April can be a fickle month for new and used cars sales with weather and holidays tending to divert the retail buyer accordingly.

This can directly impact on the defleet market and wholesale remarketing values causing stock to turn slower and give a lower return.

However, April 2018 seems to have been better than many expected in both markets with ample demand specifically in the used car market where an anecdotal comment has suggested stock has been particularly short for certain vehicles.

New car registrations for April 2018 showed a notable improvement over the same period last year with volumes up by 10.4%.

It is interesting to note that whilst last month’s severe drop in registrations caused by changing VED legislation in March 2017 was widely reported by the national press, this month’s improvement has had little comment.

The reality is that, as predicted by Cazana earlier in the year, the April data will be the beginning of a rebalance of new car market reporting that will filter through the rest of the year.

An overall drop of 8.8% reported for April year to date is beginning the turn towards the full year expectations of a new car market some 6.5% below the 2017 total.

Diesel sales continue to disappoint with a further drop of 24.9% for the month although this is a lighter reduction than of late.

Confusing government policy and lack of balanced mainstream press coverage seem to be the culprits that are helping deter new car buyers whether they be from the private or fleet sectors.

However, AFV registrations continue to improve with a 49.3% increase for April bringing the year to date total to 16.1% higher than by the same time in 2017 taking market share to 5.2% up 1.1% on last 2017.

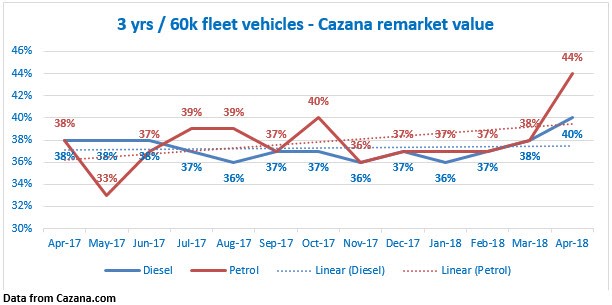

However, the used market is key at the moment and the chart below shows how retail driven Cazana Remarket values have performed as a percentage of original cost new over the last year for three-year-old vehicles.

The chart shows that a year ago petrol and diesel cars were worth the same amount of their original cost new albeit that the average cost new for petrol cars was £20,076 and diesel higher at £28,248 confirming that diesel fleet vehicles tend to be larger in size and more expensive.

This position has shifted notably with a premium for petrol cars now showing as 4% in April 2018.

The trend lines also accurately show that as a whole petrol values are increasing although it is clear that the journey has been bumpy over the course of the year.

This will be due to defleet volumes at certain times of the year, but there is also a correlation to the type of comment in the national press.

This is also evident on the diesel-powered valuation line which clearly shows that values started to dip in late spring 2017 as the press reached a hiatus around diesel pollution.

It is interesting to note that there has been a consistent performance as a whole for diesel-powered cars of this age and mileage which is encouraging, especially given the increase in volumes coming to the market.

Most importantly this retail based insight shows that values have been increasing over the last 3 months as consumer demand has focussed on the used market.

It is likely to have been driven by the realisation of value for money and the increase in innovative finance propositions so this is good news for the industry and specifically the fleet sector.

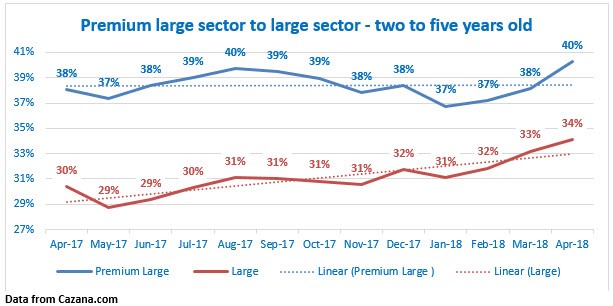

For April we look at the comparison between activity and value performance in the larger car sector and the premium large car market.

In recent years there has been a reduction of models produced by manufacturers for the large car sector as predominantly fleet demand has attracted customers to the premium brands and alternative types of vehicles.

The chart below shows how retail driven Cazana Remarket values have been affected as a percentage of original cost new.

From this chart it is evident that whilst the trend for premium large values over the last 12 months has been largely static with pricing variation over a 3-percentage point delta, the movement in large car values has been more positive.

With movement over a four percentage point delta the shift has been upwards.

The gap between the two sectors has halved over the period too and there is now just a four percent point difference.

The chart also reiterates that values in recent months have been on an upward trajectory.

This will be an interesting trend to monitor as large car volumes are low in comparison and therefore values may well continue to rise.

In summary, April has been a better month for new and used car sales and dealers have also been both busy and productive.

Although the used car profit corridor has been under pressure and generally speaking dealers have been frustrated at times, they have been selling metal and that ticks the finance departments check list. This is excellent news for the fleet sector as remarketing financial return has been positive.

This has come as a welcome boost where perhaps expectations had not foreseen this market strength.

Author: Rupert Pontin (pictured), director of valuations, Cazana

Login to comment

Comments

No comments have been made yet.