Just one quarter of FN50 customers are on sole supply contracts with their leasing provider, lagging well behind cars, where 37% are happy to sign up to solus contracts.

With vans a tool of the trade, reliability and relationships are crucial factors in ensuring they stay on the road, yet fleets appear to want multiple relationships with suppliers to ensure they are getting maximum value for money.

Most van fleets have fleet managers running the operation, unlike many car fleets which can be more readily outsourced or managed within an HR or finance department, which means they are more able to manage relationships with multiple providers.

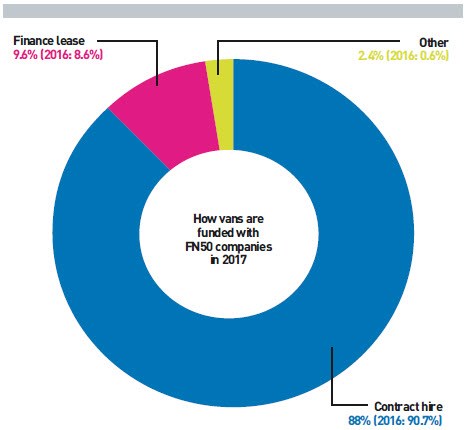

It suggests a general lack of trust between fleets and their leasing providers, perhaps reinforced by the fact that a rising proportion have decided to opt out of full contract hire in favour of finance lease.

Here, the fleet makes payments that cover the cost of the vehicle, possibly including a final balloon payment, and gets a rebate of the rental when the vehicle is sold, (either by them or the leasing company), dependent on the terms of the lease.

The better the resale price, the higher the rebate.

LeasePlan bucks this trend.

Almost half (47%) of its van customers have taken a sole-supply deal which represents the highest level seen in the top half of the FN50 table.

The highest ratio overall is held by Windsor Vehicle Leasing (WVL) at 84%. It is a smaller business specialising in fleets between one to 25 vehicles and WVL puts its focus on service to help differentiate itself from larger corporate rivals.

Philip Newton, chairman and owner of WVL, said: “You could have all the fancy ideas in the world, but if you’re not making an offer that has a point of difference – and that appeals to the customer – then you’re dead in the water.

“It’s essential for a business of our type and our size because we’re a smaller operator. There is room in the market for us but we have to get our offer right. And it has to be sufficiently different from what the big boys offer.”

Contract hire funding has lost some lustre over the past 12 months, although it could be a short-term blip. Last year, almost 91% of FN50 vans were financed this way; this year is has slipped to 88%.

‘Other’ is the big winner, rising from 0.6% to 2.4%, due to the increase in flexi-lease/rental popularity as fleets seek greater flexibility during uncertain economic times.

Other methods also include contract purchase and a new long-term hybrid lease product.

Based upon a standard lease agreement, hybrid leasing operates nearly identically to contract hire. However, there is a different set-up when it comes to the disposal of vehicles with the customer keeping 90% of any profit and the final 10% going to the leasing company. There is also the option for businesses to buy the vehicle at the end of the term.

Vans and trucks funded with maintenance

Van fleet operators are increasingly willing to bundle maintenance with leasing contracts when they opt for finance.

The proportion opting for ‘with maintenance’ has risen from 60% last year to 64%.

It remains below cars (68%), but it suggests that fleets choosing contract hire funding are keen to hand the responsibility of minimising vehicle downtime to their leasing provider.

Vehicle downtime in the van market is one of the most important factors in managing a commercial fleet as a stationary vehicle can represent hundreds, if not thousands, of pounds in lost business per day per vehicle.

Lookers Leasing and Fleet and Distribution Management are the only two companies to provide data that shows 100% of commercial vehicles funded with maintenance.

The truck market shows the highest level of maintenance included with contracts at 72%. A number of companies, including Traction Finance, fund 100% of their trucks with maintenance contracts.

Fraikin has 94.4% of vans with maintenance and 75.8% of HGVs.

Login to comment

Comments

No comments have been made yet.