Amid a tough economic environment and weak business confidence to invest in fleet renewal, the UK’s new light commercial vehicle (LCV) market continues to perform poorly.

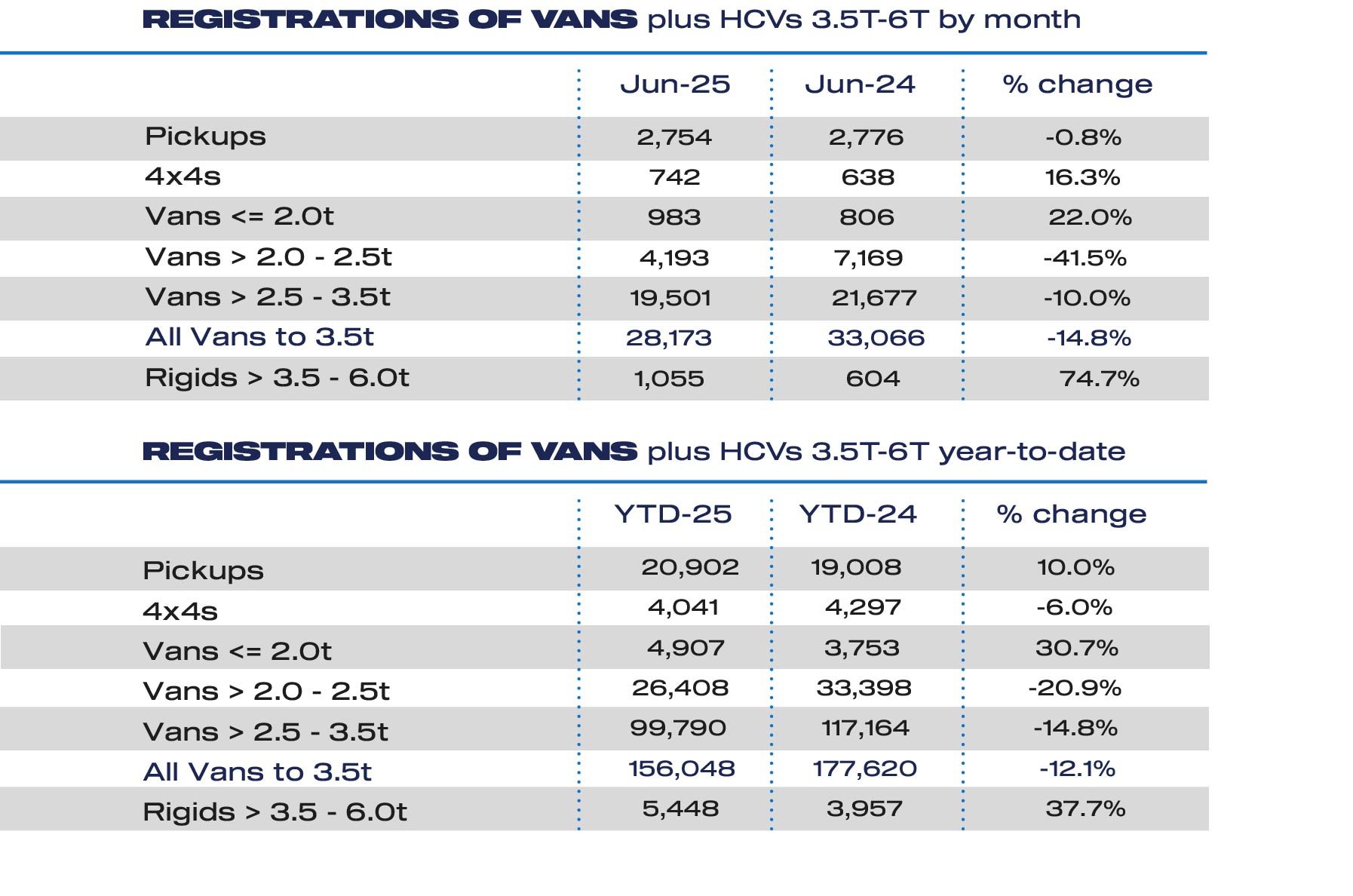

Registrations fell by 12.1% to 156,048 units in the first half of 2025, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT).

With a 14.8% drop in June, the market declined for the seventh consecutive month, rounding off the worst opening half-year performance since 2022.

Year-to-date performance was led by declining demand for the largest vans, down by 14.8% with 99,790 registered, as well as deliveries of medium sized vans, which fell by 20.9% to 26,408 units, while 4x4 uptake also fell, by 6% to 4,041 units.

There was growth, however, in demand for small vans, up 30.7% to 4,907 units.

Uptake of new pick-ups in the half-year period was also up 10% to 20,902 units, however, that growth was down to fleets ordering vehicles prior to a tax change introduced in April, which saw the vehicles treated as company cars for tax purposes.

There were two consecutive months of decline following the changes to benefit-in-kind (BIK) for double and extended cab pick-ups.

The SMMT says that the change in treatment is putting additional costs on key business sectors, constraining new orders of the zero and lower emission models which are entering the market, and keeping more polluting vehicles on the road for longer. It also believes it will reduce total tax revenues given the lower registration volumes.

SMMT continues to urge Government to postpone the measure for at least one year so that industry and operators can better plan and prepare for the change.

Zero-emission demand half of mandated share

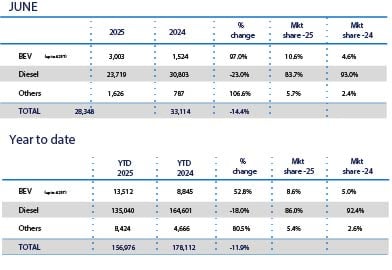

Demand for battery electric vans was up 52.8% in the first half of the year, with 13,512 units registered, helped by a 97% jump in deliveries in June.

However, in the year to date, new electric van registrations remain at just 8.6% of the overall market, little more than half the 16% share mandated by Government for 2025.

Many businesses are being held back by a lack of access to suitable commercial vehicle charging at public, depot and shared hub locations, says the SMMT.

Market regulation is only workable if sufficient operators can switch, so Government must ensure greater access to LCV-suitable infrastructure across the country it argues.

Preferential treatment for depot grid connections is also a necessary step, given some sites could face waits of up to 15 years, and consistent and efficient implementation of local planning policy would give fleets the confidence they need to transition their operations to zero emissions.

Mike Hawes, SMMT chief executive, said: “Half a year of declining demand for new vans reflects a difficult economic climate and weak business confidence and the fact that this downturn comes just as industry invests heavily to expand its zero emission LCV offering is particularly concerning.

“Decarbonisation remains a shared ambition but with the EV market more than a third below this year’s target, bold measures are needed to drive demand.

“Accelerated CV infrastructure rollout, quicker grid connections and streamlined planning are now critical.”

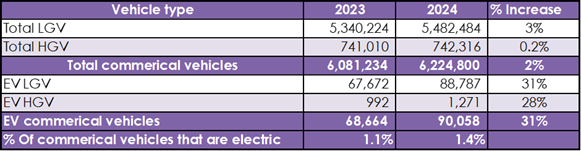

The latest registrations data comes as separate research from Inverto shows that electric lorries and vans increased in the UK by 31% over the past 12 months, but are still well below 2% of all commercial vehicles.

It suggests that the number of electric freight vehicles on UK roads has grown significantly, up to 88,787 in the last year compared to 67,678 in the previous 12 months.

Nevertheless, these vehicles still represent only 1.4% of the total 6.2 million freight vehicles in the UK.

With curbing Scope 3 emissions now a requirement in many private and public sector contracts, companies that operate freight vehicles are adopting electric vehicles (EVs) to meet emissions targets.

Kiren Pandya, principal at Inverto, said: “The expansion of the commercial EV sector is expected to continue slowly.

“The main commercial EV expansion challenge facing logistics firms is the high cost of purchasing or leasing EV freight fleets. High interest rates make it more difficult for fleet operators to finance commercial EVs.

“Given the higher prices of EV vehicles, the cost of financing has become a key barrier to adoption, despite the growing number of green policy initiatives, such as the pledge to reach net-zero emissions by 2035.”

He added: “There are practical challenges which are slowing the transition. For example, limitations to current battery technology means that there are very few options for switching heavy goods vehicles (HGVs) to electric which is why the number of electric HGVs is just 0.02 % of all HGVs.

“While many fleet companies are encouraged or even required to transition to commercial EVs as part of their contractual obligations with clients following strong sustainability policies, the broader uptake remains slow.”

Login to comment

Comments

No comments have been made yet.