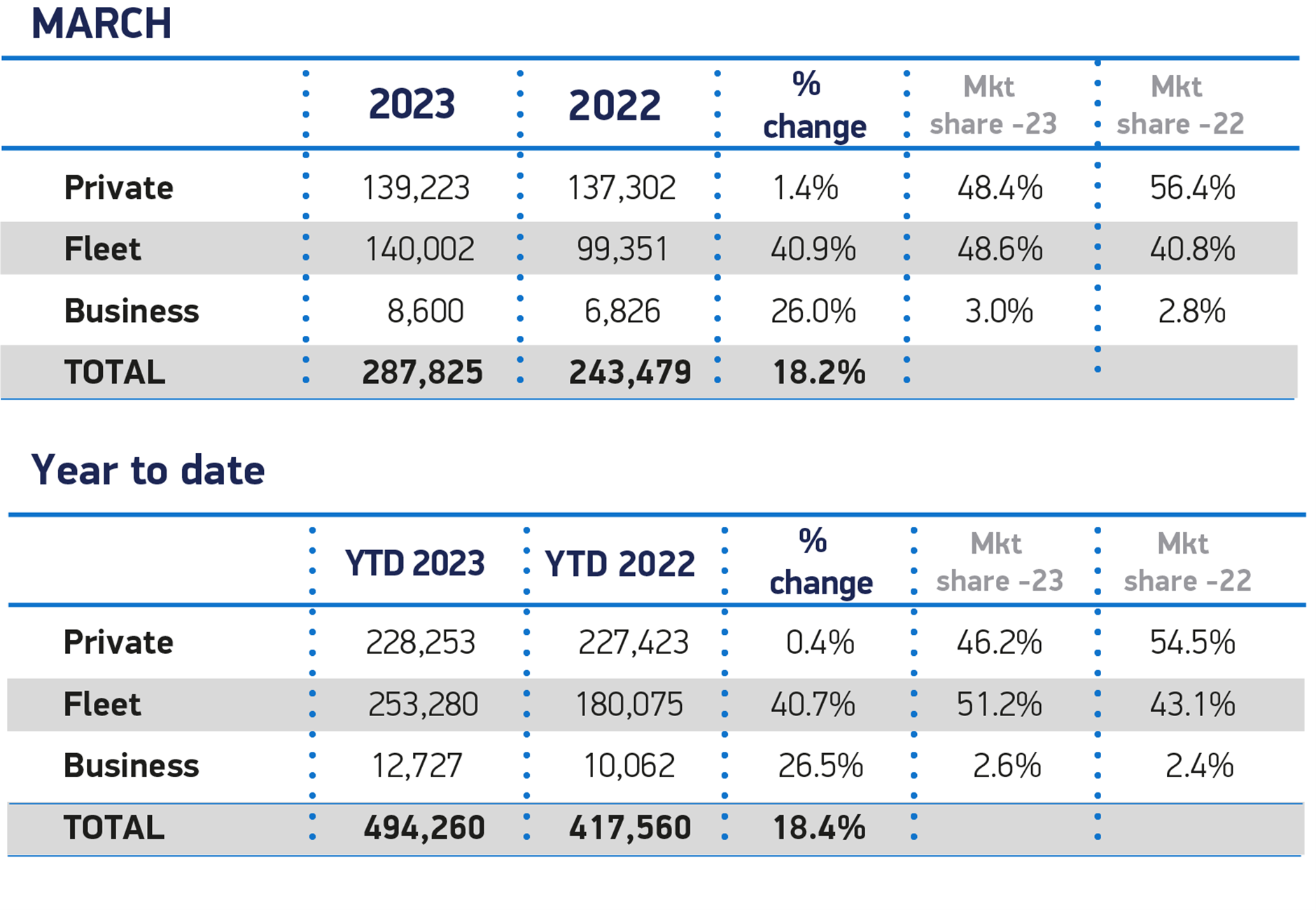

Fleet registrations drove the new car market in March, with 40% more company cars sold year-on-year, new figures from the Society of Motor Manufacturers and Traders (SMMT) suggest.

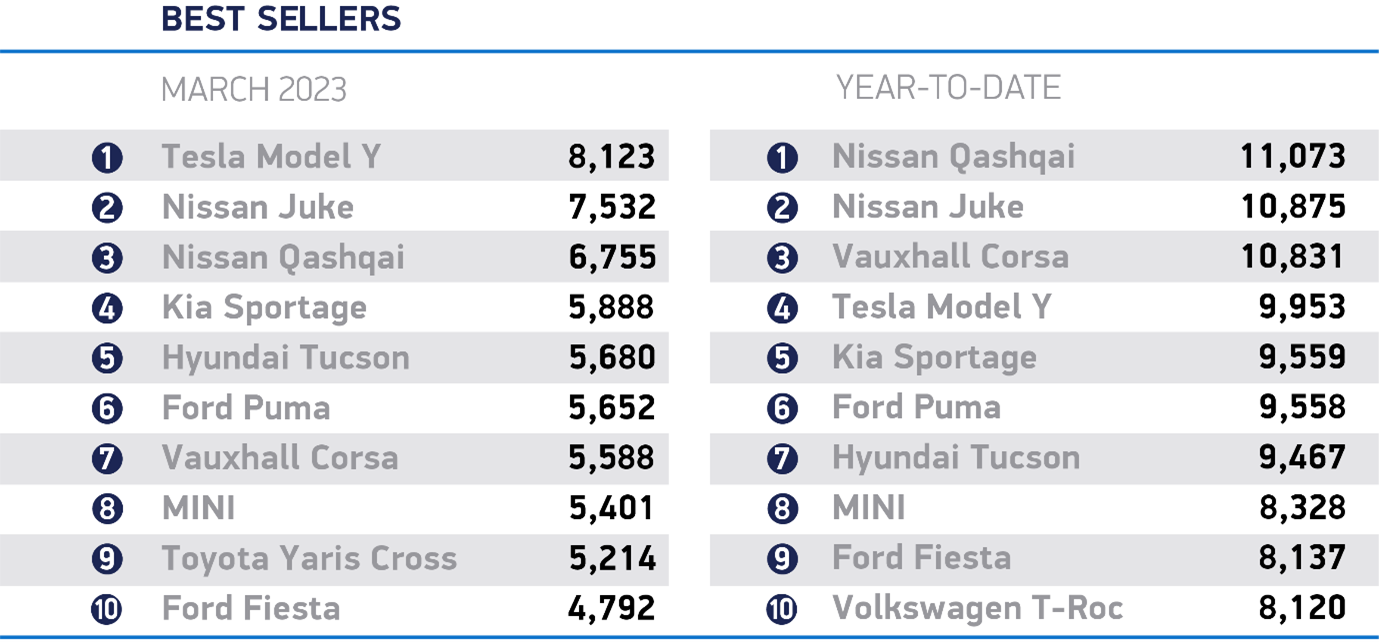

Overall new car registrations were up by 18.2% to deliver the best ‘new plate month’ performance since before the pandemic.

However, with deliveries to private buyers up by just 1.4%, the overall increase was thanks to fleet and business registrations.

From the 287,825 new cars delivered, some 148,602 were registered to fleets, 40% more than the 106,177 company cars delivered in March, 2022.

It was the eighth consecutive month of growth for the new car market, as supply chain challenges slowly continue to ease.

As a result, the first quarter of 2023 is the strongest since 2019, with just under half a million new cars joining the road. However, the market still being significantly below pre-pandemic levels, down 29.5% on Q1 2019.

Year-to-date, some 266,007 new cars have been registered to fleet and business, 75,870 more than the 190,137 units registered in the first three months of last year.

Mike Hawes, chief executive of the SMMT, said: “March’s new plate month usually sets the tone for the year so this performance will give the industry and consumers greater confidence.

Mike Hawes, chief executive of the SMMT, said: “March’s new plate month usually sets the tone for the year so this performance will give the industry and consumers greater confidence.

“With eight consecutive months of growth, the automotive industry is recovering, bucking wider trends and supporting economic growth.”

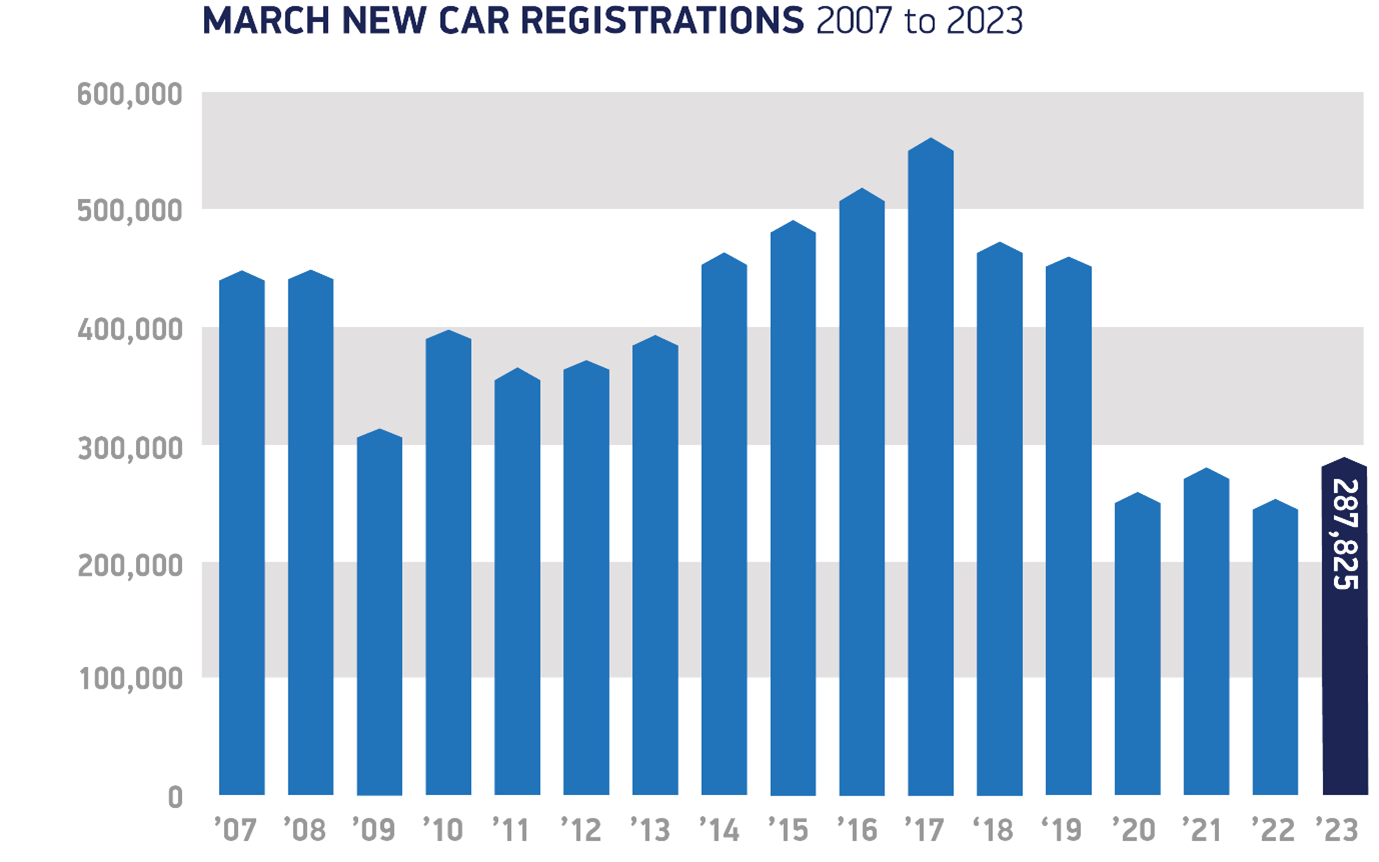

By segment, superminis posted the largest percentage growth in March – up 27.2%, to remain Britain’s most popular car type.

Lower medium and dual-purpose vehicles were the second and third most popular respectively, with all three vehicle types combined representing 86.5% of total registrations.

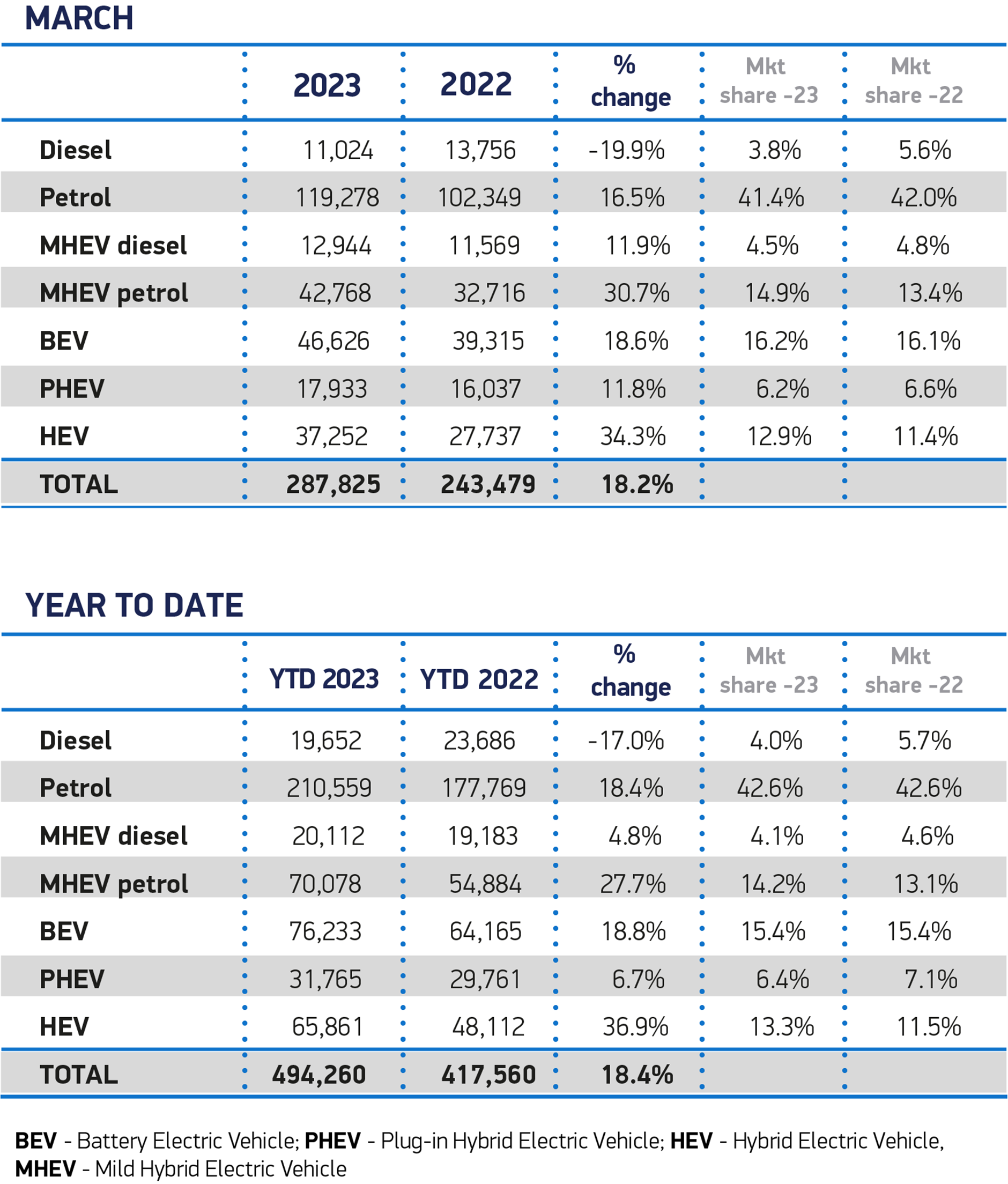

Petrol-powered vehicles remained the most popular fuel type, comprising 56.3% of new units, while battery electric vehicle (BEV) deliveries reached a record monthly high of 46,626, representing growth of 18.6%.

Overall, the BEV market share remained almost the same as last year at 16.2% and, with plug-in hybrid (PHEV) registrations growing by 11.8%, plug-in registrations comprised 22.4% of the market – a slight decline on 2022.

The biggest growth, however, was in hybrids (HEVs), with a 34.3% surge helping electrified vehicles account for more than one in three registrations for the month.

With the publication last week of the consultation on a zero emission vehicle (ZEV) mandate – due to come into force in less than nine months – the market will have to move more rapidly to battery electric and other zero tailpipe emission cars and vans, suggests the SMMT.

Models are coming to market in greater numbers, but it says that consumers will only make the switch if they have the confidence they can charge whenever and wherever they need.

Success of the mandate, therefore, will be dependent not just on product availability but on infrastructure providers investing in the public charging network across the UK, it says.

Hawes continued: “The best month ever for zero emission vehicles is reflective of increased consumer choice and improved availability but if EV market ambitions – and regulation – are to be met, infrastructure investment must catch up.”

Jon Lawes, managing director at Novuna Vehicle Solutions, believes that the latest sales figures confirm the UK’s ongoing willingness to move to electric vehicles (EVs).

However, he said: “We are seven years out from the Government’s 2030 target and the additional funding announced for EV infrastructure is just not enough to transform the charging provision nationwide, which is woefully inadequate.

“Our own research shows that the UK will need to put 30,000 new charging points in the ground every single year for the next seven years, to meet the demand. That’s a tenfold increase in the number achieved in the past decade.

“What we need to see is a sustained, joined up approach at Government and local authority level, to deliver tangible action and at pace to hit these targets and retain confidence in the industry and the market.”

Kim Royds, EV director at British Gas, also believes that charging infrastructure remains an issue. She said: “Despite advances in EV uptake over the past few years, there is still some way to go to ensure charging infrastructure is accessible, user friendly and utilising the latest charging and payment technologies.

“The Government’s ZEV mandate consultation is an important commitment to an electric future, but as always, the devil is in the detail.

“Motorists and manufacturers also need it to go hand in hand with greater investment in establishing a full and proper charging network if we’re to get all transport in the UK carbon-free.”

Nick Williams, transport managing director at Lloyds Banking Group, parent company of Lex Autolease, says that, while it remains to be seen if the finalised ZEV mandate legislation will fully deliver on aims to boost the supply of EVs in the country and drive investment in the sector, it was a “bold step forward on the journey to net zero”.

Login to comment

Comments

No comments have been made yet.