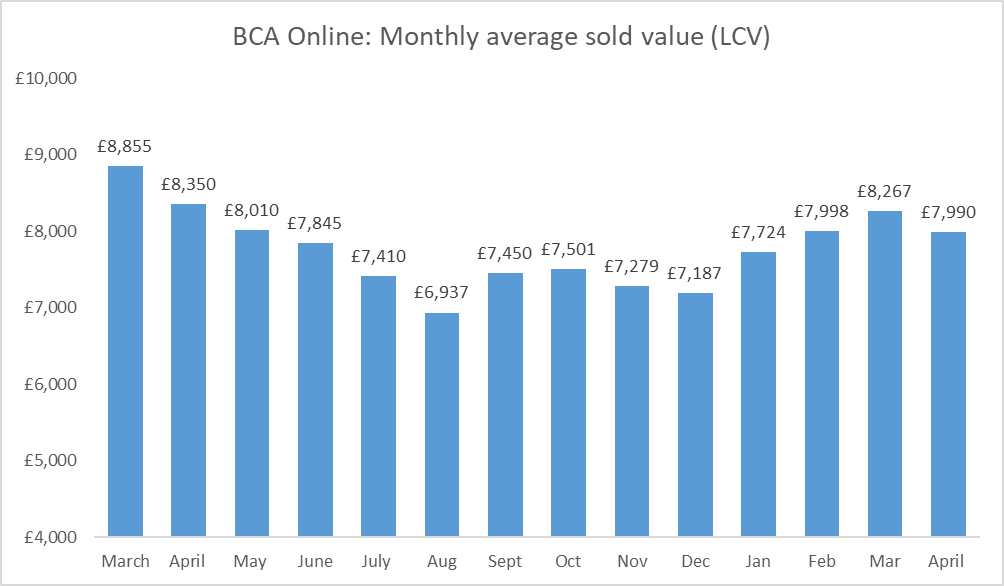

Used light commercial vehicle (LCV) values remained resilient in April, according to BCA’s latest remarketing data.

The average value of a used LCV was £7,990 in April, maintaining the higher value profile experienced since the turn of the year and reversing the trend seen across the latter part of 2024 when values were under significant pressure.

Sold used LCV volumes, meanwhile, averaged more than 2,000 each week during the month, with sale conversions staying high as buyers competed for stock.

Used LCV values also continued to outperform guide price expectations, averaging 102.7% across the month, as strong levels of wholesale demand continued, and retailers continued to report strong interest from buyers while also managing low inventory levels on forecourts.

Stuart Pearson, chief operating officer at BCA, said: “We have continued to see a very competitive marketplace for LCVs in 2025, with good levels of demand and rising numbers of buyers within our sales programme.”

Competition remained fierce for clean condition, lower mileage vehicles, says BCA, with values routinely exceeding price guide expectations by a considerable margin, particularly where customers appeared to be buying to order.

Older, higher mileage stock also found a ready audience providing the condition was fair and valuations were realistic, according to BCA.

The combination of high mileage and poorer condition vehicles proved to be more challenging however, with extra effort required to align bidder and vendor expectations.

Pearson continued: “Our online commercial vehicle sales programme sells seven days a week and has totally challenged the concept around when is the prime time to sell.

“Understanding that this means a different thing to every customer is important, and the flexibility of the programme, combined with the volume and selection of stock on offer means that we’ve been able to satisfy the needs of more buyer customers, which helps to drive sales performance for our sellers.”

He concluded: “We continue to deliver enhancements and improvements to our services for LCV buyers and sellers and remain committed to ongoing investment in technology and infrastructure to support all parts of the buying and selling process as growth in the commercial vehicle sector accelerates.”

The latest data on the used van market comes as new research suggests that, while some fleets are already adopting used vans, more than a third are planning to buy second-hand LCVs, rather than new vehicles, within the next three years.

The 2025 Arval Mobility Observatory Fleet and Mobility Barometer shows that 13% of fleets already own at least some second-hand vans, while 36% plan to buy these vehicles by 2028.

Login to comment

Comments

No comments have been made yet.