge variety of derivatives and optional extras available will certainly pose challenges, and it’s likely that OEMs will withdraw some models ahead of the deadline.”

The average resale price achieved versus Cap Clean or equivalent was 101% in the past 12 months – one percentage point higher than last year. Individually, leasing companies reported average values of between 85% and 114%.

The average time taken to sell defleeted vans in the past 12 months was 18 days – two fewer than in 2017.

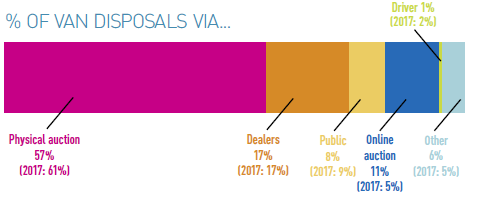

Meanwhile, the number of defleeted vans sold through online auctions more than doubled this year, with volumes growing six percentage points from 5% in 2017 to 11% in 2018. This growth has come mainly at the expense of physical auction, which saw a four percentage point drop to account for 57% of sales.

However, online auctions remain only the third most popular route to market for used vans, with selling to dealers the second most popular way (17% of volume), sitting behind physical auctions.

Login to comment

Comments

No comments have been made yet.