Fleet FAQ

Q:

How much do electric vehicles (EVs) cost?

A:

One of the biggest challenges for employers looking to switch their fleet to electric vehicles (EVs) is the perceived price premium EVs carry when compared with petrol and diesel alternatives.

If an employer takes a traditional ‘list price’ or ‘lease rental’ approach to measuring vehicle costs, then EVs will often appear more expensive.

But, by looking beyond the more visible, upfront costs of vehicle ownership, employers can make more informed decisions that will support a switch to an electrified fleet.

Taking a total cost of ownership (TCO) approach not only shows that EVs are often cheaper over their lifetime, but it also facilitates better financial management of a car scheme.

TCO, as one would expect, captures all direct and indirect costs associated with buying and using a car over its expected lifetime.

It includes the more visible and obvious costs, such as vehicle funding costs (including lease rentals, finance payments, depreciation etc.), maintenance costs (including tyres, servicing, MOTs etc.) and motor insurance.

However, TCO also takes into consideration the less visible costs.

These, typically, include the cost of ‘filling up’ – be that battery charge or traditional fuel – or mileage reimbursement provided, direct and indirect taxes including VAT, corporation tax, National Insurance Contributions (NICs), ad-hoc costs such as insurance, the impact of known future changes in tax rules and rates, plus other financial considerations.

Integrating these elements enables employers to make better informed judgements on the financial implications associated with switching to EVs.

Why TCO is important for EVs

Measuring vehicle costs with a traditional approach does not take account of key differences between EVs and internal combustion engine (ICE) vehicles.

A large part of the financial support introduced to incentivise EV adoption is delivered through the tax system.

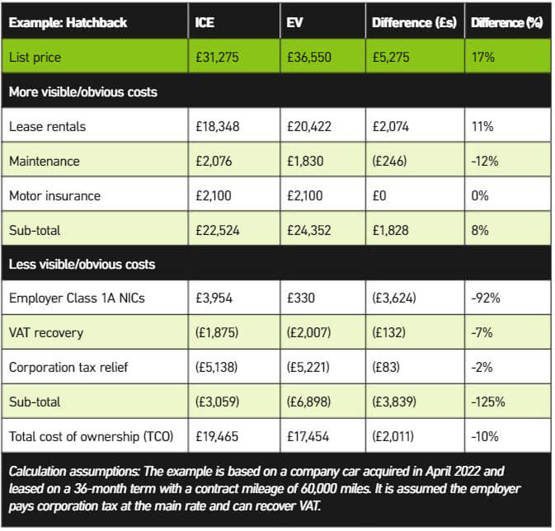

This might be through low benefit-in-kind (BIK) rates, salary sacrifice opportunities, or corporation tax reliefs (see table below).  As shown, the EV is more expensive if you only consider the list price or the obvious costs.

As shown, the EV is more expensive if you only consider the list price or the obvious costs.

However, the ICE vehicle is much more expensive when incorporating the less visible costs; the greatest difference being the employer NICs.

Further, if business mileage costs are included, additional savings can be realised due to the lower cost of electricity compared with fuel.

Prices for the latter have recently hit an all-time high, although, of course, the cost of electricity has also risen steeply since the start of the month.

*Financial information accurate as of 2022

> Interested in comparing electric vehicle data? Check out our EV tool.

> Interested in ensuring the efficient use of EVs. Check out our dedicated editorial sections: Insight & policy | EV news | Charging & infrastructure | Costs & incentives | Benefit-in-kind | EV case studies | EV road tests

> EVs by price: lowest to highest