A dip in new car registrations in July has been blamed, in part, on buyers waiting to see what models will qualify for the electric car grant.

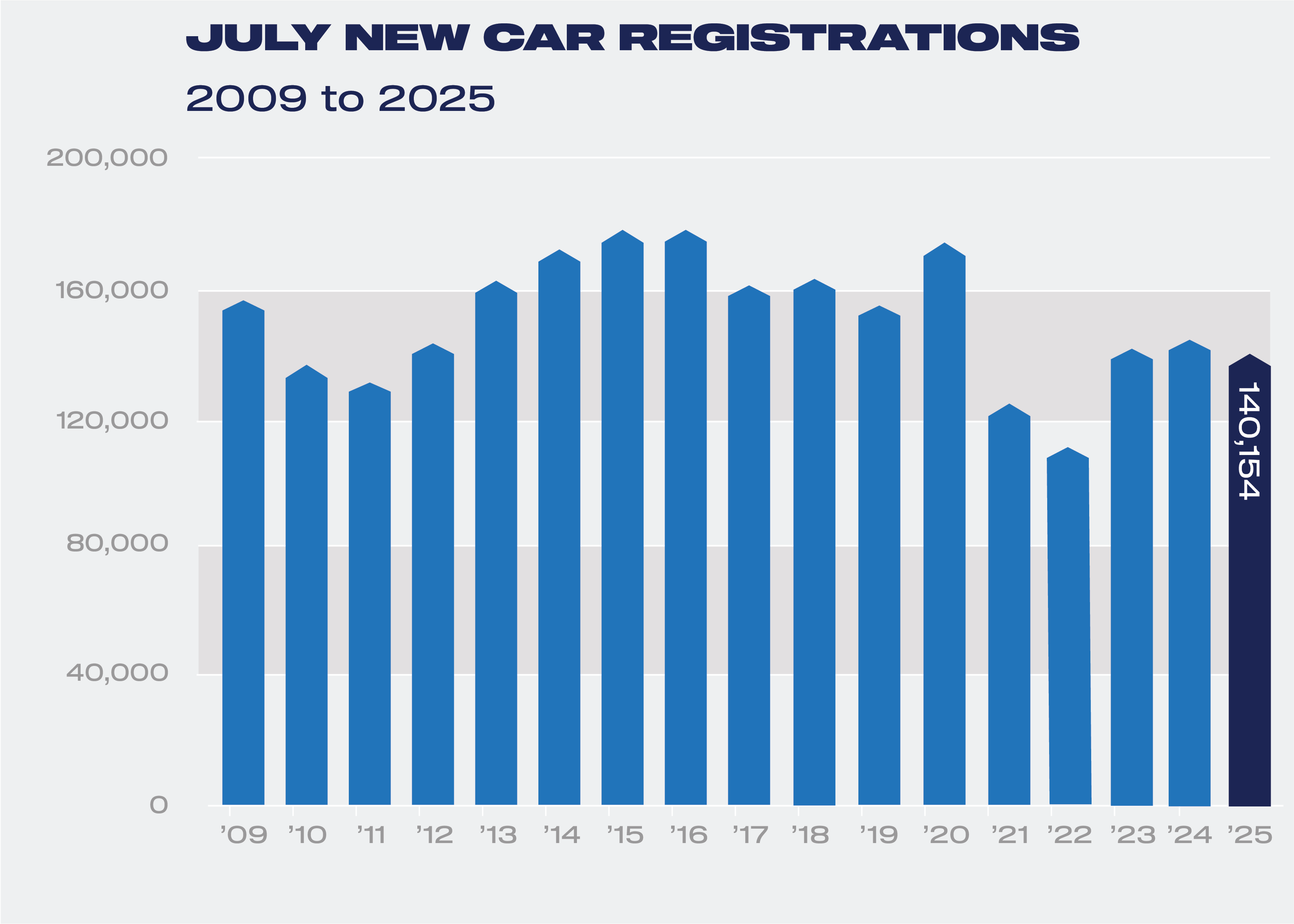

New car registrations fell by 5% in the month to 140,154 units, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT).

The performance was the weakest for the month since 2022 and 10.8% lower than in pre-pandemic 2019.

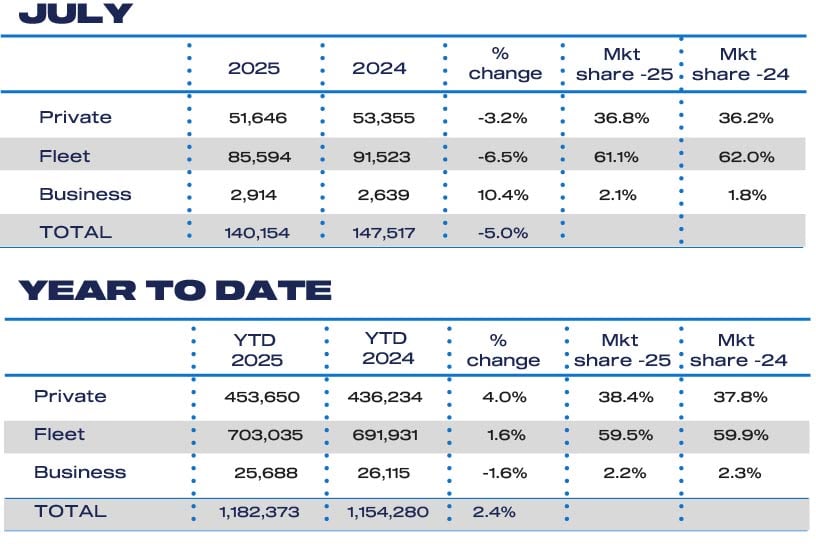

Fleet and business buyers were responsible for 88,508 registrations in July, which was down by 6.3% year-on-year, equating to a 63.2% market share.

Demand from private buyers, meanwhile, fell 3.2% to 51,646 units.

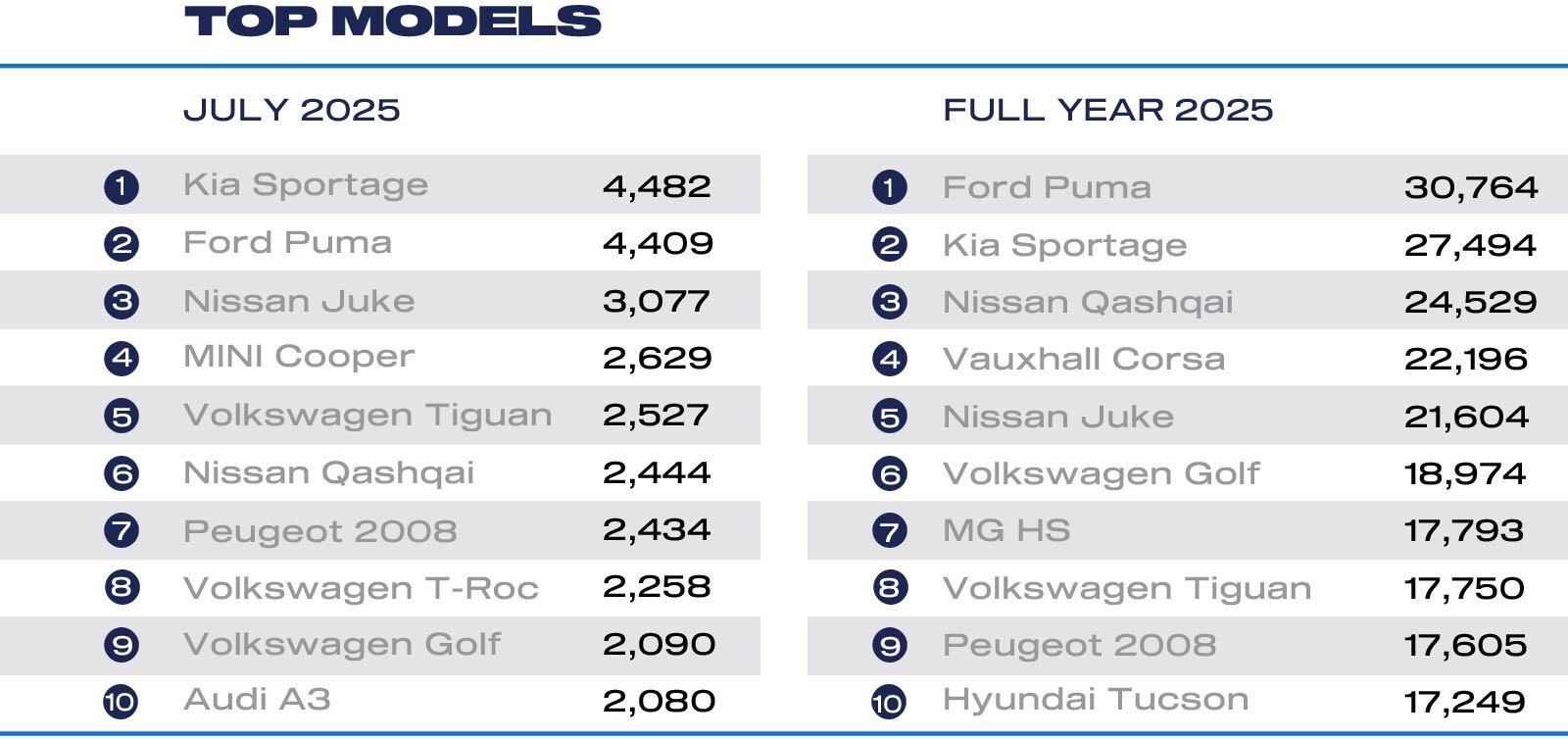

Declines were seen across most segments, with only dual purpose, mini and luxury saloon models recording growth.

Year-to-date, fleet and business new car registrations now stand at 728,723 units – a 1.5% in increase compared to the 718,046 units registered at this stage last year.

Private new car registrations currently stand at 453,650 units – a 4% uplift on last year.

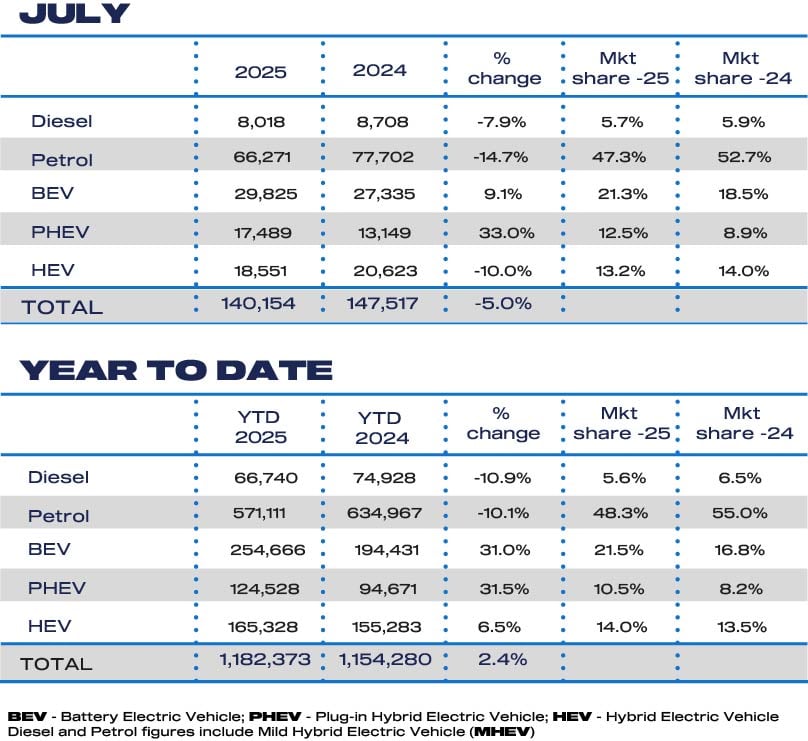

Bucking the wider market performance in July, registrations of plug-in hybrid electric vehicles (PHEVs) rose 33% and battery electric vehicles (BEVs) 9.1%.

However, the BEV increase is modest in comparison with the 34.6% increase recorded for the first half of 2025.

July was the second weakest month of BEV growth this year, after April’s tax changes distorted the market in that month.

With the Government launching the electric car grant in July, full model eligibility has yet to be confirmed.

So far, the Department for Transport (DfT) has only confirmed four Citroen models – the Citroen e-C3, e–C4, e-C5 and the e-Berlingo (M versions only) – will qualify for the lower of the two grants available (£1,500).

The SMMT says this is causing some buyers to hold off pending confirmation of which vehicles will qualify for a discount of up to £3,750.

BEV market share reached 21.3%, up from 18.5% in the same month last year, but remains short of the 28% required by the zero emission vehicle (ZEV) mandate, demonstrating the importance of accelerating uptake over the remainder of the year.

Hybrid electric vehicle (HEV) transactions declined by 10% to 18,551 units, while combined petrol and diesel deliveries fell 14% to 74,289 units, but still accounted for more than half (53%) of July’s market.

Year-to-date, the overall market remains up 2.4% at 1.18 million units, including more than a quarter of a million BEVs.

July’s decline is expected to be temporary, said the SMMT, with the latest market outlook – undertaken before eligible ECG models were confirmed – revised up to 1.9 million units for 2025, with BEV volumes revised up marginally too and expected to take a 23.8% share.

Mike Hawes, SMMT chief executive, said: “July’s dip shows yet again the new car market’s sensitivity to external factors, and the pressing need for consumer certainty.

“Confirming which models qualify for the new EV grant, alongside compelling manufacturer discounts on a huge choice of exciting new vehicles, should send a strong signal to buyers that now is the time to switch.

“That would mean increased demand for the rest of this year and into next, which is good news for the industry, car buyers and our environmental ambitions.”

Jon Lawes, managing director at Novuna Vehicle Solutions, highlighted the impact of the new electric car grant on registrations. “The new EV grant for models under £37,000 is welcome, but its rushed rollout and limited industry consultation have caused confusion,” he said.

“Manufacturers are scrambling to work out which models apply while consumers are left in limbo, wondering if they’ll actually get up to £3,750 in savings – risking a slowdown in demand, particularly in private sales, which continue to lag behind fleets. And excluding used EVs is a missed opportunity to improve affordability and buyer confidence.

“To sustain growth, we need clear, stable grant criteria, targeted support for used EVs, and a robust charging strategy for urban, rural, and fleet needs.

“With joined-up policy, better infrastructure, and clear consumer messaging, the UK can meet its Net Zero goals and make the switch to electric the obvious choice for all drivers.”

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, also wants more clarity around eligibility for the grant for it have its intended impact.

“We’re beginning to see signs of a two-tiered market which risks leaving a significant portion of the population behind in the transition to EVs,” he said.

“The recent 12% decline in UK vehicle manufacturing highlights the urgent need for a robust and supportive industrial policy to safeguard the future of the automotive industry.

“The Government’s launch of the Drive35 programme to kickstart auto investment and jobs is a good start, but more continued support is required to secure the UK’s electric future.”

Login to comment

Comments

No comments have been made yet.