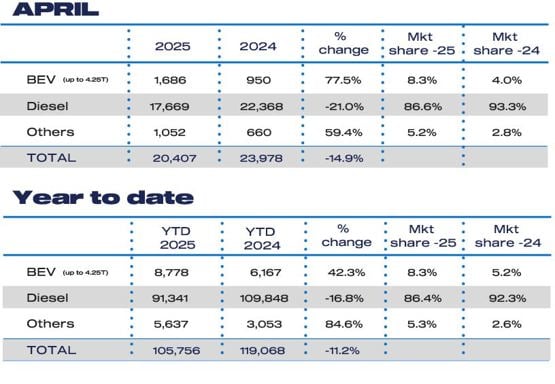

UK new light commercial vehicle (LCV) registrations fell sharply by 14.9% in April, marking the market’s weakest April since 2020, according to the latest data from the Society of Motor Manufacturers and Traders (SMMT).

The decline marks the fifth consecutive month of falling demand, with the SMMT citing weak business confidence as one of the factors holding back investment in the latest models.

Just 20,332 vans, 4x4s and pick-ups were registered last month as economic uncertainty, tax changes and seasonal factors combined to hold back fleet investment.

While April is traditionally a lower volume month and was impacted this year by the timing of a late Easter, the figures also reflect deeper concerns around ongoing business confidence, suggests the SMMT.

Large van demand hit hardest

The steepest decline was recorded among the largest LCVs (over 2.5 to 3.5 tonnes), with registrations down 22.9% to 12,113 units – though this segment still accounted for nearly 60% of all new LCVs.

Medium and small van registrations also dropped, by 5.8% and 5.5% respectively.

By contrast, 4x4 registrations rose by 19.2%, and pick-ups – buoyed by pre-tax-change ordering activity – climbed 10.2% to 2,740 units.

However, concerns are mounting that the recent reclassification of double-cab pickups as cars for benefit-in-kind and capital allowances will add significant costs for sectors like farming, construction and utilities, potentially delaying future fleet replacements.

The SMMT has called on the Government to postpone the tax change by at least a year to allow businesses and suppliers time to adapt and avoid unintended environmental and fiscal consequences.

Electric van growth continues – but still off the pace

Despite the overall market slowdown, battery electric vans (BEVs) continue to see momentum.

Registrations of electric LCVs up to 4.25 tonnes grew by 77.5% in April to 1,686 units, now representing 8.3% of the market – up from 4.0% a year ago.

The expansion comes as manufacturers invest heavily in zero-emission product lines, with nearly 40 models now available and more being introduced – including launches at last month’s Commercial Vehicle Show.

Yet even with this growth, BEV uptake remains well below the 16% share for the Zero Emission Vehicle mandate (ZEV) mandate targets in 2025.

The SMMT warned that infrastructure and policy gaps continue to hinder faster transition. Fleet operators face grid connection delays of up to 15 years in some cases, making depot electrification an unrealistic short-term goal for many.

Calls for infrastructure reform

The industry is calling for targeted Government intervention to accelerate the rollout of commercial vehicle-friendly public charging infrastructure across the strategic road network.

The SMMT also wants grid connection processes overhauled and prioritised for transport depots – in line with recent Government commitments to expedite connections for sectors such as data centres and renewable energy.

Mike Hawes, SMMT chief executive, said: “Five months of shrinking demand for new vans reflects weaker business confidence and a challenging economic environment.

“Such conditions discourage fleet upgrades into new zero emission technology, meaning older, more polluting vehicles stay on the road longer.

“Switching must have clear commercial benefits, so the sector needs bold and assertive action if ambitious mandate targets are to be met.”

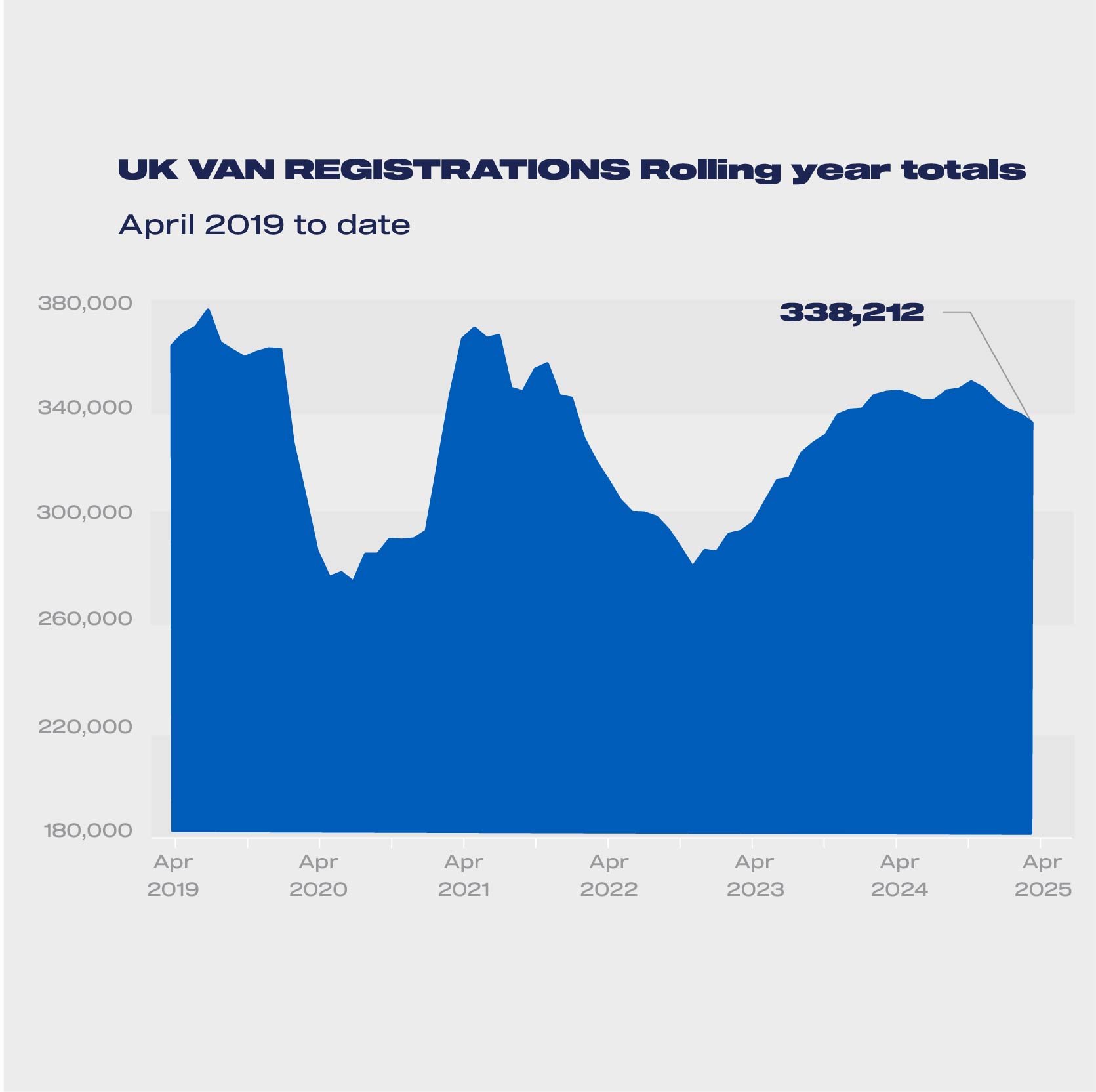

Reflecting the impact of these economic and regulatory pressures, the SMMT has downgraded its full-year forecast for the new LCV market in 2025 by 11,000 units. It now expects 337,000 registrations, down 4.3% on this year.

BEVs are projected to account for 9.1% of LCV registrations in 2025 – rising to 13.3% in 2026 – both figures falling significantly short of the Government’s mandated targets of 16% and 24% respectively.

Login to comment

Comments

No comments have been made yet.