Electric vehicles accounted for 22% of new car registrations across Europe in August, according to analysis of sales figures by Jato Dynamics.

Overall registrations were up 20% when compared to August last year, as demand for new cars remains strong across the continent.

Petrol powered cars accounted for more than half (53%) of the registrations.

Felipe Munoz, global analyst at JATO Dynamics, said: “Although the current industry debates often point towards a slowdown in growth for BEVs, our data shows that growth in demand remains strong, due to their increasingly competitive pricing, and continuous support from governments across Europe.”

EV demand is being fuelled by a growth in the number of Chinese brands bringing cheaper cars to market, alongside strong supply of Tesla models.

Between January and August, Tesla’s registrations have rocketed from 45,600 units in 2020, to a record 236,400 units this year. Similarly, last month, it gained 2.43 points of market share in the overall market, achieving a new record of 3.76%, while its share in the BEV market jumped from 10.2% in August 2022, to 17.3%.

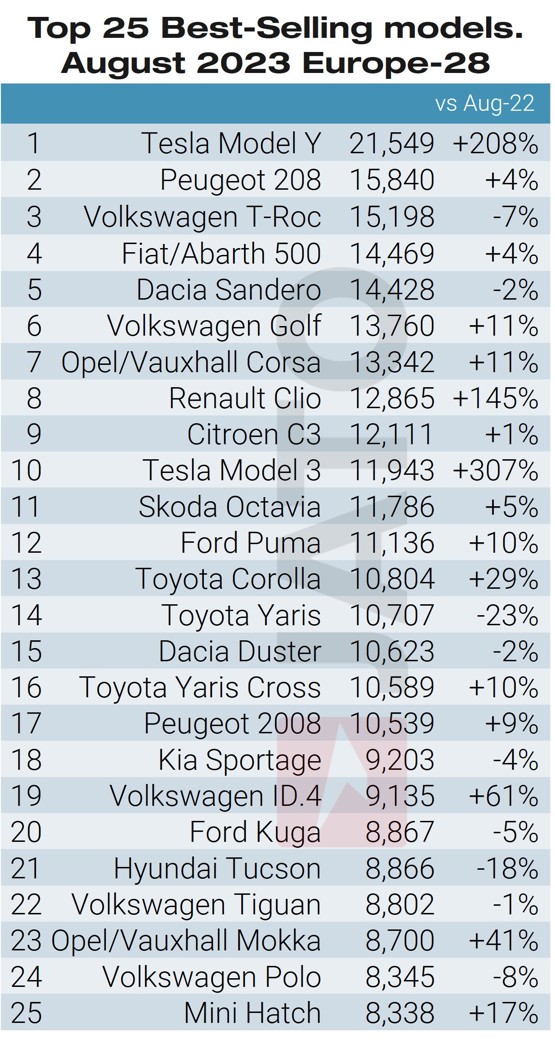

The Tesla Model Y remained the best-selling car in Europe, in August.

MG also steadily climbed the ranking in August – gaining the second-most market share between August 2022 and the same month this year, in both the BEV and overall markets. Last month, MG hit the European top 20 brands, outselling the likes of Jeep, Mazda, Mini and Suzuki. In the BEV market, MG registered more cars than Audi, Opel/Vauxhall, Peugeot, Renault or Skoda.

Ford, Hyundai-Kia, Stellantis, and the Volkswagen brand are among those impacted by the rise of Tesla and MG. For Stellantis, its brands Citroen and Peugeot will require more electric models as their diesel range continues to experience a fall in demand. While Hyundai-Kia and Volkswagen are posting increases with their electric models, growth is not keeping up with the market average, being overshadowed by the likes of Tesla and MG.

Login to comment

Comments

No comments have been made yet.