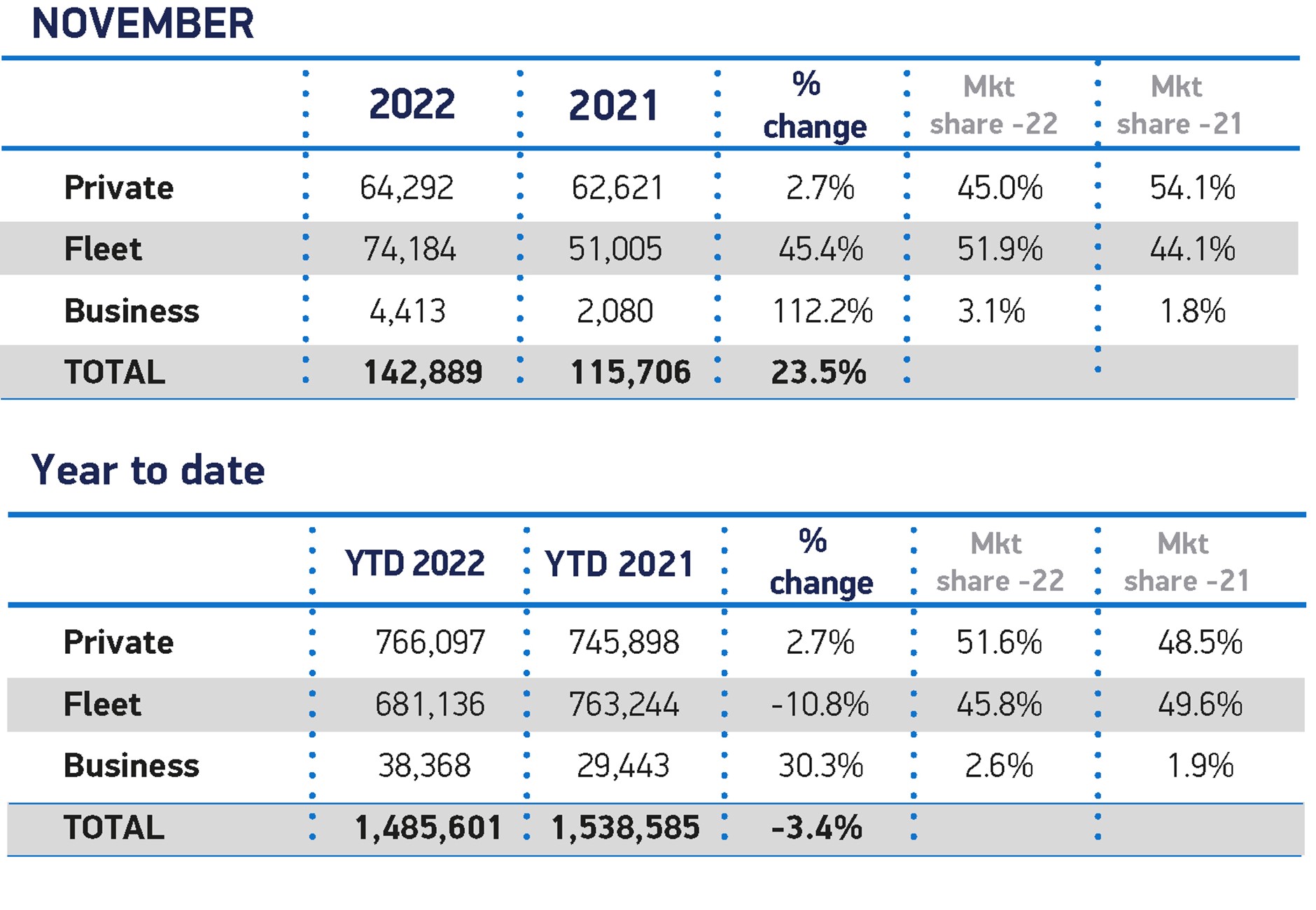

Fleet and business new car registrations increased by a massive 57% in November, compared to the same month, last year.

New figures from the Society of Motor Manufacturers and Traders (SMMT) show that 78,897 new company cars were registered in the month, a substantial increase on the 53,085 registered in November 2021.

Year-to-date, however, fleet and business registrations are down more than 9%, with SMMT figures showing that 719,504 new cars have been registered so far this year, compared to 792,687 units, last year.

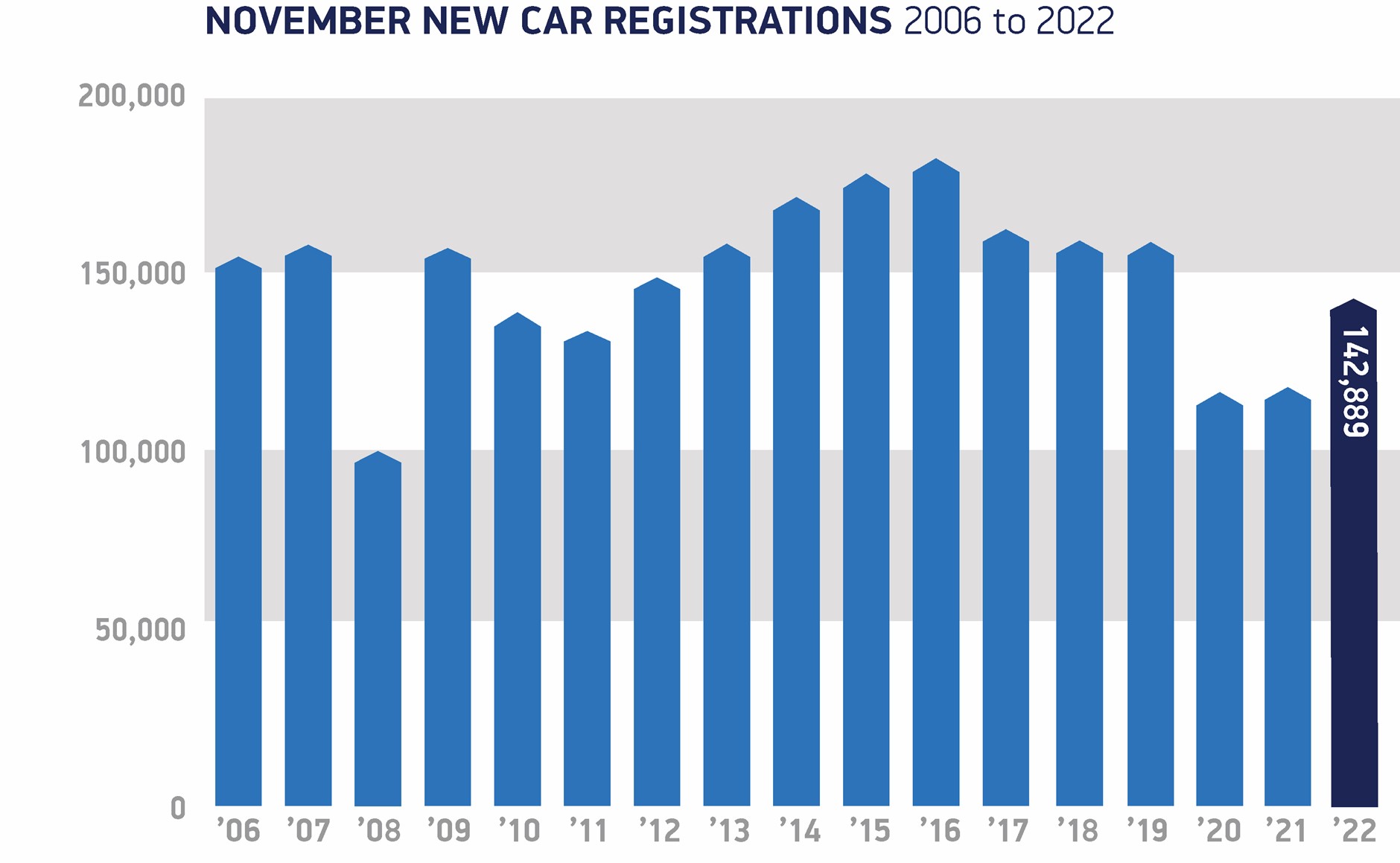

Including private sales, the UK new car market grew 23.5% in November to 142,889 registered units in the fourth consecutive month of year-on-year growth.

The growth delivered the best total for November since 2019, with manufacturers continuing efforts to fulfil orders amid erratic global components supply.

However, overall registrations in the month were still 8.8% below 2019 levels and, while further recovery is anticipated in 2023, global and domestic economic challenges mean that the market will remain below pre-pandemic levels, says the SMMT.

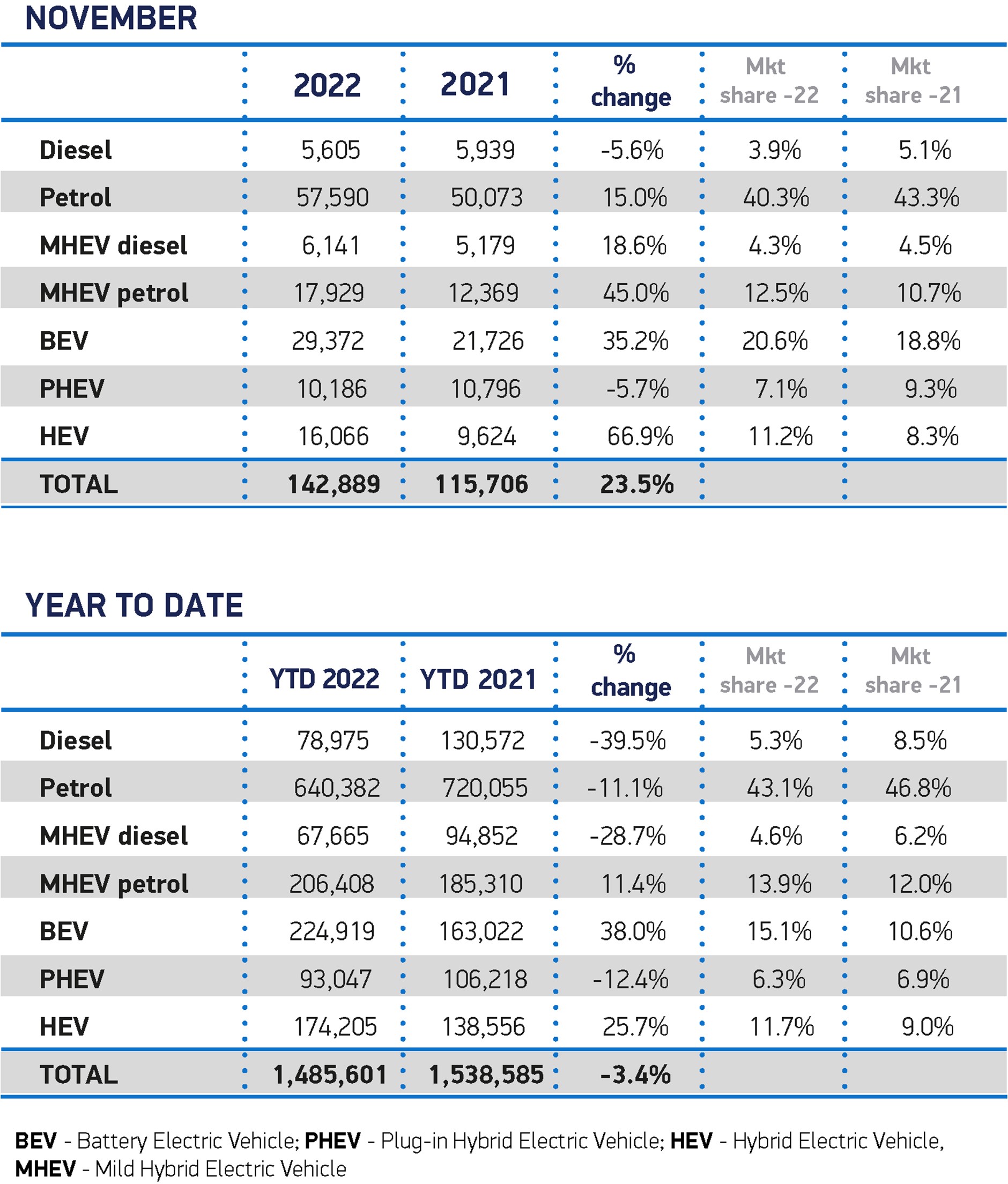

Zero emission vehicle uptake continues to grow, with newly registered battery electric vehicles (BEVs) up 35.2% to represent more than one in five new cars (20.6%) – the largest monthly share of BEVs this year.

Conversely, plug-in hybrid (PHEVs) registrations fell by -5.7%, making up 7.1% of the market.

As a result, some 39,558 new plug-ins were registered, representing more than one in four (27.7%) new cars joining UK roads in November.

Hybrid electric vehicles (HEVs), meanwhile, rose by 66.9% to 11.2% of the market, driven particularly by fleet operators looking for flexibility and emissions reductions., suggests SMMT.

Meryem Brassington, electrification propositions lead at Lex Autolease, said: “It has been a stellar year for the electric vehicle market, setting a new record for the pace at which people are making the transition to electric.

“The 29,372 EVs registered in November represent a 20.6% share of the new car market – another feather in the electrification cap as we continue along the road to zero.

“November also brought clarity from Government on company car tax rates beyond 2025, https://www.fleetnews.co.uk/news/latest-fleet-news/electric-fleet-news/2022/11/17/autumn-statement-company-car-tax-for-evs-to-increase-by-1 giving fleets the long-awaited certainty they need to commit to an electric future.

“However, with the introduction of VED for EVs, it’s important that the tax system continues to operate in a fair, emissions-based way if we are going to continue to clean up the older and more polluting vehicles on the UK’s roads.”

Jon Lawes, managing director at Novuna Vehicle Solutions, also says it is encouraging to see that the new car market is still expanding, with BEVs capturing their largest monthly share of the new car market in 2022 last month.

However, he added: “Supply chain issues are now one of the most significant barriers to EV adoption.

“We're seeing fewer than half the number of cars rolling off production lines than we did five years ago, owing primarily to ongoing issues obtaining computer chips for vehicles, which could severely dampen EV adoption in the coming months.

"While companies such as ours have taken steps to meet demand, such as purchasing vehicles up to 15 months in advance to ensure customers can get into new vehicles as soon as possible and extending lease agreements for those willing to wait, it's clear that this isn't the solution.

“To reduce these vulnerabilities and provide confidence to the sector, the Government should consider developing a robust semiconductor industry in the UK."

The most in-demand supermini and lower medium vehicle segments both grew by 21.5% and 20.5% respectively in November, while dual purpose vehicles increased by 21.8%.

There was significant growth in luxury saloon and multi-purpose vehicles, up 87.3% and 288.6%, but these segments still remain a small section of the market.

As growth returns to the new car market, the car sector is poised to deliver an additional £8 billion for the UK economy in 2023, with an anticipated 15.4% market growth.

UK Automotive is making rapid strides to deliver on its net zero targets, says SMMT, and further acceleration requires forward-thinking planning and collaboration from all stakeholders.

Measures that boost motorists’ confidence in EVs, including a fiscal framework that encourages EV adoption and targets to speed up the provision of charging infrastructure, will help to ensure uptake is in line with the UK’s green goals, particularly as the ambitious Zero Emission Vehicle Mandate comes into effect, according to the SMMT.

Mike Hawes, SMMT chief executive, said: “Recovery for Britain’s new car market is back within our grasp, energised by electrified vehicles and the sector’s resilience in the face of supply and economic challenges.

“As the sector looks to ensure that growth is sustainable for the long term, urgent measures are required – not least a fair approach to driving EV adoption that recognises these vehicles remain more expensive, and measures to compel investment in a charging network that is built ahead of need.

“By doing so we can encourage consumer appetite across the country and accelerate the UK’s journey to net zero.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, believes that the short-term prospects for the automotive sector rely heavily on the performance of fleet sales.

“With many fleet managers currently under pressure to manage a wholesale transition to electric, there will have been relief that the Autumn Statement signalled a continued commitment to encouraging EV adoption through company car schemes,” he said.

“Benefit-in-kind (BIK) rates for EVs will rise from the current rate of 2%, going up 1% per year from April 2025 to 5% by the 2027/28 tax year.

“Signposting the road ahead for BIK rates should give fleet managers renewed confidence to forge ahead with the transition to electric.

“However, with supply still struggling to keep up with demand, it might be a while before we see this translate into a significant increase in sales.”

Kim Royds, EV director at British Gas, says that, despite ongoing supply chain challenges, the accelerated growth of EVs reaffirms the appetite among drivers to transition away from traditional petrol or diesel vehicles.

However, she added: “There is still a great deal of work to be done to futureproof the UK’s charging network to meet the increased demand and ensure all motorists have access to reliable and convenient charge points.

“Providing compelling and easy options for home charging is a vital part of this and will help to stimulate further growth across the EV market.”

Login to comment

Comments

No comments have been made yet.