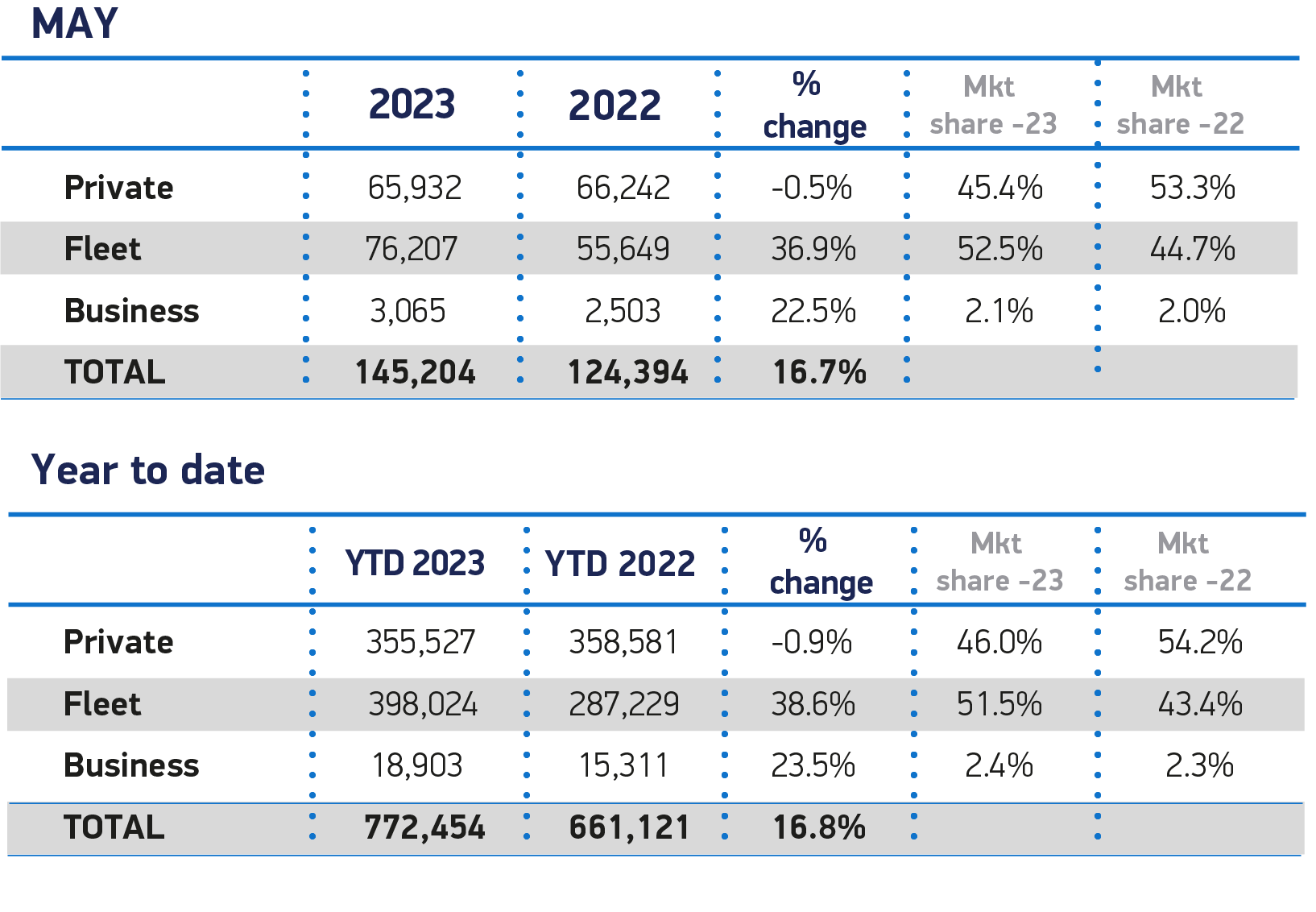

Fleet and business registrations rose by more than a third in May, with 79,272 company cars registered compared to 58,152 units in May 2022.

Overall, there were 145,204 cars sold during the month, with fleet and business holding a 54% market share, up eight percentage points year-on-year.

Year-to-date, fleet and business registrations are now almost 38% higher than they were in the first five months of 2022.

Some 416,927 company cars have been registered, over 100,000 more than the 302,540 units registered over the same period last year.

Overall, including private sales, 772,454 cars have been registered so far this year, an increase of more than 16% on the 661,121 units from January to May, last year.

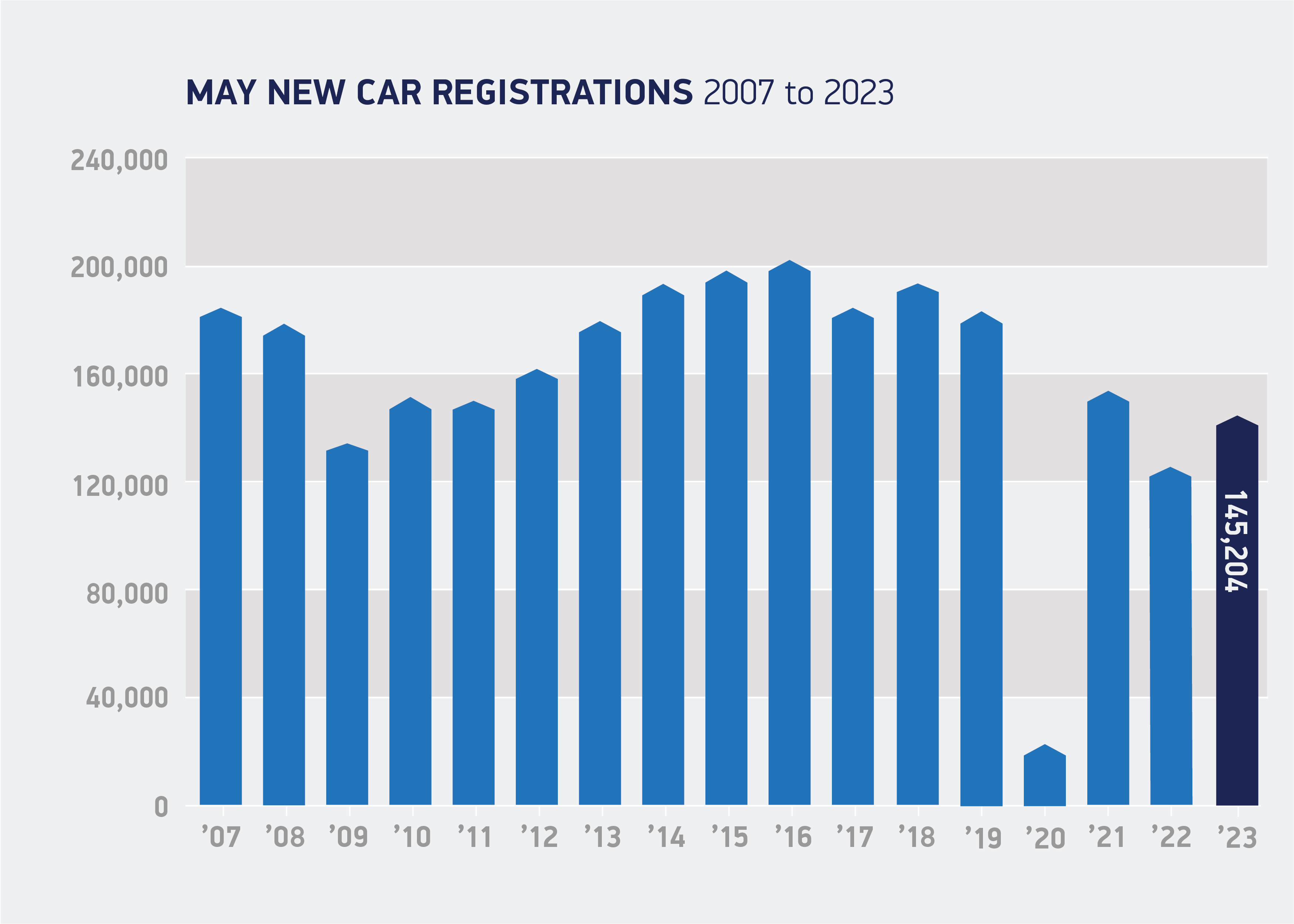

The performance marks 10 consecutive months of growth, although registrations remain 21% below pre-pandemic 2019 levels.

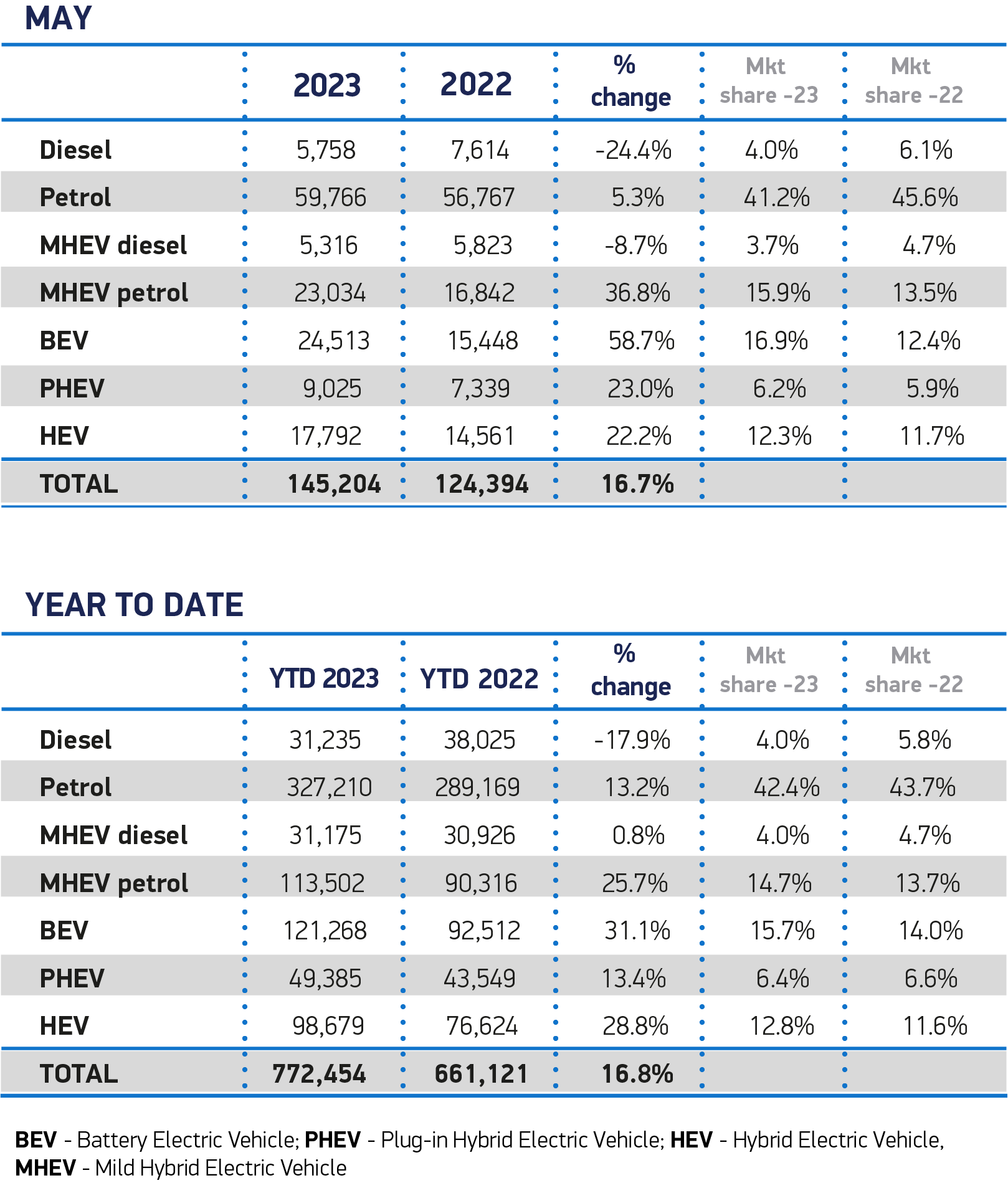

Petrol-powered cars remain Britain’s best sellers, accounting for 57% of all registrations.

Petrol-powered cars remain Britain’s best sellers, accounting for 57% of all registrations.

Alternatively powered vehicles, however, continue to make up an ever-larger share of the market, with plug-in hybrids (PHEVs) rising 23% to reach a 6.2% market share and hybrids (HEVs) growing 22% to comprise 12% of all registrations.

May saw battery electric vehicles consolidate their position as the UK’s second most popular power train. A further 24,513 joined the road during the month, up almost 59% on May last year to secure a 17% market share.

Nick Williams, transport managing director at Lloyds Banking Group, said: “May marked another step forward in the UK’s journey to electric, with EVs continuing to grow their share of the new car market.

“The latest increase in zero emissions vehicles joining our roads keeps the transport sector moving in the right direction to achieve its net zero targets.

“To continue to help drive a fair and affordable switch to electric, the Government will need to invest in the country’s charging infrastructure, as well as support the used EV market.

“Following the closure of the Government’s consultation on the Zero Emissions Vehicles (ZEV) mandate at the end of last month, we hope to see these important elements represented in the finalised policy. This support will help chart our electric future in the UK.”

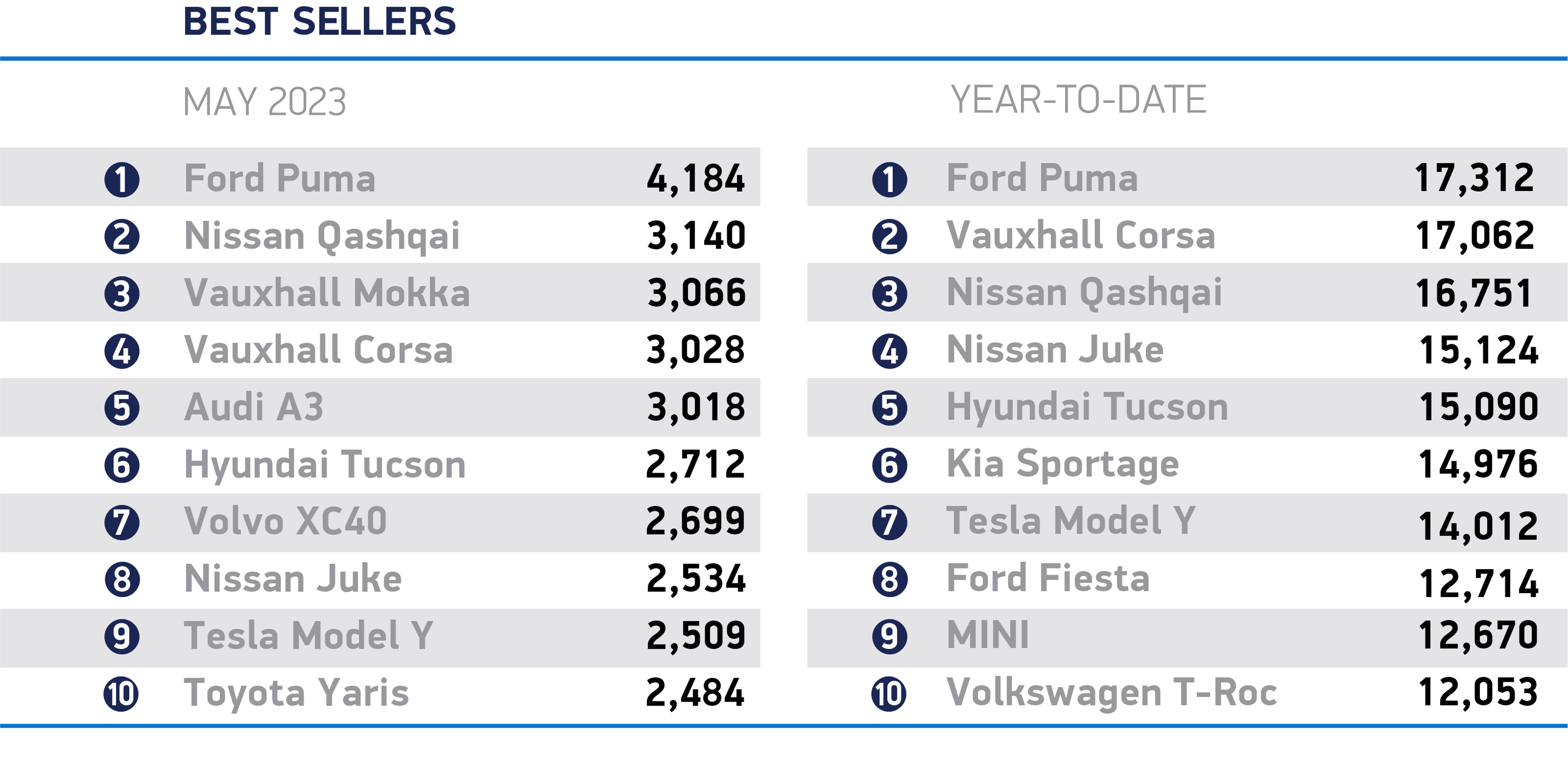

Of the new cars registered in May, lower mediums, superminis and dual purpose were the most popular, comprising 86.3% of the market.

Mike Hawes, SMMT chief executive, said: “After the difficult, Covid-constrained supply issues of the last few years, it’s good to see the new car market maintain its upward trend and the fact that growth is, increasingly, green growth is hugely encouraging.

“Transforming the market nationwide, however, and at an even greater pace means we must increase demand and help any reticent driver overcome any concerns about electric vehicles. This will require every stakeholder – industry, Government, charge point operators and energy companies – to play their part, accelerating investment to drive decarbonisation.”

Jon Lawes, managing director of Novuna Vehicle Solutions, believes that the latest EV figures should be the catalyst for the Government to address the blockages that could jeopardise the future of the UK’s zero emission transition.

“Despite recent funding, we’re still lacking a clear strategy to achieve the level of increase in charging points necessary to transform the UK’s sluggish EV infrastructure,” he said. “This is particularly prevalent when analysing the more rural areas of the UK.

“Alongside this, we need to prioritise the development of domestic EV battery manufacturing capacity in order to retain carmakers and avoid the risk of tariffs on British cars under post- Brexit regulations starting next year. It's essential to address these challenges for the long-term success of the UK's EV sector.”

Login to comment

Comments

No comments have been made yet.