Leasing companies’ success in winning business in the retail sector, such as company staff who have opted to take cash and buy outside the car scheme, has resulted in a dilution of their contract hire business and the rise of ‘other’ funding methods, primarily personal contract hire (PCH).

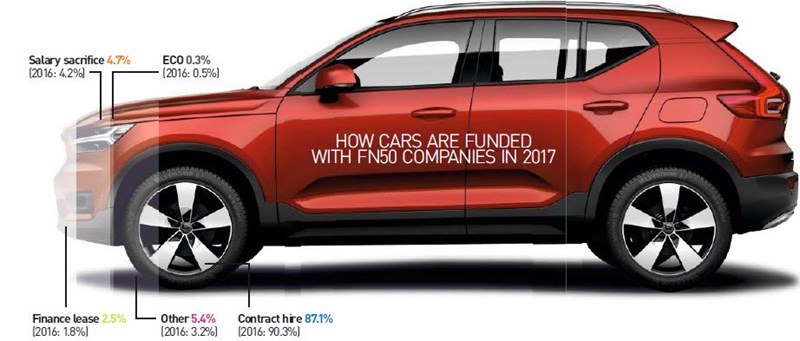

Business contract hire continues to dominate FN50 funding, accounting for 87.1% of the risk fleet, but that leading position has been gradually eroded as the market diversifies. Last year, business contract hire accounted for 90.3% of cars; the year before 91%.

Typical of the move towards diversification is the UK market leader, Lex Autolease. Contract hire share of its funding has fallen three percentage points year-on-year, from 93% to 90%. While just 2% goes through other funding types, the company intends to increase its business through personal lines over the next few years.

Tim Porter, Lex Autolease managing director, said: “The personal market is a strong area of growth and we have been well placed to take advantage.”

There is a blurring of the lines between small-to-medium enterprise (SME) and personal business, with many small business owners preferring to fund through PCH.

“Driving this business is RV-based funding methods which means the monthly price is very attractive especially with the discounts offered upfront by the manufacturers,” Porter said. “Hiring a car and giving it back is attractive to the way the consumer thinks.”

Lex has invested heavily in its website interface to make it as relevant to the personal market as it is to business users, particularly on the selection tools.

“We have to make it simpler and pain-free for them,” Porter added.

PCH is particularly appealing to former company car drivers who have become used to having maintenance included on contract hire as they can do the same with fully maintained contracts on PCH.

FN50 newcomer Affinity Leasing (No 30) has a high level of alternative funding across its fleet, with 82% of its business going through ‘other’ – the most of any leasing company.

The company specialises in deals with unions, associations and other ‘affinity’ groups, offering their employees special discounts on cars funded through PCH and personal contract purchase (PCP). The remainder of its cars are funded through contract hire at 18%.

Lex Autolease points to a trend for corporates to offer affinity terms to their employees, particularly when they have taken a cash option.

“More people are taking cash because they are motivated by the range of vehicles they can get on the open market,” said Porter. “But instead of them going to the open market, we are having conversations with the corporate to offer affinity terms for leasing.”

Salary sacrifice on the rise

SG Fleet UK has a diversified funding portfolio, with 69% of its cars on contract hire and 21% on salary sacrifice.

David Fernandes, SG Fleet UK country head, said: “It’s about customer choice – specific solutions for the customer’s need rather than one size fits all.”

While salary sacrifice may have lost its place as the second most popular funding option to other types, it has recovered after a dip last year, likely caused by the uncertainty around changes to taxation rules.

Across the FN50, 4.7% of cars were funded through salary sacrifice compared to 4.2% last year.

While in the two years previous (2014 and 2015), salary sacrifice accounted for 5% of funded cars, in volume terms it has grown considerably over that time as the number of cars in the FN50 increased.

In 2014, the 50 biggest leasing companies funded just over 51,000 cars via salary sacrifice, a similar number to 2016; this year that number has risen to 60,200.

It suggests salary sacrifice is alive and kicking. Government changes on the product introduced on April 6 this year have not dissuaded customers from taking up schemes.

Watford-based Tusker retains its presence as the market leader in salary sacrifice with 91% of its 20,278 cars funded through the product. This has increased from 89% last year and 82% the year before. The rest of its cars are funded through contract hire.

Tusker has retained a consistent line during the consultation on the tax treatment of salary sacrifice, saying that the impact from the changes would be much less drastic than others had been forecasting.

David Hosking, Tusker chief executive, said: “We decided that uncertainty had been in the market for too long.

“Our customers and the benefits industry overall needed clarity around salary sacrifice cars.”

Tusker held meetings directly with the Treasury, HMRC and its policy advisors EY (Ernst & Young) to gain clarification on its understanding of the rules.

The fact clarification was needed highlights how complex the changes have been.

Only in the recent Finance Bill was it made clear that the finance rental for cars above 75g/km should be separated from other costs, such as maintenance and insurance, when comparing to the normal car benefit charge to determine which of the two is the highest value.

The higher value becomes the taxable benefit and is also the amount on which the employer pays Class 1A NIC (national insurance contributions).

Any salary sacrificed for other elements of the car – maintenance, insurance, breakdown cover, tyres, etc. – will not be taxed, ensuring they are treated the same way as company cars regardless of how they are provided.

Salary sacrifice is likely to continue growing its share of FN50 funding, judging by the views of the main providers.

Zenith, one of the few top 10 leasing companies to have a significant presence in the market, experienced a “big increase in March”, according to chief executive officer Tim Buchan, prior to the introduction of the new rules on tax.

However, he added: “There was a lot of misunderstanding and there are still prospects who think it’s all over. But we are seeing a strong pipeline of companies without a scheme who are seeing it as an added benefit for their staff rather than a way to save tax.”

More than a third (36.5%) of leasing contracts are on sole-supply arrangements. This compares with 34% last year.

While multi-supply deals put the pressure on leasing companies to remain competitive on pricing, the rising popularity of sole-supply suggests fleets are choosing to simplify their supply and invoice processes.

Of the 32 companies that responded to the sole-supply question, 13 have a higher level of solus deals with customers in place compared with the industry average.

More fleets include maintenance

The trend for fleets to lease vehicles with maintenance included continues, with growth of two percentage points over the past 12 months to 68%. It shows companies are increasingly looking for all of the costs associated with motoring to be settled by one package.

Of the 44 companies that answered the question concerning maintenance, 27 have above average levels of car customers that have included maintenance with their contracts. The lowest percentage recorded was at 8%, with customers of that company choosing alternative ways of getting their cars serviced like a pay-as-you-go solution or going direct to a dealership or independent workshop.

Lex sits at the market average of 68% for cars taken with maintenance while there are only two companies in the FN50 that show 100% of car customers on with maintenance contracts.

Login to comment

Comments

No comments have been made yet.