The ongoing global shortage of semiconductors and other components has seen almost 100,000 fewer cars produced by UK manufacturers in Q1, compared to the same period last year.

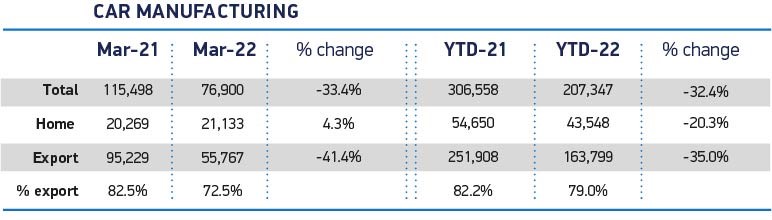

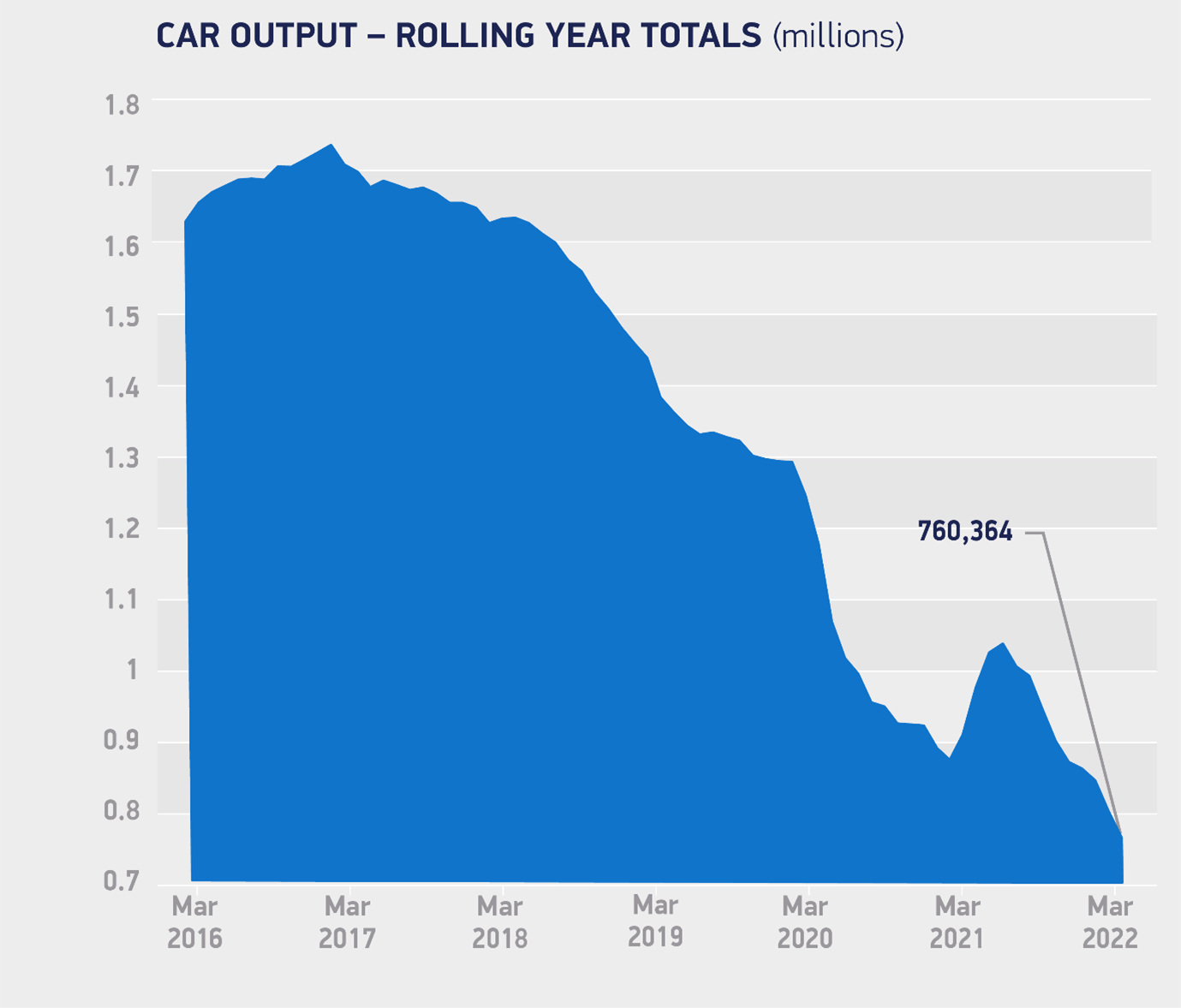

UK car manufacturing declined by a third (32.4%) during the first three months of 2022, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT).

With production volumes still constrained by the ongoing global shortage of semiconductors and other components, 207,347 new cars were built during the first quarter, down from 306,558 in pandemic-affected Q1 2021.

Mike Hawes, SMMT chief executive, said: “Two years after the start of the pandemic, automotive production is still suffering badly, with nearly 100,000 units lost in the first quarter.

“Recovery has not yet begun and, with a backdrop of an increasingly difficult economic environment, including escalating energy costs, urgent action is needed to protect the competitiveness of UK manufacturing.

“We want the UK to be at the forefront of the transition to electrified vehicles, not just as a market but as a manufacturer so action is urgently needed if we are to safeguard jobs and livelihoods.”

Output in the last month of the quarter fell by more than a third, down by 33.4% year-on-year, with 76,900 units made compared with 115,498 in the same month last year.

This decline, says the SMMT, resulted in the weakest March since the financial crisis in 2009, and was driven primarily by a decrease in production for overseas markets, which fell by 41.4%.

Exports to the US saw the greatest decrease during March, dropping by 63.8% year-on-year, largely due to the closure of Honda’s plant in Swindon in July 2021, which manufactured for the US market, while exports to the EU declined by 24.5%.

Chris Knight, automotive partner at KMPG, says that manufacturers are prioritising components into higher-margin cars, which is bad news for fleets.

“A focus on prioritising available components and materials into higher-margin vehicle production and sales has been to the detriment of some parts of the fleet industry,” explained Knight.

“But with rental and leasing markets beginning to recover as travel and commuting again increases, leasing companies will be looking at which manufacturers have, and haven’t, supported them during these challenging times.

“An increase in hybrid working may of course change the nature of company car schemes forever and lead to less miles driven, but in turn it could drive more consumers, whether supplemented by a vehicle allowance or not, to look at rental options as an alternative to ownership.

“This was a trend we were already seeing pre-pandemic, particularly in urban areas and amongst younger consumers. And the tightening cost of living squeeze will only increase the number of people assessing whether short- or medium-term rental or leasing is a more affordable model for them than buying a vehicle.”

Login to comment

Comments

No comments have been made yet.