The UK new car market for fleet and business registrations fell by 11% in July, with 94,2952 units registered compared to 105,855 in July 2016, according to figures published today by the Society of Motor Manufacturers and Traders (SMMT).

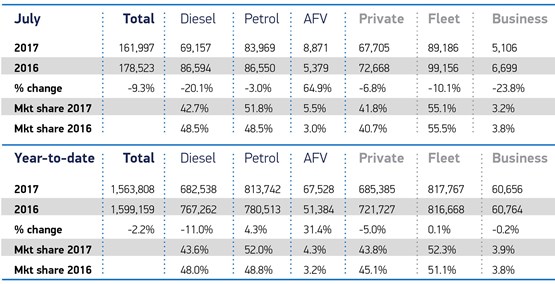

Overall the new car market fell by 9.3%, the fourth consecutive monthly fall, with 161,997 new cars were registered in the month.

Meanwhile, registrations for new petrol and diesel cars declined by 3% and 20.1% respectively. The SMMT says months of speculation about government policies on diesels has inevitably led to a softening of demand and slowed the market shift to the latest cleaner Euro 6 diesels which are valued by consumers for their fuel efficiency and lower CO2 emissions.

However, the demand for alternative fuel vehicles (AFVs) soared by 64.9% as consumers continue to invest in the latest low-emission fuel technology. AFVs took a new record 5.5% market share in July, as 8,871 new units were driven off forecourts. Nearly 70,000 new AFVs have joined UK roads this year.

So far, the year-to-date overall performance remains at a high level thanks to a strong first quarter – with more than 1.5 million new cars registered on UK roads since January.

And, despite a decline in fleet and business registrations in July compared to July 2016, year-to-date figures for the sector showed that registrations were on a par with 2016, with 878,423 units registered compared to 877,432 for the same period in 2016.

Mike Hawes, SMMT chief executive, said, “The fall in consumer and business confidence is having a knock on effect on demand in the new car market and government must act quickly to provide concrete plans regarding Brexit.

“While it's encouraging to see record achievements for alternatively fuelled vehicles, consumers considering other fuel types will have undoubtedly been affected by the uncertainty surrounding the Government's clean air plans.

“It is important to remember that there are no plans to charge drivers using the latest Euro 6 models and no proposed bans for conventional petrol and diesel vehicles for some 23 years.

“The lower demand in recent months will inevitably mean competition from manufacturers will intensify and it will be a good opportunity for consumers to get a great deal on their next car, with many exciting new models launched in the coming months.”

Lauren Pamma, head of consultancy at Lex Autolease, said: “It’s normal for there to be a ‘summer dip’ in registrations ahead of the new plates in September and general business uncertainty has added to the fall. However, it’s encouraging to see that fleets still account for more than half of total registrations.

“An increase in alternative fuelled vehicle registrations is no surprise and it’ll be fascinating to see what the impact of the Government Air Quality Plan, announced last week, will have on take up of electric and hybrid vehicles in coming months. However, as far as businesses are concerned, 2040 is four to six fleet cycles away, which allows plenty of time for fleets to adopt electric vehicles.

“Appetite from fleets for electric vehicles will continue to grow, but we’re unlikely to see a short-term mass move to pure electric given the limited vehicle types currently available which are fit for many fleets’ purposes.”

Login to comment

Comments

No comments have been made yet.