March is generally a very busy month whether it be in the new or the used car market.

Focus tends to be on new car sales as the new registration plate is launched and that affects both the retail and fleet markets.

Private buyers seek to show off a new plate on their purchase, and fleets like to defer sales to March to get the latest plate on the asset for a better return on investment come sale time.

New car registrations for March 2018 endured a 15.7% drop over the bumper March 2017 figure that was an anomaly due to the impending VED changes that came into place on April 1, 2017.

Last year dealers and manufacturers worked hard to clear stocks of cars that were to be adversely affected by the increase in car tax rates.

As such a drop of such magnitude in March this year should have been expected, although the national press are enjoying over playing the position.

By the end of the year the UK market will have balanced from it’s 12.4% year-to-date decline in registrations to a more reasonable 6.5% fall as predicted by Cazana last year.

Diesel versus petrol

The diesel debate continues to rage and the 37.2% drop in new diesel car registrations in March has not helped speculation over the future of diesel despite commitment to the fuel type from many key manufacturers that are prepared, and financially able, to invest in the future of the technology.

The used market is under close scrutiny from all angles with concern over current and future values but at the moment the market is stable.

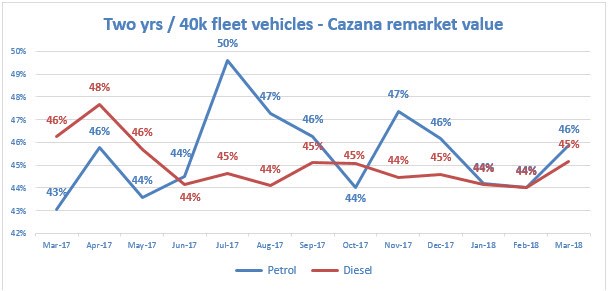

The chart below shows activity in the fleet sector for typical younger ex-fleet cars :-

Data from Cazana.com

Data from Cazana.com

The above chart demonstrates that a year ago diesel cars enjoyed a 3% premium over petrol as a % of original cost new and in the last 12 months the position has shifted to show 1% premium for petrol cars.

This is an upward shift of 4% and is interesting because it now shows a premium of 3% for petrol powered vehicles over diesel.

Anecdotal market discussion has suggested that the influx of ex-PCP product at this age and mileage might have damaged values of petrol cars.

However, the reality from live retail based data is ultimately contrary, although prices have been volatile during the course of the last 12 months.

It is also worth considering the fact that diesel cars rest just 1% lower than at the same point last year and following a drop from late spring, showed a solid consistency which highlights the fact that the retail consumer is still happy to buy diesel cars.

Premium versus volume in the lower medium sector

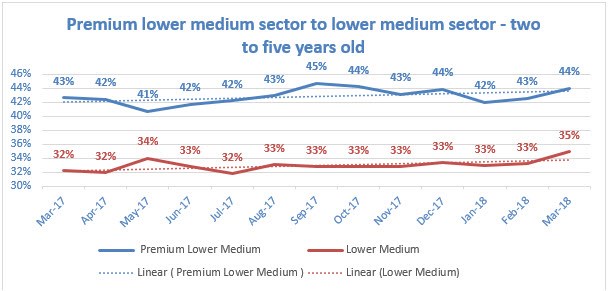

This month we also take a snapshot comparison of the premium lower medium sector against the lower medium sector.

The shift of private demand and fleet user preference away from volume manufacturers has been ongoing for some years and this chart shows the lack of impact of this trend in the used market.

Values are expressed as a % of original cost new based on the Cazana remarket price which is derived from retail data :-

Data from Cazana.com

Data from Cazana.com

The above chart clearly depicts a high level of consistency in both sectors which is important given the volume of cars that filter back to both markets.

A year ago the uplift for the premium lower medium sector was 11% and in March 2018 this figure is now 9% points.

This suggests that reduced volumes of lower medium cars in the market have resulted in a minor improvement in retail and therefore wholesale values.

Given that a high proportion of lower medium used cars have been owned by fleets this is a trend to be watched in the future as the lower medium sector may see a greater resurgence in values.

To summarise, March 2018 has been a difficult month for new car sales but good for used car dealers. Fleet car values for the sectors reviewed have been reliable and robust and there is no clear evidence from the data that this will change in the short term.

Consideration must be given to the impact of volumes going forward in the mid to long term but it would appear consistency and positivity is the order of the day.

Clearly there is more insight to be gained from looking at more specific information and Cazana can assist with detailed analysis.

Author: Rupert Pontin (pictured), director of valuations, Cazana

Login to comment

Comments

No comments have been made yet.