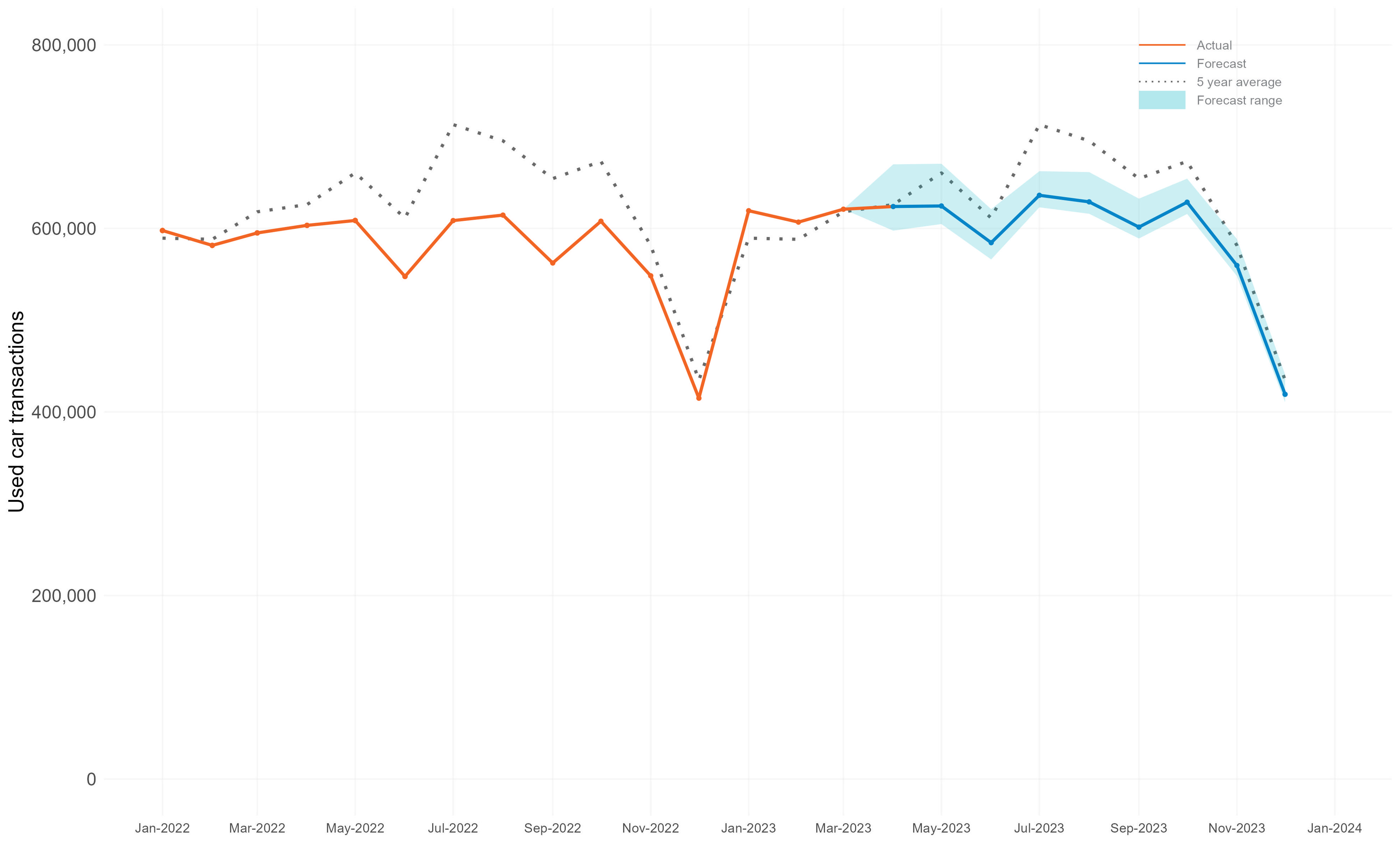

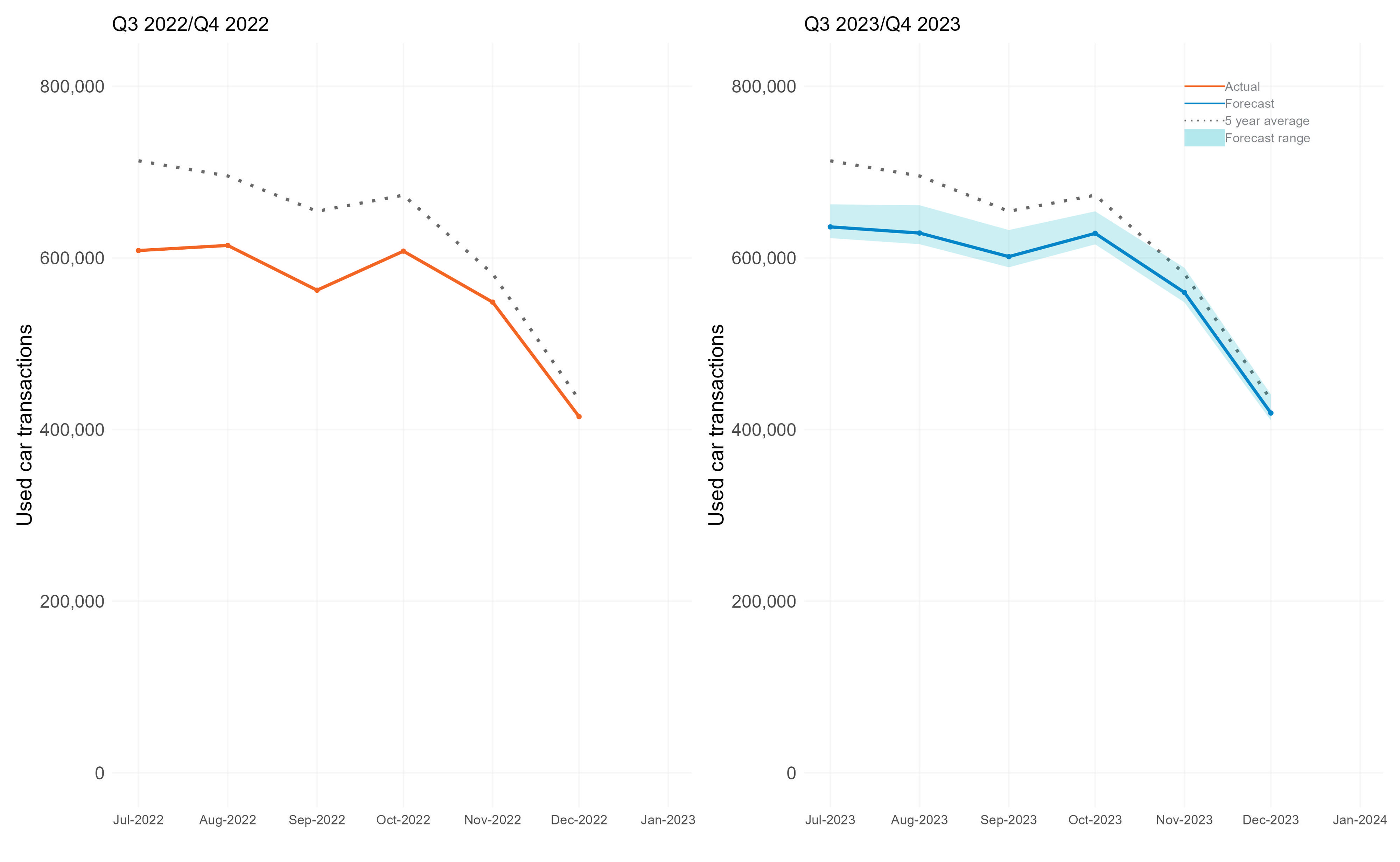

Cox Automotive is predicting that used car transactions for the year will exceed 7.1 million units, a 4% year-on-year increase.

However, that will still be 3% below the average pre-pandemic yearly figure, with Cox forecasting 1,866,540 transactions in Q3, softening to 1,607,517 in Q4.

With various challenges persisting, a more substantial recovery is not expected until early or mid-2024.

Factors including global economic conditions and energy-related issues continue to act as obstacles to overall growth.

Retail pricing remains unaffected by the rise in interest rates and pressures on household expenditure, the forecast adds, maintaining consumer pricing stability.

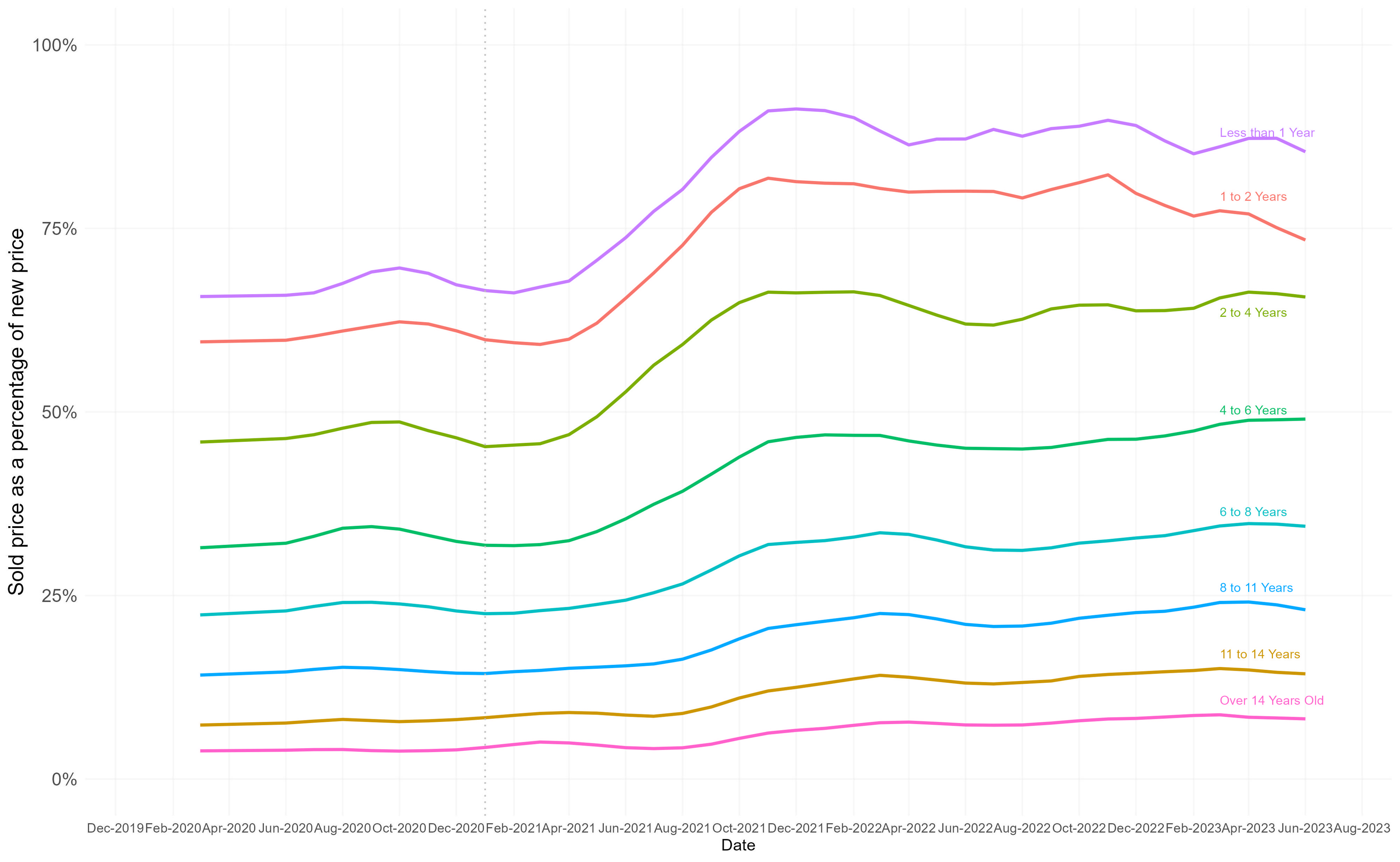

Philip Nothard, insight and strategy director at Cox Automotive, said: “The global loss of 42 million new vehicles in production has permanently impacted the future composition of the used market.

“However, our analysis points to a steady improvement in the UK sector for this year, which can be partly attributed to production cycles moving back to near normality.

“It nevertheless remains a changing landscape and the impact of supply and demand on valuations in the used sector has become increasingly evident in recent months.”

He added that concerns of a “cliff edge” in used vehicle values should diminish once the economy stabilises.

Used electric vehicles risk

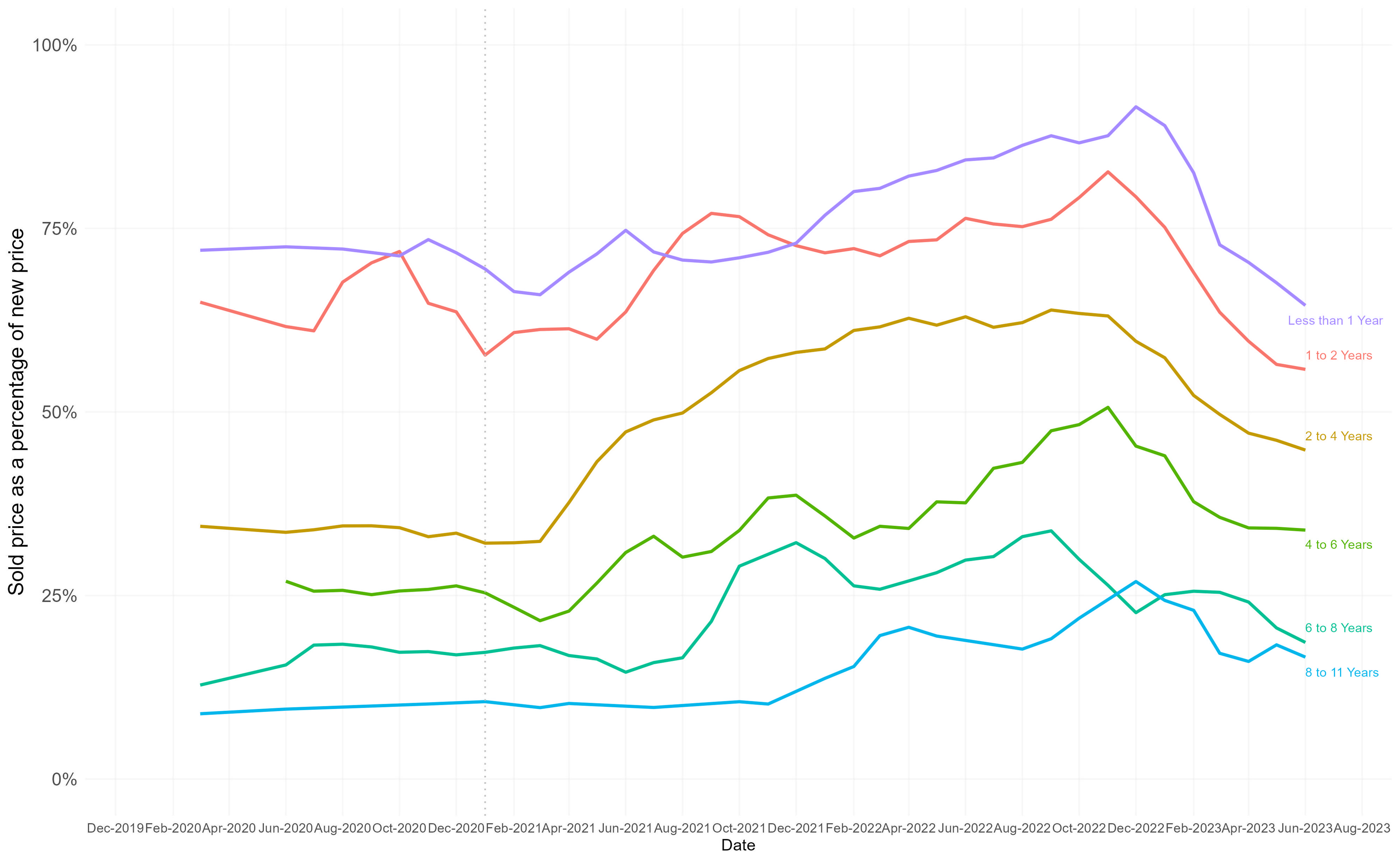

Nothard says that current state of the electric vehicle (EV) market poses a potential risk for the used car sector.

“While 64% of franchised dealers stocked BEVs as part of their used vehicle inventory in 2022, just 11% of independent dealers did,” he explained.

“This creates uncertainty around the pricing and availability of pre-owned electric vehicles, which could lead to cautionary buying behaviour from both retailers and consumers.

“By the end of 2023, more than a fifth of 0-1-year-old vehicles in the UK parc is expected to be a BEV, and this figure is projected to increase to 41% for 1-3-year-old cars by 2027.

“To keep pace with this rapid market shift, the sector must prioritise education, knowledge-sharing, and legislative measures to support the ownership and stocking of pre-owned electric vehicles.”

Login to comment

Comments

No comments have been made yet.