By Rupert Pontin, director of insight at Cazana

The scale of the general election win came as a surprise to both the markets and too much of the UK population although Boris Johnson’s Brexit mandate must be seen as a clear reflection of the result of the 2015 referendum that in itself surprised the European community overall.

It is also a reflection of the nation’s belief that the Conservative party is trusted to deliver its promises through a credible leader capable of taking the country to the next stage on the global political and economic landscape.

For the UK economy as a whole the really good news is that a decision has finally been made, and irrespective individual personal beliefs, UK commerce is now very clear on what will be happening over the coming 12 months.

With the Brexit deal being voted on in Parliament, there is now little chance of it being rejected and the country can move to withdraw from the European Union on January 31.

The next phase will see the Prime Minister negotiate trade deals with an ambitious view to leaving Europe completely by December 31, 2020, a task that will be difficult to achieve in the timescale.

But this clarification of events will allow the UK economy and commerce to plan properly for the first time in years. The immediate stock and currency market responses were largely favourable and this positivity will likely continue to grow over the next twelve months.

The chart below shows the business confidence levels over the last 3 years:-

Business Confidence as at December 2019

Data courtesy of Trading Economics and the CBI

Data courtesy of Trading Economics and the CBI

It is interesting to note that whilst this chart reflects the state of confidence and expectations running up to the general election, the expectation is for a marked upturn in confidence in the near future.

By the end of the next quarter confidence is expected to have improved to -20 points with an expectation of reaching -8 points by December 2020.

It will be interesting to see the impact of this change on the new and used car markets. With 2019 year to date new car registration volumes resting at a Cazana predicted 2.7 percentage points lower than last year, and used car sales volumes still on target to reach at least 8 million when all sources are considered, it looks as though 2020 could be a positive year for the industry.

However, it is also worth noting that whilst business and consumer confidence as a whole have been poor during 2019, it is also widely acknowledged that the automotive industry outperformed other industry sectors and therefore a year of parity would be acceptable.

The fleet sector has had a more complex year overall with big industry question marks only resolved in recent months drawing a line under the prickly issues of personal taxation and model availability from the OEM’s.

Therefore, it was not surprising to see a boost of 2.8% in the November fleet registration figures that reflected the pent-up demand held back from the market in the last few months. This has resulted in an increase in the volume of cars in the wholesale trade, and that would generally be seen as a good thing especially where used car demand has been exceeding supply in the last eight to 10 weeks.

There is little sign of a decline in retail consumer demand either and this is also good news particularly for those that may have been dreading an increase in wholesale stock to remarket at the tail end of the year.

Therefore, in general, remarketing activity has been good and whilst retail pricing has dipped by a few percentage points in comparison the same period last year, there has generally not been any need to distress the market.

However, there is a problem amid the good news. In the retail market petrol pricing suffered a dip in September and October for sub 12-month-old sub 12k cars which had an onward impact on the 24 month old market and it would seem that the fleet market has also been affected.

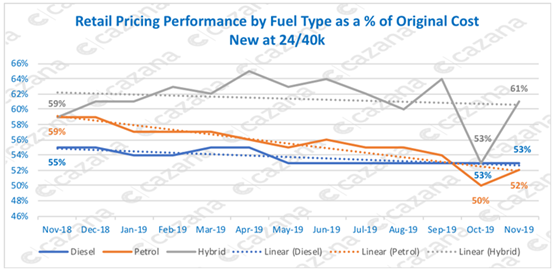

The chart below highlights retail price performance as a % of original cost new for 24 month old 40k cars over the course of the last 12 months:

Data powered by cazana.com

Data powered by cazana.com

The data in this chart is of great interest from several perspectives. There has been a marked dip in retail pricing for both petrol and hybrid cars in the last 2 months with a very significant drop in pricing for hybrid-powered cars of 11 percentage points over the course of just a month.

In the same period, petrol-powered cars dipped by 4 percentage points.

The suggestion here is that perhaps supply just outstripped demand although it is also worth considering that changes in the type of vehicle returning to the market could also have played a significant part.

It is also interesting to see that the bounce-back in November suggesting this was just a short-term blip although the retail opportunities lost could have been highlighted by the type of realtime data provided by Cazana. This pricing anomaly was also evident in retail profile cars.

The year on year performance is also worth noting and that shows an uplift in pricing of 2 percentage points for hybrid, cars which is generally in line with overall market performance and the expectation given the increased consumer interest in more ecologically friendly fuel types.

Petrol pricing has declined by 7 percentage points over the year at this age and mileage profile which is likely to be a direct reflection of increased volume in not only the late and low mileage sub 12-month category but also the retail profile 2-year-old cars that have come back from PCP. Of note is the fact that diesel pricing has remained very stable and dropped by just 2 percentage points.

In summary, the market is generally showing to be in good health with positive retail demand and therefore robust wholesale figures have been experienced overall. Only the retail demand for 2-year-old ex-fleet profile product has been of concern for the fleet market.

All signs are that this position will need to be watched as new car sales two years ago were PCP driven and as such there will be more cars coming back to crowd the used market.

Detail and speed of data coming to the market will help businesses to be able to truly understand the position of individual vehicles and using realtime unedited data science-based insight and pricing will continue to allow companies to maximise their ROI and give a much greater chance of commercial success.

Login to comment

Comments

No comments have been made yet.