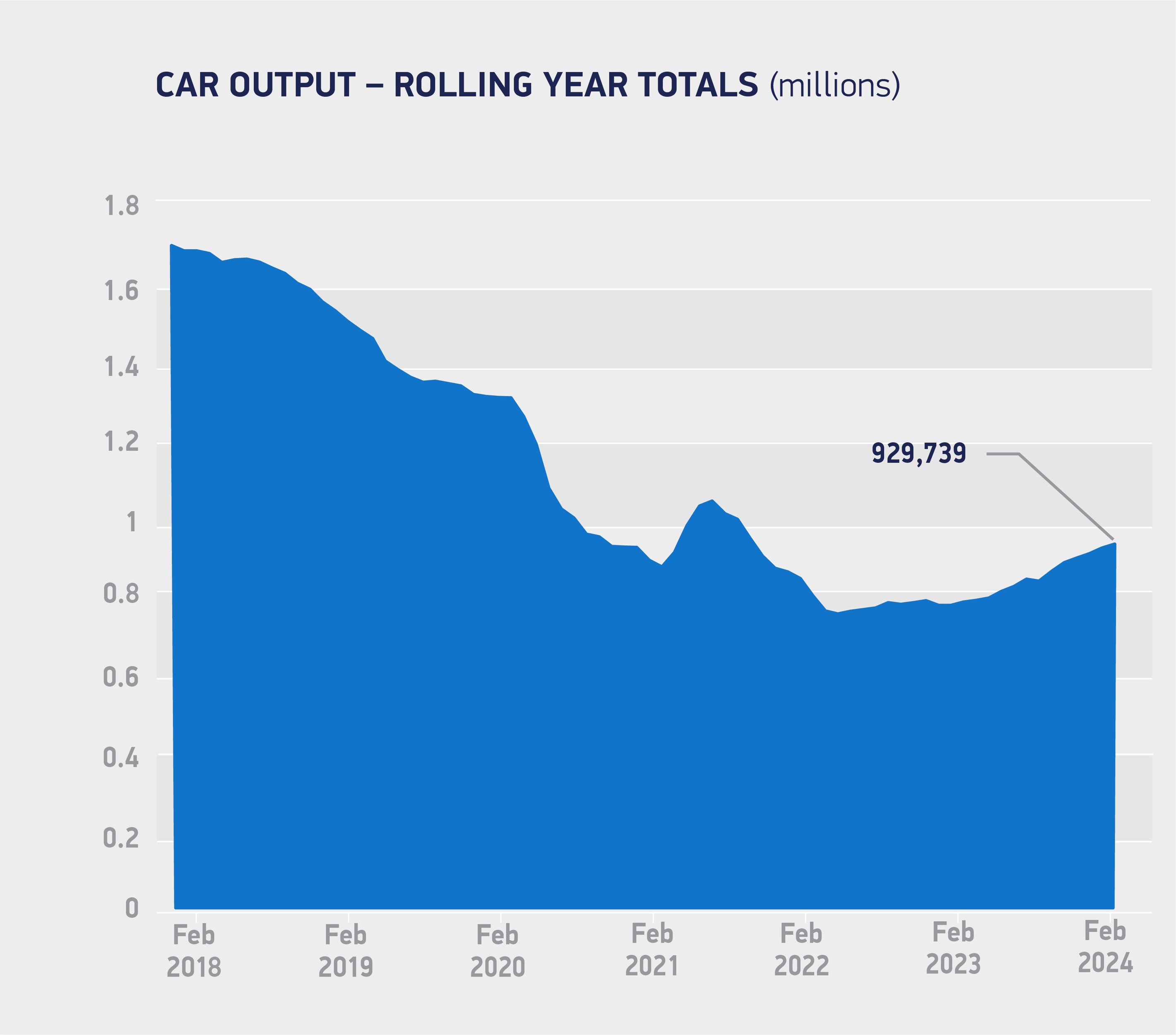

UK car production recorded its sixth consecutive month of growth in February, according to new figures from the Society of Motor Manufacturers and Traders (SMMT).

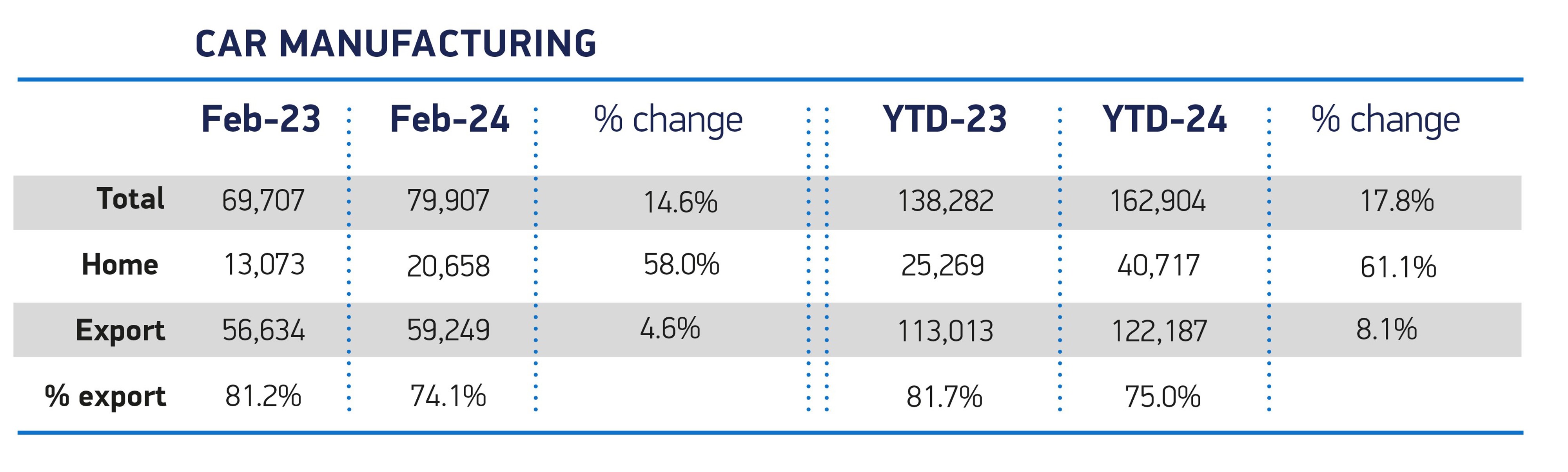

It rose by 14.6% to 79,907 units, making it the best February performance since 2021, driven by output for the domestic market which grew 58% to 20,658 units, an increase of 7,585.

Volumes for export, meanwhile, rose 4.6% to 59,249, representing a rise of 2,615 units, with three quarters (74.1%) of all cars made in the month shipped overseas.

The EU received by far the largest proportion of exports (59.9%) followed by the US (14.8%), China (7.1%), Australia (3.3%) and Turkey (2.3%).

Volumes to all these markets apart from Turkey, which fell by 20.3%, increased, led by the US, which was up by 95.6%.

Mike Hawes, SMMT chief executive, said, “Another month of growth for UK car production is welcome news, reflecting strong demand at home and around the world for the latest British-built cars.

“The industry is transitioning from internal combustion engine cars to electrified vehicles, building on the massive investment commitments made last year.

“The UK industry faces stiff competition, however, as global competitors seek to secure new models and technologies so a commitment to our industrial competitiveness, from all political parties in this likely election year, must be maintained.”

Production of electrified vehicles (battery electric, plug-in hybrid and hybrid) maintained its recent level, representing more than a third (36.3%) of all output in the month.

Factories turned out a combined 29,038 units, up 6% on the year before, and with two thirds (67.3%) of these models built for export evidence of the need to ramp up UK battery production and electric vehicle supply chain capabilities.

To date, UK car production is up 17.8% at 162,904 units, the best start to the year since 2021. However, with major manufacturers recently announcing the end of production of some long-running models as they gear up to make new electric variants, production volumes may be more variable in the months ahead, warned the SMMT.

Richard Peberdy, UK head of automotive for KPMG, said: “Fleet buying continues to drive the bulk of the domestic market growth – which includes EVs being purchased for salary sacrifice leasing.

“Private sales levels have held up relatively well to the ongoing squeeze on household budgets and a higher cost of borrowing, but growing the levels of consumer demand is challenging. Car makers are trying to stimulate extra demand by discounting and incentivising.”

Login to comment

Comments

No comments have been made yet.