Both BCA and Manheim have reported strong demand for used light commercial vehicles (LCVs), with values rising year-on-year.

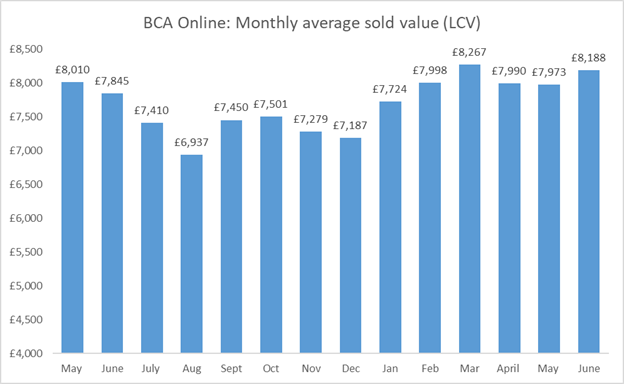

Used LCV values at BCA averaged £8,188 in June 2025, up by £209 (2.6%) over the month and ahead of June 2024 values by £343 (4.4%).

It was the second highest monthly value figure recorded this year, just behind March, which is typically one of the stronger trading months in any given year.

Performance against guide price expectations rose by nearly two percentage points to 103.3% in June, continuing a trend seen throughout 2025.

Sold LCV volumes, meanwhile, were on a par with May figures at just under 9,000 units and more than 2,500 different buyers purchased stock as bidding remained competitive bidding for the best-presented vehicles.

Across the first half of the 2025, BCA has seen used LCV values average just over £8,000, equivalent to 103% of price guide expectations, with nearly 7,000 different buyers purchasing.

Manheim Auction Services, part of Cox Automotive, has seen sold volumes across its van auctions increase by 9.3% year-on-year.

Furthermore, when compared with figures from 2023, these volumes are up by 30.2%, with growth coming amid challenging market dynamics.

Data from the SMMT highlights the contraction in the new LCV market in the first half of 2025, with an overall reduction of registrations by 12.1%, marking the worst opening half-year performance since 2022.

In the last quarter, many fleet operators in the UK have slowed vehicle replacement cycles in response to this, reducing overall used vehicle stock in the wholesale marketplace.

Meanwhile, Manheim’s sold volumes reached levels not seen since before the pandemic, and further positive results for sold prices were also achieved across the lanes.

Average selling values for vans increased by 9% in Q2 versus Q1 2025, with these vehicles now selling for £8,063 on average.

Matthew Davock, director of commercial vehicles at Manheim UK, said: “There are many reasons to feel confident about today’s used commercial vehicle market.

“While the new vehicle sector faces headwinds, the used market continues to offer a clear opportunity for buyers seeking quality, in-demand stock.

“The feedback from buyers reflects this, as the price point of used vans combined with the challenges seen in the new market is pushing many operators to source more used vans.”

BCA says that condition remains very important and even higher mileage, older vehicles can attract a lot of attention if the condition is acceptable for a retail forecourt.

Stock acquisition, meanwhile, remains an issue for many buyers and this is unlikely to change in the months ahead, particularly if new sales remain depressed.

Stuart Pearson, chief operating officer at BCA UK, said: “We continue to very work closely with sellers to ensure stock is presented in the best possible condition to attract buyers.”

Login to comment

Comments

No comments have been made yet.