The market share of Chinese car brands in Europe has almost doubled in the first half of 2025, reaching a record 5.1%.

Data from Jato Dynamics shows a 91% uplift in new car registrations from Chinese manufacturers, since the start of the year.

Five Chinese brands are driving the rapid growth: BYD, Jaecoo, Omoda, Leapmotor and Xpeng.

BYD, which has been particularly aggressive in its pricing strategy, registered 70,500 units in H1 2025 – a year-on-year increase of 311%. In June alone, BYD registered 15,565 units, entering the top-selling 25 brands and outselling Suzuki, Mini and Jeep. The BYD Seal U was along with the Volkswagen Tiguan the top-selling PHEV in Europe in June, and the third in H1.

Jaecoo and Omoda, both part of Chery, also made substantial progress, although this has not been due to their electric line-up. Plug-in hybrid SUVs accounted for 29% of their combined monthly registrations in June, while traditional ICE models made up almost two-thirds (63%) of the total. The Jaecoo 7 was Europe’s 9 th top-selling PHEV in June.

Leapmotor registered over 8,300 units in June alone – driven largely by the popularity of its T03 city car and C10 SUV. Meanwhile, Xpeng has emerged as the most successful high-end Chinese car brand in Europe so far in 2025, with 8,338 units registered in the first half of the year. Its growth has been led by strong demand for the G6 SUV, which accounted for 5,615 of those registrations.

Some of the industry’s biggest players have conceded market share. Stellantis experienced the largest decrease in the first six months of the year, with its market share declining from 16.7% to 15.3% year-on-year.

Tesla experienced the second steepest decrease in market share in H1 2025, down from 2.4% in H1 2024 to 1.6%. Over this period, it has lost its place in the group rankings to SAIC Motor, owner of MG, which outsold Tesla for the first time.

Overall, new car sales across Europe have slumped with a decline of 0.3% year-on-year.

A total of 6.8m units were registered in H1, yet this is 1.56m units behind the performance of H1 2019.

“Persistently high prices, geopolitical and economic tensions with Europe’s trading partners, and the post-pandemic market reality are behind the decline,” said Felipe Munoz, global analyst at JATO Dynamics. “Western Europe has lost the equivalent of more than 2.5 million units of annual sales since 2019.”

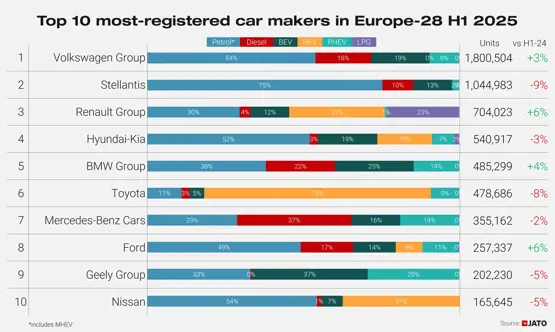

Volkswagen Group registered the most cars in Europe, in H1, followed by Stellantis and Renualt Group.

Electric car registrations exceeded the one million units mark for the first time in the first half of the year. In total, 1,193,397 units were registered, up by 25% year-on-year. However, despite the positive trajectory, growth slowed in June with registrations rising by 15% to 240,247 units. Electric cars accounted for 17.4% of Europe’s new car market in the first half of 2025 – an increase of 3.6 percentage points compared to the same period last year.

As a segment, electric cars continue to grow in importance for most of Europe’s biggest carmakers. JATO Dynamics’ data shows that, excluding Tesla, BYD is the OEM most dependent on the segment, which represent almost two-thirds (64%) of its total sales mix. However, similar to SAIC – which saw its BEV share drop to 15.4% – BYD’s electric car share has declined compared to H1 2024. This shift reflects a strategic pivot toward other powertrains, as both manufacturers sought to mitigate the impact of tariffs imposed on their electric models.

In contrast, Ford saw a notable increase, with electric cars rising from 4.5% of its sales in H1 2024 to 13.7% in H1 2025. Volkswagen Group's electric car share grew from 10.1% to 18.7% over the same period, while Hyundai-Kia saw an increase from 12.6% to 19.1%. Growth was also recorded at BMW Group and Renault Group, with more modest gains observed at Stellantis, Toyota, and Mercedes-Benz.

Login to comment

Comments

No comments have been made yet.