Author: Rupert Pontin (pictured), director of valuations at Cazana

The fear of a no-deal Brexit and WLTP has left the new fleet car market in a difficult and confusing place.

This is despite July new car registrations improving 1.2% over the same period last year.

Fleet registrations showed an increase of 2.6% for the month the reality is that it’s hard to sell new cars into this sector.

Deals to keep the metal moving are commonplace and there is a great deal of reluctance from the fleet operators to give commitment with so many different factors affecting both business and user chooser drivers.

The biggest issues at the moment seem to be the concern over a no Brexit deal scenario and WLTP.

The Brexit position is worrying businesses looking at forecasting their own performance for next year.

With that as a concern, there is a reluctance to commit to fleet changes until better clarity is given by a government that so far appears to have delivered only rhetoric and European gain with little traction for the UK.

A number of sizeable organisations have already indicated plans to alter their trading and operational structures should the UK not strike a sensible agreement with the European Union to come into place next March In addition, confusion over the WLTP position has also delayed sales.

Drivers delay making choices too

User choosers and company drivers as a whole are showing reluctance to commit to a replacement vehicle until they are more comfortable with the changes to taxation and the cars they will be driving.

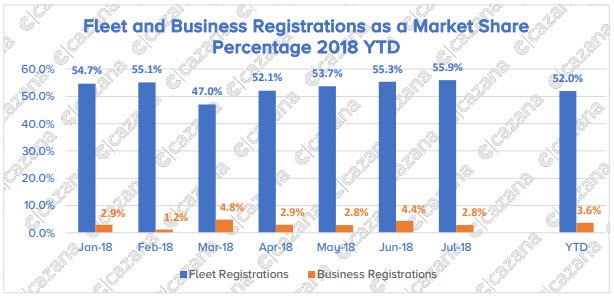

The chart below clarifies the fleet and business sector performance so far this year:-

> Data from the SMMT

Whilst this chart looks reasonably stable, the year to date figure for fleet registrations is 6% down on 2017 and for the far smaller yet important business sector volumes are down 11.4% on 2017.

Activity in the coming eight weeks will be fascinating.

Last month Cazana focussed on the performance of diesel cars in the used car market with a highlight on what had been happening with retail driven pricing for what has been long mooted as a weak area of the market.

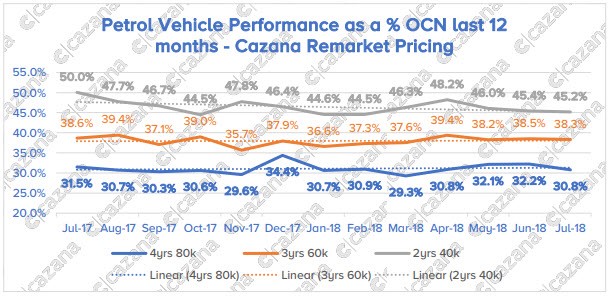

However, much has been made of the enhanced performance of petrol models and the chart below seeks to clarify the position of ex-fleet profile petrol cars in the used car market.

Where there are fewer cars registered in this market there is a higher residual value percentage of original cost new and this is volume driven.

There are also anecdotal comments that smaller engine petrol cars are less desirable as smaller engines work harder in their fleet life and with higher mileage prove less reliable.

The chart below shows the comparison between ex-fleet profile petrol cars at two, three and four years old at typical fleet mileages.

This is data driven from Cazana live retail pricing but shown as a percentage of the original cost new based on the Cazana Remarket wholesale value.

Defending the small car sector

This chart is interesting as it shows a couple of changes in the ex-fleet used car market.

Retail pricing data generally shows a good level of stability for the traditional three-year-old 60,000 mile cars where remarket values have dropped just 0.3% since July 2017.

Four-year-old examples have seen a greater drop year on year of 0.7% of original cost new which is once more probably not of great concern to the market.

However, the two-year-old 20,000 mile examples have dipped by 4.8 percentage points year on year.

This suggests there are more of this age car in the market and retail demand and pricing are therefore being forced downwards.

Interestingly this data matches that reported in the Cazana monthly market update that highlighted pressure on two-year-old ex-PCP cars.

Therefore, it is necessary to look more intensely at the data to try to identify where the issue with this age ex-fleet car lies.

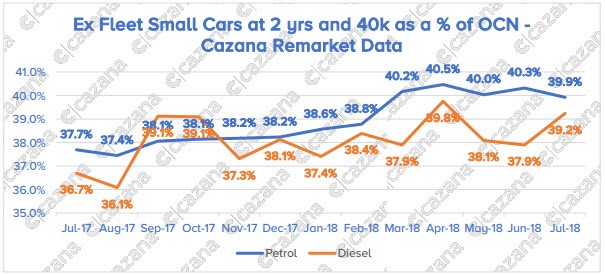

There has been a significant level of comment that the small car sector has been behind this downturn as a direct result of the volume of smaller cars being pre-registered and thus pushing down on values in the sector.

Anecdotally this has been taken one stage further and comment has been that it is due to increased pressure from the PCP market although this has been heralded as unlikely and it is C-sector and small SUV’s that are causing the issue.

The following chart seeks to dismiss the rumour that the small car sector is behind this weakness in ex-fleet cars at two years old and forty thousand miles by comparing values of both fuel types over the course of the last year:

This chart actually shows significant increases in retail driven wholesale pricing with the Cazana Remarket value as a percentage of original cost new for small petrol cars 2.2 percentage points in the last 12 months.

Despite significant instability with diesel pricing there is also an increase for small diesel cars at 40,000 miles with a 2.5 percentage point uplift in values.

As such the weakness must lie in cars in other market sectors.

In summary, where the UK market has seen an upturn in registrations both overall and in the fleet sector it is important to acknowledge that registrations are not sales.

Incentives could boost the market

The reality is that the fleet business is tough at the moment and will stay so for the next couple of months unless fabulous incentives are put in place and the reality is that this is a strong possibility.

Closer scrutiny of used fleet products paints a better picture and despite new market apathy, the used retail demand is keeping values firm generally speaking.

Detail is the key and greater direction can be gained by looking at specific market sectors and even individual models as highlighted by insight shared in this monthly fleet focus.

Login to comment

Comments

No comments have been made yet.