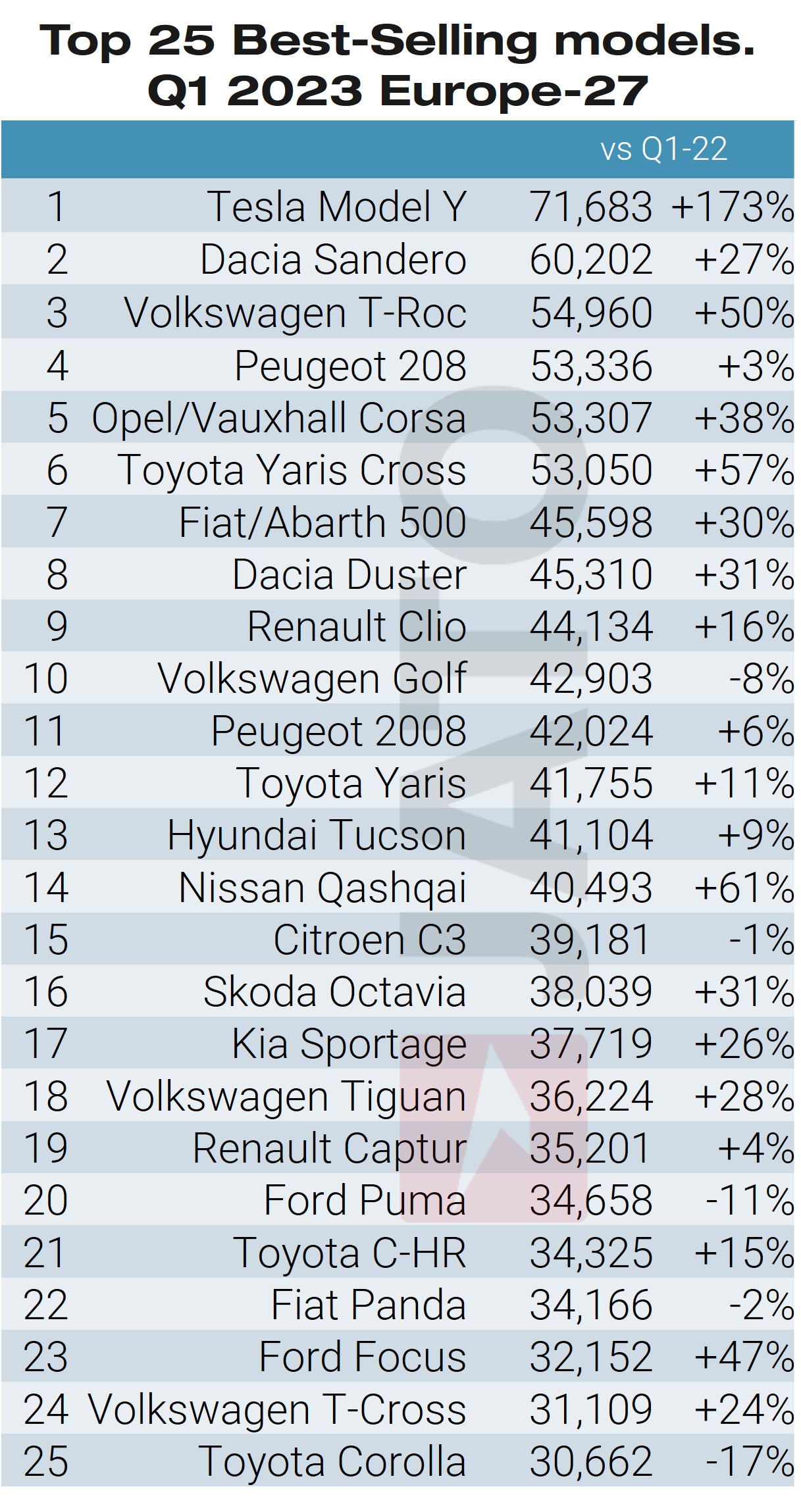

The Tesla Model Y was Europe’sbest-selling new passenger car in March, according to Jato Dynamics.

Analysing sales across 27 markets in Europe, it was also the best-selling car in Q1 2023.

It is the first time that the model has topped the year-to-date ranking and is in stark contrast to Q1 last year, when the Model Y was ranked 31st.

Felipe Munoz, global analyst at Jato Dynamics, said: “Increase in production alongside fewer supply chain issues enabled Tesla to finally deliver vehicles to its customers at pace.

“The Model Y will likely be among the five best-selling products in Europe at the end of this year.”

However, the success of the Model Y came at the expense of the Model 3, which saw fewer registrations - down by 42% in March, and 40% during Q1 2023.

Munoz added: “Given the popularity of SUVs, it is perhaps unsurprising that the Model Y has risen in demand, in comparison to its sedan peer.”

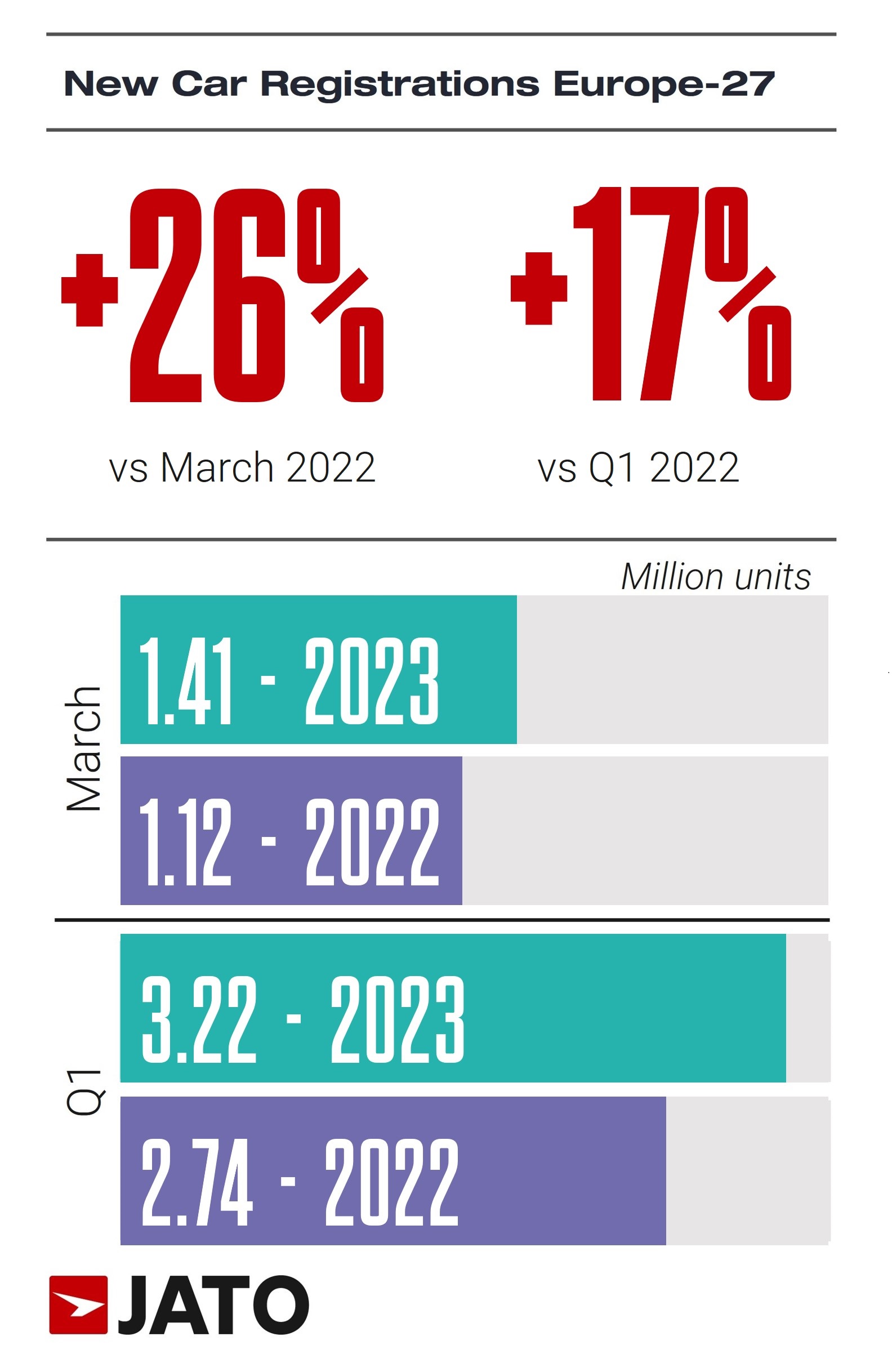

In March, Jato reports that the number of European new car registrations increased by 26% to 1,414,815 units, and by 17% in Q1 to 3,220,806 units – the highest it has been since 2019.

Munoz said: “The increase in registrations is largely explained by accumulated orders from months previous that could not be delivered due to the lack of components at the time.

“We’ll be watching closely to see how this growth is impacted by further inflationary pressure in the coming months.”

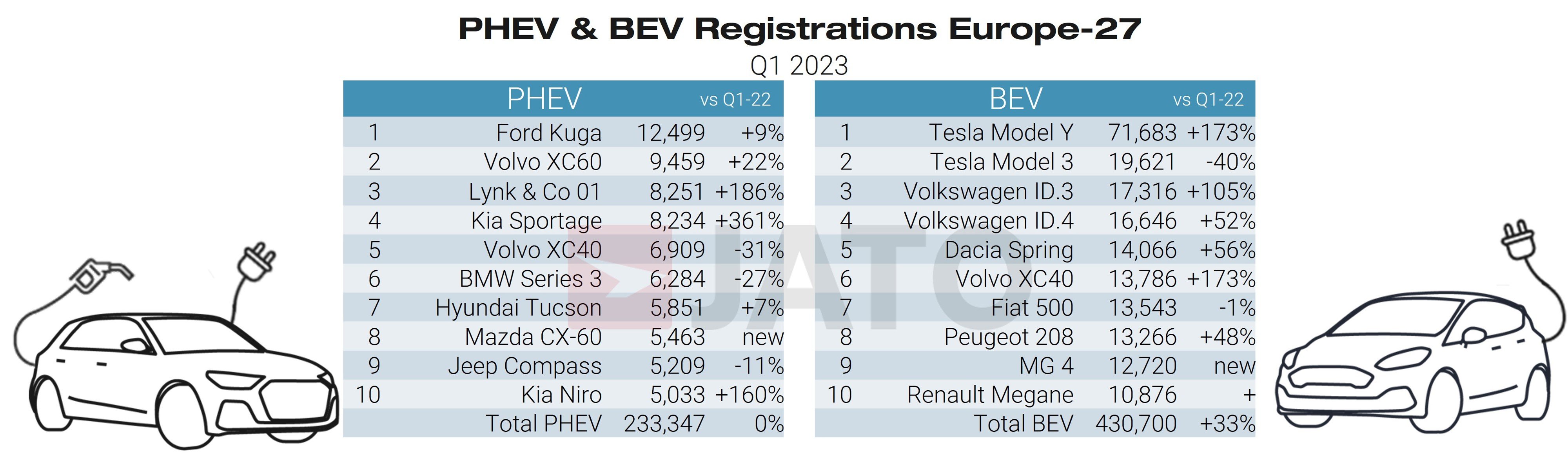

Battery electric vehicles (BEVs) were a strong driver of this growth. More than half of registrations in Q1 were BEVs, with volume increasing by 43% in March to over 219,000 units.

More models, lower prices, and appealing incentive packages across all markets has contributed to this positive rise in demand, says Jato.

The market share of BEVs totalled 13.4% for Q1 - the highest ever for the first quarter in Europe.

Tesla’s volume totalled 28% of all BEV registrations in March, and 22% for Q1.

“Tesla is showing stronger results this year than seen in 2022, despite the record set last year,” continued Munoz. “However, the speed of growth would have been even faster had it not been for the triumph of the Model Y and the subsequent lack of registrations of the Model 3.”

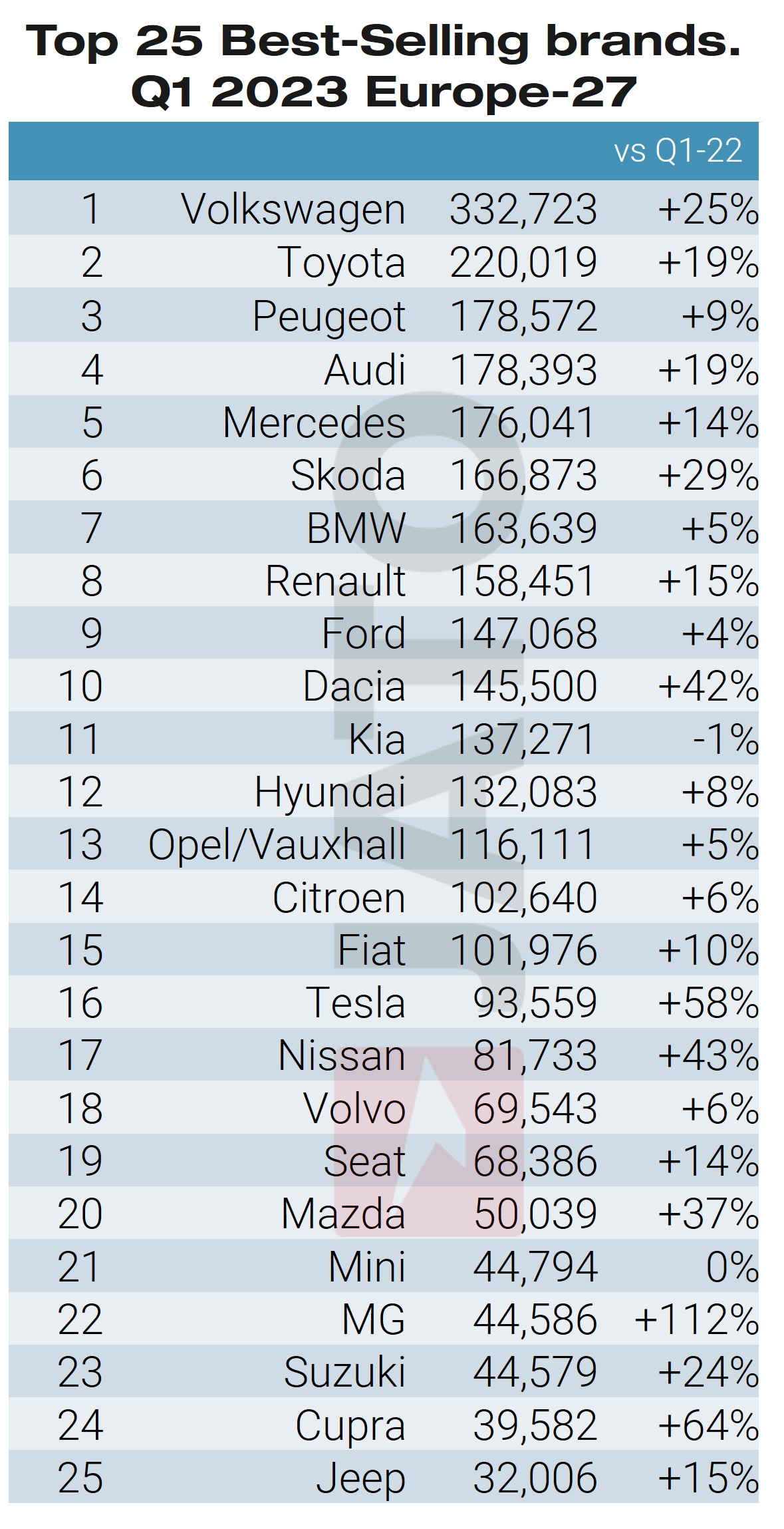

The Volkswagen Group came only 2,400 units behind Tesla in the Q1 ranking, with its total BEV volume up by 57%.

Even during the reigning period for Tesla, Volkswagen’s rise equalled Tesla’s. With Volkswagen performing better in March, registrations grew by 75% in comparison to Tesla’s 44%.

Geely Group, SAIC Group, and Toyota also produced good results in the BEV market during Q1.

SAIC Group (MG and Maxus) enjoyed positive results. With the popularity of the recently introduced MG 4, the Chinese manufacturer continued to climb the rankings.

In March 2023, the MG brand made the top 10 BEV ranking of OEMs - ahead of Nissan, Toyota, and Ford.

The MG 4 achieved fourth place in the top 10 BEV ranking for March.

MG is a prime example of how Chinese OEMs can thrive in the Western market, using a reputable Western brand and selling a competitive product.

Toyota, still marginal in terms of BEV volume, registered more than 3,700 units of the bZ4X. This saw the manufacturer’s overall BEV volume grow by 437% during the quarter.

Remarkably, Toyota outsold Ford in Q1. Nevertheless, its figures lagged behind the large volumes posted by the majority of its European counterparts and Hyundai-Kia.

Login to comment

Comments

No comments have been made yet.