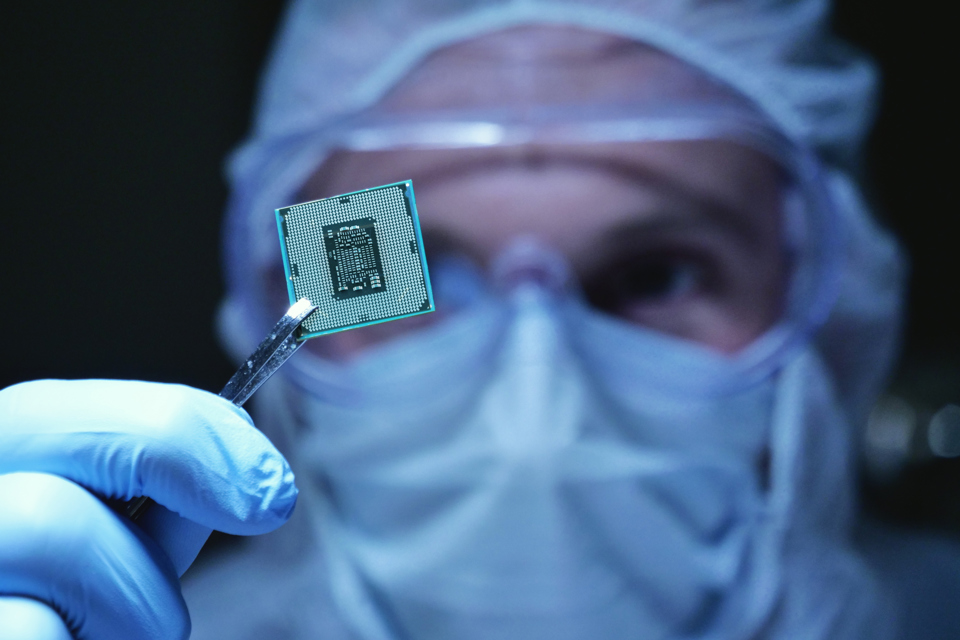

Stellantis has revealed plans aimed at better managing and securing the long-term supply of vital microchips.

The new strategy includes: the creation of a semiconductor database to provide full transparency of semiconductor content; and long-term chip level demand forecasting to support capacity securitisation agreements with chip makers.

Furthermore, it will implement and enforceme a ‘green list’ to reduce chip diversity and – in case of future chip shortages – to put Stellantis in control of the allocation; and the purchasing of mission-critical parts at chip makers including a long-term securitisation of chip supply.

The carmaker, which owns 16 car brands, including Vauxhall, is also in discussions with semiconductor providers like Infineon, NXP Semiconductors, Onsemi, and Qualcomm to further improve its platforms and technologies.

In addition, Stellantis says it is working with AiMotive and SiliconAuto to develop its own semiconductors in the future.

“An effective semiconductor strategy requires a deep understanding of semiconductors and the semiconductor industry,” said Maxime Picat, chief purchasing and supply chain officer at Stellantis.

“We have hundreds of very different semiconductors in our cars. We have built a comprehensive ecosystem to mitigate the risk that one missing chip can stop our lines.

“At the same time, key vehicle capabilities directly depend on the innovation and performance of single devices.”

To date, Stellantis has entered into direct agreements for semiconductors with a purchasing value of more than €10 billion through 2030.

The supply agreements cover a variety of vital microchips, including: Silicon Carbide (SiC) Mosfets, which are fundamental to the range of EVs; Microcontroller Units (MCUs), a key part of the computing zones for its platform’s electrical architecture; System-on-a-chips (SoCs), where performance is essential for the high-performance computing (HPC) units that deliver the in-vehicle infotainment and autonomous driving assist functions.

Login to comment

Comments

No comments have been made yet.