Mobility services, electrification, connectivity, autonomy and alternative ownership/user-ship: the range of challenges, issues and new model solutions bombarding the companies moving goods, services and people around the UK is complex and intensifying.

Disrupters are entering the market promising more efficient, convenient, cheaper and greener ways of running your operations and meeting the mobility needs of your employees, but the traditional vehicle manufacturers are fighting back.

They are investing heavily in myriad new technologies and services, but have differing views about the requisite speed of progress.

And, it seems, no one is asking the fleets and their drivers what technologies they actually want and need, far less liaising with legislators about their regulatory direction of travel. No wonder the prevailing emotion is one of confusion.

Business priorities are dictating investment strategies and, while no one publicly wants to be left behind, manufacturers are at different stages in their development cycles.

One company that is addressing all future technology streams with equal urgency is Hyundai. Now the world’s third largest vehicle manufacturer, the ambitious Korean organisation is taking a three-pronged strategic approach, focusing on alternative fuels, alternative purchasing and shared services.

Tony Whitehorn, until last month the UK president and managing director at Hyundai (he continues to act as executive advisor to Hyundai during a transitional period), is one of the more open-minded and forthright manufacturer bosses. He believes the industry needs to “wake up” to the new opportunities offered by technology, but Hyundai certainly isn’t waiting around for the laggards.

It is trialling alternative subscription models and variable lease concepts at a global level and they are scheduled to come to the UK this year.

“Everything will become omni-channel – online, city stores, dealers, flagship sites for supply – and different methods of purchasing and acquisition – PCP, lease, flexi, etc.,” Whitehorn says. “Then there will be a variety of methods of propulsion. We have to be more flexible in everything we do.

“Society is individualistic and we have to reflect that; we have to cater for it.”

The proliferation in flexible options is encouraging a growing proportion of employees to eschew the company car and take cash. Pay-on-use schemes, ride hailing and shared services are beginning to offer viable alternatives to those who do not need regular and constant access to their own transport, particularly in cities.

Here, manufacturers are battling tech companies who are releasing apps and services at an unprecedented pace catering for Whitehorn’s “individualistic society”.

Increasingly, it’s a case of ‘if you can’t beat them join them’, resulting in joint ventures with, or acquisitions of, those new entrants by the major manufacturers.

The big unknown is whether these services can accommodate the mass market. Ride hailing is fine for a few people looking to go from point A to point D via points B and C to collect and drop off others (although some might say this is simply a fancy name for a taxi service).

Likewise, pay-on-use services, where people have access to a car only for the time they need it, and that car moves to the next user when they have reached their destination.

Does it work for 1,000 people? Or 10,000, particularly if those people wish to leave home at slightly different times? And what about the logistics of getting cars from one person to another?

Until we get fully autonomous vehicles which can drive themselves between users, the sharing economy is unlikely to offer a viable large-scale alternative.

By themselves, ride hailing, pay-on-use or car sharing may not be the solution, but they are likely to be part of a broader suite of options that suit different people at different times (of the day or of their lives).

For those that remain in a car scheme, and the companies offering them, the connected car will become far more influential, something that is recognised by a number of manufacturers.

Ford, Jaguar Land Rover and Tata pooled their expertise to demonstrate the benefits of connected and autonomous vehicle (CAV) technology as part of the three-year Government-backed Autodrive project in Coventry and Milton Keynes, which recently concluded.

Ford and Tata took the lead on the connected car, while Jaguar Land Rover focused on trialling the autonomous technology. It required the three to design interoperable systems, sharing common protocols, illustrating how future collaborations could speed up the development of autonomous and connected cars.

The trials started at the Mira Proving Ground in 2015 before being taken out onto public roads.

Tim Armitage, Autodrive project director and associate director at consultancy Arup, describes it as a “steep learning curve”, particularly autonomous driving, due to the complexity of the urban environment and the unpredictability of people.

“We have built on the demonstrations and understood more complicated scenarios,” he says. “We are now up to 40mph in Coventry and 60mph in Milton Keynes. The next stage is to build (up) to higher speeds.”

Coventry and Milton Keynes were selected for the trial due to their different road environments.

“If they work there, they will work anywhere,” Armitage explains.

The autonomous cars have chalked up thousands of miles, but equally important was engaging the public. By and large, their reaction has been positive, according to Armitage.

“They are very open-minded – a small proportion would get in today,” he says. “Others are wary. But the majority are up for giving it a try.”

This supports Society of Motor Manufacturers and Traders (SMMT) research where 16% said they wanted one now and 22% would consider in the future. Just 13% disliked the idea.

Armitage adds: “There is no doubt the future is autonomous vehicles doing all journey types on all types of road.”

Within the next four years, he expects to see Level 4 autonomous vehicles in geographically limited areas, such as motorways and city centres, in line with the Government’s own targets of driverless cars on public roads by 2021.

But, he concedes we remain “a long way off” from full, go-anywhere autonomy. “It will be decades before we have Level 5,” he says.

It’s a different matter for vehicle-to-vehicle and vehicle-to-infrastructure connectivity. These applications are already coming to market and, unlike autonomy, they will be available as retrofit for existing vehicles “within the next few years”.

Armitage says: “There are tremendous gains, such as identifying parking spaces and emergency vehicle warnings which will help safety and reduce congestion. It’s part of the changing world of mobility, with electric and ownership changes.”

While the Autodrive project has now concluded, Arup is working on commercial consulting projects, helping companies to understand the real-world applications of connected technology.

The project’s biggest success, according to Armitage, was bringing together three competitive manufacturers to develop and demonstrate the systems collaboratively.

“This is where all manufacturers will have to move to in future – collaboration is key,” he says.

Hyundai might not agree. It is dipping into its vast reserves to extend its own connected services next year, including software that alerts dealers when the car needs a service to enable pre-booking. It will be able to carry out early diagnostics, such as tyres; it might also be able to re-programme the car over the air, making recalls no longer necessary.

Connectivity will limit the amount of time cars are off road, although this is already reducing, thanks to electric vehicles (EVs). According to Hyundai’s stats, a diesel car spends an average of 1.3 hours on a ramp for a service; an electric vehicle comes off after just 20 minutes.

As technology becomes more complex, fleet and leasing company options for servicing might become more limited. Whitehorn believes independent repairers will have “less ability” to service and repair electric vehicles and highly connected cars, meaning franchised dealers are able to capture more work.

With leasing companies sending 23% of their service, maintenance and repair (SMR) work for cars and 33% of their van aftersales to independents, according to FN50 research, this might not go down too well.

The consequences may be twofold: higher volumes of work going through fewer franchised dealers could result in longer waiting times for fleets, despite EVs spending less time on the ramp, while the higher costs often charged by dealers would be passed onto fleets through higher ‘with maintenance’ leasing fees.

Hyundai is already seeing a dramatic shift in its fuel mix across fleet and retail, with diesel dropping by 50% this year, replaced by electric and petrol.

Hyundai senior vice-president Lee Ki-Sang laid bare the company’s EV aspirations at last year’s Paris Motor Show. Today, Hyundai has 13 alternative fuel models on the global market; by 2025 it will have 38.

“We have an aggressive EV strategy,” Ki-Sang says. “We want to make affordable EVs for our customers.”

Among the battery technologies Hyundai is developing are solid-state, metal-air and lithium-sulphur. They will power cars from A-segment to E-segment.

Its solutions include hybrid, plug-in hybrid – both of which will expand to fill all car segments – pure electric for city range and long range cars, and hydrogen fuel cell (FCEV) for large cars, trucks and buses.

Hyundai is also trialling an alternative sales channel to market.

The new Kona EV is available only on Hyundai’s ‘click to buy’ initiative, not via dealers. Prospective customers – retail or fleet – can get quotes, have any part-exchange valued (underwritten by Hyundai) and pay online. The dealer gets an email with the customer’s details and will arrange to deliver the car and collect the old one.

Like Hyundai, Peugeot has ambitious plans to electrify its model line-up, but with a more nuanced approach.

Jean-Philippe Imperato, Peugeot brand director, outlined a five-year strategy of “un-boring the future”, putting the focus on “serenity, pleasure and simplicity”.

He explains: “Many customers are completely lost with emissions levels, hybrids, plug-ins. We say whoever you are, wherever you live, we will have an answer for you. You buy our Peugeot and you choose your engine – petrol, diesel, electric. The design of Peugeot is more important than the powertrain.”

Describing electrification as “not a revolution”, Imperato adds: “We have to convince fleet managers that, wherever their employees work, they can have a different powertrain for their use. But the car will be (for example) a 208.”

Peugeot revealed the E-Legend concept at the Paris show, an electric and connected car with an autonomous option. But it has no plans to push ahead until volumes justify the investment.

“We will make money from electric. Why? We don’t accept losing money. There is no trade-off between pollution and profitability. The price will be higher but the TCO (total cost of ownership) of any car has to be around the TCO of a diesel car – that’s how fleet managers will measure it.

“We see C-segment for plug-in and C and D for full electric. But it will be different in different countries and in different cities so we must be able to adapt the powertrain to the local market and the individual user.”

After electric, comes connectivity, then mobility and then fuel cell. Peugeot is working on a fuel cell but doesn’t expect the technology will be ready until 2025.

Peugeot has acquired mobility providers in certain countries and is developing short-term lease options and connected vehicles. But, while global bosses are pressing ahead with autonomy and mobility, at a local level the language is a little more measured.

Peugeot UK managing director David Peel says becoming a mobility service provider was “without doubt” a medium-term global vision, but in the UK “we are more focused on the shorter term”.

He explains: “That’s to try to find a solution where people have flexibility. They can use EVs in the week, (but) if they want something to go longer distance at the weekend, your finance/lease package allows you to have a bigger vehicle.”

Peugeot was arguably ahead of the game when it launched Mu in 2009. Mu offered this level of flexibility to switch vehicles, and included bikes and other mobility options. However, seven years later, the concept was replaced by a simpler rental scheme due to lack of uptake.

Those experiences led Peel to believe that acceptance of subs services will be gradual.

“People enjoy having (their own) car,” he says. “They know what’s in the glovebox; they use it as a home from home. They are not swapping from one to another.”

Peugeot’s PSA sister brand Citroen is also cautiously dipping a toe into the mobility sector. It is already running alternative usership schemes in France, including the Rent and Smile short-term rental service and Earn and Drive, which enables people to park for free at airports and train stations with their car hired to other users while they are away. The revenue is shared with the car driver.

“We can’t just think about the car; it’s also the way we communicate and use the car, and the capacity to switch from one car to another,” says Xavier Peugeot, senior vice-president, product and strategy, at Citroen.

“Ownership is reducing with increases in user-ship – that has to be our roadmap. By 2025 we will also implement digital services and everything we expect will come faster than we expect.”

Citroen is developing autonomous systems and autonomous cars and has a pair of C4 Picassos on full autonomous trial, plus the C5 Aircross with highway driver assist.

“The (C5) car can drive by itself, although you have to touch the steering wheel,” Peugeot says.

PSA Group has carried out real-world testing with no major problems. It has also tested customers’ reactions to autonomous cars.

“Most people get used to it very quickly,” Peugeot says. “There is an issue of trust, but the technology is ready and efficient. We just have to adapt the rules of driving and the regulations.”

Citroen is also preparing its electric launch plan, which begins with the plug-in C5 Aircross this year. By 2025, the entire range will have an electric option.

“We will have two platforms: CMP (common modular platform) is for smaller cars and will have an electrified version,” Peugeot says. “It will be petrol, diesel and 100% electric, but no plug-in. EMP2 is for larger cars and will allow petrol, diesel and plug-in hybrid but no full electric.”

French counterpart Renault is arguably making the most noise about autonomous systems, with several concept reveals at major motor shows over the past couple of years. It has set up a mobility lab in Rouen, France, to accelerate development of new technology.

The latest is EZ-Ultimo, which sets the stage for upscale ride-hailing, on-demand, from an hour to a day. Described by the company as an “individual mobile lounge”, EZ-Ultimo is a robo-vehicle concept, with Level 4 autonomy which is connected to infrastructure enabling it to adapt to urban environments, the motorway or for shuttle services on dedicated roads.

EZ-Ultimo is the third in Renault’s family of mobility concept vehicles focusing on autonomous, electric, connected and shared services.

It uses the same flexible platform as Renault’s on-demand ride-hailing robo-vehicle EZ-Go and its autonomous last-mile urban delivery solution, EZ-Pro.

Renault’s development plan looks prescient following recent proposals by the mayor of Paris to turn much of the city centre into a car-free zone, with entry restricted to autonomous and electric shuttle buses.

However, fleets and drivers should not mistake Renault’s investment in autonomous technology as a belief that people will no longer drive cars, according to Christian Ledox, Renault-Nissan alliance global director for mobility. It simply means greater choice.

He says: “We see a future where people will continue to drive, but they will also look for solutions that are enjoyable and flexible, such as paying by the kilometre for car-on-demand. Electricity, autonomy and connectivity open a wide set of possibilities – it saves parking space, facilities, congestion and emissions. The benefits are so great that we are convinced it will happen.”

Ledox predicts that by 2022, Renault will have a fleet of ride-hailing robo vehicles serving major cities in Europe. Testing is on-going in France, including on a university campus in Paris, transporting students to/from the train station.

Renault is also working with consultants Transdev on an autonomous and shared mobility project in Rouen featuring four electric self-driving Zoes. They operate on a first and last mile basis, transporting people around three routes in the city, totally six miles, with 17 stops. Users can call a vehicle in real time, from a dedicated application available on smartphone.

The project, which features the SAM (seamless autonomous mobility) technology also used by alliance partner Nissan, is expected to last until this December.

Ledox recognises a number of hurdles between now and 2022, not least regulation which is lagging behind the rapid pace of development.

“There are safety and cyber security concerns so we are hiring the best to protect our systems,” he says.

“There’s the education of users, so we are testing to show how enjoyable, safe and cost-effective this can be. We have to work with cities; it’s a complex eco system.

“Cities are coming to us, including in the UK. They understand what we are trying to do.”

By 2030, Ledox predicts 70% of vehicles in urban environments will be fully autonomous. “For the remaining 30%, there could be a modified version, but driving will continue,” he says.

“It will be progressive, almost street-by-street rather than city-by-city. For example, buses that are under-employed – a small shuttle might be a more optimised solution. Or tourists in London. There is endless room for creativity.”

Renault isn’t simply developing its own solutions; it is also investing in start-up tech companies. RCI Bank, its financial services arm, bought a 75% share in ride-hailing platform iCabbi during the summer.

Meanwhile, Jaguar Land Rover’s agreement to work with Google’s self-driving project Waymo is “a big deal”, according to Rawdon Glover, UK managing director. “It helps us to think about our business differently,” he says.

Among the models JLR is investigating are fractional ownership, such as charging by the mile, transport as a service (TaaS) and new leasing arrangements where cars can be swapped.

“We are looking at all those options – it’s mobility in its broadest sense,” says Glover. “It will all be part of our make-up. In the near term it’s electric and connectivity; then it will be autonomy and the shared agenda.”

He predicts the latter will start to enter the market within the next five years, but not before there is a shake-out of the many different models. However, it will be a further five-to-10 years before those models are commercialised.

In the immediate future, JLR is assessing the best uses for connectivity technology. SMR is an obvious area, such as informing customers when their next service is due or AdBlue needs topping up. It also connects them more closely to the dealer, enabling JLR to turn servicing from reactive to proactive, helping the network to plan ahead. This level of relationship is just months away.

Further ahead is pre-diagnostics, preventing breakdowns and software updates over the air. All are being trialled.

“Ultimately, it’s the self-healing car, where it self-diagnoses, looks at a library of software updates and updates while on the move,” Rawdon says. “That will be within the next three-to-five years, although software updates will be within the next calendar year.”

Premium manufacturers are investing in mobility services, but, like Autodrive’s Armitage, some recognise that it is difficult to forge a solo path.

Consequently, BMW and Daimler have signed a joint venture to merge their mobility operations. It will see Daimler’s Car2go and Moovel added to BMW’s DriveNow car-sharing and ReachNow on-demand mobility mix. The deal will also mean combined ride-hailing services, parking and electric vehicle charging.

Tony Douglas, head of brand, BMW Group Mobility Services, says the deal will allow the two companies to upscale their mobility ops.

“We’re not at critical mass in the market, we’re nowhere near Uber,” he says. “That’s why both parties looked at each other and said ‘we could do this together; it would make a lot more sense’.”

Early signs are that UK businesses, particularly those with offices in large urban conurbations, are considering introducing similar travel models while many others are keeping a watching brief on autonomous, shared and connected technologies. But, for now, traditional options continue to dominate most companies’ fleet strategies.

Aurrigo's PodZero clocks up 6,200 autonomous miles

Eleven autonomous pods have been scuttling around Milton Keynes train station for the past year, ferrying passengers to and from destinations

as part of the Autodrive project.

Aurrigo’s PodZero vehicles are also being trialled in Australia and Singapore, with more locations expected to come on board in the coming months.

In Milton Keynes, the electric pods are capable of carrying four people.

The project, in partnership with the city council, was intended to raise the profile of autonomous transportation with the general public, and prove their viability in real world driving conditions. So far, they have clocked up more than 10,000km (6,200 miles).

The first time it travels a new route, the pod runs under driver control so it can map the environment using Lidar. According to Aurrigo deputy manager and autonomous vehicle technician Tom Sheridan, it usually takes just one run for the pod to learn the route, after which is can be entrusted to run fully autonomously.

“Its main usage is as first and last mile transport, such as at train stations or park and rides,” Sheridan says. “It will reduce traffic in high congestion areas.”

A user summons the PodZero on their smartphone. It travels at double the average walking speed, around 6mph (although it is capable of 15mph), and has a range of 20-30 miles or four-to-five hours. It recognises how far objects are away, stopping if something comes within one metre, and can track other vehicles from five metres.

The pod utilises a battery swap system, which is completed in less than a minute. A red button failsafe has been installed for passenger safety – it stops the vehicle at any time. The pod will also stop if the GPS or Lidar doesn’t know where it is.

“We are now fusing GPS with Lidar and they are working well,” Sheridan says. “We want them to be able to run on just one rather than both so the pod can navigate anywhere out of the box.”

PodZero is an autonomous platform onto which different bodies can be fitted. In Australia, for example, the trials involve a cargo pod travelling around industrial estates, while in Singapore it is being used as a private car.

“We are now able to start working with private companies (in the UK) if they want to have one for use in restricted areas,” Sheridan adds.

“At the moment, for legislation purposes, we have to have someone in the pod. In the future, our aim is to view remotely through CCTV.”

Connecting the dots

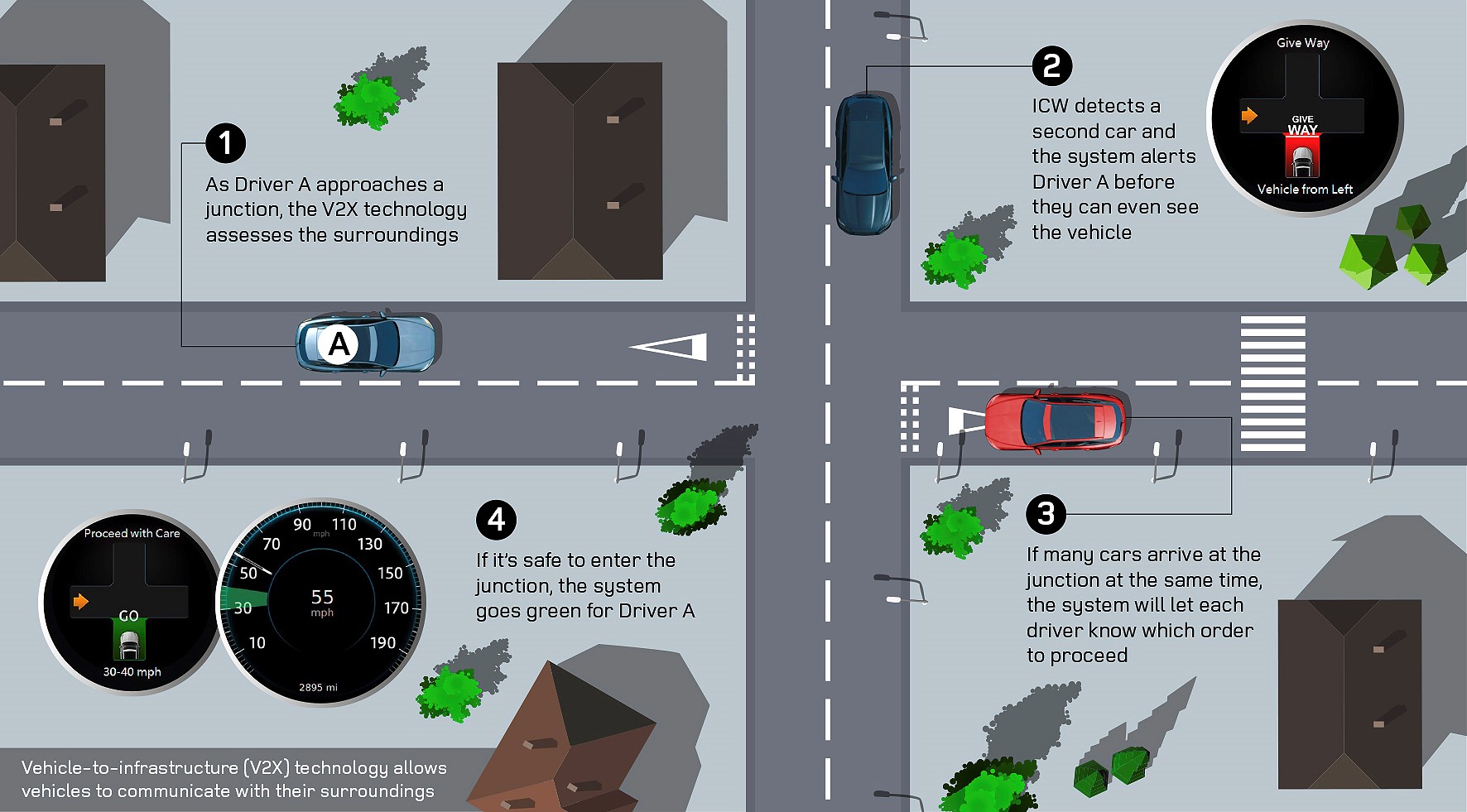

Ford and Tata led the vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2X) connectivity trials as part of the £20m Autodrive initiative.

Christian Ress, Ford supervisor automated driving Europe, says the technology would provide early advice to drivers about hazards.

Applications include emergency vehicle warning, brake light warning, intersection crash warning and traffic light speed advisory, with alerts shown on the infotainment screen.

Emergency vehicle warning connects the car to the approaching bluelight vehicle and indicates its direction and how far away it is.

“We are also trialling intersection collision warning,” says Ress. “If two cars approach a junction, there will be a warning about crossing traffic. It prioritises by recommending a speed to both cars to approach the junction so they can pass efficiently without stopping. This would be helpful for autonomous vehicles.”

While autonomous emergency braking (AEB) systems rely on radar sensing the car in front, emergency brake light warning connects the two cars via Wi-Fi. The following car analyses the distance and whether it is a critical event, and takes appropriate action.

“This will be ideal for motorway scenarios where the vehicle three or four cars behind is not aware,” says Ress. “It prepares them to stop at the same time as the front car.”

The warning works at 300-500 metres ahead, although it can be as far as 1,000 metres with clear sightlines.

The traffic light system is an example of V2X. The car connects to the lights via a roadside unit. It knows when the light will turn red and can recommend a safe speed to travel at in order to pass through without needing to accelerate excessively.

However, if the car will not make the green light, it will inform the driver so they can cruise up to the lights. It also informs the car when the light will change to green, which could be linked to the stop-start system to identify whether it is more beneficial to leave the engine idling while waiting.

“This is good for fuel economy. It reduces pollution and driver stress,” says Ress. “It will also help traffic to run more smoothly because we can feed the data to the council so it can re-phase the traffic light sequencing.”

The system also shows speed limits, including variable changes, which could be fed into the intelligent cruise control to adjust the car’s speed; hazard recognition, such as broken down vehicles; curve speed warning if the car is approaching a bend too quickly; and future lane closures due to roadworks.

Ress anticipates the technology will be on production cars within a couple of years. The software can be updated over the air rather than in the workshop.

However, while manufacturers can quickly introduce V2X, the investment required to switch on infrastructure might slow progress.

Coventry City Council invested £166,000 to connect eight traffic lights for the test project. It’s a heavy commitment; the council operates around 240 lights, suggesting a funding pot close to £5 million.

Nevertheless, Sunil Budhdeo, transport innovation manager at the council, describes the trial as “extremely successful”.

“We are now in a much better position (to understand) the emerging tech required for CAVs to operate on our network,” he says.

“This will allow us to implement these changes now in preparation for the future.”

This editorial feature appears in the January 24, 2019 issue of Fleet News and is sponsored by Goodyear

The pace of technological change in the automotive industry is accelerating dramatically, largely focused in four core technology areas – fleets, autonomy, connectivity and electric vehicles.

The pace of technological change in the automotive industry is accelerating dramatically, largely focused in four core technology areas – fleets, autonomy, connectivity and electric vehicles.

This is what we at Goodyear call the changing F.A.C.E of mobility. Recently, we launched a platform to connect like-minded people to think and engage on smart, safe and sustainable mobility, now and in the future.

The platform is called ThinkGoodMobility. We want to work with the drivers of the future, get engaged and discuss the ever-changing mobility ecosystem.

We are dedicated to exploring current and future trends, industry best practices, research insights and expert views.

ThinkGoodMobility is empowered by Goodyear innovation, meeting new mobility needs requires both a great product and extensions beyond the tyres’ walls.

It’s about delivering new and innovative designs, technologies, materials and services that anticipate the needs of consumers and fleet operators.

And, crucially, it’s about envisioning different business models around how people and modes of mobility use tyres, have those tyres serviced, maintained, bought and replaced.

At Goodyear, we want to build the future, not just observe it or read about it. To find out more about our dedication to the future of mobility go to thinkgoodmobility.com.

Look out for our next concept innovations which will appear at Geneva Motor Show at the beginning of March.

We remain focused on supporting fleet managers through this evolving mobility ecosystem and look forward to watching the Tomorrow’s Fleet feature evolve over the next 12 months.

Login to comment

Comments

No comments have been made yet.