Cox Automotive is forecasting a steady outlook for the UK’s used car market, with both volume of transactions and trade values stabilising.

Its latest used car market forecasts predicts 7.64 million transactions this year which, although it is a flat year-on-year performance, is 3.6% above the long-term average from 2001 to 2019.

Philip Nothard, insight director at Cox Automotive, said: “The used market continues to provide a vital anchor for the automotive sector.

“As trade values stabilise and consumer appetite for affordable vehicles remains strong, retailers have a clear opportunity to set robust retail prices, where market conditions support them, and maximise their margins.

“Strategic stock selection and strong retail pricing will be crucial to sustaining profitability in a supply-constrained environment.”

He said despite ongoing supply challenges, particularly for vehicles aged three to five years, the market is showing signs of resilience.

Supply constraints, largely a legacy of pandemic-era production slowdowns, are expected to ease in the second half of the year, offering retailers renewed opportunities to meet consistent consumer demand.

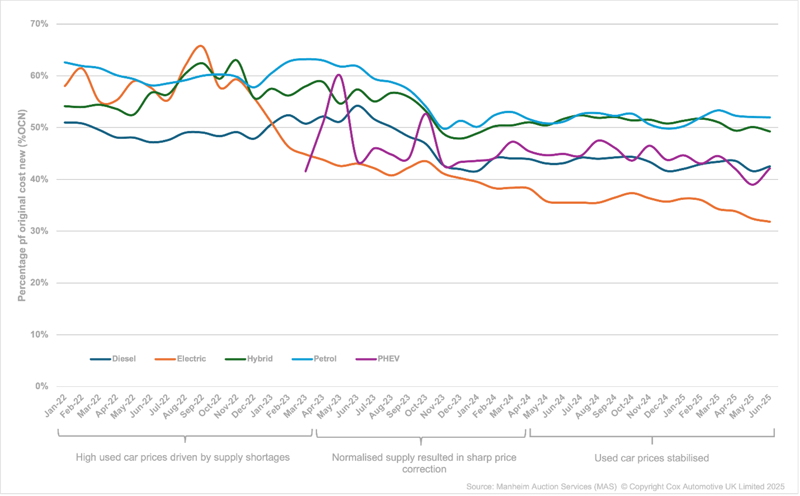

Nothard said trade values have continued to stabilise. Cox Automotive is now seeing values returning to more typical seasonal patterns, particularly for petrol and diesel models.

Looking at vehicles aged between 24 and 72 months old, values have remained consistent over the previous 18 months.

Petrol values stayed flat at 60% of original cost new in April – the same percentage as it October 2023. This is a marked difference from the 6% fall that petrol vehicles saw between October 2022 and October 2023.

Hybrid values declined by only 4% in the same period and diesel by 7%. The value of electric vehicles has also continued to fall.

Nothard said the commercial vehicle sector remains robust. Diesel continues to dominate, but electric vans are gaining ground, with a 62.6% increase in arrivals at Manheim sites in Q1 2025.

However, infrastructure concerns and cost sensitivity continue to limit buyer confidence, with only four in 10 electric vans selling first time.

Login to comment

Comments

No comments have been made yet.